Trump Administration Clears Path For Nippon-U.S. Steel Merger

Table of Contents

Antitrust Concerns and Regulatory Approval

The merger faced significant scrutiny due to antitrust concerns. The combination of two industry giants, Nippon Steel and U.S. Steel, raised fears of reduced competition, potentially leading to higher steel prices and decreased innovation. The antitrust review process, overseen by relevant regulatory bodies, including the Committee on Foreign Investment in the United States (CFIUS), was crucial in determining the merger's fate.

- Initial Antitrust Concerns: The primary concern centered on the potential for the merged entity to control a significant portion of the North American and global steel market, potentially stifling competition and harming consumers.

- Arguments Presented by Nippon Steel and U.S. Steel: The companies likely argued that the merger would lead to synergies, increased efficiency, and enhanced competitiveness in the global market, ultimately benefiting consumers. They might have also highlighted the need for consolidation in a challenging economic climate.

- Concessions Made to Gain Approval (if any): To address antitrust concerns, the companies may have offered concessions, such as divesting certain assets or agreeing to specific behavioral remedies. Details of any such concessions would need to be publicly available to analyze their effectiveness.

- Comparison to Other Similar Mergers: A comparative analysis of this merger with other major mergers in the steel industry and other sectors would provide valuable context and highlight the unique aspects of this deal and the regulatory response.

Economic Impact of the Merger

The Nippon-U.S. Steel merger is expected to have a significant economic impact, both domestically and internationally. The long-term consequences, however, remain uncertain.

- Projected Job Gains or Losses in the US: The merger could potentially lead to job losses due to efficiency gains and consolidation, but it could also create jobs in research and development, or through increased production. A detailed economic impact assessment would be necessary to accurately predict job creation or displacement.

- Potential Impact on Steel Prices for Consumers and Businesses: The merger's effect on steel prices is a critical consideration. Reduced competition could lead to price increases, impacting various industries that rely on steel. Conversely, increased efficiency might lead to lower prices.

- Changes in the Competitive Landscape of the Global Steel Market: The merger will undoubtedly reshape the global steel market, increasing the market share of the combined entity and altering the competitive dynamics amongst remaining players.

- Analysis of Potential Benefits and Drawbacks to the US Economy: The potential benefits include increased efficiency and competitiveness in the global steel market, potentially bolstering the US trade balance. Drawbacks could include higher steel prices and reduced competition.

International Trade Implications

The merger has significant implications for international trade relations, especially given the backdrop of global trade tensions and tariffs.

- Impact on US Trade Relations with Other Steel-Producing Countries: The merger could affect trade relations with countries like China, India, and the European Union, potentially triggering further trade disputes or negotiations.

- Analysis of the Merger's Potential to Influence Global Steel Prices: The combined entity's larger market share will undoubtedly grant it greater influence over global steel prices.

- How This Merger Might Affect Trade Negotiations and Policies: This merger may serve as a case study in future trade negotiations, influencing discussions on antitrust regulation and the role of mergers in shaping global trade flows.

- Potential Shifts in Global Steel Production and Distribution: The merger could lead to shifts in global steel production and distribution patterns, potentially altering sourcing strategies for steel-consuming industries worldwide.

The Trump Administration's Trade Policy and its Influence

The Trump administration's "America First" trade policy, characterized by protectionist measures and tariffs, likely played a role in the approval of this merger. A contrasting analysis with the potential responses under different administrations, prioritizing free trade or other economic philosophies, could reveal the impact of prevailing political and economic ideology on such significant business decisions. The focus on domestic industry might have influenced the decision to approve a merger that potentially strengthens a major US steel producer.

Conclusion

The Nippon-U.S. Steel merger, approved under the Trump administration, represents a significant development in the global steel industry. The merger's impact on antitrust regulations, the US economy, and international trade relations are multifaceted and require ongoing scrutiny. While potential economic benefits exist, concerns regarding reduced competition and the impact on steel prices must be carefully monitored. The Trump administration's influence on the approval process highlights the intertwining of trade policy and major business transactions. Stay informed about the unfolding developments surrounding the Nippon-U.S. Steel merger and its impact on the global steel industry. Further research into the long-term effects of this landmark deal is crucial to understanding its full ramifications on the Nippon-U.S. Steel merger and its effects on the global marketplace.

Featured Posts

-

New Orleans Jail Escape Uncovering The 10 Inmate Breakout

May 26, 2025

New Orleans Jail Escape Uncovering The 10 Inmate Breakout

May 26, 2025 -

How To Train Your Dragon Toothless Vs Red Death Size Comparison Poster

May 26, 2025

How To Train Your Dragon Toothless Vs Red Death Size Comparison Poster

May 26, 2025 -

Maccabi Tel Aviv Edges Closer To Israeli Football Glory

May 26, 2025

Maccabi Tel Aviv Edges Closer To Israeli Football Glory

May 26, 2025 -

Wta Rome Zheng Qinwens Upset Win Over Sabalenka

May 26, 2025

Wta Rome Zheng Qinwens Upset Win Over Sabalenka

May 26, 2025 -

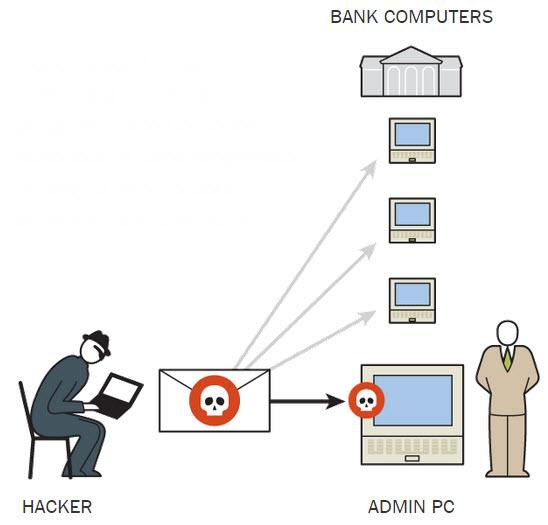

Millions Lost Inside Job Or Sophisticated Office365 Hack

May 26, 2025

Millions Lost Inside Job Or Sophisticated Office365 Hack

May 26, 2025