Trump's Tariffs On China: A Deep Dive Into The Rising Costs And Supply Chain Issues Facing The US

Table of Contents

Soaring Consumer Prices: The Direct Impact of Tariffs

The most immediate and visible effect of Trump's tariffs on China was a surge in consumer prices. The tariffs, essentially taxes on imported goods, were directly passed on to consumers, making everyday items more expensive.

Increased Costs of Imported Goods

- Electronics: Tariffs on electronics, including smartphones, laptops, and televisions, led to noticeable price increases.

- Furniture: The cost of furniture, a significant portion of which was imported from China, rose sharply, impacting household budgets.

- Clothing and Apparel: Clothing and apparel, heavily reliant on Chinese manufacturing, became more expensive for American consumers.

These price increases weren't simply isolated incidents. The mechanics are straightforward: tariffs increase the cost of imported goods at the port of entry. Importers then pass these increased costs onto retailers, ultimately leading to higher prices for consumers. This is further compounded by inflationary pressures, creating a vicious cycle of rising costs.

Impact on Inflation and the Cost of Living

The increased prices resulting from Trump's tariffs on China contributed significantly to overall inflation in the US.

- Inflation Statistics: Data from the Bureau of Labor Statistics show a clear correlation between the implementation of tariffs and a rise in the Consumer Price Index (CPI).

- Tariff-Inflation Correlation: Numerous economic analyses have pointed to a direct link between the tariffs and increased inflation, impacting the cost of living for millions of Americans.

The ripple effect was substantial. Increased prices for imported goods didn't exist in a vacuum; they triggered price increases in other sectors as businesses faced higher input costs. This amplified the impact on the overall cost of living, squeezing household budgets and reducing disposable income.

Supply Chain Disruptions: A Consequence of Trade Wars

Trump's tariffs on China didn't just impact prices; they severely disrupted already complex global supply chains. The interconnectedness of global trade means that disruptions in one area can have cascading effects throughout the entire system.

The Complexity of Global Supply Chains

Global supply chains are intricate networks involving multiple countries and companies. Trump's tariffs threw a wrench into this finely tuned system.

- Manufacturing: Many US manufacturers relied on components sourced from China, leading to production delays and shortages when tariffs increased costs and complicated procurement.

- Agriculture: American farmers, particularly soybean producers, faced significant challenges exporting to China due to retaliatory tariffs imposed by the Chinese government.

The reliance on just-in-time manufacturing, a system designed to minimize inventory costs by receiving materials only when needed, was particularly vulnerable to these disruptions. Tariffs introduced unexpected delays and uncertainties, rendering this efficiency-focused approach ineffective.

Reshoring and its Challenges

In response to the tariffs and supply chain disruptions, some companies attempted to reshore – moving production back to the US. However, this proved significantly challenging.

- Costs of Reshoring: Relocating production is incredibly expensive, involving significant capital investment in new facilities and equipment.

- Labor Shortages: Finding a sufficient workforce with the necessary skills posed a major obstacle.

- Infrastructure Limitations: Existing infrastructure in the US often lacked the capacity to handle the increased production demands.

While reshoring holds long-term potential, the immediate challenges revealed the limitations of a rapid shift away from established global supply chains.

The Search for Alternative Suppliers

Facing difficulties with sourcing from China, many US companies sought alternative suppliers elsewhere.

- Vietnam, Mexico, and other Southeast Asian Countries: These countries benefited from the shift, becoming attractive alternatives for manufacturing and sourcing.

- Challenges of Finding Alternatives: Identifying reliable suppliers with comparable quality and cost-effectiveness proved difficult, extending lead times and increasing costs.

This search for alternatives had broader geopolitical implications, reshaping international trade relationships and influencing economic power dynamics.

The Impact on Specific US Industries

The impact of Trump's tariffs on China wasn't uniform across all industries. Some sectors, like agriculture and manufacturing, experienced particularly severe consequences.

Agriculture

The agricultural sector bore the brunt of retaliatory tariffs imposed by China.

- Soybean Exports: The Chinese government targeted US soybeans, leading to significant export losses and financial hardship for American farmers.

- Government Subsidies: The US government implemented various subsidy programs to mitigate the damage, but these measures couldn't fully compensate for lost revenue.

This situation had major political implications, sparking debates about trade policy and support for rural communities.

Manufacturing

US manufacturing industries faced a double whammy: higher input costs due to tariffs and increased competition from countries that benefited from the shift in global supply chains.

- Job Losses and Factory Closures: Some manufacturers experienced job losses and were forced to close facilities due to decreased competitiveness and profitability.

- Changes in Production Strategies: Companies adjusted their production strategies, often diversifying sourcing and seeking cost reductions wherever possible.

The competitiveness of US manufacturing in the global market remained a significant concern, raising questions about long-term economic sustainability.

Conclusion: Understanding the Long-Term Effects of Trump's Tariffs on China

Trump's tariffs on China had a far-reaching and largely negative impact on the US economy. This article highlighted the significant increase in consumer prices, the substantial disruption of global supply chains, and the negative consequences for specific industries, particularly agriculture and manufacturing. The long-term effects of these tariffs continue to unfold, influencing US-China relations, and impacting the global economic landscape. The lasting impacts include lingering inflationary pressures, a reshaped global supply chain landscape, and a renewed focus on domestic manufacturing with associated challenges. Further research into the effects of tariffs on China, and a deeper understanding of US-China trade relations are crucial for developing effective and sustainable trade policies in the future. Continue your exploration into the complexities of the effects of tariffs on China; understanding this issue is vital for informed civic engagement.

Featured Posts

-

Trumps First 100 Days Part 2 Trade Deregulation And The Impact Of Executive Orders

Apr 29, 2025

Trumps First 100 Days Part 2 Trade Deregulation And The Impact Of Executive Orders

Apr 29, 2025 -

Hagia Sophia From Byzantine Basilica To Ottoman Mosque And Museum

Apr 29, 2025

Hagia Sophia From Byzantine Basilica To Ottoman Mosque And Museum

Apr 29, 2025 -

Wildfire Betting A Reflection Of Our Times Examining The Los Angeles Case

Apr 29, 2025

Wildfire Betting A Reflection Of Our Times Examining The Los Angeles Case

Apr 29, 2025 -

Ryan Reynolds Celebrates Wrexham Afcs Historic Promotion

Apr 29, 2025

Ryan Reynolds Celebrates Wrexham Afcs Historic Promotion

Apr 29, 2025 -

Anthony Edwards Adidas 2 Everything We Know So Far

Apr 29, 2025

Anthony Edwards Adidas 2 Everything We Know So Far

Apr 29, 2025

Latest Posts

-

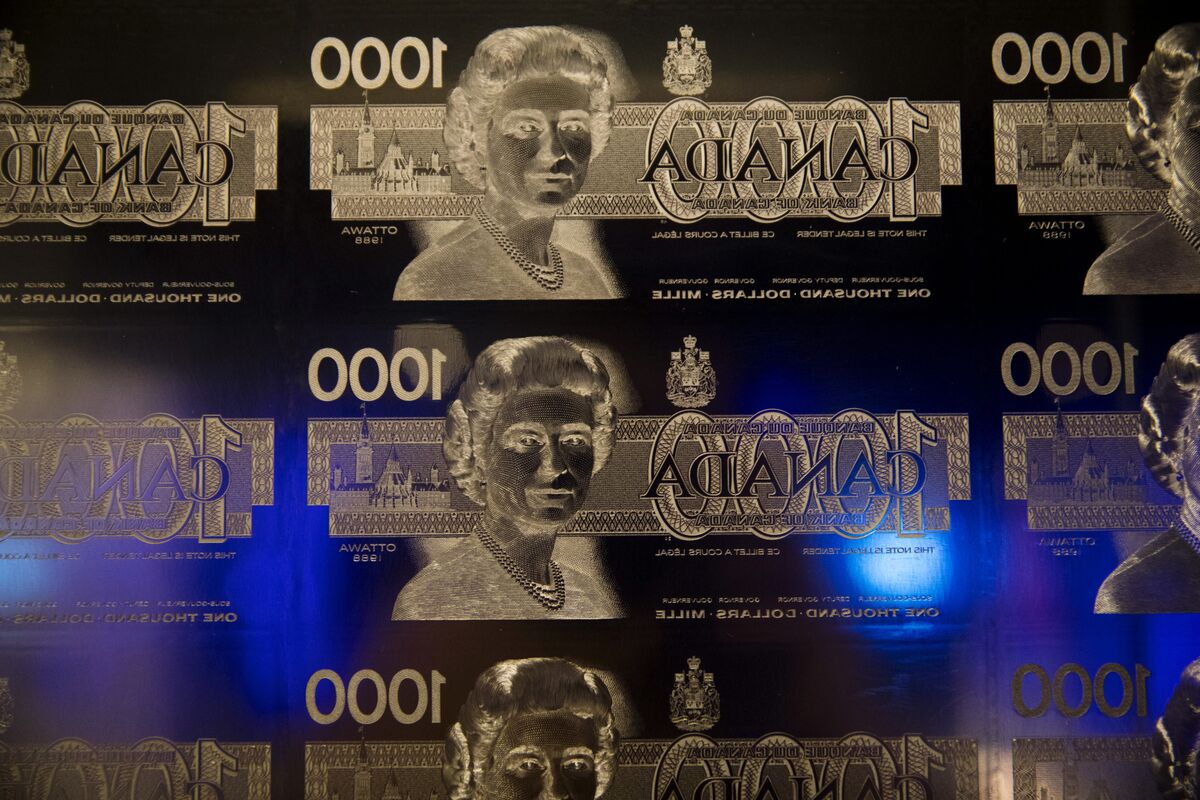

Rosenberg Accuses Bank Of Canada Of Monetary Policy Mistake

Apr 29, 2025

Rosenberg Accuses Bank Of Canada Of Monetary Policy Mistake

Apr 29, 2025 -

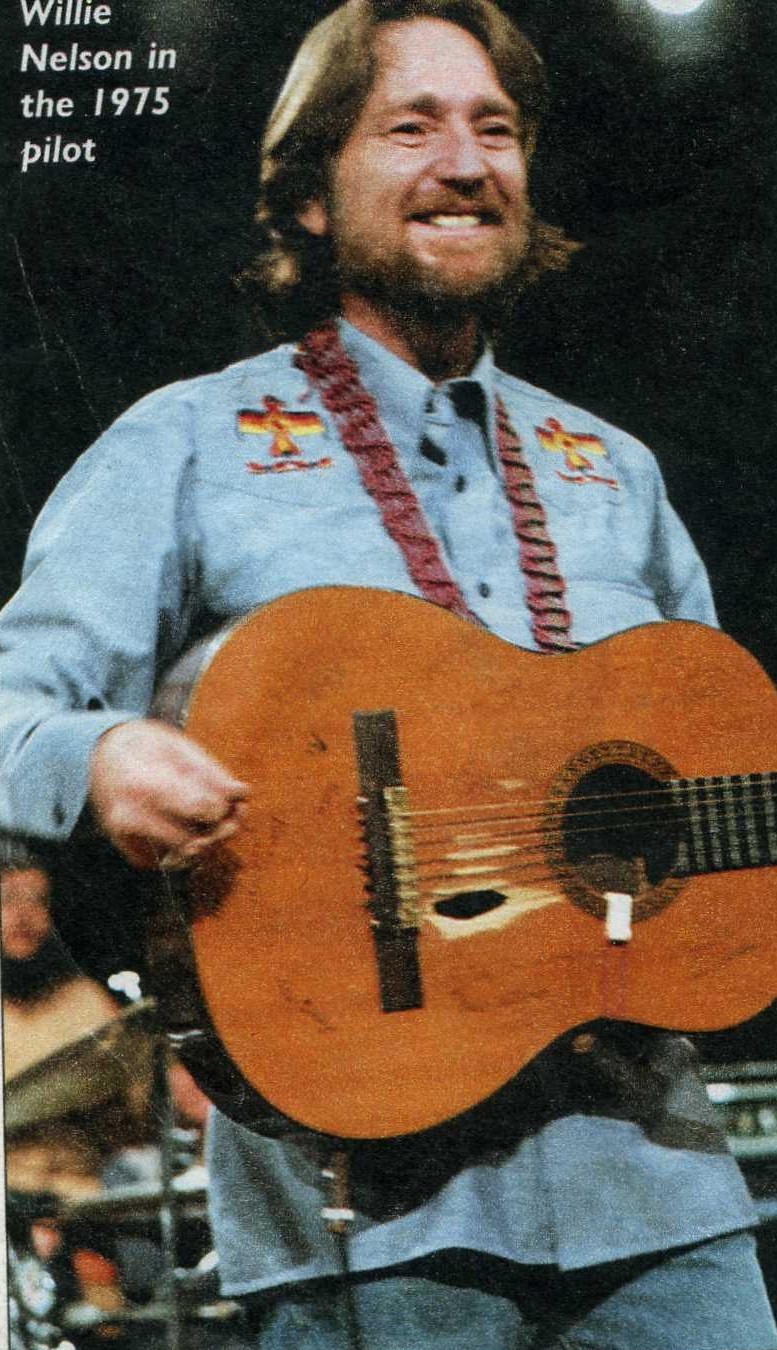

Willie Nelson And Family An Austin City Limits Concert Retrospective

Apr 29, 2025

Willie Nelson And Family An Austin City Limits Concert Retrospective

Apr 29, 2025 -

1 050 V Mware Price Increase At And T Details Broadcoms Proposed Hike

Apr 29, 2025

1 050 V Mware Price Increase At And T Details Broadcoms Proposed Hike

Apr 29, 2025 -

Rosenberg Critiques Bank Of Canadas Monetary Policy A Cautious Approach

Apr 29, 2025

Rosenberg Critiques Bank Of Canadas Monetary Policy A Cautious Approach

Apr 29, 2025 -

70 Off Hudsons Bay Final Store Liquidation Sale Begins

Apr 29, 2025

70 Off Hudsons Bay Final Store Liquidation Sale Begins

Apr 29, 2025