Universal Credit Hardship Payment Refunds: What You Need To Know

Table of Contents

What are Universal Credit Hardship Payments?

Universal Credit (UC) is a benefit paid to individuals and families who are on a low income or out of work. Its purpose is to provide financial support to help cover essential living costs such as rent, food, and utilities. However, unexpected circumstances can create financial hardship, even for those receiving UC. This is where hardship payments come in.

Hardship payments are additional funds provided by the Department for Work and Pensions (DWP) to help UC claimants cope with unexpected expenses or temporary financial difficulties. Eligibility criteria vary depending on the type of hardship payment. Generally, you must demonstrate a genuine need for additional financial assistance due to unforeseen circumstances.

Different types of hardship payments exist:

- Advance Payments: These are payments made in advance of your regular UC payment to cover immediate needs. They are repayable through deductions from future UC payments.

- Budgeting Loans: These are larger loans designed for specific purposes, such as covering a cooker or washing machine repair. They are also repaid through deductions from future payments.

Who qualifies for a hardship payment? Eligibility is based on individual circumstances and demonstrating a genuine need. Factors such as unexpected medical bills, essential home repairs, or loss of income can support a claim.

What documentation is needed to apply? This can vary but generally includes evidence of the hardship experienced, such as bills, quotes, or letters from relevant professionals.

What are the repayment terms? Repayment terms for both advance payments and budgeting loans are usually set at affordable, manageable deductions from your regular UC payments, and will vary on your individual circumstances.

Understanding Universal Credit Refund Eligibility

A Universal Credit refund might apply in several situations:

- Overpayment: If you've received more UC than you were entitled to, you may be required to repay the excess. This could be due to a mistake in the calculation of your entitlement or a failure to report a change in circumstances.

- Incorrect Calculation: Errors in calculating your UC can lead to both underpayments and overpayments, resulting in the need for a refund or further payment.

- Changes in Circumstances: A significant change in your circumstances (e.g., change in employment status, change of address, change in household members) might necessitate a recalculation of your UC entitlement, potentially leading to a refund or further payment.

Requesting a refund: You should contact the Jobcentre Plus immediately if you believe you've been overpaid. Keep detailed records of your income and expenditure.

Accurate Record Keeping: This is crucial in avoiding disputes and ensuring a smooth process should you need to apply for a refund or appeal a decision. Maintaining detailed records is paramount in navigating the UC system effectively.

- Common reasons for Universal Credit overpayments: Failing to report a change in circumstances (employment, income, household composition), inaccurate information provided in your application, and administrative errors by the DWP.

- Steps to appeal a decision: If you disagree with a decision regarding your hardship payment or refund, you can appeal the decision through the DWP's internal appeals process. Detailed information is provided on the Gov.uk website.

- Contact information for relevant support organisations: Citizens Advice, StepChange Debt Charity, and local advice centers offer invaluable support and guidance.

How to Apply for a Universal Credit Hardship Payment Refund

Applying for a Universal Credit refund involves these steps:

- Gather necessary documentation: This includes evidence supporting your claim, such as bank statements, payslips, and bills.

- Contact Jobcentre Plus: You can apply online through your UC account, by phone, or by post. The preferred method is online, allowing for easy tracking of your application.

- Complete the necessary forms: Be thorough and accurate when providing information. Ensure all supporting evidence is included.

- Submit your application: Keep a copy of your completed application and supporting documents for your records.

- Necessary forms and documentation: Specific forms may be required; check the Gov.uk website for the most up-to-date information.

- Timeframe for processing applications: Processing times can vary, so be patient. You can typically track the progress of your application online.

- What to expect during the application process: You might be contacted for additional information. Be prepared to provide clear and concise responses.

Avoiding Universal Credit Overpayments and Hardship

Proactive management of your Universal Credit claim can help prevent overpayments and financial hardship.

-

Report changes promptly: Inform the Jobcentre Plus immediately of any changes to your income, employment, or household circumstances.

-

Understand your statement: Regularly review your Universal Credit statement to ensure it's accurate and reflects your actual circumstances.

-

Seek professional help: If you're struggling to manage your finances, seek advice from Citizens Advice or a debt counselling charity.

-

Regularly update your details: Ensure your contact information and other personal details remain up-to-date with the Jobcentre Plus.

-

Understand your Universal Credit statement: Check it carefully each month for any discrepancies.

-

Seek professional advice if needed: Don't hesitate to contact relevant support organizations if you need help understanding the system or managing your finances.

Where to Find Further Help and Support with Universal Credit

Several organizations provide support and guidance regarding Universal Credit:

-

Gov.uk: The official government website offers comprehensive information on Universal Credit.

-

Citizens Advice: Provides free, independent advice on a wide range of issues, including benefits.

-

StepChange Debt Charity: Offers free debt advice and support.

-

Local councils and advice centres: Many local authorities offer support services for UC claimants.

-

Links to relevant government websites: [Insert links to relevant Gov.uk pages]

-

Contact numbers for relevant helplines: [Insert relevant helpline numbers]

-

Information on local support groups: Contact your local council for details.

Conclusion

Understanding Universal Credit hardship payments and refunds is crucial for managing your finances effectively. Knowing your rights and responsibilities, accurately reporting changes in circumstances, and maintaining meticulous records are key to avoiding potential problems. Knowing your rights regarding Universal Credit hardship payment refunds can significantly impact your financial well-being.

Don't hesitate to seek help if you're struggling with Universal Credit. Understanding your entitlements to Universal Credit hardship payment refunds can make a real difference. If you believe you are entitled to a Universal Credit hardship payment refund, take action today! Contact the relevant authorities or seek advice from a reputable organization. Learn more about Universal Credit hardship payments and refunds now!

Featured Posts

-

Ps 5 Pro Disassembly Inside Look At The Liquid Metal Cooling

May 08, 2025

Ps 5 Pro Disassembly Inside Look At The Liquid Metal Cooling

May 08, 2025 -

Uefa Heton Arsenalin Per Shkelje Te Rregullave Gjate Ndeshjes Kunder Psg

May 08, 2025

Uefa Heton Arsenalin Per Shkelje Te Rregullave Gjate Ndeshjes Kunder Psg

May 08, 2025 -

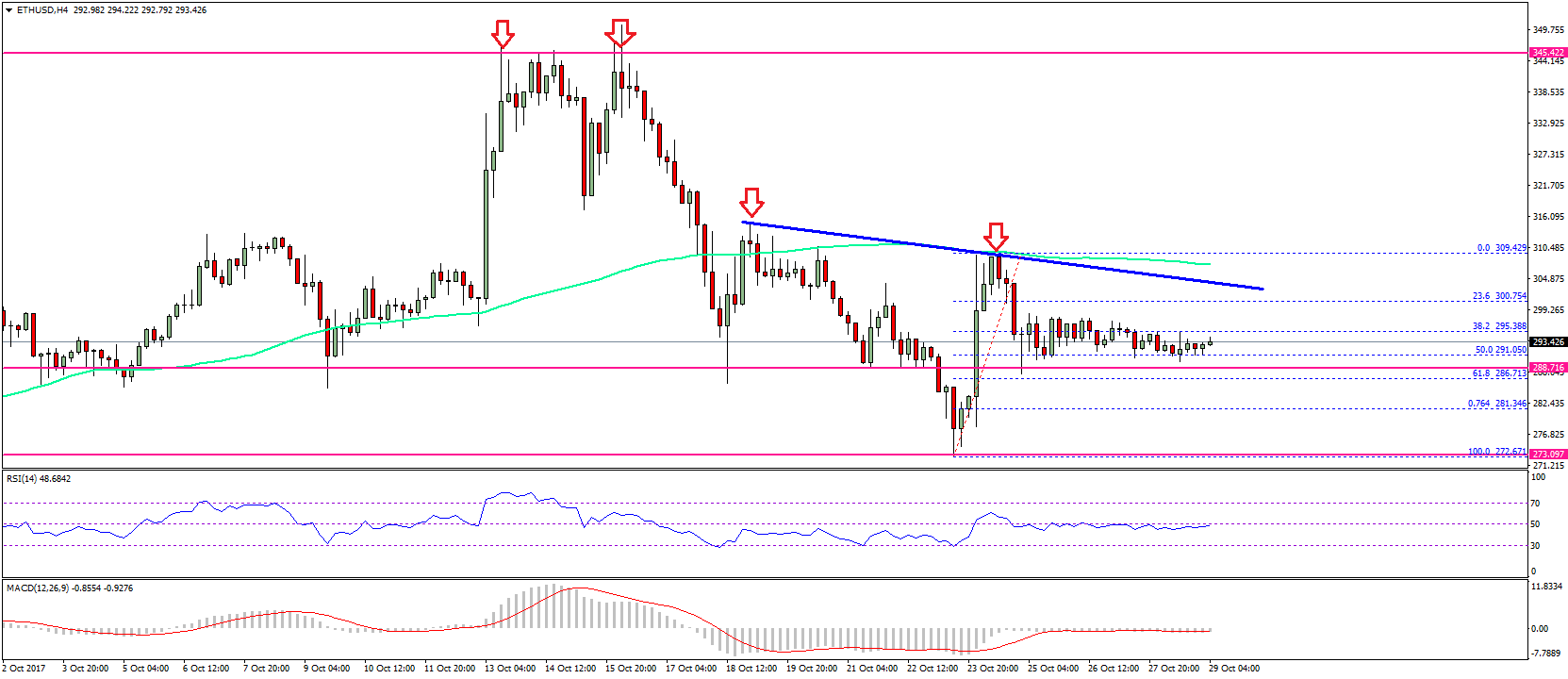

Ethereum Price Rebound Potential A Weekly Chart Indicator Analysis

May 08, 2025

Ethereum Price Rebound Potential A Weekly Chart Indicator Analysis

May 08, 2025 -

The Vaticans Finances An Unresolved Crisis Under Pope Francis

May 08, 2025

The Vaticans Finances An Unresolved Crisis Under Pope Francis

May 08, 2025 -

1 0

May 08, 2025

1 0

May 08, 2025

Latest Posts

-

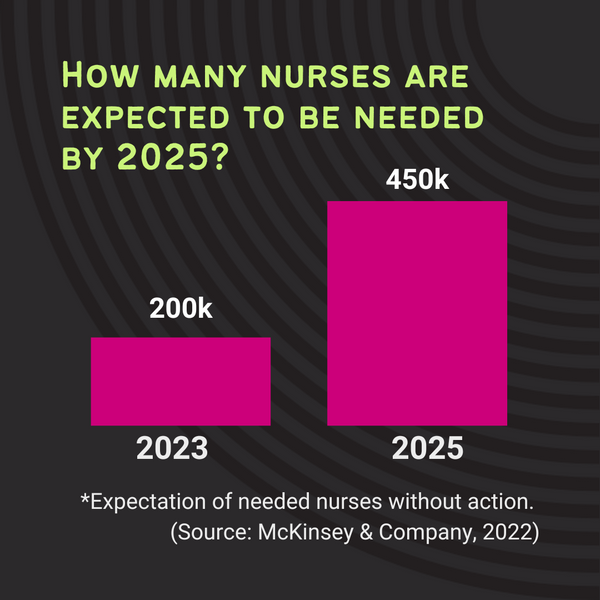

Community Colleges Get 56 M To Combat Nursing Crisis

May 09, 2025

Community Colleges Get 56 M To Combat Nursing Crisis

May 09, 2025 -

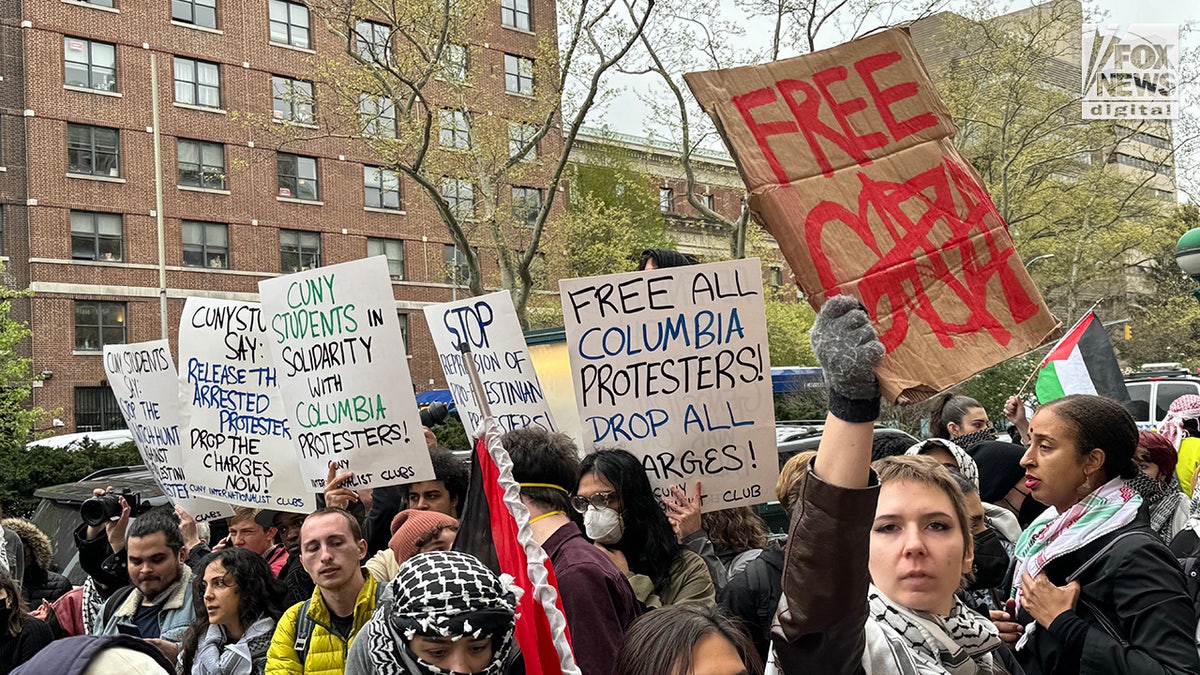

Anchorage Protests Thousands Demonstrate Against Trump Policies Again

May 09, 2025

Anchorage Protests Thousands Demonstrate Against Trump Policies Again

May 09, 2025 -

56 Million Boost For Community Colleges To Tackle Nursing Shortage

May 09, 2025

56 Million Boost For Community Colleges To Tackle Nursing Shortage

May 09, 2025 -

Second Wave Of Anti Trump Protests Sweeps Anchorage

May 09, 2025

Second Wave Of Anti Trump Protests Sweeps Anchorage

May 09, 2025 -

Thousands Return To Anchorage Streets To Protest Trump Administration Policies

May 09, 2025

Thousands Return To Anchorage Streets To Protest Trump Administration Policies

May 09, 2025