Trump's Tariffs: Goldman Sachs Provides Exclusive Advice To Affected Nations

Table of Contents

Goldman Sachs' Role in Navigating Trump's Tariffs

Goldman Sachs leveraged its expertise in international finance and economics to provide crucial support to countries impacted by the Trump administration's tariffs. Their services went beyond simple analysis; they offered bespoke solutions tailored to each nation's unique economic situation.

Strategic Consulting Services

Goldman Sachs provided comprehensive strategic consulting services, meticulously analyzing the tariff impact on individual nations. This involved a deep dive into each country's economic structure and vulnerabilities to provide truly customized solutions.

- Analysis of tariff impact on specific industries: The firm's analysts meticulously examined the effects of tariffs on various sectors, identifying which industries were most vulnerable and the potential ripple effects throughout the economy. This detailed analysis was crucial for developing effective mitigation strategies.

- Development of mitigation strategies to minimize negative economic effects: Beyond identifying problems, Goldman Sachs worked with affected nations to devise strategies to offset the negative impacts. This involved exploring options like adjusting domestic policies, seeking new trade partners, and diversifying export markets.

- Exploration of alternative trade partners and diversification strategies: A core component of their advice focused on reducing reliance on the US market. This involved identifying and fostering relationships with new trade partners and developing more resilient supply chains.

- Assessment of investment risks and opportunities in the changing global landscape: The changing trade landscape created both risks and opportunities. Goldman Sachs helped nations assess these, advising on where to invest and how to mitigate emerging risks.

Financial Modeling and Forecasting

Goldman Sachs employed sophisticated economic modeling and forecasting techniques to predict the potential impact of Trump's tariffs. This allowed nations to anticipate economic consequences and proactively implement countermeasures.

- Scenario planning to explore different policy responses: Various scenarios were modeled, allowing nations to assess the potential effectiveness of different policy responses and prepare for various outcomes.

- Quantitative analysis of the effectiveness of different mitigation strategies: The firm’s quantitative analysis helped nations objectively evaluate the potential success of different mitigation strategies, ensuring resources were allocated effectively.

- Development of early warning systems to identify potential economic shocks: Goldman Sachs assisted in creating systems to identify potential future economic shocks early, allowing for timely intervention and minimizing negative impacts.

Specific Advice Offered to Affected Nations

The advice provided by Goldman Sachs wasn't generic; it addressed the specific challenges faced by individual nations impacted by Trump's tariffs. This tailored approach proved crucial in helping countries navigate these unprecedented economic headwinds.

Diversification of Trade Partners

Reducing dependence on the US market was a central theme in Goldman Sachs' recommendations. The firm actively encouraged affected nations to forge stronger economic ties with other countries.

- Identifying new export markets with less restrictive trade policies: Goldman Sachs helped identify potential export markets with more favorable trade policies, opening up new avenues for growth and economic stability.

- Negotiating new trade agreements and fostering stronger economic ties with other nations: The firm assisted in negotiating new trade agreements and building stronger economic relationships with alternative partners.

- Developing strategies to attract foreign direct investment from diverse sources: Diversifying investment sources was critical to reducing vulnerability. Goldman Sachs helped nations develop strategies to attract foreign direct investment from a broader range of countries.

Investment in Domestic Industries

Goldman Sachs emphasized the importance of strengthening domestic industries to reduce vulnerability to external trade shocks. This involved targeted investment and policy changes.

- Identifying key sectors for strategic investment and growth: The firm helped identify sectors with the highest potential for growth and recommended targeted investments to foster expansion and job creation.

- Developing policies to support innovation and technological advancement within domestic industries: To enhance competitiveness, Goldman Sachs advised on policies that encourage innovation and technological advancements within domestic industries.

- Attracting domestic and foreign investment through tax incentives and other supportive measures: Attracting investment was key. The firm advised on using tax incentives and other measures to encourage both domestic and foreign investment.

Risk Mitigation and Contingency Planning

Preparing for future trade disputes was another crucial aspect of Goldman Sachs' advice. This involved developing robust contingency plans and strengthening economic resilience.

- Developing comprehensive contingency plans for various trade scenarios: Goldman Sachs assisted in preparing for a range of potential trade scenarios, ensuring that nations were ready for various outcomes.

- Strengthening financial reserves to withstand economic shocks: Building strong financial reserves was vital. The firm advised on strategies to bolster financial stability and withstand economic disruptions.

- Implementing policies to protect vulnerable industries and populations: Goldman Sachs helped develop policies to protect vulnerable industries and populations from the negative effects of trade disputes.

Conclusion

Goldman Sachs played a significant role in advising nations impacted by Trump's tariffs, providing crucial strategic and financial guidance. Their expert advice, encompassing diversification strategies, domestic investment recommendations, and robust risk mitigation plans, helped nations navigate the complex challenges posed by these protectionist trade policies. Understanding the implications of Trump's tariffs and the strategic advice offered by firms like Goldman Sachs is crucial for anyone involved in international trade or global finance. To better understand the complexities of international trade policy and mitigate the risks of future trade disputes, further research into the impact of Trump's tariffs and the strategies employed by nations to overcome them is essential. Understanding the long-term effects of these tariffs is vital for investors and policymakers alike.

Featured Posts

-

Hollywood Shutdown Double Strike Cripples Film And Television

Apr 29, 2025

Hollywood Shutdown Double Strike Cripples Film And Television

Apr 29, 2025 -

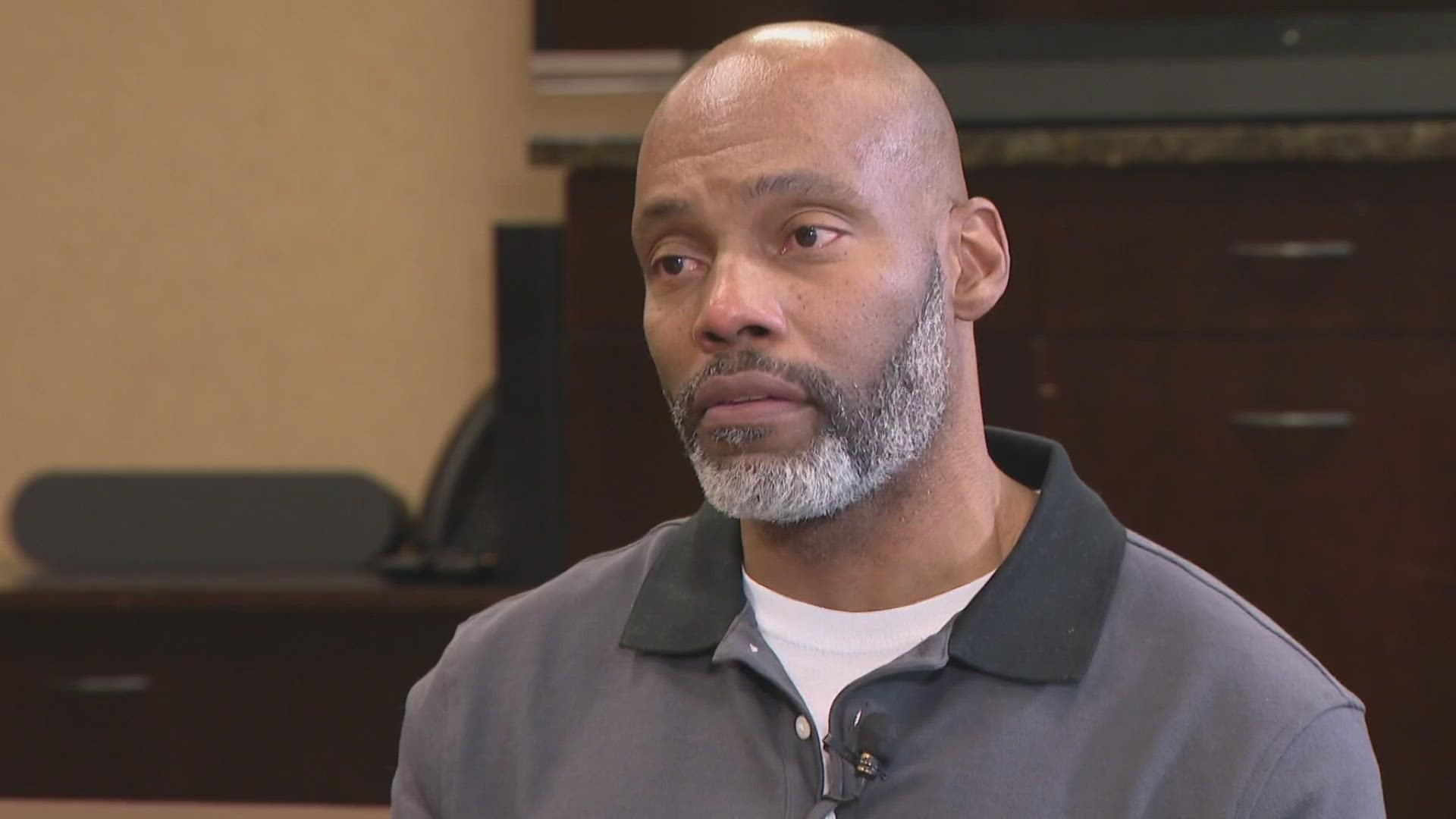

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025 -

Market Value Plunge Seven Stocks Lose 2 5 Trillion In 2024

Apr 29, 2025

Market Value Plunge Seven Stocks Lose 2 5 Trillion In 2024

Apr 29, 2025 -

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025 -

One Plus 13 R Vs Pixel 9a A Detailed Comparison Review

Apr 29, 2025

One Plus 13 R Vs Pixel 9a A Detailed Comparison Review

Apr 29, 2025

Latest Posts

-

Brit Paralympian Missing At Wrestle Mania Found Safe

Apr 29, 2025

Brit Paralympian Missing At Wrestle Mania Found Safe

Apr 29, 2025 -

Controversial Cardinals Conclave Voting Rights Under Scrutiny

Apr 29, 2025

Controversial Cardinals Conclave Voting Rights Under Scrutiny

Apr 29, 2025 -

Papal Conclave Disputed Voting Rights Of A Convicted Cardinal

Apr 29, 2025

Papal Conclave Disputed Voting Rights Of A Convicted Cardinal

Apr 29, 2025 -

Convicted Cardinal Fights For Conclave Voting Rights

Apr 29, 2025

Convicted Cardinal Fights For Conclave Voting Rights

Apr 29, 2025 -

Cardinal Maintains Voting Eligibility Despite Conviction

Apr 29, 2025

Cardinal Maintains Voting Eligibility Despite Conviction

Apr 29, 2025