Understanding The Risks: Japan's Steep Bond Curve And Its Future

Table of Contents

The Mechanics of Japan's Steep Bond Curve

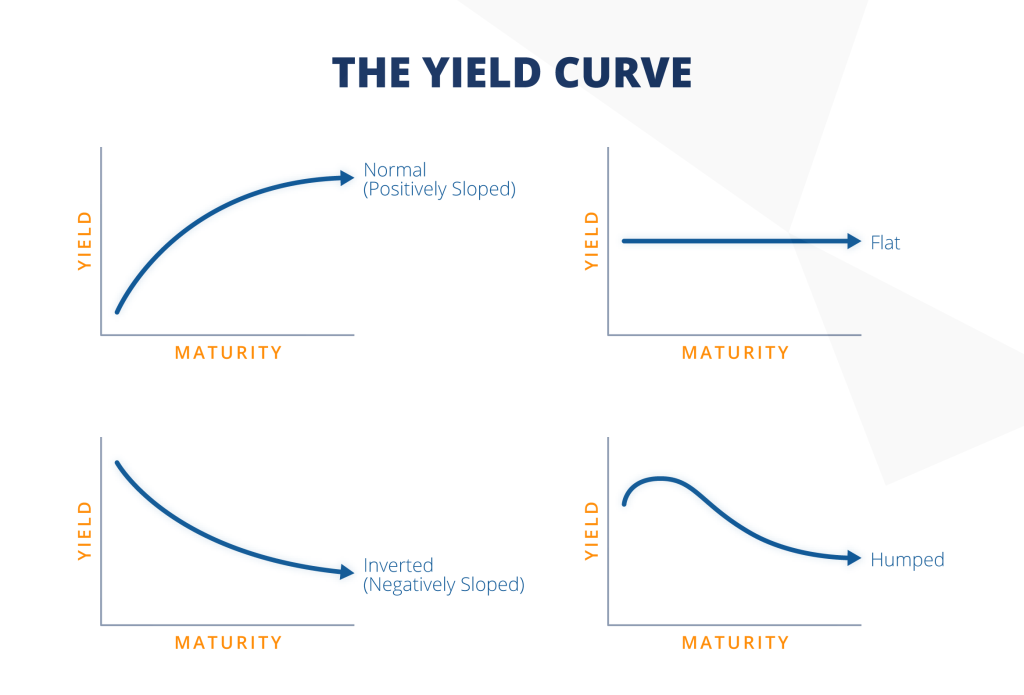

Understanding Japan's steep bond curve requires grasping the concept of a yield curve. A yield curve is a graphical representation of the relationship between the interest rates (or yields) of bonds with different maturities. Several shapes are possible:

- Normal Yield Curve: Long-term rates are higher than short-term rates, reflecting expectations of future economic growth and higher inflation.

- Inverted Yield Curve: Short-term rates are higher than long-term rates, often signaling an impending economic recession.

- Flat Yield Curve: Short-term and long-term rates are roughly equal.

- Steep Yield Curve: A significant difference exists between short-term and long-term interest rates, with long-term rates considerably higher. This is the current situation facing Japan.

Japan's yield curve is considered "steep" because of the substantial gap between the ultra-low short-term interest rates maintained by the Bank of Japan (BOJ) and the comparatively higher long-term rates. This disparity reflects a complex interplay of factors:

- Impact of Bank of Japan's (BOJ) monetary policy on short-term rates: The BOJ's prolonged quantitative and qualitative monetary easing (QQE) program has kept short-term interest rates near zero, even negative in some cases. This policy aims to stimulate economic activity and combat deflation.

- Influence of inflation expectations and global economic conditions on long-term rates: Despite the BOJ's efforts, inflation expectations remain subdued. However, global factors, such as rising US interest rates and increased commodity prices, exert upward pressure on Japanese long-term rates.

- Role of government bond issuance in shaping the yield curve: Japan's high level of government debt necessitates significant bond issuance, influencing the supply and demand dynamics within the bond market and contributing to the steepness of the curve.

Risks Associated with a Steep Bond Curve in Japan

A steep yield curve, while not inherently negative, presents considerable risks for Japan's economy:

- Increased borrowing costs for the government: The higher long-term interest rates make it more expensive for the Japanese government to finance its substantial debt, potentially straining public finances further.

- Potential for higher inflation if long-term rates rise significantly: While current inflation remains low, a sharp increase in long-term rates could fuel inflationary pressures, potentially eroding purchasing power.

- Impact on corporate investment and economic growth: Higher borrowing costs can discourage corporate investment and hinder economic growth, particularly for smaller businesses.

- Risk of market instability and potential for a bond market crash: A steep yield curve can create market instability, potentially triggering a bond market crash if investor confidence falters.

Potential Future Scenarios for Japan's Bond Market

The future trajectory of Japan's bond curve remains uncertain, with several plausible scenarios:

- Scenario 1: Gradual flattening of the curve as the BOJ adjusts monetary policy: The BOJ might gradually unwind its QQE program, allowing short-term rates to rise and reducing the gap with long-term rates.

- Scenario 2: Continued steepness leading to increased financial pressure: If the BOJ maintains its ultra-loose monetary policy while global interest rates continue to rise, the steepness could persist, increasing the financial burden on the government and potentially impacting the economy negatively.

- Scenario 3: Sharp reversal of the curve, potentially triggering market volatility: A sudden shift in investor sentiment or unexpected economic events could lead to a sharp reversal of the curve, creating significant market volatility and potentially destabilizing the financial system.

- External factors such as US interest rate hikes and global economic slowdown: Global economic events, such as US interest rate hikes or a global economic slowdown, can significantly influence the shape and direction of Japan's yield curve.

Mitigation Strategies and Policy Responses

Addressing the risks associated with Japan's steep bond curve requires a multi-pronged approach:

- Gradual adjustment of BOJ's monetary policy: A carefully managed exit from QQE, avoiding abrupt changes that could shock markets, is crucial.

- Fiscal reforms to reduce government debt burden: Implementing structural fiscal reforms to reduce Japan's massive public debt is essential for long-term financial stability.

- Structural reforms to boost economic growth and inflation: Measures to increase productivity, promote innovation, and encourage investment can help to foster sustainable economic growth and eventually increase inflation to a healthy level.

- International cooperation to manage global economic risks: Collaboration with other nations to address global economic challenges, such as managing global interest rate fluctuations, is vital.

Conclusion

Japan's steep bond curve presents a significant challenge with far-reaching implications for the nation's economy. Understanding the mechanics of this curve, the associated risks, and the potential future scenarios is crucial for navigating this complex landscape. Policymakers need to carefully consider various mitigation strategies to minimize potential negative impacts on government finances, businesses, and consumers. Failure to address these risks effectively could have significant consequences for Japan's long-term economic prosperity. Stay informed about developments concerning Japan's steep bond curve and its impact on the Japanese and global economy. Regularly review analyses and forecasts to make informed decisions regarding investments and economic planning.

Featured Posts

-

Securing Rare Earth Minerals Avoiding A New Cold War

May 17, 2025

Securing Rare Earth Minerals Avoiding A New Cold War

May 17, 2025 -

Analysis Trumps Plans For A New F 55 Fighter And F 22 Enhancement

May 17, 2025

Analysis Trumps Plans For A New F 55 Fighter And F 22 Enhancement

May 17, 2025 -

Japans Q1 Gdp Decline A Precursor To Trump Tariffs

May 17, 2025

Japans Q1 Gdp Decline A Precursor To Trump Tariffs

May 17, 2025 -

Understanding The Risks Japans Steep Bond Curve And Its Future

May 17, 2025

Understanding The Risks Japans Steep Bond Curve And Its Future

May 17, 2025 -

End Of Ryujinx Nintendo Contact Leads To Development Halt

May 17, 2025

End Of Ryujinx Nintendo Contact Leads To Development Halt

May 17, 2025

Latest Posts

-

Latest Update Chinas Ambassadors Stance On Formal Trade Deal With Canada

May 17, 2025

Latest Update Chinas Ambassadors Stance On Formal Trade Deal With Canada

May 17, 2025 -

China And Canada Ambassadors Statement On A Potential Trade Agreement

May 17, 2025

China And Canada Ambassadors Statement On A Potential Trade Agreement

May 17, 2025 -

Ambassadors Remarks On China Canada Trade Deal Prospects

May 17, 2025

Ambassadors Remarks On China Canada Trade Deal Prospects

May 17, 2025 -

Chinas Ambassador On Potential Formal Trade Agreement With Canada

May 17, 2025

Chinas Ambassador On Potential Formal Trade Agreement With Canada

May 17, 2025 -

Canada China Trade Relations Ambassadors Remarks On Formal Trade Deal

May 17, 2025

Canada China Trade Relations Ambassadors Remarks On Formal Trade Deal

May 17, 2025