Uber Stock Recession-Proof? Analyst Insights

Table of Contents

Uber's Resilience Factors

Several factors contribute to the argument that Uber stock possesses some degree of recession resistance.

Essential Service Model

Uber's ride-hailing and food delivery services are considered essential by many, suggesting continued demand even during economic slowdowns.

- Demand for affordable transportation persists during economic hardship: People still need to get to work, appointments, and other essential destinations, even when budgets are tight.

- Food delivery services often see increased usage during recessions: As people cut back on dining out, the convenience and affordability of food delivery become more appealing.

- The gig economy nature allows for flexible spending: Uber drivers can adjust their work hours based on demand, offering a flexible income stream during uncertain times.

The price sensitivity of Uber's services is a key aspect. While considered essential by many, the reality is that during a downturn, even the cost of a ride-share or food delivery can be considered a discretionary expense. Data shows a correlation between reduced consumer spending and decreased Uber usage. However, Uber's pricing flexibility, as discussed below, attempts to mitigate this.

Pricing Power & Dynamic Pricing

Uber’s dynamic pricing model, adjusting prices based on demand, is a crucial factor. This potentially mitigates revenue loss during economic downturns.

- Surge pricing during high demand periods (e.g., bad weather, events): This compensates for increased demand and potentially higher driver costs.

- Potential downsides (e.g., negative customer perception): High surge pricing can lead to customer dissatisfaction and a shift to competitors.

Analyzing historical data reveals Uber's ability to adapt its pricing to fluctuating demand. During past economic slowdowns, Uber adjusted pricing strategies, although the impact on revenue and profitability varied depending on the severity of the downturn and the specific market conditions.

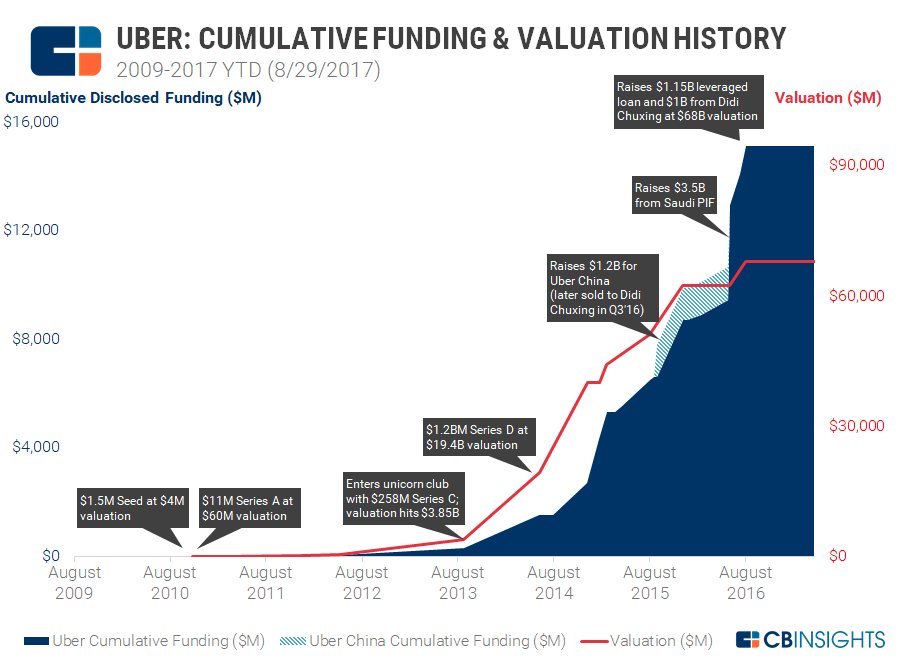

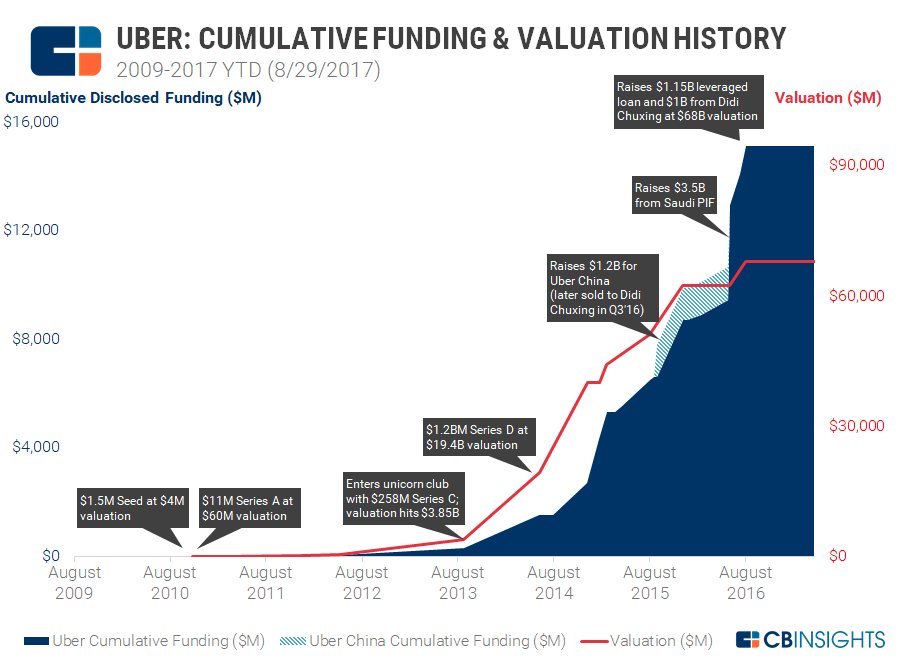

Diversification of Revenue Streams

Uber's expansion into food delivery (Uber Eats), freight (Uber Freight), and other services diversifies its revenue base, reducing reliance on a single sector.

- Contribution of each revenue stream: Uber Eats, in particular, has shown significant growth and resilience, providing a buffer against potential downturns in the ride-hailing segment.

- Growth potential of each segment during economic uncertainty: Different segments may react differently to economic fluctuations. For example, freight might show more resilience than ride-sharing during a recession.

Comparative data showcases the varying growth rates and resilience of these different services. While ride-sharing might suffer during a downturn, the food delivery and freight segments could potentially offset some of the losses.

Potential Risks to Uber's Recession-Proof Thesis

Despite its apparent strengths, several significant risks challenge the "recession-proof" narrative surrounding Uber stock.

Consumer Spending Sensitivity

Despite being essential to some, Uber services are discretionary expenses. Reduced consumer spending significantly impacts demand.

- Correlation between consumer confidence indices and Uber's revenue: Historical data shows a clear correlation – lower consumer confidence translates to less Uber usage.

- Potential layoffs and reduced disposable income: Economic downturns often lead to job losses and decreased disposable income, directly impacting demand for Uber services.

Real-world examples from past recessions illustrate how severely Uber usage can be affected by economic hardship. People prioritize essential expenses over ride-sharing or food delivery when faced with financial constraints.

Competition & Market Saturation

Intense competition from companies like Lyft, DoorDash, and others pressures Uber's pricing and profitability.

- Key competitors and their market share: The ride-hailing and food delivery markets are increasingly crowded, leading to intense competition for customers and drivers.

- Pricing strategies and competitive advantages: Competitors may offer lower prices or incentives, further eroding Uber's margins.

Price wars are a real possibility during a recession, as companies fight to retain market share. This could significantly impact Uber's profitability, even if demand remains relatively stable.

Inflationary Pressures & Rising Costs

Increased operational costs, such as fuel prices and driver wages, negatively impact Uber's margins.

- Impact of inflation on Uber's operational costs: Rising fuel prices and increased driver compensation directly reduce profitability.

- Strategies Uber might employ to mitigate these pressures: Uber may attempt to pass on costs to consumers, but this can affect demand. Improving operational efficiency is another crucial strategy.

Analyzing historical data reveals Uber's past responses to cost increases. The company's ability to efficiently manage costs during inflationary periods will be crucial for its resilience during a recession.

Analyst Opinions on Uber Stock During a Recession

Analyst opinions on Uber stock during a recession vary considerably. Some analysts maintain a bullish outlook, citing the company's diversification and pricing power. Others express concerns about consumer spending sensitivity and competitive pressures. For example, a recent report from [Insert Analyst Firm Name] projected a [Insert Percentage]% decline in Uber's revenue during a mild recession, while [Insert Another Analyst Firm Name] suggested a more moderate [Insert Percentage]% decrease. These differing projections highlight the uncertainty surrounding Uber's future performance during an economic downturn. Quotes from reputable analysts and their rationales should be included here for a more comprehensive analysis.

Conclusion

This article examined whether Uber stock is truly recession-proof. While its essential service model, dynamic pricing, and diversified revenue streams suggest a degree of resilience, significant risks remain, including consumer spending sensitivity, competition, and inflationary pressures. Analyst opinions are varied, highlighting the uncertainty surrounding its performance during an economic downturn.

Call to Action: Further research into Uber's financial performance, competitive landscape, and overall market conditions is crucial before making investment decisions regarding Uber stock's recession-proof potential. Thorough due diligence is essential before investing in any stock, especially during periods of economic uncertainty. Remember to consult with a financial advisor before making any investment decisions related to Uber stock or other recession-proof investments.

Featured Posts

-

End Of Ryujinx Nintendo Contact Leads To Development Halt

May 17, 2025

End Of Ryujinx Nintendo Contact Leads To Development Halt

May 17, 2025 -

The Significance Of Trumps May 15 2025 Middle East Trip

May 17, 2025

The Significance Of Trumps May 15 2025 Middle East Trip

May 17, 2025 -

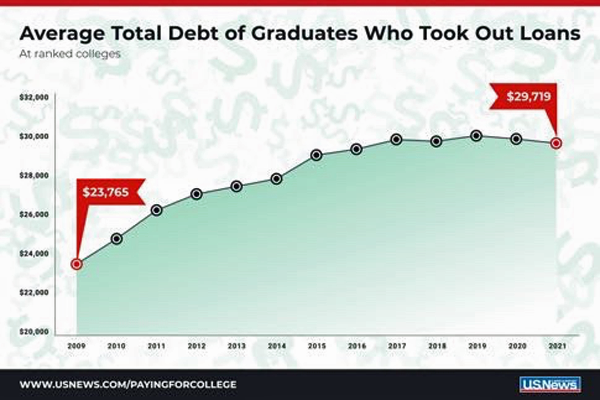

Managing Student Loan Debt Expert Financial Planning Advice

May 17, 2025

Managing Student Loan Debt Expert Financial Planning Advice

May 17, 2025 -

Djokovic Gap Alcaraz O Ban Ket Miami Open 2025 Phan Tich Nhanh Dau

May 17, 2025

Djokovic Gap Alcaraz O Ban Ket Miami Open 2025 Phan Tich Nhanh Dau

May 17, 2025 -

Srbija Na Evrobasketu Generalna Proba U Bajernovoj Dvorani

May 17, 2025

Srbija Na Evrobasketu Generalna Proba U Bajernovoj Dvorani

May 17, 2025

Latest Posts

-

Anunoby Anota 27 Knicks Vencen A 76ers Novena Derrota Seguida

May 17, 2025

Anunoby Anota 27 Knicks Vencen A 76ers Novena Derrota Seguida

May 17, 2025 -

Piston And Knicks Season Performance A Statistical Comparison

May 17, 2025

Piston And Knicks Season Performance A Statistical Comparison

May 17, 2025 -

Detroit Pistons Vs New York Knicks Key Factors For Success In 2023 2024

May 17, 2025

Detroit Pistons Vs New York Knicks Key Factors For Success In 2023 2024

May 17, 2025 -

Piston Success Vs Knicks A Season Head To Head Analysis

May 17, 2025

Piston Success Vs Knicks A Season Head To Head Analysis

May 17, 2025 -

Novena Derrota De Sixers Anunoby Y Knicks Los Dominan

May 17, 2025

Novena Derrota De Sixers Anunoby Y Knicks Los Dominan

May 17, 2025