Understanding Amundi MSCI World II UCITS ETF USD Hedged Dist: NAV & Performance

Table of Contents

Decoding the Net Asset Value (NAV)

The Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV is calculated daily by summing the market value of all the assets held in the ETF's portfolio and dividing by the total number of outstanding shares. This calculation considers the current market prices of the underlying stocks included in the MSCI World Index, factoring in currency exchange rates due to the global nature of the holdings.

Several factors influence the daily fluctuations in the NAV:

- Market movements: Changes in the prices of the underlying stocks directly impact the NAV. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV.

- Currency fluctuations: The "USD Hedged" aspect means the ETF aims to minimize the impact of currency fluctuations between the underlying assets' currencies and the US dollar. However, the hedging strategy isn't perfect, and minor fluctuations can still affect the NAV.

- Dividends from underlying holdings: Dividends received from the underlying companies are usually reinvested, contributing to NAV growth.

Bullet points:

- Impact of currency hedging on NAV: The USD hedge aims to reduce volatility related to currency exchange rate movements, providing relative stability to investors holding US dollars.

- Frequency of NAV updates: The NAV is typically calculated and published daily, reflecting the closing prices of the underlying assets.

- Where to find real-time NAV information: Real-time NAV information is usually available on the ETF provider's website, financial data platforms (like Bloomberg or Refinitiv), and through brokerage accounts.

Analyzing ETF Performance

Evaluating the Amundi MSCI World II UCITS ETF USD Hedged Dist's performance involves analyzing several key performance indicators (KPIs).

- Total return: This represents the overall return including capital appreciation and dividends reinvested.

- Annualized return: This expresses the average annual growth rate over a specific period.

- Sharpe ratio: This measures risk-adjusted return, comparing the excess return to the standard deviation of the returns.

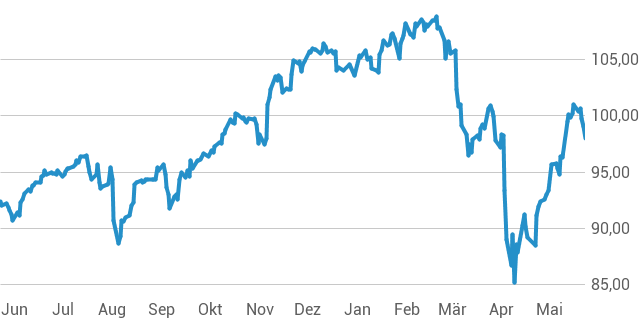

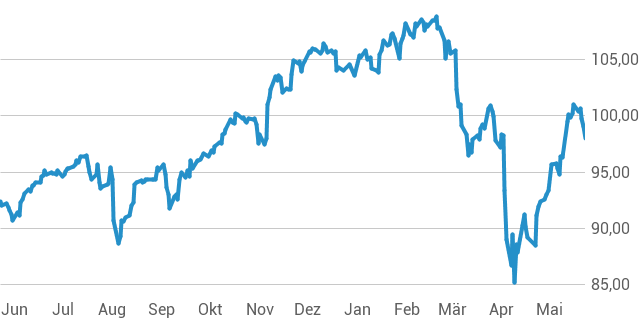

Historical performance data is crucial. While we cannot provide specific charts and graphs here, you can find this information on the Amundi website and various financial data providers. Analyzing 1-year, 3-year, and 5-year performance periods allows for a comprehensive understanding of its long-term trends. Comparing its performance to the MSCI World Index, its benchmark, helps evaluate its tracking efficiency. The impact of the USD hedge on performance should also be considered – it might offer stability in certain market conditions but potentially reduce returns in others.

Bullet points:

- Historical return data: Accessing historical return data is crucial for evaluating past performance. Look for visual representations like line graphs showing the NAV's evolution over time.

- Risk assessment: Assess the ETF's volatility and standard deviation to gauge its risk profile. Higher volatility suggests greater risk but also potentially higher returns.

- Comparison with similar ETFs: Comparing the Amundi MSCI World II UCITS ETF USD Hedged Dist to similar globally diversified ETFs helps determine its relative performance and competitiveness.

Understanding Distributions (Dividends)

The Amundi MSCI World II UCITS ETF USD Hedged Dist distributes dividends to its shareholders, representing a portion of the income generated by the underlying assets. These distributions affect the NAV, as they reduce the fund's asset value on the ex-dividend date. The frequency and amount of these distributions vary, depending on the dividends paid by the companies held within the ETF's portfolio.

Bullet points:

- Distribution history: Review historical distribution data to understand the frequency and typical amounts paid.

- Tax implications for different investor locations: Dividends are subject to taxation depending on the investor's location and applicable tax laws. Consult a tax professional for specific guidance.

- Reinvestment options: Many brokers offer automatic dividend reinvestment, allowing shareholders to buy more ETF shares with their distributions.

Factors Affecting Amundi MSCI World II UCITS ETF USD Hedged Dist Performance

The performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist is influenced by various macroeconomic and microeconomic factors.

- Global economic conditions: Global economic growth, inflation, interest rates, and geopolitical events all play a significant role in affecting the overall market performance and consequently the ETF's returns.

- Sector-specific performance: The MSCI World Index includes companies from various sectors. Strong performance in specific sectors (e.g., technology, healthcare) will positively impact the ETF, while weakness in others will negatively affect it.

- Currency hedging impact: The USD hedge aims to reduce the effect of currency fluctuations, but it is not a perfect safeguard. Market conditions can still influence the impact of the hedging strategy on overall performance.

Bullet points:

- Impact of interest rate changes: Interest rate hikes typically negatively impact stock market valuations, while rate cuts can stimulate growth.

- Influence of geopolitical events: Geopolitical uncertainty and global conflicts can significantly impact market sentiment and investor confidence, thereby affecting the ETF's performance.

- Sector-specific performance drivers: Analyzing the performance of different sectors within the MSCI World Index helps identify factors driving the ETF's returns.

Conclusion: Key Takeaways and Call to Action

Understanding the NAV and performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist requires analyzing various factors, including market movements, currency fluctuations, and dividend distributions. While the USD hedge aims to mitigate currency risk, it's essential to understand its limitations. This ETF offers exposure to a broad range of global equities, but it also carries inherent market risks. The historical performance data, available through various financial resources, is a key tool for evaluating its past performance and potential future returns. Remember to compare it to similar ETFs and benchmark indexes to gauge its competitiveness.

To make informed investment decisions, it's crucial to conduct thorough research and understand your risk tolerance. Learn more about the Amundi MSCI World II UCITS ETF USD Hedged Dist and explore global ETF investment options carefully. Understanding your investment in Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial before committing your capital. Consider consulting a financial advisor to discuss your investment goals and whether this ETF aligns with your portfolio strategy.

Featured Posts

-

Chine La Repression Des Dissidents Francais

May 24, 2025

Chine La Repression Des Dissidents Francais

May 24, 2025 -

Elektromobiliu Ikrovimas Su Porsche Naujas Centras Europoje

May 24, 2025

Elektromobiliu Ikrovimas Su Porsche Naujas Centras Europoje

May 24, 2025 -

New Ferrari Flagship Facility Launch Bangkok Post Coverage

May 24, 2025

New Ferrari Flagship Facility Launch Bangkok Post Coverage

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 24, 2025 -

Spy Shots The 2026 Porsche Cayenne Ev Takes Shape

May 24, 2025

Spy Shots The 2026 Porsche Cayenne Ev Takes Shape

May 24, 2025

Latest Posts

-

Lvmh Stock Takes A Hit 8 2 Decline After Q1 Sales Report

May 24, 2025

Lvmh Stock Takes A Hit 8 2 Decline After Q1 Sales Report

May 24, 2025 -

La Strategie Chinoise Pour Reduire Au Silence Les Opposants En France

May 24, 2025

La Strategie Chinoise Pour Reduire Au Silence Les Opposants En France

May 24, 2025 -

Proposed French Law Banning Hijabs In Public For Under 15s Gains Support

May 24, 2025

Proposed French Law Banning Hijabs In Public For Under 15s Gains Support

May 24, 2025 -

Silence Impose La Chine Et La Repression En France

May 24, 2025

Silence Impose La Chine Et La Repression En France

May 24, 2025 -

Debate Intensifies Macrons En Marche Supports Restricting Hijabs For Girls Under 15

May 24, 2025

Debate Intensifies Macrons En Marche Supports Restricting Hijabs For Girls Under 15

May 24, 2025