Understanding Ethereum's Price: A Comprehensive Guide To Market Analysis And Predictions

Table of Contents

Factors Influencing Ethereum's Price

Several interconnected factors influence Ethereum's price, creating a complex interplay of technological advancements, regulatory actions, macroeconomic conditions, and market sentiment.

Technological Developments

Ethereum's price is heavily tied to its technological advancements and adoption. Upgrades and improvements directly impact its functionality, scalability, and overall appeal.

- Ethereum 2.0 (ETH2): The transition to a proof-of-stake consensus mechanism is expected to enhance scalability, security, and energy efficiency, potentially driving up the price.

- Scaling Solutions: Projects like Layer-2 scaling solutions (e.g., Polygon, Optimism) aim to alleviate network congestion and reduce transaction fees (gas fees), boosting user experience and potentially increasing demand for ETH.

- Developer Activity and dApp Adoption: A vibrant developer community and the proliferation of decentralized applications (dApps) built on Ethereum indicate a healthy ecosystem and contribute to positive price movements. Increased usage and network activity generally correlate with higher prices.

- Examples of Impact: The successful implementation of major upgrades often leads to short-term price increases, while periods of network congestion can cause temporary dips.

Regulatory Landscape

Government regulations significantly impact investor confidence and, consequently, Ethereum's price. Different jurisdictions have varying approaches to cryptocurrencies, creating a complex and evolving legal environment.

- Taxation: The way governments tax cryptocurrency transactions directly affects investor behavior and overall market participation.

- Security Regulations: Regulations focusing on anti-money laundering (AML) and know-your-customer (KYC) compliance can influence trading practices and potentially limit access to Ethereum.

- Potential Future Changes: Announcements of new regulations or potential regulatory frameworks often trigger significant price fluctuations, either positive or negative, depending on the perceived impact.

- Examples of Regulatory Impacts: News of stricter regulations can lead to sell-offs, whereas supportive regulatory frameworks can boost investor confidence and potentially increase the price.

Macroeconomic Factors

Ethereum's price is also influenced by broader macroeconomic trends and global events.

- Inflation and Interest Rates: Periods of high inflation and rising interest rates can negatively impact risk assets like cryptocurrencies, potentially leading to lower Ethereum prices.

- Bitcoin's Price: Bitcoin's price movements often influence the entire cryptocurrency market, including Ethereum. Positive movements in Bitcoin tend to have a positive spillover effect on altcoins like ETH.

- Global Economic Events: Major economic events such as recessions, geopolitical instability, or significant market corrections can impact investor sentiment and influence Ethereum's price.

- Examples of Macroeconomic Impacts: A global recession can lead to risk-averse behavior among investors, causing a decline in cryptocurrency prices, including Ethereum.

Market Sentiment and News

Market sentiment, driven by media coverage, social media trends, and investor psychology, plays a crucial role in Ethereum's price volatility.

- Fear, Uncertainty, and Doubt (FUD): Negative news or rumors can create FUD, leading to sell-offs and price drops.

- Hype Cycles: Positive news or significant developments can generate hype, potentially driving price surges.

- Major Announcements and Partnerships: Announcements of partnerships, integrations, or new developments within the Ethereum ecosystem can trigger significant price fluctuations.

- Examples of News Impacts: A major exchange listing can cause a significant price increase, while a security breach or negative regulatory news can lead to sharp declines.

Analyzing Ethereum's Price

To effectively understand Ethereum's price, both technical and fundamental analysis are crucial.

Technical Analysis

Technical analysis uses charts and indicators to identify price trends and predict future movements.

- Chart Patterns: Identifying patterns like head and shoulders, triangles, or flags can provide insights into potential price reversals or continuations.

- Indicators: Using indicators such as moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) helps to gauge momentum, identify overbought or oversold conditions, and spot potential trend changes.

- Support and Resistance Levels: Identifying support and resistance levels, which represent price areas where buying or selling pressure is expected to be strong, can help in predicting potential price bounces or breakdowns.

- Practical Examples: Observing a bullish crossover of a 50-day and 200-day moving average might signal a potential uptrend.

Fundamental Analysis

Fundamental analysis focuses on evaluating Ethereum's underlying value based on its technology, adoption, and utility.

- Network Activity: Monitoring metrics like transaction volume, active addresses, and gas fees provides insights into network usage and overall demand.

- Developer Community: A strong and active developer community is a positive sign, indicating ongoing development and improvements to the platform.

- On-Chain Metrics: Analyzing on-chain data such as the number of smart contracts deployed, total value locked (TVL) in DeFi protocols, and the number of active developers can provide valuable insights into the health and growth of the Ethereum ecosystem.

- Key Metrics: Transaction fees, network congestion, developer activity, number of dApps, and total value locked in DeFi are all crucial metrics to consider.

Predicting Ethereum's Price (with caveats)

Predicting Ethereum's price with certainty is impossible. The cryptocurrency market is inherently volatile and influenced by numerous unpredictable factors.

- Limitations of Prediction: While analysis can provide insights, no model can accurately predict future price movements with complete accuracy.

- Diversification: Diversifying investments across different asset classes is crucial to mitigate risk.

- Risk Management: Employing sound risk management strategies, such as setting stop-loss orders and only investing what you can afford to lose, is paramount.

- Prediction Models (with Caution): Various prediction models exist, but their accuracy is questionable. Treat them as potential indicators, not guarantees.

- Unpredictable Nature: Remember the cryptocurrency market is highly speculative and prone to sudden, significant shifts driven by unexpected events.

Conclusion

Understanding Ethereum's price requires a holistic approach encompassing technological advancements, regulatory factors, macroeconomic conditions, and market sentiment. Analyzing both technical and fundamental aspects provides a more nuanced understanding of price movements. However, it's crucial to remember that predicting Ethereum's price with precision is inherently challenging. Thorough research, due diligence, and a diversified investment strategy are vital for navigating the volatile world of Ethereum and making informed investment decisions. Continue learning about understanding Ethereum's price through reputable sources like crypto news websites and educational platforms to stay ahead in this dynamic market.

Featured Posts

-

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Case

May 08, 2025

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Case

May 08, 2025 -

1 500 Bitcoin Growth Is This Realistic A 5 Year Forecast

May 08, 2025

1 500 Bitcoin Growth Is This Realistic A 5 Year Forecast

May 08, 2025 -

How Matt Damon Chooses Roles Insights From Ben Affleck

May 08, 2025

How Matt Damon Chooses Roles Insights From Ben Affleck

May 08, 2025 -

Kripto Para Yatirimlarinda Risk Duesuesler Ve Satis Stratejileri

May 08, 2025

Kripto Para Yatirimlarinda Risk Duesuesler Ve Satis Stratejileri

May 08, 2025 -

Nba Game Thunder Vs Trail Blazers March 7 How To Watch Live

May 08, 2025

Nba Game Thunder Vs Trail Blazers March 7 How To Watch Live

May 08, 2025

Latest Posts

-

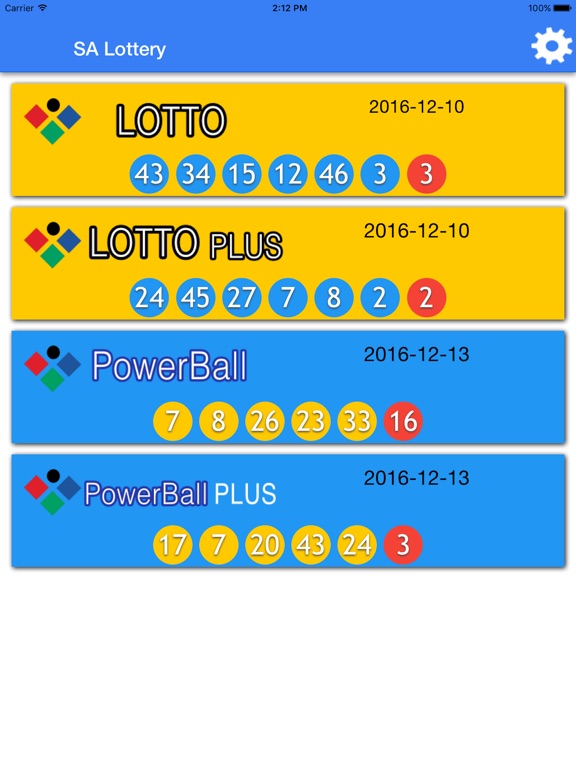

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025 -

Xrps Future The Impact Of Secs Commodity Debate

May 08, 2025

Xrps Future The Impact Of Secs Commodity Debate

May 08, 2025 -

Daily Lotto Friday 18th April 2025 Results

May 08, 2025

Daily Lotto Friday 18th April 2025 Results

May 08, 2025 -

Winning Numbers Daily Lotto Wednesday April 16 2025

May 08, 2025

Winning Numbers Daily Lotto Wednesday April 16 2025

May 08, 2025 -

The Sec And Xrp Navigating The Uncertainty Around Commodity Classification

May 08, 2025

The Sec And Xrp Navigating The Uncertainty Around Commodity Classification

May 08, 2025