Trump's Tariff Comments Boost European Stock Markets; LVMH Slumps

Table of Contents

Positive European Market Response to Trump Tariff News

Trump's latest comments on tariffs, while not explicitly detailing any new policies, seemed to alleviate some investor anxieties surrounding escalating trade conflicts. This led to a noticeable reduction in trade war fears and a subsequent surge in European stock markets.

Reduced Trade War Fears

Specific comments perceived as less aggressive than previous pronouncements contributed to the positive market sentiment. Analysts interpreted these statements as signaling a potential de-escalation of trade tensions, reducing tariff uncertainty and market volatility.

- Comment 1: (Insert specific quote or paraphrase of a Trump comment suggesting a softening of trade policy). Analysts interpreted this as a sign of potential compromise.

- Comment 2: (Insert specific quote or paraphrase of a Trump comment suggesting a willingness to negotiate). This fueled speculation of a potential trade deal and reduced expectations of further tariff escalation.

- Market Impact: The DAX rose by X%, the CAC 40 by Y%, and the FTSE 100 by Z% following the comments. This significant increase reflects a palpable shift in investor confidence.

Shift in Investor Sentiment

The news triggered a clear "risk-on" sentiment, characterized by increased investor confidence and market optimism. This wasn't uniform across all sectors, however.

- Technology Sector: The technology sector, often sensitive to trade disputes, experienced significant gains, reflecting optimism about reduced trade barriers.

- Luxury Goods: While the broader market rallied, luxury goods companies like LVMH showed a markedly different trend (discussed further below).

- Automobiles: The automotive industry, heavily impacted by previous tariff disputes, also saw a positive reaction, indicating a lessening of trade war anxieties.

"The market reacted positively to the perceived reduction in trade war risk," commented [Name of Financial Analyst], Chief Economist at [Financial Institution]. "Investors are clearly hoping for a less confrontational trade policy going forward."

LVMH's Negative Performance Despite Broader Market Gains

Despite the overall positive response to Trump's tariff comments in European markets, LVMH experienced a decline in its stock price. This highlights the company's specific vulnerability to tariff changes and other contributing factors.

Specific Vulnerability to Tariff Changes

LVMH's negative performance underscores the unique sensitivities of luxury goods companies to import tariffs and fluctuations in consumer spending.

- International Supply Chains: LVMH's extensive global supply chains make it particularly susceptible to import tariffs, as increased costs can directly impact its profitability.

- Pricing Strategies: Increased import costs due to tariffs may force LVMH to either absorb higher expenses or pass them on to consumers, potentially impacting sales.

- Stock Performance: LVMH's stock price fell by X% following the release of Trump's comments, contrasting sharply with the positive performance of broader European indices.

Other Contributing Factors

While tariff anxieties played a role, other factors may have contributed to LVMH's slump.

- Slowing Global Growth: Concerns about a global economic slowdown could be negatively impacting luxury goods demand, regardless of tariff changes.

- Increased Market Competition: Intense competition within the luxury goods sector could also be placing pressure on LVMH's margins and stock price.

- Geopolitical Uncertainty: Broader geopolitical uncertainties, independent of specific tariff announcements, can also impact investor sentiment toward luxury goods companies.

The Future Implications of Trump's Tariff Policies on Global Markets

Despite the temporary relief provided by Trump's recent comments, significant uncertainties remain regarding future trade policy.

Uncertainties Remain

The long-term impact of Trump's tariff policies remains highly uncertain.

- Future Tariff Announcements: The possibility of future tariff announcements or changes in trade policy creates ongoing geopolitical risks for investors.

- Negotiation Outcomes: The outcome of ongoing trade negotiations will significantly impact market sentiment and investor confidence.

- Market Volatility: Continued uncertainty surrounding trade policy is likely to contribute to persistent market volatility.

“[Quote from a financial analyst on the ongoing uncertainty and potential future market impacts],” stated [Name of Analyst] at [Institution].

Strategies for Investors

Given the persistent uncertainty surrounding Trump's tariff policies, investors should adopt a cautious yet opportunistic approach.

- Diversification: Diversifying investment portfolios across different sectors and geographies can help mitigate risks associated with trade policy uncertainty.

- Risk Management: Implementing robust risk management strategies is crucial to navigate the volatility caused by fluctuating trade policies.

- Stay Informed: Staying informed about ongoing developments in trade policy and global markets is critical for making sound investment decisions.

Conclusion: Navigating the Impact of Trump's Tariff Comments

Trump's recent tariff comments generated a mixed market reaction, with European stock markets rising while LVMH experienced a decline. This highlights the complex interplay between trade policy, market sentiment, and the specific vulnerabilities of different industries. Understanding the interconnectedness of global markets and the potential impacts of Trump's tariff comments – and indeed all future trade policy shifts – is crucial for investors and businesses alike. Stay informed by following reputable financial news sources and the analyses of leading market experts to navigate this complex and evolving landscape.

Featured Posts

-

Billie Jean King Cup Kazakhstans Win Against Australia

May 24, 2025

Billie Jean King Cup Kazakhstans Win Against Australia

May 24, 2025 -

Sexist Chants Aimed At Female Referee Spark Investigation

May 24, 2025

Sexist Chants Aimed At Female Referee Spark Investigation

May 24, 2025 -

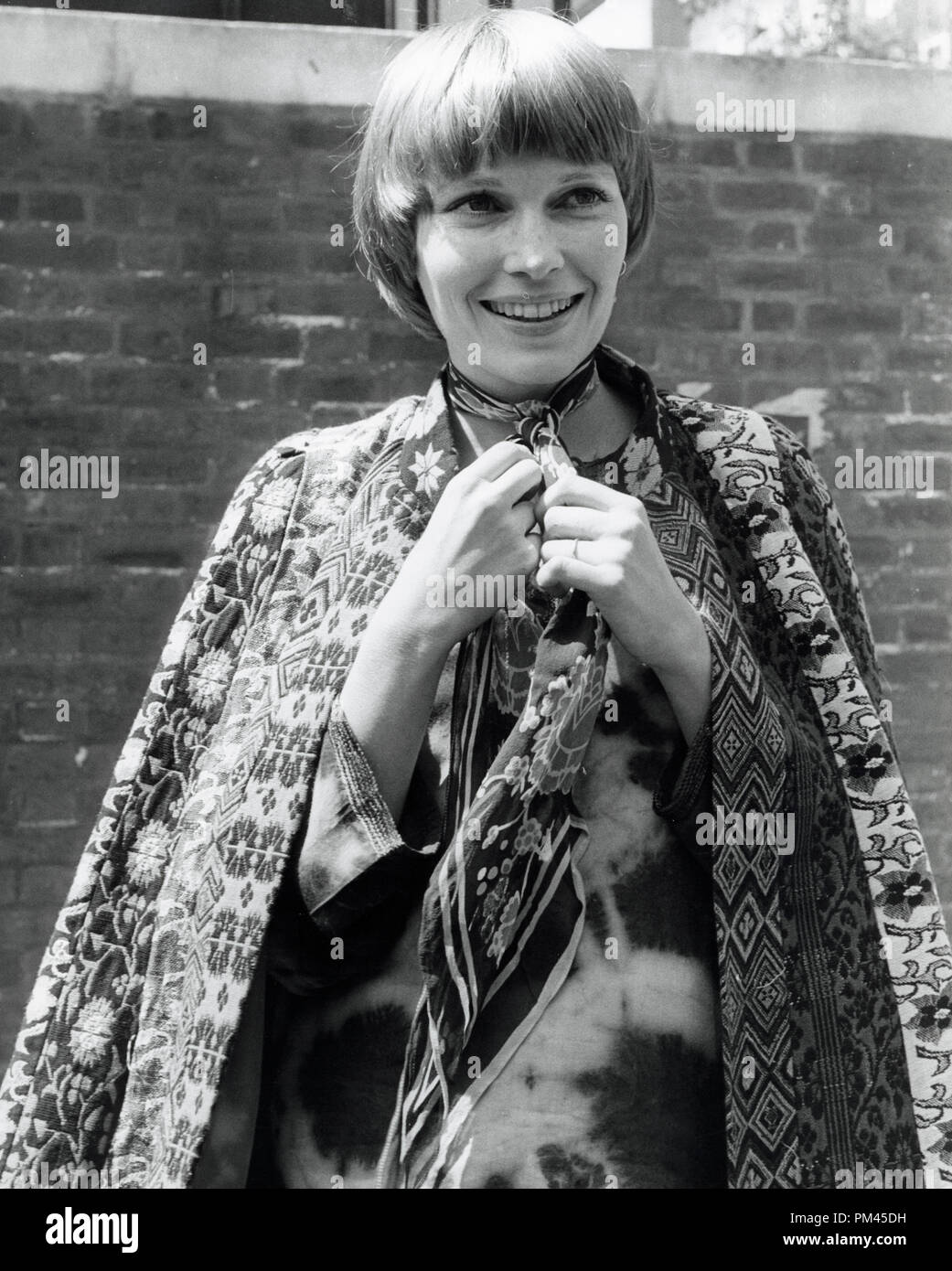

Ronan Farrow And Mia Farrow A Hollywood Comeback Story

May 24, 2025

Ronan Farrow And Mia Farrow A Hollywood Comeback Story

May 24, 2025 -

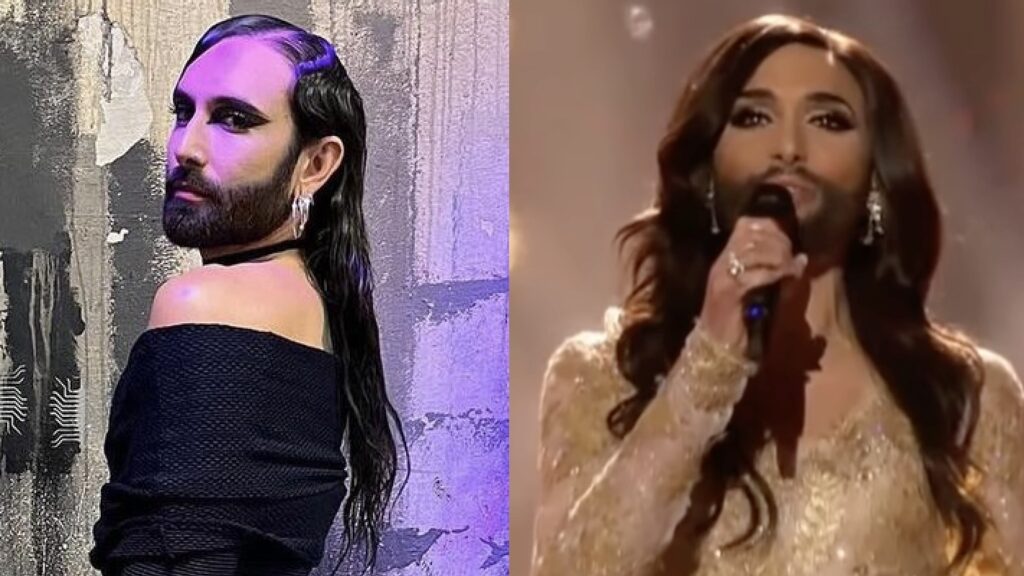

Eurovision Village 2025 Conchita Wurst Live With Special Guest Jj

May 24, 2025

Eurovision Village 2025 Conchita Wurst Live With Special Guest Jj

May 24, 2025 -

Trumps Tariff Hike Sends Amsterdam Stock Exchange Down 2

May 24, 2025

Trumps Tariff Hike Sends Amsterdam Stock Exchange Down 2

May 24, 2025