Trump's Student Loan Privatization Plan: What It Could Mean For Borrowers

Table of Contents

Understanding the Proposed Privatization

Trump's proposed plan aimed to fundamentally restructure the federal student loan system by shifting responsibility from the government to private lenders. This entailed a significant shift in how student loans are originated, serviced, and ultimately repaid. Instead of the government directly managing the process, private entities would take on the role of loan origination, disbursement, and collection.

- Shifting Responsibility: The core tenet involved transferring the responsibility of loan servicing and disbursement from government agencies like Sallie Mae (now Navient) and others to private financial institutions.

- Interest Rate and Repayment Changes: The plan likely would have resulted in fluctuating interest rates determined by market forces, potentially impacting repayment plans and overall loan costs. This is in contrast to the historically fixed or relatively stable interest rates offered under federal loan programs.

- Government Oversight (or Lack Thereof): A key concern revolved around the level of government oversight and regulation within a privatized system. The extent to which the government would continue to monitor lending practices and protect borrowers from predatory lending was a major point of contention.

- Comparison with Private Loan Options: The proposal differed significantly from existing private student loan options. While private loans already exist, they typically carry higher interest rates and less favorable repayment terms compared to federal loans. Trump's plan suggested a complete overhaul, potentially affecting all student borrowers.

Potential Benefits of Privatization (According to Proponents)

Supporters of Trump's privatization plan argued that it would lead to several key benefits, primarily increased efficiency and competition within the student loan market.

- Increased Competition & Lower Interest Rates (Debated): Proponents suggested that introducing competition among private lenders would drive down interest rates, making loans more affordable for borrowers. However, this claim was widely debated, with critics arguing that increased competition wouldn't necessarily translate to lower rates for all borrowers.

- More Flexible Repayment Options: The argument was made that private lenders could offer more flexible repayment options tailored to individual borrowers' circumstances and financial situations. This could potentially include income-driven repayment plans or other flexible payment structures.

- Improved Customer Service & Streamlined Processes: Advocates suggested that private lenders, with their focus on customer satisfaction, could provide better customer service and more streamlined loan processing than government agencies.

- Innovation in Loan Products and Services: Private sector involvement was seen as a potential catalyst for innovation, potentially leading to the development of new and improved student loan products and services.

Counterarguments and Criticisms

Despite the purported benefits, the proposal faced significant criticism due to potential negative impacts on borrowers.

- Risk of Predatory Lending Practices: A major concern was the potential for private lenders to engage in predatory lending practices, taking advantage of vulnerable students facing financial hardship. This included the potential for high-interest rates, excessive fees, and misleading terms.

- Increased Interest Rates and Fees: Critics argued that the elimination of government subsidies and the influence of market forces could lead to significantly higher interest rates and fees for borrowers, particularly those with lower credit scores or from disadvantaged backgrounds.

- Lack of Consumer Protections and Regulatory Oversight: The absence of robust government oversight raised concerns about the lack of consumer protections in a fully privatized system. This could leave borrowers vulnerable to unfair lending practices and abusive collection tactics.

- Concerns about Equity and Access for Low-Income Students: Many expressed concern that a privatized system could exacerbate existing inequalities in access to higher education, potentially limiting opportunities for low-income students and students of color.

The Impact on Different Borrower Groups

Trump's proposed privatization would not have impacted all borrowers equally.

- Impact on Federal Student Loan Borrowers: The vast majority of student loan borrowers rely on federal student loans. Privatization would have drastically altered the terms and conditions of these loans, potentially leading to higher costs and less favorable repayment options.

- Impact on Private Student Loan Borrowers: Existing private student loan borrowers might have seen changes in the market as the shift to a privatized system played out, leading to an overall change in competition and potentially terms.

- Disproportionate Impact on Minority Borrowers and Low-Income Students: Critics warned that a privatized system could disproportionately harm minority borrowers and low-income students, who already face significant barriers to accessing higher education. These groups would likely be more vulnerable to predatory lending practices and less able to navigate complex financial terms.

- The Role of Credit Scores: In a privatized system, credit scores would likely play a much larger role in loan eligibility and interest rates, potentially excluding many borrowers who lack strong credit histories.

Long-Term Consequences and Unanswered Questions

The long-term effects of Trump's proposed plan remained highly uncertain and generated significant debate.

- Impact on the Overall Economy: The potential impact on the overall economy was unclear, with some arguing that a more efficient loan system could stimulate growth, while others warned of potential instability and increased household debt.

- Effect on Higher Education Affordability: Critics raised concerns that privatization could further reduce the affordability of higher education, making college unattainable for many students.

- Long-Term Sustainability: Questions arose about the long-term sustainability of a privatized student loan system, especially considering the potential for systemic risk and the possibility of financial crises within the private lending sector.

- Government Intervention: The extent to which the government would intervene to mitigate potential negative consequences in a privatized system remained unclear. Concerns existed about the lack of a safety net to protect borrowers from abusive lending practices.

Conclusion

Trump's Student Loan Privatization Plan presented a complex and controversial proposal with potentially far-reaching consequences for student borrowers and the economy. While proponents argued for increased efficiency and competition, critics raised serious concerns about predatory lending, reduced consumer protections, and increased inequality. Understanding the nuances of Trump's Student Loan Privatization Plan, and its potential implications for various borrower groups, is essential for making informed financial decisions and advocating for policies that protect students. Continue researching Trump's Student Loan Privatization Plan to ensure your financial well-being.

Featured Posts

-

Best Crypto Casinos Usa Is Jack Bit The 1 Bitcoin Gambling Site

May 17, 2025

Best Crypto Casinos Usa Is Jack Bit The 1 Bitcoin Gambling Site

May 17, 2025 -

China Box Office Mission Impossible Secures Release Date

May 17, 2025

China Box Office Mission Impossible Secures Release Date

May 17, 2025 -

Refinancing Federal Student Loans Is It Right For You

May 17, 2025

Refinancing Federal Student Loans Is It Right For You

May 17, 2025 -

2024 25 High School Confidential Key Events Of Week 26

May 17, 2025

2024 25 High School Confidential Key Events Of Week 26

May 17, 2025 -

Analyzing The Warner Bros Pictures Presentation At Cinema Con 2025

May 17, 2025

Analyzing The Warner Bros Pictures Presentation At Cinema Con 2025

May 17, 2025

Latest Posts

-

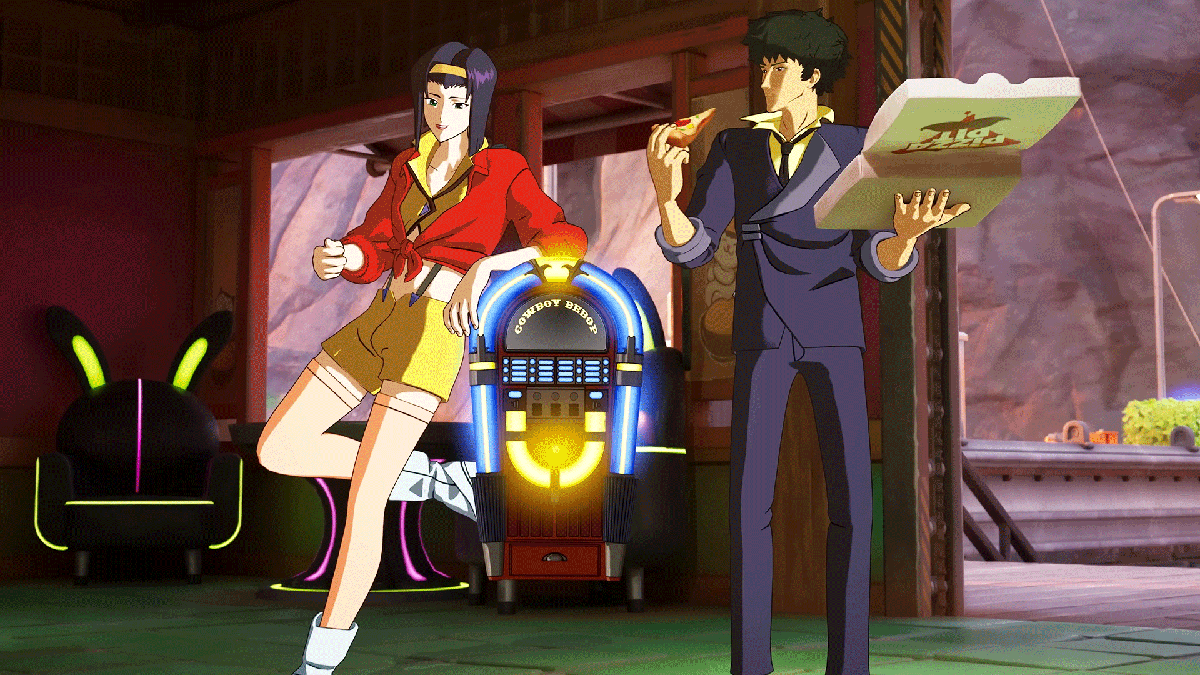

Fortnite Cowboy Bebop Bundle Price Check For Faye Valentine And Spike Spiegel Skins

May 17, 2025

Fortnite Cowboy Bebop Bundle Price Check For Faye Valentine And Spike Spiegel Skins

May 17, 2025 -

Cowboy Bebop Faye Valentine And Spike Spiegel Fortnite Skins Price And Release Date

May 17, 2025

Cowboy Bebop Faye Valentine And Spike Spiegel Fortnite Skins Price And Release Date

May 17, 2025 -

Fortnite Players Express Disappointment With New Shop Items

May 17, 2025

Fortnite Players Express Disappointment With New Shop Items

May 17, 2025 -

Fortnites Cowboy Bebop Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025

Fortnites Cowboy Bebop Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025 -

Fortnite Fans Furious Over Latest Item Shop Update

May 17, 2025

Fortnite Fans Furious Over Latest Item Shop Update

May 17, 2025