Understanding The India Market Rally: Factors Behind Nifty's Surge

Table of Contents

Foreign Institutional Investor (FII) Inflows

The significant influx of capital from Foreign Institutional Investors (FIIs) has been a major catalyst for the India market rally. This increased investment reflects growing confidence in India's economic prospects and the attractiveness of its stock market.

Increased Confidence in the Indian Economy

FIIs are increasingly optimistic about the Indian economy, driven by several factors:

- Strong GDP Growth Projections: India consistently ranks among the fastest-growing major economies globally. The projected GDP growth for the coming years further strengthens investor confidence.

- Improving Macroeconomic Indicators: Positive trends in inflation, current account deficit, and foreign exchange reserves signal a stable and strengthening macroeconomic environment.

- Structural Reforms: Government initiatives aimed at improving ease of doing business, streamlining regulations, and fostering infrastructure development have boosted investor sentiment. Examples include the Goods and Services Tax (GST) implementation and the focus on digital infrastructure.

Data and Statistics: FII investments have surged by [Insert recent data on FII inflows into the Indian market] in the last [time period], highlighting their strong belief in the India market rally.

Attractive Valuation Compared to Global Markets

Compared to other global markets, the Indian stock market offers attractive valuations for many stocks. This relative undervaluation, coupled with the strong growth outlook, makes it a compelling investment destination.

- Comparison with other major market indices: The Price-to-Earnings (P/E) ratio of the Nifty 50 is [Insert Data] compared to [Insert P/E ratios of comparable global indices like S&P 500, FTSE 100 etc.], indicating a potentially lower valuation.

- Undervalued Sectors: Specific sectors within the Indian market, such as [mention sectors], are seen as particularly undervalued, attracting significant FII interest.

Charts and Data: [Insert a chart or graph comparing valuation metrics of the Nifty 50 with other major global indices].

Domestic Institutional Investor (DII) Participation

The surge in the India market rally is not solely driven by foreign investment. Domestic Institutional Investors (DIIs) have also played a crucial role, demonstrating growing confidence in the Indian economy.

Growing Domestic Savings and Investments

Rising domestic savings and a burgeoning middle class have fueled increased participation by DIIs in the stock market.

- Growth in Mutual Funds: The Assets Under Management (AUM) of Indian mutual funds have seen significant growth, reflecting increasing domestic investment in equities.

- Insurance Sector Investments: Insurance companies are also increasingly allocating funds to the stock market, further bolstering DII participation.

- Overall Increase in Domestic Investment: A growing awareness of the potential for long-term wealth creation through equity investments is driving higher domestic participation.

Statistical Data: DII investments have increased by [Insert data on DII investments] in the last [time period], showcasing the rising confidence in the Indian market.

Government Initiatives Promoting Domestic Investments

Government policies aimed at boosting domestic investments have further contributed to the Nifty's surge.

- Specific Government Policies: Initiatives such as [mention specific policies promoting domestic investments] have encouraged increased participation from DIIs.

- Impact on DII Participation: These measures have created a more favorable environment for domestic investors, leading to higher investment levels.

Strong Corporate Earnings and Profitability

Robust corporate earnings and improving profitability have fueled investor confidence, significantly contributing to the India market rally.

Improved Business Sentiment and Increased Profitability

Many sectors within the Indian economy are experiencing strong growth in earnings.

- Examples of Sectors: [Mention specific high-performing sectors like IT, FMCG, etc.] are showcasing strong earnings growth, boosted by [mention factors driving growth].

- Key Drivers of Profitability: Factors like increasing consumer spending, efficient operations, and government support are driving increased profitability.

Statistical Data: Corporate earnings have grown by [Insert data on corporate earnings growth] in the last [time period], reinforcing the positive sentiment.

Positive Outlook for Future Growth

Analysts predict continued growth across several sectors, contributing to a positive outlook for the Indian stock market.

- Growth Prospects: Sectors like [mention sectors] are poised for significant growth in the coming years, driven by [mention drivers of growth].

- Impact on Stock Prices: This positive outlook is translating into increased investor interest and higher stock prices.

Analyst Reports: [Cite relevant analyst reports and predictions supporting this positive outlook].

Global Macroeconomic Factors

Global macroeconomic conditions also play a role in influencing the India market rally.

Shifting Global Investment Flows

Changes in global interest rates and geopolitical events impact investment flows into emerging markets, including India.

- Impact of Global Interest Rates: Lower interest rates in developed economies can lead to increased capital flows into emerging markets like India.

- Geopolitical Risks: Global uncertainties can sometimes lead investors to seek safer havens, and India's relative stability may attract investments.

India's Relative Strength Amidst Global Uncertainty

India's strong economic fundamentals and relative resilience compared to other global economies make it an attractive investment destination.

- Economic Stability: India's stable macroeconomic indicators make it a relatively safe haven compared to some other countries.

- Strong Growth Potential: The long-term growth potential of the Indian economy continues to attract foreign investors.

Conclusion

The recent India market rally and Nifty's surge are a result of a confluence of factors: strong FII and DII participation, robust corporate earnings, and a positive global macroeconomic environment favoring India's relative strength. Understanding these factors is crucial for investors seeking to participate in this dynamic market. To capitalize on the opportunities presented by the ongoing India market rally, continue to research current market trends and consider seeking advice from a qualified financial advisor. Staying informed about the factors influencing the Nifty's performance is key to making sound investment decisions.

Featured Posts

-

Analysis Of Teslas Q1 2024 Earnings 71 Net Income Decrease And Political Factors

Apr 24, 2025

Analysis Of Teslas Q1 2024 Earnings 71 Net Income Decrease And Political Factors

Apr 24, 2025 -

Cassidy Hutchinson Key Jan 6 Hearing Witness To Publish Memoir This Fall

Apr 24, 2025

Cassidy Hutchinson Key Jan 6 Hearing Witness To Publish Memoir This Fall

Apr 24, 2025 -

Us Tariffs Drive Chinas Lpg Imports Towards The Middle East

Apr 24, 2025

Us Tariffs Drive Chinas Lpg Imports Towards The Middle East

Apr 24, 2025 -

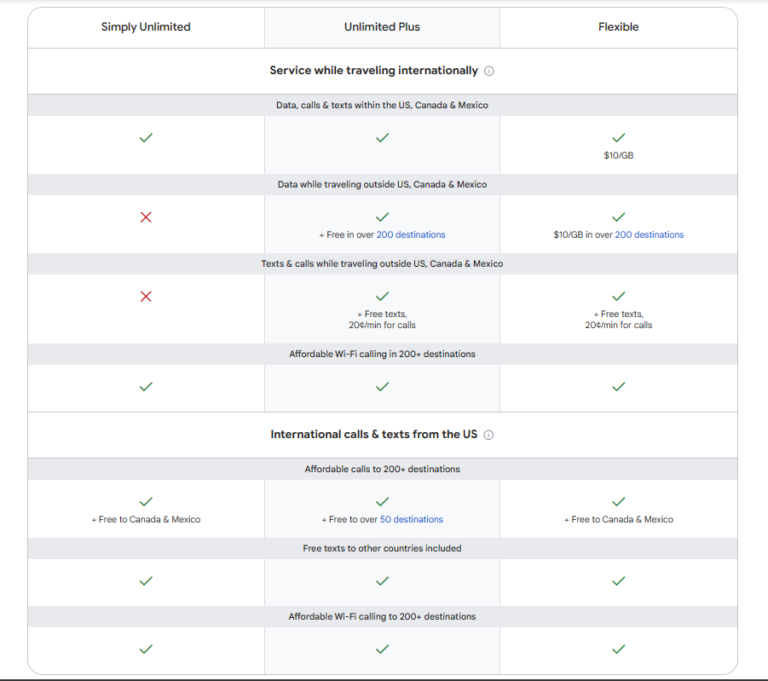

Is Google Fis 35 Unlimited Plan Right For You A Detailed Review

Apr 24, 2025

Is Google Fis 35 Unlimited Plan Right For You A Detailed Review

Apr 24, 2025 -

Fiscal Responsibility A Missing Element In Canadas Liberal Agenda

Apr 24, 2025

Fiscal Responsibility A Missing Element In Canadas Liberal Agenda

Apr 24, 2025