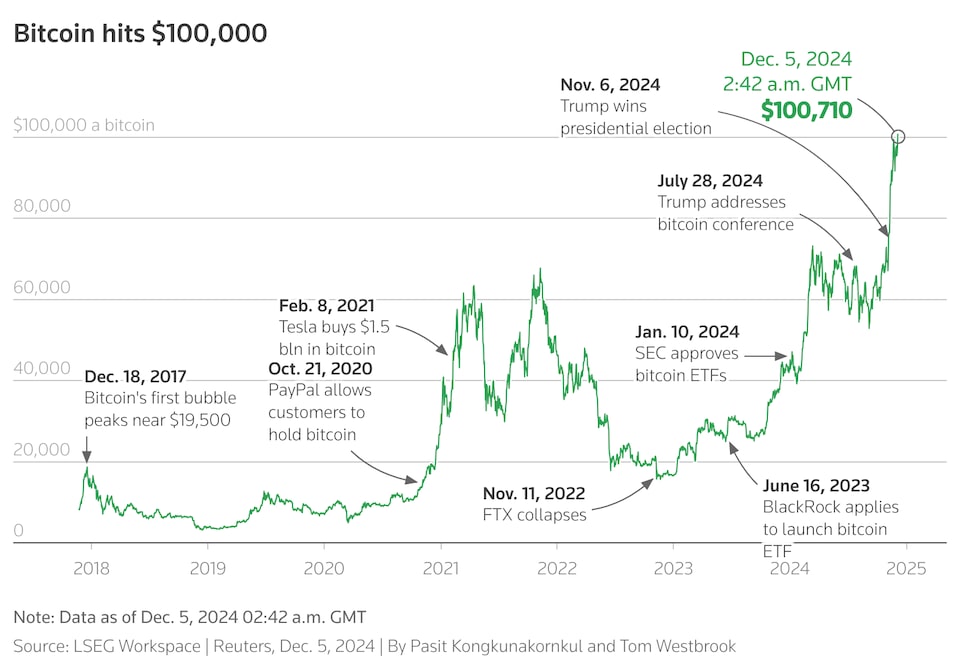

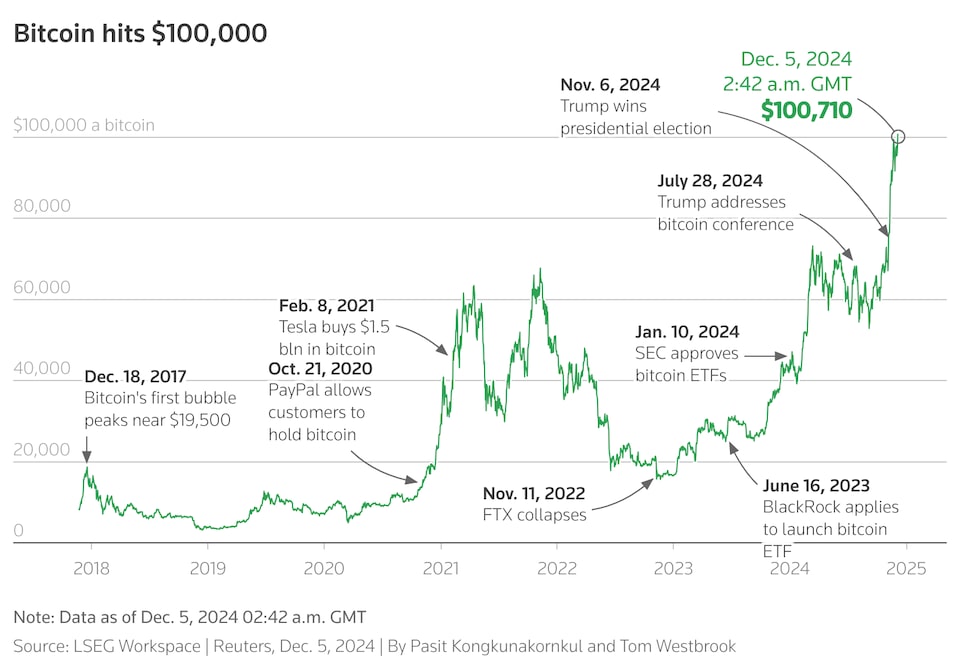

Trump's Crypto Chief Predicts Further Bitcoin Growth Following Price Jump

Table of Contents

The Prediction and its Significance

[Insert Advisor's Name Here]'s prediction is noteworthy due to its source and the timing. Following a recent significant Bitcoin price jump, the advisor forecasted [State the specific prediction – e.g., a further 20% increase in Bitcoin's price within the next six months]. This optimistic outlook has injected considerable confidence into the market, potentially influencing investor sentiment and driving further investment.

- Specific price target: [State the specific price target, if any, mentioned by the advisor].

- Timeframe: The prediction is projected to unfold within [Specify timeframe of the prediction].

- Market capitalization impact: This prediction, if realized, could significantly increase Bitcoin's market capitalization by [Estimate percentage increase, if possible, based on the prediction].

- Comparison to previous predictions: This prediction can be compared to [Advisor's Name]'s previous predictions, highlighting their accuracy rate and reliability.

Reasons Behind the Optimistic Outlook

The advisor's bullish stance on Bitcoin's future is underpinned by several factors. These contributing factors suggest a positive outlook for continued Bitcoin growth despite market volatility.

- Institutional Adoption: Increased adoption of Bitcoin by major institutional investors provides a solid foundation for sustained growth. Large-scale investments signal a growing belief in Bitcoin's long-term viability.

- Regulatory Clarity (or Lack Thereof): While regulatory uncertainty remains a factor, some argue that increasing clarity (or even the lack thereof resulting in a more hands-off approach) could inadvertently benefit Bitcoin's price. This is because regulatory clarity reduces uncertainty and can attract institutional investment.

- Technological Advancements: Ongoing developments within the Bitcoin ecosystem, such as the Lightning Network, are enhancing scalability and transaction speeds, potentially attracting more users and increasing adoption.

- Global Economic Uncertainty: Growing global economic uncertainty could further boost Bitcoin’s appeal as a safe-haven asset, driving demand and price appreciation. Investors often turn to Bitcoin during times of economic instability.

Counterarguments and Potential Risks

While the prediction is optimistic, it's crucial to acknowledge potential counterarguments and risks. A balanced perspective is necessary when considering investments in volatile assets like Bitcoin.

- Regulatory Hurdles: Governments worldwide are increasingly scrutinizing cryptocurrencies. Stringent regulations or outright bans could significantly impact Bitcoin's price.

- Market Volatility: Bitcoin's price is notoriously volatile. Sharp price corrections are a distinct possibility, potentially negating the positive prediction.

- Competition from Altcoins: The emergence and growth of competing cryptocurrencies pose a continuous challenge to Bitcoin's dominance.

- Environmental Concerns: The energy consumption associated with Bitcoin mining remains a significant environmental concern, potentially impacting its long-term sustainability and investor appeal.

Analyzing Trump's Crypto Chief's Track Record

Assessing [Advisor's Name]'s past predictions is vital in evaluating the credibility of their latest forecast. Examining the advisor's track record allows for a more informed assessment of the prediction's reliability.

- Past Predictions: Analyze previous predictions made by [Advisor's Name], noting their accuracy and the factors contributing to their success or failure.

- Reputation and Expertise: Consider [Advisor's Name]'s background and expertise in the cryptocurrency space. Are they a credible source with a proven understanding of market dynamics?

- Potential Conflicts of Interest: Transparency regarding any potential conflicts of interest is essential for evaluating the objectivity of the prediction.

Conclusion

Trump's former crypto chief's prediction of further Bitcoin growth following its recent price jump is a significant development in the cryptocurrency market. While the prediction is based on several positive factors, including increasing institutional adoption and technological advancements, potential risks such as regulatory uncertainty and market volatility must be considered. Analyzing the advisor's track record is crucial in evaluating the prediction's reliability. Stay tuned for updates on Bitcoin growth and learn more about [Advisor's Name]'s analysis to make informed decisions in this dynamic market. Remember, conducting your own thorough research before making any investment in Bitcoin or any cryptocurrency is crucial due to its inherent volatility. The potential for further growth exists, but informed decision-making is paramount in this sector.

Featured Posts

-

Kbo 5 0 355 3

May 08, 2025

Kbo 5 0 355 3

May 08, 2025 -

1 Mdb Scandal Malaysias Bid To Extradite Former Goldman Sachs Partner

May 08, 2025

1 Mdb Scandal Malaysias Bid To Extradite Former Goldman Sachs Partner

May 08, 2025 -

Analysis 67 M Ethereum Liquidation And The Implications For The Market

May 08, 2025

Analysis 67 M Ethereum Liquidation And The Implications For The Market

May 08, 2025 -

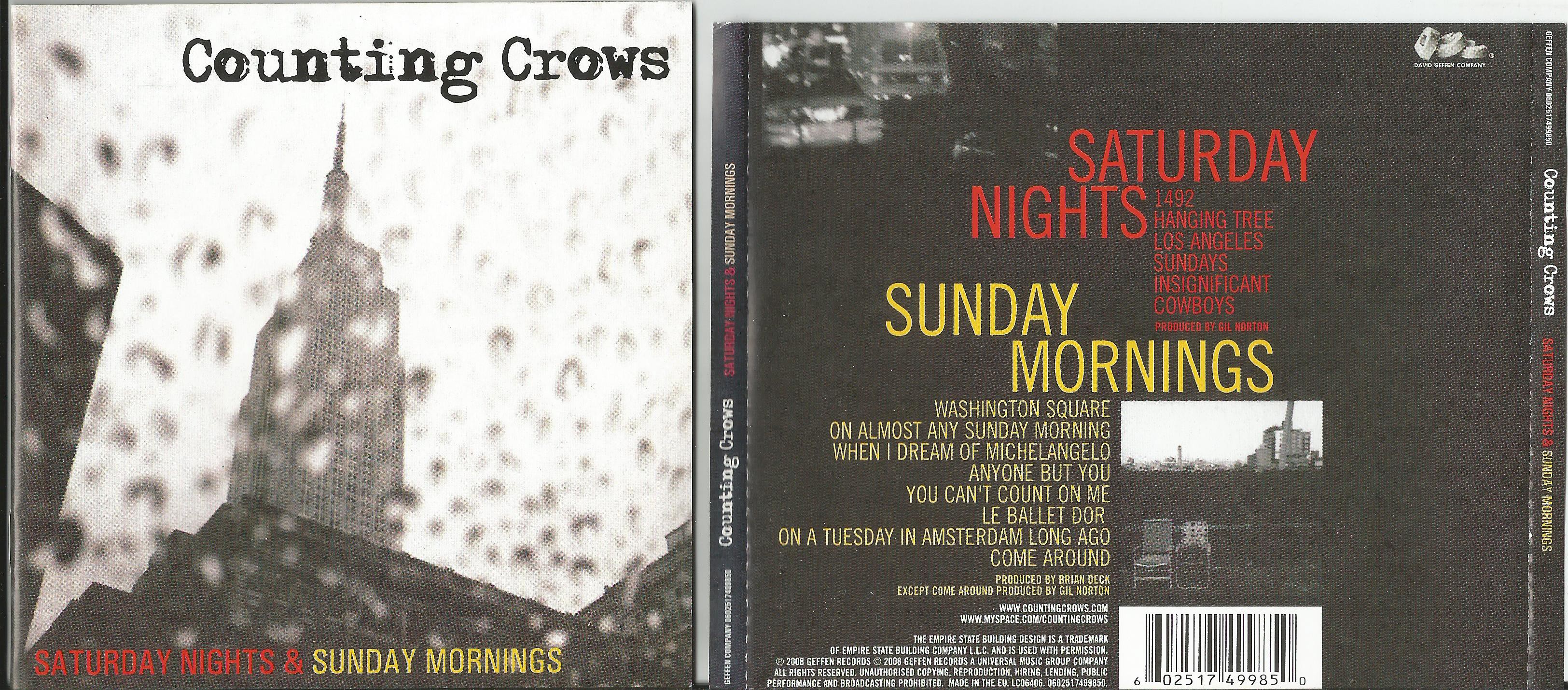

Counting Crows The Saturday Night Live Effect

May 08, 2025

Counting Crows The Saturday Night Live Effect

May 08, 2025 -

Cassidy Hutchinson Memoir A Fall 2024 Release On Her Jan 6 Testimony

May 08, 2025

Cassidy Hutchinson Memoir A Fall 2024 Release On Her Jan 6 Testimony

May 08, 2025

Latest Posts

-

Minecraft Superman Thailand Theater Shows 5 Minute Preview

May 08, 2025

Minecraft Superman Thailand Theater Shows 5 Minute Preview

May 08, 2025 -

James Gunns Superman Movie First Look At Krypto

May 08, 2025

James Gunns Superman Movie First Look At Krypto

May 08, 2025 -

Lidl Faces Lawsuit From Consumer Group Regarding Its Plus App

May 08, 2025

Lidl Faces Lawsuit From Consumer Group Regarding Its Plus App

May 08, 2025 -

Superman Minecraft 5 Minute Preview Thailand Theater Teaser

May 08, 2025

Superman Minecraft 5 Minute Preview Thailand Theater Teaser

May 08, 2025 -

Consumer Organisation Takes Lidl To Court Over Plus App

May 08, 2025

Consumer Organisation Takes Lidl To Court Over Plus App

May 08, 2025