Uber (UBER) Investment: Potential And Risks

Table of Contents

The Potential of Uber (UBER) Investment

Uber's position in the global transportation market presents significant investment potential. Let's examine the key factors driving this potential:

Dominant Market Share and Global Reach

Uber's extensive global network and leading market share in many regions provide a strong foundation for future growth. The company's dominance is particularly pronounced in major metropolitan areas worldwide. This established presence minimizes the risk of market entry for new competitors, giving Uber a significant advantage.

- Market dominance in key cities: Uber boasts a substantial market share in numerous cities globally, securing a significant portion of the ride-sharing market.

- Expansion into new markets (e.g., autonomous vehicles, delivery services): Uber's strategic expansion beyond ride-sharing, into areas like autonomous vehicles and delivery services, demonstrates a forward-thinking approach to long-term growth and diversification of revenue streams. The potential impact of successful autonomous vehicle deployment on Uber's profitability is substantial.

- Strategic partnerships: Collaborations with other companies in complementary industries further enhance Uber's market reach and service offerings. Strategic partnerships can unlock new opportunities and bolster market penetration. The expansion of Uber's services and integration with other services greatly enhance the user experience and strengthen their market position. This expansion is reflected in increased Uber market share and Uber global expansion.

Diversification Beyond Ride-Sharing

Uber's diversification strategy mitigates the risk associated with relying solely on ride-sharing revenue. Uber Eats, Uber Freight, and micromobility services contribute to a more resilient and diversified business model.

- Uber Eats market share: Uber Eats has established itself as a significant player in the food delivery market, competing effectively with other delivery platforms. The growth of Uber Eats positively impacts the overall financial performance of Uber.

- Uber Freight growth: Uber Freight targets the lucrative freight transportation market, capitalizing on the growing demand for efficient logistics solutions. The success of Uber Freight could significantly impact the Uber investment landscape.

- Micromobility expansion (e-scooters, e-bikes): The integration of micromobility options into the Uber app expands service offerings and caters to diverse customer needs. This diversification strategy directly relates to Uber diversification and growth potential.

Technological Innovation and Future Growth

Uber's commitment to technological innovation positions it for long-term growth and efficiency improvements. Investment in areas such as autonomous vehicles and AI is crucial for future competitiveness.

- Self-driving car development: Uber's ongoing investment in self-driving technology could revolutionize transportation and significantly reduce operational costs. The successful implementation of autonomous vehicles could significantly boost Uber's profitability.

- AI-powered routing: AI algorithms optimize routes and improve efficiency, leading to cost savings and enhanced customer satisfaction. The enhanced efficiency through AI-powered routing impacts Uber technology and contributes to cost optimization.

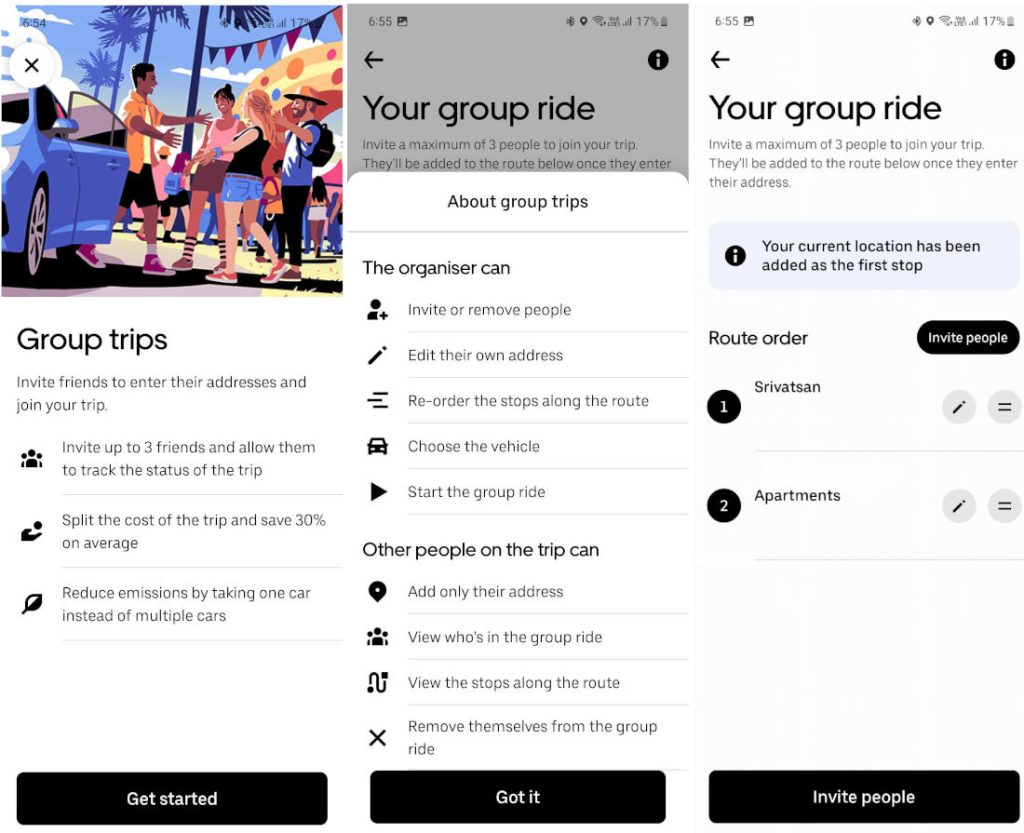

- Improved app features: Continuous app improvements enhance user experience and loyalty. These improvements increase user engagement and improve market penetration. Investment in app features is a significant component of Uber technology.

Risks Associated with Uber (UBER) Investment

Despite the potential, investing in Uber carries substantial risks that warrant careful consideration.

Intense Competition and Regulatory Hurdles

Uber faces intense competition from established players and new entrants in various markets. Furthermore, evolving regulations pose significant challenges.

- Lyft competition: Lyft is a direct competitor, vying for market share in many of the same regions as Uber. Competition impacts the profitability of both companies.

- Regulatory uncertainty: Varying regulations across different jurisdictions create uncertainty and potential legal challenges. Regulatory changes significantly impact Uber regulation and operations.

- Legal battles: Ongoing legal disputes related to driver classification and other issues pose reputational and financial risks. The outcome of these legal battles poses significant Uber legal risks.

- Varying local regulations: Adapting to diverse local regulations across different countries increases operational complexity and costs.

Profitability Concerns and Financial Performance

Uber's history of losses and the ongoing challenge to achieve consistent profitability represent a key investment risk.

- Uber's financial performance: A thorough analysis of Uber's financial statements is necessary to assess its long-term financial health.

- Profitability challenges: Understanding the factors hindering Uber's profitability is crucial for evaluating its investment potential.

- Path to profitability: Analyzing Uber's strategies for achieving sustainable profitability is vital for investors.

- Debt levels: High debt levels can increase financial risk and limit future growth potential. The level of Uber debt is a crucial consideration for prospective investors.

Driver Relations and Labor Issues

Disputes with drivers regarding worker classification and compensation create significant operational and reputational risks.

- Driver classification lawsuits: Ongoing lawsuits concerning driver classification as employees or independent contractors pose legal and financial risks.

- Driver compensation: Fair driver compensation is crucial for maintaining a stable workforce and positive public image. Driver compensation impacts Uber labor costs and potentially their market competitiveness.

- Unionization efforts: Unionization efforts could significantly impact operational costs and labor relations.

- Impact on operational costs: Resolving labor-related issues requires significant resources and impacts operational efficiency and costs. This impacts Uber driver relations and the overall operational efficiency of the business.

Conclusion

Investing in Uber (UBER) presents both significant potential and considerable risks. While its global reach, diversification efforts, and technological innovation offer promising long-term growth prospects, investors must carefully consider intense competition, regulatory uncertainty, profitability challenges, and labor relations issues. A thorough understanding of these factors is crucial before making any investment decision. Before investing in Uber (UBER) stock, conduct thorough due diligence and consider consulting a financial advisor to determine if it aligns with your investment strategy and risk tolerance. Make an informed decision about your Uber (UBER) investment today.

Featured Posts

-

Review Of The Best Bitcoin Casinos Launching In 2025

May 18, 2025

Review Of The Best Bitcoin Casinos Launching In 2025

May 18, 2025 -

Resorts World Casino Hit With 10 5 Million Money Laundering Penalty

May 18, 2025

Resorts World Casino Hit With 10 5 Million Money Laundering Penalty

May 18, 2025 -

Michael Morales Back To Back Ufc Bonuses At Vegas 106

May 18, 2025

Michael Morales Back To Back Ufc Bonuses At Vegas 106

May 18, 2025 -

Affordable Rides Home New Uber Shuttle Service From United Center

May 18, 2025

Affordable Rides Home New Uber Shuttle Service From United Center

May 18, 2025 -

Shopify Vip

May 18, 2025

Shopify Vip

May 18, 2025

Latest Posts

-

Studio Ghibli Aesthetics Owaisis Eid Message On Palestine And Rejection Of The Waqf Bill

May 18, 2025

Studio Ghibli Aesthetics Owaisis Eid Message On Palestine And Rejection Of The Waqf Bill

May 18, 2025 -

Eid Solidarity Owaisis Studio Ghibli Style Post Condemns Waqf Bill Supports Palestine

May 18, 2025

Eid Solidarity Owaisis Studio Ghibli Style Post Condemns Waqf Bill Supports Palestine

May 18, 2025 -

Alsrae Altwyl Dwr Htb Alhrb Fy Italt Amd Alhrb

May 18, 2025

Alsrae Altwyl Dwr Htb Alhrb Fy Italt Amd Alhrb

May 18, 2025 -

Owaisis Ghibli Inspired Eid Post Solidarity With Palestine Opposition To Waqf Bill

May 18, 2025

Owaisis Ghibli Inspired Eid Post Solidarity With Palestine Opposition To Waqf Bill

May 18, 2025 -

Htb Alhrb Wnar Alsrae Drast Halt Lltathyrat Twylt Almda

May 18, 2025

Htb Alhrb Wnar Alsrae Drast Halt Lltathyrat Twylt Almda

May 18, 2025