Trump's Shift On Fed Policy Fuels US Dollar Surge

Table of Contents

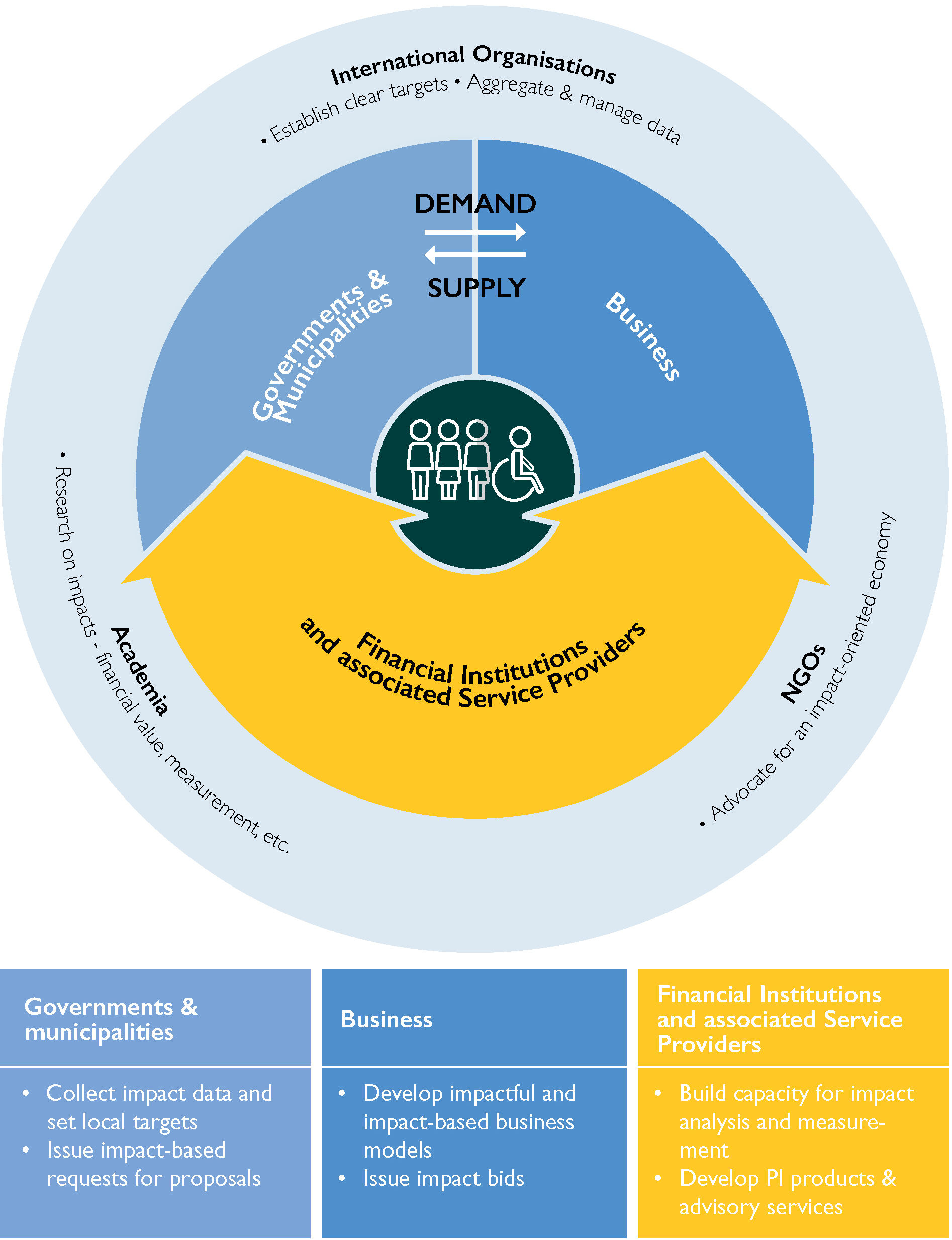

The strength of the US dollar is intrinsically linked to the Federal Reserve's interest rate decisions. Higher interest rates generally attract foreign investment, increasing demand for the dollar and thus boosting its value. Before this recent shift, market expectations were largely shaped by Trump's consistent criticism of the Fed, creating an atmosphere of uncertainty.

This article will argue that Trump's altered approach to Fed policy is a primary driver of the current US dollar surge.

Trump's Previous Stance on the Fed and its Market Impact

Trump's earlier presidency was marked by frequent public criticism of the Federal Reserve and its chair, Jerome Powell. He repeatedly attacked the Fed's interest rate hikes, arguing they hampered economic growth and unfairly targeted his administration's economic policies. His statements often painted the Fed as an obstacle to his economic agenda.

This consistent negativity significantly impacted market sentiment. The uncertainty created by Trump's pronouncements led to periods of increased volatility in the dollar and decreased investor confidence. The market struggled to predict the future direction of monetary policy, given the unpredictable nature of Trump's comments.

- Examples of Trump's past criticisms: Public statements labeling the Fed's actions as "crazy" and "ridiculous," along with direct criticism of Powell's leadership.

- Impact on market sentiment: Increased market volatility, reduced investor confidence, and periods where the dollar weakened significantly due to uncertainty.

- Specific instances of dollar weakness: Several instances can be cited where the dollar experienced declines immediately following strongly critical statements from the former President.

The Shift in Trump's Approach to Federal Reserve Policy

The surprising shift in Trump's rhetoric regarding the Fed represents a significant turning point. While the exact reasons remain open to interpretation, this change could be attributed to evolving economic conditions, a desire for greater market stability ahead of elections, or a reassessment of the Fed's role in economic management.

- Specific statements or actions indicating the shift: A noticeable decrease in public criticism of the Fed, a more conciliatory tone in statements, and even occasional praise of the Fed's actions.

- Possible motivations: A recognition of the potential negative economic consequences of continued attacks on the Fed's independence, a desire for a more stable economic environment during a politically sensitive period, or even a change in his economic advisors' advice.

- Relevant news articles or official statements: Referencing specific news articles and official statements that documented this shift in Trump's approach would lend further credibility.

The Subsequent US Dollar Surge: Causes and Consequences

This change in Trump's stance had an almost immediate impact on market confidence. The reduction in uncertainty surrounding the Fed's independence and predictability led to increased investor confidence, directly boosting demand for the US dollar. This increased demand subsequently drove up the dollar's value against other major currencies.

The strengthening dollar has significant ripple effects across the global economy. While beneficial for some (e.g., cheaper imports for US consumers), it can negatively impact US exports and potentially exacerbate trade imbalances. It could also contribute to lower inflation in the US and influence global economic growth patterns.

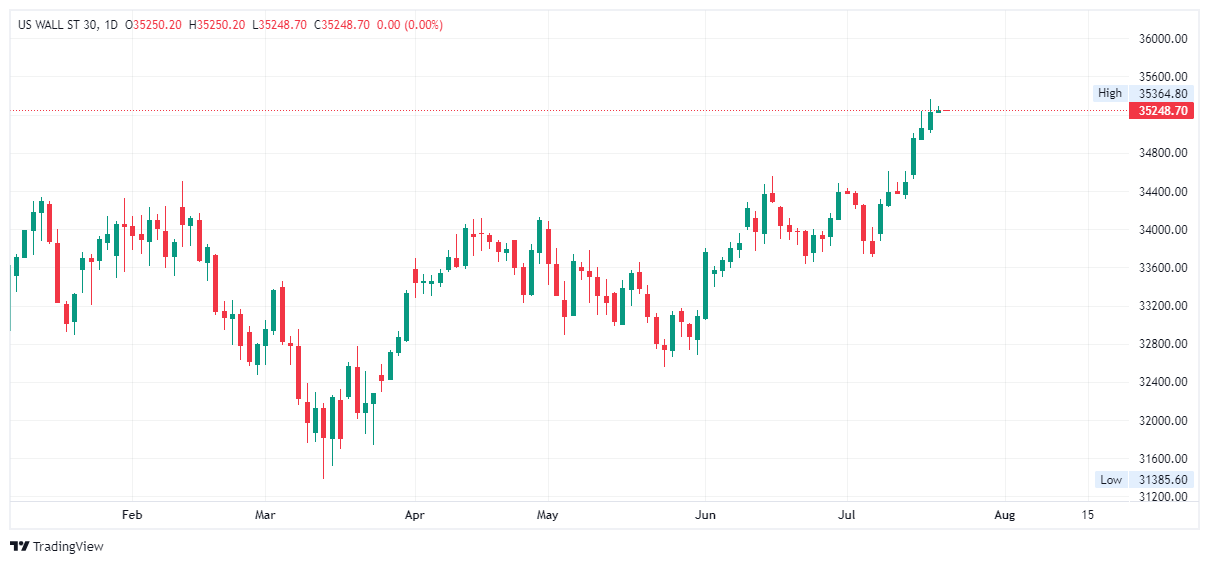

- Quantitative data demonstrating the US dollar's appreciation: Providing specific charts and figures demonstrating the extent of the dollar's rise against other major currencies.

- Analysis of how investor sentiment changed: Examining surveys and market data to show the shift in investor perception and confidence following Trump's change in stance.

- Potential implications for US trade balance and global economic growth: Discussing the possible positive and negative impacts on the US trade balance, global trade, and economic growth globally.

Analyzing the Interplay between Political Rhetoric and Currency Markets

Political uncertainty is a major factor influencing currency markets. Unpredictable statements from political leaders, particularly regarding economic policy, can create significant volatility as investors react to perceived risk. This volatility affects currency valuations as investors seek safer havens or adjust their positions based on perceived changes in risk.

- Examples of other instances: Highlighting historical examples where political pronouncements drastically impacted currency values.

- Investor confidence and currency valuations: Explaining the direct correlation between investor confidence and currency valuations; higher confidence generally leads to stronger currencies.

- Importance of clear communication: Emphasizing the need for clear and consistent communication from political leaders regarding economic policy to maintain market stability.

Conclusion: Understanding the Implications of Trump's Shift on Fed Policy

Trump's altered perspective on the Federal Reserve's policies has demonstrably contributed to the recent surge in the US dollar's value. This shift, a significant departure from his previous criticisms, has reduced market uncertainty and boosted investor confidence, leading to increased demand for the dollar. The long-term implications of this change remain to be seen, but its impact on the US economy and global markets is undeniable.

To stay abreast of the ongoing developments surrounding Trump's shift on Fed policy and its impact on the US dollar, it's crucial to follow financial news closely and analyze market trends. Subscribe to our newsletter for regular updates and insightful analysis on this important topic and continue to monitor the evolving relationship between Trump's views and the fluctuating value of the US dollar.

Featured Posts

-

Market Rally 1000 Point Dow Jump Sparks Investor Optimism

Apr 24, 2025

Market Rally 1000 Point Dow Jump Sparks Investor Optimism

Apr 24, 2025 -

Newsom Calls On Oil Companies Amidst Soaring California Gas Prices

Apr 24, 2025

Newsom Calls On Oil Companies Amidst Soaring California Gas Prices

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025 -

Rethinking Middle Management Their Impact On Company Culture And Performance

Apr 24, 2025

Rethinking Middle Management Their Impact On Company Culture And Performance

Apr 24, 2025 -

16 Million Penalty For T Mobile Details Of Three Year Data Breach Settlement

Apr 24, 2025

16 Million Penalty For T Mobile Details Of Three Year Data Breach Settlement

Apr 24, 2025