Ethereum Price Rebound Potential: A Weekly Chart Indicator Analysis

Table of Contents

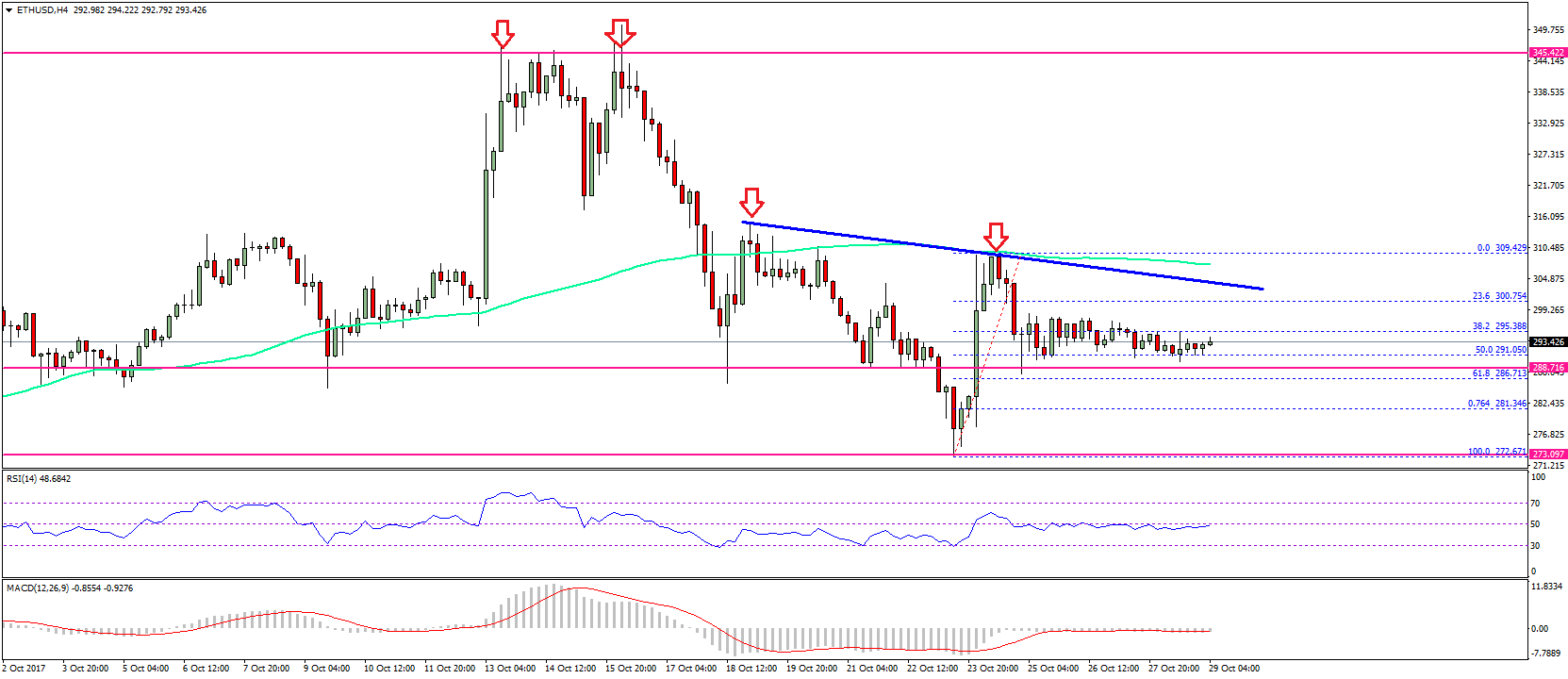

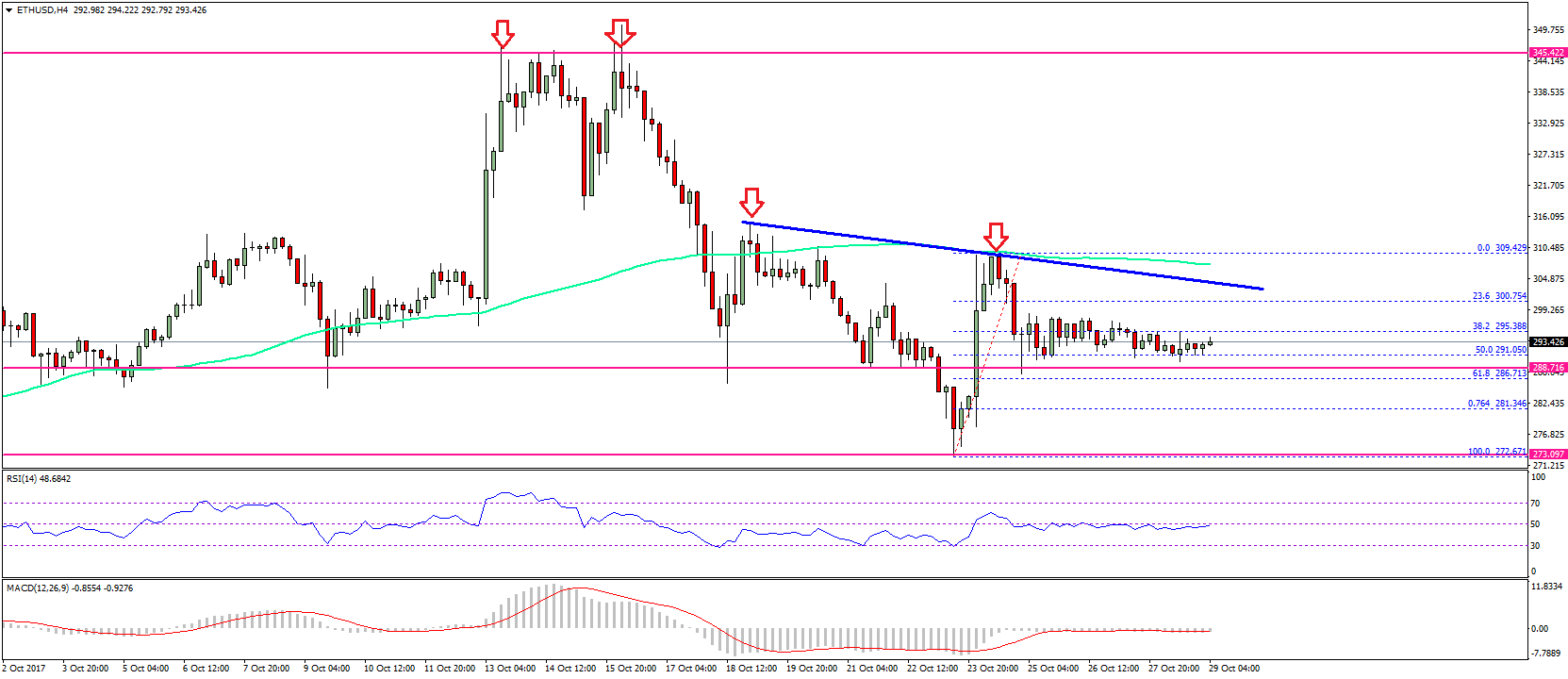

Analyzing the Weekly Chart: Key Support and Resistance Levels

Analyzing the weekly Ethereum chart is fundamental to predicting potential price movements. Identifying key support and resistance levels helps gauge the strength of any potential rebound.

Identifying Key Support Levels

Support levels represent price points where buying pressure is expected to outweigh selling pressure, potentially halting a price decline. On the Ethereum weekly chart, several key support levels warrant attention:

- 20-week moving average: This long-term moving average often acts as a significant support level. A bounce off this level would signal strong buying interest.

- 50-week moving average: Similar to the 20-week MA, the 50-week MA provides another crucial long-term support indicator. Breaks below this level can be more bearish, but a bounce suggests underlying strength.

- Psychological price levels: Round numbers like $1500 and $1800 often act as significant psychological support barriers. Traders tend to place buy orders at these levels, creating increased support.

[Insert chart showing 20-week and 50-week moving averages and psychological support levels]

The confluence of multiple support levels increases the likelihood of a price rebound. Holding above these levels is a bullish signal, while breaking below them could signal further downside potential.

Assessing Resistance Levels

Resistance levels represent price points where selling pressure is expected to exceed buying pressure, potentially halting a price increase. Identifying these levels is crucial for gauging the strength of any potential rebound:

- Recent highs: Previous price highs often act as resistance. Breaking through these levels signals a significant bullish breakthrough.

- Psychological price levels: Similar to support levels, psychological levels like $2000 and $2500 can act as resistance barriers.

- Trendline resistance: Upward-sloping trendlines often act as dynamic resistance. Breaking above these trendlines confirms a strong bullish trend.

[Insert chart showing recent highs, psychological resistance levels, and trendline resistance]

Overcoming these resistance levels is crucial for confirming a sustained Ethereum price rebound. The strength of the breakout will determine the potential magnitude of the rebound.

Indicator Analysis: RSI, MACD, and Bollinger Bands

Technical indicators provide valuable insights into market momentum and potential reversals. Let's analyze several key indicators on the weekly Ethereum chart:

Relative Strength Index (RSI)

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Oversold conditions: An RSI reading below 30 often signals an oversold market, suggesting potential for a price bounce.

- Potential for bullish divergence: A bullish divergence occurs when the price makes lower lows, but the RSI makes higher lows. This divergence suggests weakening selling pressure and potential for a price reversal.

[Insert chart showing the RSI indicator]

An oversold RSI coupled with bullish divergence strengthens the case for an Ethereum price rebound.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator.

- Bullish crossover: A bullish crossover occurs when the MACD line crosses above the signal line, suggesting a shift in momentum towards a bullish trend.

- Potential for a positive MACD histogram: A positive MACD histogram indicates bullish momentum.

[Insert chart showing the MACD indicator]

A bullish crossover and a positive MACD histogram reinforce the possibility of an Ethereum price rebound.

Bollinger Bands

Bollinger Bands depict price volatility.

- Price touching or breaking below the lower band: This indicates potential oversold conditions, suggesting a potential price bounce.

- Potential bounce off the lower band: Prices often bounce off the lower Bollinger Band, providing a potential rebound opportunity.

[Insert chart showing the Bollinger Bands indicator]

The interaction of the price with the Bollinger Bands can be a valuable tool in identifying potential Ethereum price rebound opportunities.

Ethereum Market Sentiment and News

Market sentiment and relevant news significantly influence Ethereum's price.

Assessing Market Sentiment

Current market sentiment towards Ethereum plays a crucial role in determining its price movement.

- Social media sentiment: Analyzing social media sentiment reveals overall market optimism or pessimism.

- News headlines: Major news headlines concerning Ethereum directly impact its price.

- Analyst predictions: Analyst predictions offer insights into future price expectations.

Analyzing these factors offers a holistic view of market sentiment.

Impact of Key News Events

Upcoming news events and developments can either boost or hinder an Ethereum price rebound:

- Upcoming Ethereum upgrades: Network upgrades can lead to increased adoption and potentially higher prices.

- Regulatory updates: Positive regulatory developments can boost investor confidence.

- Major partnerships or integrations: Strategic partnerships and integrations often lead to increased adoption and price appreciation.

Keeping abreast of these developments is crucial for understanding the Ethereum price rebound potential.

Risk Assessment and Disclaimer

Investing in cryptocurrencies carries significant risks:

- Volatility: Cryptocurrency prices are highly volatile, subject to sharp price swings.

- Market uncertainty: The cryptocurrency market is relatively young and susceptible to unexpected events.

- Regulatory risks: Regulatory changes can significantly impact cryptocurrency prices.

This analysis is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consider seeking professional financial advice before making any investment decisions.

Conclusion

This weekly chart indicator analysis suggests a potential for an Ethereum price rebound, supported by key support levels, oversold indicators (RSI, Bollinger Bands), and potential bullish signals from the MACD. However, it's crucial to consider market sentiment, upcoming news events, and inherent risks associated with cryptocurrency investments. Before making any investment decisions, conduct thorough research and consider seeking professional financial advice. Remember, understanding the potential for an Ethereum price rebound requires continuous monitoring of these indicators and market conditions. Stay informed and make well-calculated decisions regarding your Ethereum investments.

Featured Posts

-

Polluter Reform Dbs Banks Perspective On A Necessary Transition

May 08, 2025

Polluter Reform Dbs Banks Perspective On A Necessary Transition

May 08, 2025 -

Ukraines Cemetery Scandal Corruption And The Exploitation Of War Dead

May 08, 2025

Ukraines Cemetery Scandal Corruption And The Exploitation Of War Dead

May 08, 2025 -

Thunder Vs Pacers Injury Report March 29th Game Update

May 08, 2025

Thunder Vs Pacers Injury Report March 29th Game Update

May 08, 2025 -

Veteran Wide Receiver Joins Browns Bolstering Receiving Corps Report Details

May 08, 2025

Veteran Wide Receiver Joins Browns Bolstering Receiving Corps Report Details

May 08, 2025 -

Coming Soon Your Guide To The European Digital Identity Wallet

May 08, 2025

Coming Soon Your Guide To The European Digital Identity Wallet

May 08, 2025

Latest Posts

-

April 16 2025 Daily Lotto Results

May 08, 2025

April 16 2025 Daily Lotto Results

May 08, 2025 -

Xrp Price Rally Outperforming Bitcoin Post Sec Grayscale Etf News

May 08, 2025

Xrp Price Rally Outperforming Bitcoin Post Sec Grayscale Etf News

May 08, 2025 -

Could Xrp Etf Approval Trigger 800 Million In First Week Investment

May 08, 2025

Could Xrp Etf Approval Trigger 800 Million In First Week Investment

May 08, 2025 -

April 12th Lottery Results Winning Jackpot Numbers

May 08, 2025

April 12th Lottery Results Winning Jackpot Numbers

May 08, 2025 -

17th April 2025 Daily Lotto Results

May 08, 2025

17th April 2025 Daily Lotto Results

May 08, 2025