Trump's Legacy: A Herculean Task For The Next Federal Reserve Chair

Table of Contents

The Inflationary Legacy of Trump-Era Policies

Trump's economic policies have left a significant inflationary legacy for the next Federal Reserve Chair to manage. Understanding the interplay of fiscal and monetary policy in this context is crucial. Key contributing factors include:

-

Tax Cuts and the National Debt: The 2017 Tax Cuts and Jobs Act significantly reduced corporate and individual income taxes. While stimulating short-term economic growth, these cuts led to a substantial increase in the national debt, fueling inflationary pressures. Increased government borrowing competes with private sector borrowing, driving up interest rates and contributing to higher prices across the board.

-

Deregulation and its Impact: The Trump administration pursued a policy of deregulation across various sectors. While intended to boost economic activity, reduced regulatory oversight can lead to increased production costs and potentially higher prices for consumers. This makes controlling inflation even more challenging for the Federal Reserve.

-

Trade Disputes and Supply Chain Disruptions: Trump's trade wars, particularly with China, disrupted global supply chains, leading to shortages and price increases for various goods. These disruptions exacerbated existing inflationary pressures, complicating the task of maintaining price stability. The impact on consumer prices was significant, particularly in sectors reliant on imported goods.

-

Inflation Expectations: Persistent inflation can lead to a self-fulfilling prophecy as consumers and businesses anticipate future price increases, leading to upward pressure on wages and prices. The next Fed Chair will need to manage inflation expectations effectively to prevent a wage-price spiral, a scenario where inflation becomes entrenched and difficult to control. This requires clear communication and credible monetary policy actions.

Navigating the Uncertainties in Financial Markets

The Trump era witnessed significant volatility in financial markets, creating another significant hurdle for the next Federal Reserve Chair. Key challenges include:

-

Trade Policy and Market Volatility: Trump's unpredictable trade policies and tariffs created significant uncertainty in financial markets, leading to increased volatility in stock prices and exchange rates. This volatility makes it difficult for the Fed to assess the true state of the economy and to implement effective monetary policy.

-

Interest Rate Management in a Volatile Market: Managing interest rates in a volatile market environment requires a delicate balance. Raising interest rates too aggressively can stifle economic growth, while leaving them too low can fuel inflation. The next Fed Chair must navigate this tightrope carefully, reacting to market fluctuations while keeping long-term economic health in mind.

-

Increased National Debt and Market Confidence: The soaring national debt under the Trump administration raises concerns about the long-term sustainability of US government finances. This can erode market confidence and potentially lead to higher borrowing costs for the government and the private sector. Maintaining investor confidence will be paramount.

-

Asset Bubbles and Risk Management: Periods of low interest rates and easy monetary policy can contribute to the formation of asset bubbles. The next Fed Chair will need to proactively monitor financial markets for signs of excessive risk-taking and implement policies to mitigate the potential for a financial crisis.

Addressing the Rising National Debt

The significant increase in the national debt during the Trump administration represents a long-term economic challenge. This necessitates careful consideration by the next Fed Chair:

-

Debt Sustainability: The sheer scale of the national debt raises serious concerns about its long-term sustainability. High levels of debt can constrain future government spending, limit the effectiveness of fiscal policy, and increase the risk of a sovereign debt crisis.

-

Impact on Long-Term Economic Growth: A large national debt can crowd out private investment, reducing potential economic growth. Higher interest payments on the debt also divert resources from other productive uses.

-

Balancing Fiscal Responsibility and Economic Stimulus: The Fed Chair must carefully consider the interaction between fiscal and monetary policy. While monetary policy can stimulate the economy, it cannot solve the problem of a large and growing national debt. Effective fiscal policy measures are crucial.

-

Potential Need for Fiscal Policy Changes: Addressing the rising national debt requires significant changes in fiscal policy, including spending cuts, tax increases, or a combination of both. These changes will be politically challenging but necessary for long-term economic stability.

Maintaining Economic Stability Amidst Geopolitical Uncertainty

Trump's foreign policy decisions significantly impacted the global economy and created geopolitical uncertainty. The next Federal Reserve Chair must account for:

-

Impact of Foreign Policy on the Global Economy: Trump's trade wars and imposition of economic sanctions created ripples across the global economy, affecting international trade, investment flows, and overall economic growth. The next Fed Chair must carefully consider the potential spillover effects of geopolitical events.

-

Managing Economic Stability Amidst Tensions: Maintaining economic stability amidst geopolitical tensions is a significant challenge. Unexpected events and shifts in global power dynamics can quickly destabilize markets and require swift and decisive action from the Federal Reserve.

-

Spillover Effects from Global Events: The US economy is increasingly interconnected with the global economy. Economic shocks originating in other parts of the world can quickly spread to the US, requiring the Fed to adapt its policies accordingly.

-

Adaptive Monetary Policy Strategies: In a world characterized by increasing geopolitical uncertainty, the Federal Reserve needs adaptive monetary policy strategies that can respond quickly to unexpected shocks and maintain economic stability.

Conclusion

The next Federal Reserve Chair faces an unprecedented challenge in navigating the complex economic legacy of the Trump administration. Successfully managing inflation, stabilizing financial markets, addressing the rising national debt, and maintaining economic stability amidst geopolitical uncertainty will require exceptional skill and strategic foresight. Understanding the intricacies of Trump's economic policies and their lasting impact is crucial for the next Fed Chair to effectively formulate and implement appropriate monetary policies. The ability to respond effectively to these intertwined challenges will determine the success or failure of the next Federal Reserve Chair in fostering sustainable economic growth and prosperity. Therefore, careful analysis of Trump's legacy on the economy is paramount for effective future economic management. The challenges are immense, and a comprehensive understanding of Trump's economic legacy is critical for the next Federal Reserve Chair's success.

Featured Posts

-

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Star Speaks Out

Apr 26, 2025

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Star Speaks Out

Apr 26, 2025 -

Zuckerberg And Trump A New Era For Facebook And America

Apr 26, 2025

Zuckerberg And Trump A New Era For Facebook And America

Apr 26, 2025 -

The Company That Laid You Off Wants You Back What To Say

Apr 26, 2025

The Company That Laid You Off Wants You Back What To Say

Apr 26, 2025 -

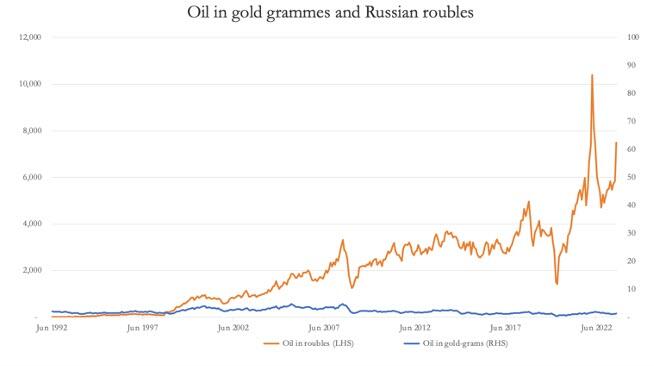

Is Gold A Safe Investment During Trade Wars Analyzing Bullions Performance

Apr 26, 2025

Is Gold A Safe Investment During Trade Wars Analyzing Bullions Performance

Apr 26, 2025 -

Harvards Future A Conservative Professors Perspective

Apr 26, 2025

Harvards Future A Conservative Professors Perspective

Apr 26, 2025