Understanding The D-Wave Quantum (QBTS) Stock Jump: Key Factors

Table of Contents

The recent surge in D-Wave Quantum's (QBTS) stock price has captivated investors and sparked significant interest in the burgeoning field of quantum computing. This remarkable jump hasn't been accidental; it's the result of a confluence of factors pointing towards a promising future for this innovative technology and a potentially lucrative investment opportunity. This article delves into the key elements driving this growth, offering insights into both the potential and the inherent challenges.

Increased Investor Confidence in Quantum Computing Technology

The rising QBTS stock price reflects a growing belief in the potential of D-Wave's quantum annealing technology and its place in the broader quantum computing landscape. This confidence stems from several key developments:

D-Wave's Technological Advancements

D-Wave has consistently pushed the boundaries of quantum annealing, leading to increased investor confidence. Recent advancements include:

- Release of Leap 2: This enhanced cloud-based platform provides users with more powerful quantum processing units (QPUs) and improved access to D-Wave's quantum computing resources, accelerating research and development.

- Improved QPU Performance: Significant strides have been made in increasing the number of qubits and improving their coherence times, resulting in more accurate and efficient computations. This directly translates to better solutions for real-world problems.

- Strategic Partnerships: Collaborations with industry leaders in various sectors demonstrate the practical applicability of D-Wave's technology and boost confidence in its market potential. These partnerships validate the technology and its ability to deliver tangible results.

Growing Market Adoption of Quantum Annealing

Beyond technological advancements, the increased adoption of D-Wave's quantum annealing technology across diverse sectors is a crucial driver of investor confidence. Successful implementations are showcasing the technology's ability to solve complex optimization problems:

- Logistics Optimization: Major logistics companies are leveraging D-Wave's systems to optimize delivery routes, reducing costs and improving efficiency. These tangible results demonstrate the practical value of quantum annealing.

- Financial Modeling: The application of quantum annealing in financial modeling, particularly for portfolio optimization and risk management, is gaining traction. Its ability to handle complex datasets and identify optimal strategies is proving valuable.

- Materials Science: Research into material discovery and design using D-Wave's technology is yielding promising results, highlighting its potential to accelerate innovation in this crucial field. This expansion into diverse fields broadens the potential market for QBTS.

Positive Financial Performance and Future Outlook

D-Wave's improving financial picture further reinforces investor confidence and fuels the QBTS stock jump.

Strong Financial Results and Revenue Growth

Recent financial reports have showcased positive trends, indicating a growing and sustainable business model:

- Increased Revenue from Software and Services: The success of D-Wave's Leap quantum cloud service and its related software offerings shows a growing market demand for access to quantum computing resources.

- Reduced Operating Losses: D-Wave is demonstrating improved operational efficiency and cost management, signaling a move toward profitability, a key factor for attracting long-term investors.

- Successful Funding Rounds: Securing additional funding validates investor confidence in D-Wave's potential and its ability to execute its growth strategy. This infusion of capital fuels further development and expansion.

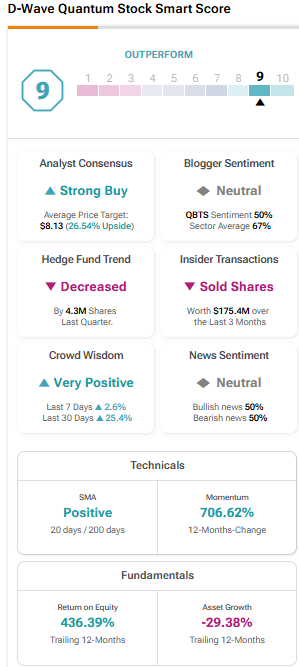

Positive Analyst Predictions and Future Projections

Reputable financial analysts are increasingly bullish on D-Wave's future prospects, contributing to the positive investor sentiment:

- Increased Price Targets: Several investment firms have raised their price targets for QBTS, reflecting their belief in the company's long-term growth potential.

- Positive Ratings: Positive ratings from analysts suggest a strong belief in D-Wave's ability to capture market share and achieve significant revenue growth in the coming years.

- Projected Market Share Growth: Forecasts indicate a substantial increase in D-Wave's market share within the quantum computing sector, reflecting the company's competitive advantage in the quantum annealing space.

Increased Media Attention and Public Awareness

Positive media coverage and growing public awareness play a vital role in driving investor interest and the QBTS stock price increase.

Positive Media Coverage and Public Perception

Increased visibility in reputable media outlets has contributed significantly to the heightened interest in D-Wave and its technology:

- Features in Tech Publications: Positive articles highlighting D-Wave's technological advancements and real-world applications help shape public perception and attract potential investors.

- Industry Conference Recognition: Positive reviews and presentations at industry conferences further enhance the credibility and visibility of D-Wave's technology.

- Increased Social Media Engagement: Growing social media buzz surrounding QBTS indicates increased public awareness and engagement, which often translates into increased investment interest.

Growing Interest in ESG (Environmental, Social, and Governance) Investing

D-Wave's focus on sustainable technology also plays a role in attracting environmentally conscious investors:

- Energy-Efficient Quantum Computing: D-Wave's commitment to developing energy-efficient quantum computing aligns with the growing interest in ESG investing, attracting investors seeking companies with strong environmental and social responsibility profiles.

- Sustainable Technology Initiatives: Highlighting D-Wave's initiatives focused on sustainability strengthens its appeal to ESG-focused investors. This growing segment of the investment market is actively seeking companies committed to environmentally friendly practices.

Conclusion

The recent surge in D-Wave Quantum (QBTS) stock price is a reflection of several converging factors: significant technological advancements, increasing market adoption, strong financial performance, and positive media attention. While the quantum computing market is inherently volatile and carries investment risk, the current trajectory for D-Wave suggests compelling growth potential. Further research into D-Wave Quantum (QBTS) and the broader quantum computing landscape is advised before making investment decisions; however, the current trends indicate a promising future for the company and its technology, presenting potential investment opportunities for those interested in this exciting and rapidly evolving sector.

Featured Posts

-

Four Star Admiral Burke Found Guilty Of Bribery

May 21, 2025

Four Star Admiral Burke Found Guilty Of Bribery

May 21, 2025 -

Amazon Warehouse Closures In Quebec A Labour Tribunal Showdown

May 21, 2025

Amazon Warehouse Closures In Quebec A Labour Tribunal Showdown

May 21, 2025 -

Big Bear Ai Bbai Stock Analysis An Indicator Based Investment Assessment

May 21, 2025

Big Bear Ai Bbai Stock Analysis An Indicator Based Investment Assessment

May 21, 2025 -

The D Wave Quantum Qbts Stock Market Crash On Monday Causes And Effects

May 21, 2025

The D Wave Quantum Qbts Stock Market Crash On Monday Causes And Effects

May 21, 2025 -

Ktore Prostredie Vyhovuje Vasej Firme Home Office Kancelaria Alebo Hybrid

May 21, 2025

Ktore Prostredie Vyhovuje Vasej Firme Home Office Kancelaria Alebo Hybrid

May 21, 2025