Understanding High Stock Valuations: BofA's Insights For Investors

Table of Contents

BofA's Perspective on Current Market Conditions and High Stock Valuations

BofA regularly publishes reports and analyses offering their perspective on the current market landscape and the implications of high stock valuations. Their recent research often highlights the interplay between economic indicators, interest rate fluctuations, and the overall market sentiment impacting stock prices.

-

Key Findings: BofA's research frequently emphasizes the need for caution in markets exhibiting high valuations. Their analysts often scrutinize price-to-earnings ratios (P/E ratios) and other key metrics to identify potential overvaluation across various sectors. They may also assess the sustainability of current earnings growth rates to determine the long-term viability of high valuations.

-

Sectoral Analysis: BofA's reports often pinpoint specific sectors or industries they deem overvalued or undervalued. For example, certain technology sectors might be flagged as potentially overvalued due to high growth expectations, while others, like energy or certain cyclical sectors, might be identified as offering relatively better value.

-

Economic Indicators: BofA's analysts closely monitor macroeconomic indicators such as inflation rates, interest rates, and GDP growth to inform their valuation assessments. These indicators play a crucial role in forecasting future earnings and influencing investor sentiment, both of which significantly affect stock prices.

-

Market Trajectory Prediction: Based on their analysis of economic indicators and valuation metrics, BofA often provides predictions regarding the future market trajectory. This includes forecasting potential corrections or continued growth, taking into account the current environment of high stock valuations.

Identifying Overvalued Stocks: Key Metrics and Strategies

BofA likely employs various valuation metrics to identify potentially overvalued stocks. Understanding these metrics is critical for investors navigating high stock valuations.

-

P/E Ratio (Price-to-Earnings Ratio): This classic metric compares a company's stock price to its earnings per share. A high P/E ratio might suggest a stock is overvalued, especially if earnings growth doesn't justify the high price.

-

PEG Ratio (Price/Earnings to Growth Ratio): The PEG ratio takes the P/E ratio and factors in the company's earnings growth rate. A lower PEG ratio might indicate a more attractive valuation, even if the P/E ratio is high.

-

Price-to-Sales Ratio (P/S Ratio): This metric compares a company's stock price to its revenue. It's often used for companies with negative earnings, providing a relative valuation measure.

-

Interpreting Metrics in High Valuation Environments: In markets with high stock valuations, these metrics become even more crucial. Investors should compare a company's valuation metrics to its historical averages, industry peers, and overall market averages to determine if it's truly overvalued.

-

BofA's Application: BofA's analysts likely utilize a combination of these metrics and qualitative factors (e.g., management quality, competitive landscape) to reach their valuation conclusions.

-

Limitations: It's crucial to remember that relying solely on these metrics can be misleading. Other factors, like future growth prospects and industry dynamics, significantly influence a company's true value.

Risk Management Strategies for High Stock Valuation Environments

Investing in a market with high stock valuations necessitates a robust risk management strategy.

-

Diversification: Diversifying across different sectors and asset classes (stocks, bonds, real estate) can reduce the impact of any single investment underperforming. This is a crucial strategy to mitigate risk when facing high stock valuations.

-

Defensive Investing: Value investing, focusing on undervalued companies, and dividend investing, generating income from dividends, are relatively defensive strategies suitable for high-valuation environments.

-

Hedging Techniques: Options strategies and short selling (though inherently risky) can be used to hedge against potential market downturns. It’s vital to understand the potential risks associated with these advanced techniques before employing them.

-

Due Diligence: Thorough research, understanding a company's financials, and evaluating its long-term prospects remain crucial, regardless of market conditions.

The Role of Interest Rates in High Stock Valuations

Rising interest rates often negatively impact stock valuations.

-

Inverse Relationship: Higher interest rates typically increase bond yields, making bonds more attractive relative to stocks. This can lead to a shift in investor capital away from the stock market, depressing stock prices.

-

Impact on Profitability: Higher interest rates increase borrowing costs for companies, potentially reducing profitability and dampening investor sentiment.

-

BofA's Interest Rate Predictions: BofA's economists frequently forecast future interest rate movements, providing valuable context for investors to assess the potential impact on stock valuations.

Opportunities Within High Valuation Markets

Even in markets characterized by high stock valuations, opportunities exist for discerning investors.

-

Undervalued Sectors: Focusing on sectors or individual companies that are undervalued relative to their peers can provide attractive investment opportunities.

-

High-Growth Potential: Some growth stocks may still justify high valuations due to strong future earnings potential. Careful analysis is required to identify those with sustainable growth prospects.

-

Long-Term Perspective: Adopting a long-term investment horizon can help investors weather short-term market fluctuations and benefit from the long-term growth potential of well-chosen investments.

Conclusion

Understanding high stock valuations is crucial for making informed investment decisions. BofA's insights provide a valuable framework for navigating this complex market environment. By understanding key valuation metrics, employing effective risk management strategies, and identifying potential opportunities, investors can position themselves for success, even when facing high stock valuations. Don't hesitate to conduct your own thorough research and consult with a financial advisor to develop a personalized investment strategy that addresses your specific risk tolerance and financial goals in the context of these high stock valuations.

Featured Posts

-

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 22, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 22, 2025 -

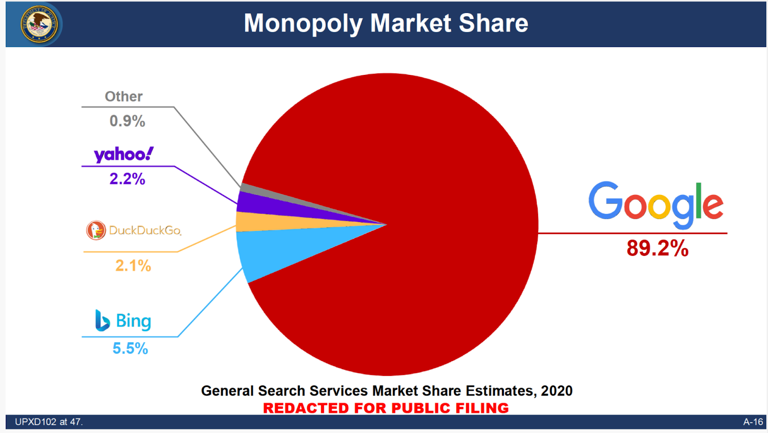

Search Monopoly Case Google And Doj Head Back To Court

Apr 22, 2025

Search Monopoly Case Google And Doj Head Back To Court

Apr 22, 2025 -

Chinas Export Led Growth A Rising Tide Of Tariff Risks

Apr 22, 2025

Chinas Export Led Growth A Rising Tide Of Tariff Risks

Apr 22, 2025 -

Pan Nordic Defense A Deep Dive Into Swedish Armor And Finnish Personnel

Apr 22, 2025

Pan Nordic Defense A Deep Dive Into Swedish Armor And Finnish Personnel

Apr 22, 2025 -

1 Billion Funding Cut Exclusive Look At Trumps Harvard Dispute

Apr 22, 2025

1 Billion Funding Cut Exclusive Look At Trumps Harvard Dispute

Apr 22, 2025