Unlocking Growth: Saudi Arabia's New Regulations For The ABS Market

Table of Contents

Increased Transparency and Regulatory Oversight

The new regulations introduce significant improvements in transparency and regulatory oversight within the Saudi Arabia ABS market. This enhanced framework aims to build investor confidence and promote market stability.

Enhanced Disclosure Requirements

The new rules mandate significantly more detailed and transparent disclosure requirements for ABS issuers. This improved transparency provides investors with greater confidence and a clearer understanding of the risks involved.

- Improved reporting standards for underlying assets: Issuers must now provide more granular data on the quality and performance of the underlying assets supporting the ABS. This includes rigorous assessments of creditworthiness and detailed information on the asset pool's composition.

- Clearer articulation of risk factors associated with ABS: The regulations mandate a comprehensive disclosure of all relevant risk factors, enabling investors to make informed decisions based on a complete understanding of potential downsides. This includes market risks, credit risks, and liquidity risks, among others.

- Increased scrutiny of originator due diligence: Issuers are subject to more stringent due diligence requirements regarding the originators of the underlying assets. This ensures the quality and reliability of the information provided and minimizes the potential for fraud or misrepresentation.

Strengthened Regulatory Framework

A more robust regulatory framework is now in place to oversee the issuance and trading of ABS in Saudi Arabia. This strengthened oversight minimizes risks and promotes greater market stability.

- Establishment of clearer guidelines for asset eligibility: The regulations define clear criteria for asset eligibility, providing certainty and reducing ambiguity for issuers. This clarity simplifies the process of structuring ABS transactions and encourages participation.

- Enhanced supervision of ABS issuers and trustees: Regulatory bodies now have more authority to supervise ABS issuers and trustees, ensuring compliance with the new regulations and protecting investor interests. This includes increased monitoring and more frequent audits.

- Improved mechanisms for dispute resolution: The new framework introduces enhanced mechanisms for dispute resolution, providing a more efficient and effective process for resolving conflicts between issuers, investors, and other market participants.

Expanding the Range of Eligible Assets

The new regulations significantly broaden the range of eligible underlying assets for ABS in Saudi Arabia, opening up exciting new opportunities for issuers and investors.

Diversification Beyond Traditional Assets

The updated rules allow for a more diverse range of underlying assets to be securitized, moving beyond traditional asset classes.

- Inclusion of previously untapped asset classes: The regulations explicitly include previously untapped asset classes, such as receivables from specific sectors like healthcare or renewable energy. This diversification reduces reliance on traditional asset classes and stimulates innovation.

- Greater flexibility in structuring ABS transactions: Issuers now have greater flexibility in structuring their ABS transactions, tailoring them to meet specific investor needs and market conditions. This enhanced flexibility promotes more creative and efficient financing solutions.

- Opportunities for innovation in ABS product design: The expanded range of eligible assets fosters innovation in ABS product design. This leads to more tailored and specialized ABS offerings catering to a wider range of investors and financing needs.

Facilitating Securitization of SMEs

A key objective of the new regulations is to facilitate the securitization of small and medium-sized enterprises (SMEs) in Saudi Arabia. This is crucial for boosting access to finance for this vital sector of the economy.

- Simplified procedures for SME ABS issuances: The regulations simplify the issuance process for SME ABS, reducing bureaucratic hurdles and making it easier for SMEs to access capital markets.

- Incentives for participation in SME securitization programs: The government is actively promoting SME securitization through various incentive programs, making it more attractive for both SMEs and investors.

- Potential for creating new financing options for SMEs: The increased accessibility of ABS financing is expected to create new and innovative financing options for SMEs, fostering their growth and development.

Attracting Foreign Investment into the Saudi Arabia ABS Market

The new regulations are designed to attract significant foreign investment into the Saudi Arabia ABS market. This influx of capital is expected to further fuel market growth and development.

Improved Investor Protection

The strengthened regulatory framework significantly enhances investor protection, making the Saudi Arabia ABS market a more attractive destination for international investors.

- Clearer legal framework for investor rights: The regulations provide a clearer legal framework that safeguards investor rights, providing greater certainty and reducing investment risks.

- Enhanced mechanisms for dispute resolution involving foreign investors: The improved dispute resolution mechanisms are designed to provide fair and efficient processes for resolving disputes involving foreign investors.

- Increased transparency and disclosure aimed at international standards: The enhanced transparency and disclosure requirements align with international best practices, making the Saudi Arabia ABS market more accessible and attractive to international investors.

Alignment with International Best Practices

The new regulations are carefully aligned with international best practices, increasing the market's global competitiveness and attracting foreign capital.

- Adoption of internationally recognized accounting and reporting standards: The adoption of internationally recognized standards simplifies cross-border investment and improves transparency.

- Integration with global market infrastructure: Increased integration with global market infrastructure improves market liquidity and reduces transaction costs.

- Increased participation in international ABS conferences and forums: Saudi Arabia's increased participation in international ABS events enhances its visibility and attracts foreign investors.

Conclusion

The new regulations governing the Saudi Arabia ABS market represent a significant step towards fostering robust growth and development within this vital sector. By increasing transparency, expanding the range of eligible assets, and attracting foreign investment, these changes are poised to unlock substantial economic opportunities. The improved regulatory framework offers a more stable and attractive environment for both issuers and investors, promising a vibrant future for the Saudi Arabia ABS market. To learn more about the specific details and implications of these new regulations and how they can benefit your business, explore the official government resources and consult with financial experts specializing in the Saudi Arabia ABS market. Investing in understanding the Saudi Arabia ABS market now is crucial for capitalizing on the immense growth opportunities it presents.

Featured Posts

-

The Us Responds To Measles Outbreak With Strengthened Vaccine Oversight

May 03, 2025

The Us Responds To Measles Outbreak With Strengthened Vaccine Oversight

May 03, 2025 -

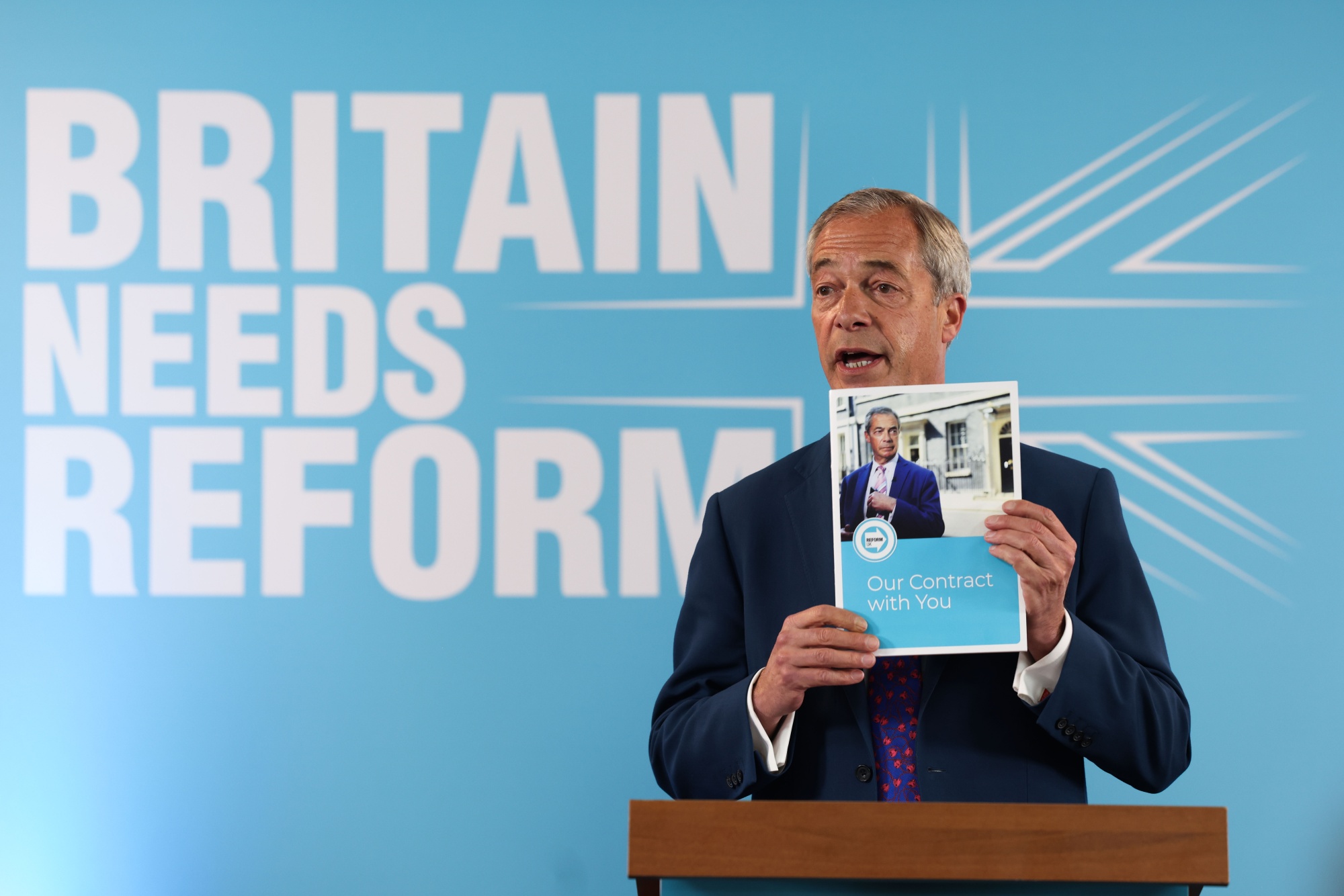

Nigel Farages Reform Party A Crucial Uk Local Election Test

May 03, 2025

Nigel Farages Reform Party A Crucial Uk Local Election Test

May 03, 2025 -

Epanidrysi Toy Kratoys Katapolemisi Tis Diafthoras Stis Poleodomies

May 03, 2025

Epanidrysi Toy Kratoys Katapolemisi Tis Diafthoras Stis Poleodomies

May 03, 2025 -

Improved Player Experience Fortnite Item Shops New Feature

May 03, 2025

Improved Player Experience Fortnite Item Shops New Feature

May 03, 2025 -

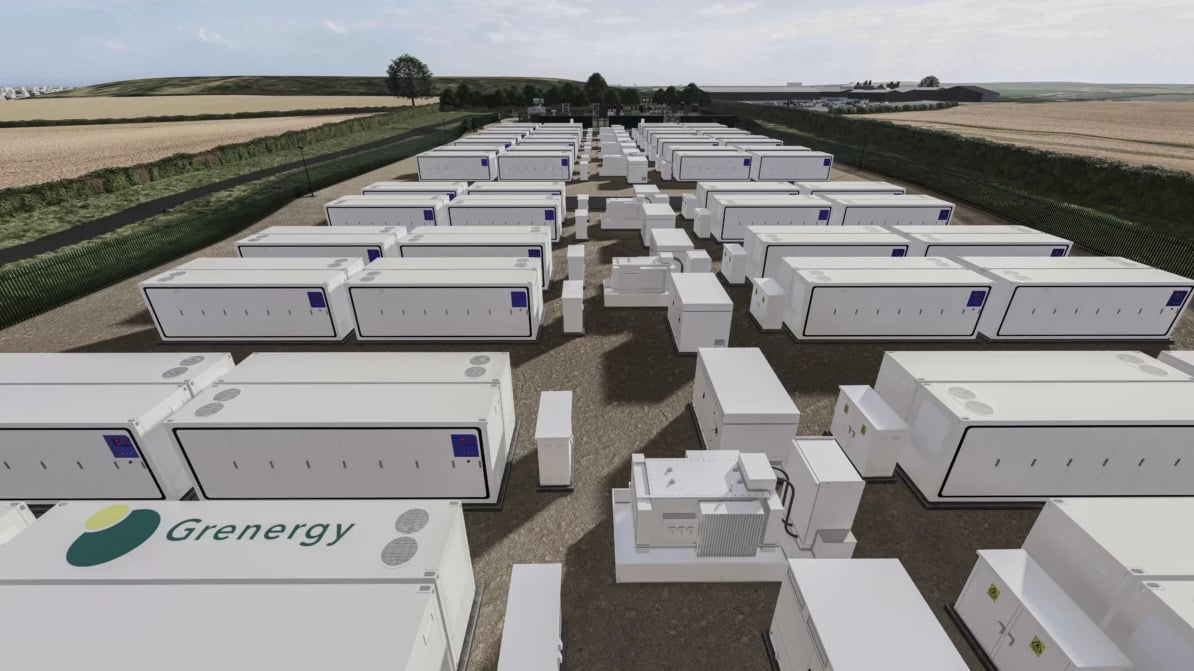

Belgiums Energy Market Financing Options For A 270 M Wh Bess

May 03, 2025

Belgiums Energy Market Financing Options For A 270 M Wh Bess

May 03, 2025