Understanding The Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

The Net Asset Value (NAV) of an ETF represents the value of a single share if the fund were to be liquidated. In simple terms, it's the total value of the ETF's assets minus its liabilities. The formula is straightforward:

Assets - Liabilities = NAV

Let's break down the components:

-

Assets: This includes the market value of all the securities (stocks, bonds, etc.) held within the ETF, plus any cash reserves. For the Amundi MSCI All Country World UCITS ETF USD Acc, this represents a globally diversified portfolio of equities.

-

Liabilities: These are the fund's debts and expenses. This typically includes management fees, operating expenses, and any accrued liabilities. The expense ratio, often expressed as a percentage, reflects the annual cost of managing the ETF.

Simplified Example:

Imagine an ETF with assets valued at $10 million and liabilities of $100,000. The NAV would be $10,000,000 - $100,000 = $9,900,000. If the ETF has 1,000,000 shares outstanding, the NAV per share would be $9.90.

The NAV is typically calculated daily, providing investors with an up-to-date assessment of the ETF's underlying asset value. Understanding this NAV calculation is crucial for effective ETF valuation.

Factors Affecting the NAV of Amundi MSCI All Country World UCITS ETF USD Acc

Several factors can significantly impact the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc:

-

Market Fluctuations: This is the primary driver. Changes in the prices of the underlying securities in the ETF's portfolio directly affect its asset value and, consequently, its NAV. Market volatility can lead to significant daily fluctuations in the NAV.

-

Currency Exchange Rates: Because this is a USD Acc (USD accumulating) ETF, fluctuations in exchange rates between the USD and the currencies of the underlying assets held within the ETF will impact the NAV. This represents a currency risk.

-

Dividend Distributions: When companies in the ETF's portfolio pay dividends, the NAV will typically decrease by the amount distributed, as the ETF's assets are reduced. However, investors receive these dividends directly, so the overall investment value isn't necessarily reduced. The dividend yield is an important consideration.

-

Management Fees and Expenses: The expense ratio (management fees and other operating expenses) reduces the ETF's assets and, therefore, its NAV. These are ongoing costs that affect the NAV over time. Understanding the expense ratio is crucial for making informed investment decisions and comparing the Amundi MSCI All Country World UCITS ETF USD Acc to other global equity ETFs.

Using NAV to Make Informed Investment Decisions

Finding the NAV for the Amundi MSCI All Country World UCITS ETF USD Acc is relatively straightforward. You can usually find it on the ETF provider's website (Amundi's website), reputable financial news sources, and many brokerage platforms.

-

Arbitrage Opportunities: For sophisticated investors, comparing the NAV to the ETF's market price can reveal potential arbitrage opportunities if a significant discrepancy exists. However, this requires a deep understanding of market mechanics and involves risks.

-

Assessing ETF Performance: Tracking the NAV over time allows you to assess the ETF's performance, independent of short-term market fluctuations in the share price. This provides a clearer picture of long-term ETF performance.

-

Buy/Sell Signals: While not a sole indicator, the NAV can be a valuable component in your overall investment strategy and portfolio management. Monitoring the NAV alongside other market indicators can help inform your buy and sell signals and refine your portfolio management approach. Understanding the relationship between price-to-NAV can be beneficial.

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc's Holdings and their Impact on NAV

The Amundi MSCI All Country World UCITS ETF USD Acc aims for global diversification, tracking the MSCI All Country World Index. This means it invests in a broad range of companies across different countries and sectors.

-

Underlying Asset Performance: The performance of these underlying assets directly influences the ETF's NAV. Strong performance by the underlying companies will generally lead to an increase in the ETF's NAV.

-

Sector Weightings: The ETF's sector allocation also plays a role. If a particular sector (e.g., technology) performs well, it will boost the ETF's NAV, while underperformance in other sectors may have a negative impact. Understanding portfolio holdings provides insight into the potential global market exposure and risk levels.

Conclusion: Mastering the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Understanding the Net Asset Value (NAV) is critical for making informed investment decisions regarding the Amundi MSCI All Country World UCITS ETF USD Acc. By understanding how NAV is calculated, the factors that influence it, and how to utilize this information in conjunction with other market data, investors can better manage their portfolio and achieve their financial goals. Regularly check the NAV of your Amundi MSCI All Country World UCITS ETF USD Acc holdings to make informed investment decisions. Learn more about Net Asset Value (NAV) and how it impacts your Amundi MSCI All Country World UCITS ETF USD Acc investment to further enhance your investment strategy.

Featured Posts

-

Porsche 956 Nin Tavan Asimli Sergisi Neden Ve Nasil

May 24, 2025

Porsche 956 Nin Tavan Asimli Sergisi Neden Ve Nasil

May 24, 2025 -

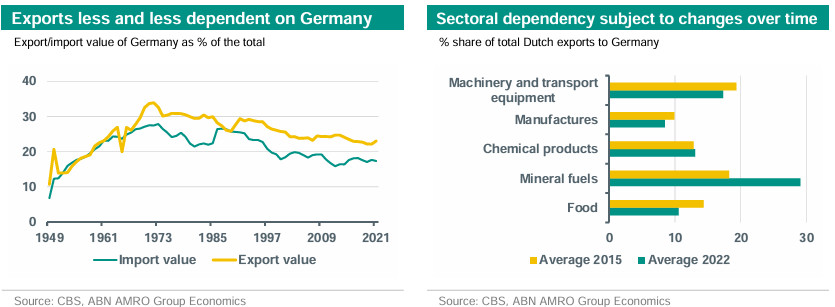

Dutch Stock Market Instability Linked To Us Trade Relations

May 24, 2025

Dutch Stock Market Instability Linked To Us Trade Relations

May 24, 2025 -

Artfae Daks Alalmany Atfaqyt Altjart Byn Alwlayat Almthdt Walsyn Keaml Ryysy

May 24, 2025

Artfae Daks Alalmany Atfaqyt Altjart Byn Alwlayat Almthdt Walsyn Keaml Ryysy

May 24, 2025 -

Radtour Essen Persoenlichkeiten Und Geschichte Auf Zwei Raedern

May 24, 2025

Radtour Essen Persoenlichkeiten Und Geschichte Auf Zwei Raedern

May 24, 2025 -

Demna Gvasalias Appointment As Guccis Creative Director A New Era For The Brand

May 24, 2025

Demna Gvasalias Appointment As Guccis Creative Director A New Era For The Brand

May 24, 2025