Understanding The Amundi MSCI World Catholic Principles UCITS ETF Acc Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets. Simply put, it's the total value of all the holdings (stocks, bonds, etc.) within the ETF, minus any liabilities, divided by the number of outstanding shares. For ETFs like the Amundi MSCI World Catholic Principles UCITS ETF Acc, this calculation reflects the collective value of companies adhering to Catholic principles.

-

NAV Calculation: The NAV is calculated daily, typically at market close, by summing the market value of each asset in the ETF's portfolio and deducting any expenses or liabilities.

-

Importance for Investment Decisions: The NAV provides a benchmark for the ETF's intrinsic value. It's critical for:

- Buying and Selling: Comparing the ETF's market price to its NAV helps determine if it's trading at a premium or discount.

- Performance Evaluation: Tracking NAV changes over time reveals the ETF's performance, allowing investors to assess growth or losses.

-

NAV and ETF Price: While ideally, the ETF's market price should closely match its NAV, slight discrepancies can occur due to supply and demand.

-

Market Fluctuations: Market volatility directly impacts the NAV. Positive market movements generally increase the NAV, while negative movements decrease it.

Understanding the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV Specifically

The Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV is influenced by its unique investment strategy. Unlike standard world index ETFs, this ETF adheres to specific exclusion criteria based on Catholic principles. This means companies involved in activities deemed ethically problematic (e.g., weapons manufacturing, abortion services) are excluded from the portfolio.

-

Impact of Exclusion Criteria: The exclusion of certain companies based on Catholic principles can potentially impact the NAV. If excluded companies are performing exceptionally well, the ETF's NAV might be lower than a comparable, broader market index ETF. Conversely, excluding poorly-performing companies can protect the NAV.

-

Currency Fluctuations: As the ETF invests globally, fluctuations in currency exchange rates can affect the NAV, especially when dealing with investments in non-Euro currencies.

-

Price vs. NAV: The ETF's market price might slightly deviate from its NAV due to trading activity and market sentiment. However, this difference is usually minimal.

Where to Find the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV?

Reliable sources for obtaining the daily NAV include:

- Amundi's Website: The official Amundi website is the primary source for accurate and up-to-date NAV information.

- Financial News Websites: Major financial news providers often display ETF NAV data.

- Brokerage Platforms: Your brokerage account will usually show the current NAV of your investments.

The NAV is typically updated daily, reflecting the closing market prices of the underlying assets. Always rely on official sources to ensure accuracy.

Using NAV to Make Informed Investment Decisions

The Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV is a powerful tool for informed investment decisions.

-

Performance Assessment: By monitoring NAV changes, investors can assess the ETF's performance over various periods, comparing it to previous periods or to other investments.

-

Comparison with Similar ETFs: Comparing the NAV of this ETF to other ethically-focused ETFs or broader market indices helps gauge its relative performance and the impact of its specific investment criteria.

-

Tracking Investment Growth: Tracking NAV allows investors to monitor their investment's growth or losses over time.

-

Calculating Returns: Simple return calculations can be made by comparing the difference between the initial NAV and the current NAV, factoring in any reinvestment of dividends (in the case of the Accumulation share class "Acc").

Conclusion: Mastering the Amundi MSCI World Catholic Principles UCITS ETF Acc Net Asset Value

Understanding the Net Asset Value of the Amundi MSCI World Catholic Principles UCITS ETF Acc is fundamental for successful ethical investing. Regularly monitoring the NAV enables investors to assess performance, make informed buy/sell decisions, and track their investment's growth. By comparing its NAV to similar ETFs and broader market indices, investors can better understand the impact of the ETF's specific Catholic principles-based investment strategy.

Learn more about the Amundi MSCI World Catholic Principles UCITS ETF Acc and its NAV to optimize your ethical investment strategy. Visit the official Amundi website for detailed fact sheets and additional information. [Link to Amundi Website]

Featured Posts

-

Kerings Q1 Earnings A 6 Share Price Drop

May 24, 2025

Kerings Q1 Earnings A 6 Share Price Drop

May 24, 2025 -

Avrupa Borsalari Karisik Bir Guenuen Ardindan Kapandi

May 24, 2025

Avrupa Borsalari Karisik Bir Guenuen Ardindan Kapandi

May 24, 2025 -

Essen Uniklinikum Und Seine Umgebung Aktuelle Ereignisse

May 24, 2025

Essen Uniklinikum Und Seine Umgebung Aktuelle Ereignisse

May 24, 2025 -

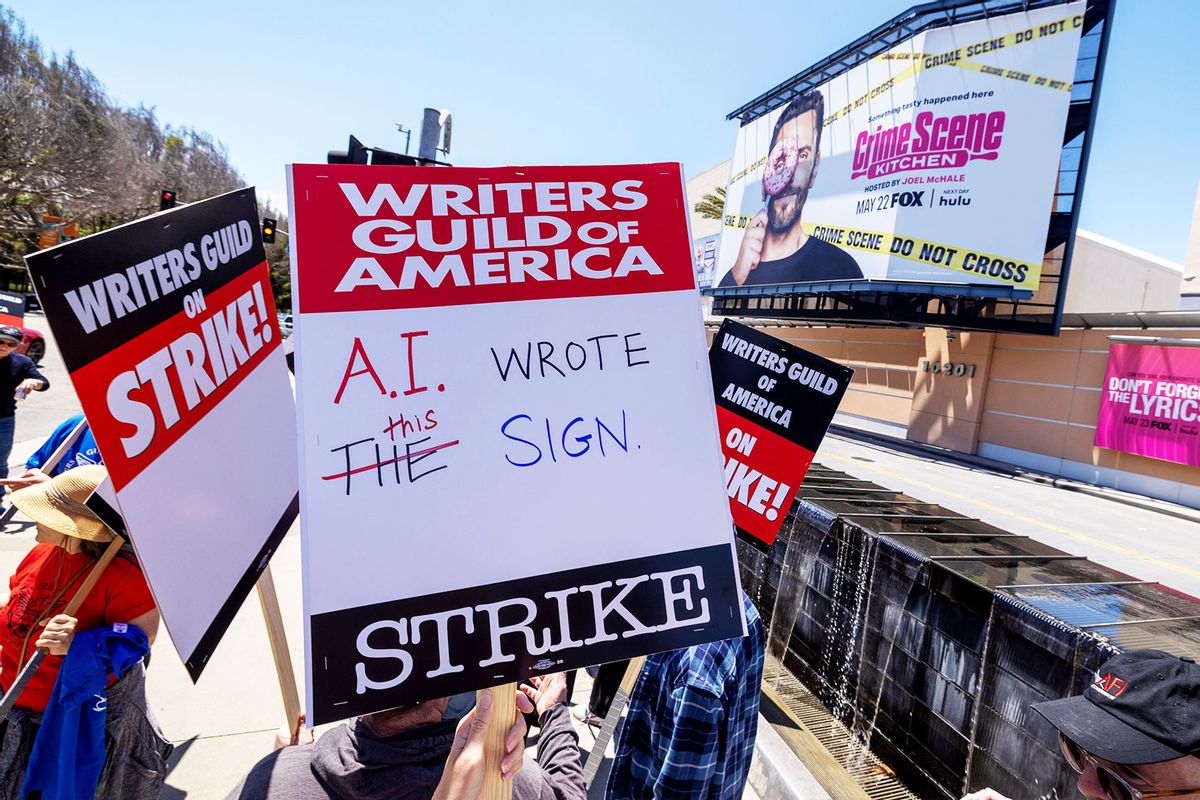

Actors And Writers Strike The Impact On Hollywood

May 24, 2025

Actors And Writers Strike The Impact On Hollywood

May 24, 2025 -

Florida Film Festival Notable Guests Include Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Notable Guests Include Mia Farrow And Christina Ricci

May 24, 2025