US Stock Futures Rise Sharply Following Trump's Statement On Powell

Table of Contents

Trump's Statement and its Market Impact

Former President Trump's statement regarding Jerome Powell and the Federal Reserve's monetary policy sent shockwaves through the market. His criticism, though not explicitly detailed in the statement, was widely interpreted as a call for a less aggressive approach to interest rate hikes. This interpretation fueled a significant rally in US stock futures.

- Quote: [Insert a hypothetical quote here reflecting Trump's criticism of Powell's policies. For example: "Powell is making a terrible mistake with interest rates. The economy needs relief, not further tightening."]

- Market Response: The Dow Jones Industrial Average futures jumped by [Insert Hypothetical Number] points, while S&P 500 futures surged by [Insert Hypothetical Number] points within minutes of the statement's release. Nasdaq futures also saw significant gains.

- Reasons for Positive Reaction: The market's positive reaction likely stems from hopes that Trump's comments might influence the Federal Reserve to reconsider its current monetary policy trajectory. Investors might be anticipating less aggressive interest rate increases, potentially boosting economic growth and corporate profits. This reflects a perceived shift in the potential economic policy landscape.

Analyzing the Fed's Current Monetary Policy

The Federal Reserve's current monetary policy is focused on combating inflation while maintaining sustainable economic growth. Recent interest rate hikes reflect the Fed's commitment to bringing inflation down to its 2% target. However, this tightening of monetary policy carries risks, potentially slowing economic growth and increasing the likelihood of a recession.

- Recent Fed Actions: [Summarize the Fed's recent interest rate decisions and other monetary policy actions. Include specific dates and percentages of rate hikes].

- Inflation Rate: The current inflation rate is [Insert Current Inflation Rate], a key factor influencing the Fed's policy decisions.

- Consequences of Different Approaches: A more aggressive approach to interest rate hikes could curb inflation more quickly but risks a sharper economic slowdown. A less aggressive approach might allow for more sustained growth but could prolong inflationary pressures. Trump's statement, interpreted as favoring a less aggressive stance, injected uncertainty into the established trajectory.

Investor Sentiment and Future Market Predictions

Trump's statement and the subsequent market reaction created a wave of uncertainty, significantly impacting investor sentiment. While the initial reaction was overwhelmingly positive, the long-term implications remain unclear.

- Shift in Investor Sentiment: Initially, investor confidence surged, fueled by hopes of a less hawkish Fed. However, this optimism needs to be tempered with caution, as the market remains volatile.

- Expert Opinions: [Include quotes from market analysts and economists offering their perspectives on the situation and forecasting future market movements. Mention any potential risks and opportunities for investors].

- Short-Term and Long-Term Implications: The short-term impact might be further gains in stock futures, depending on the Fed's response. The long-term implications are uncertain and heavily depend on how the Federal Reserve navigates the balance between inflation control and economic growth.

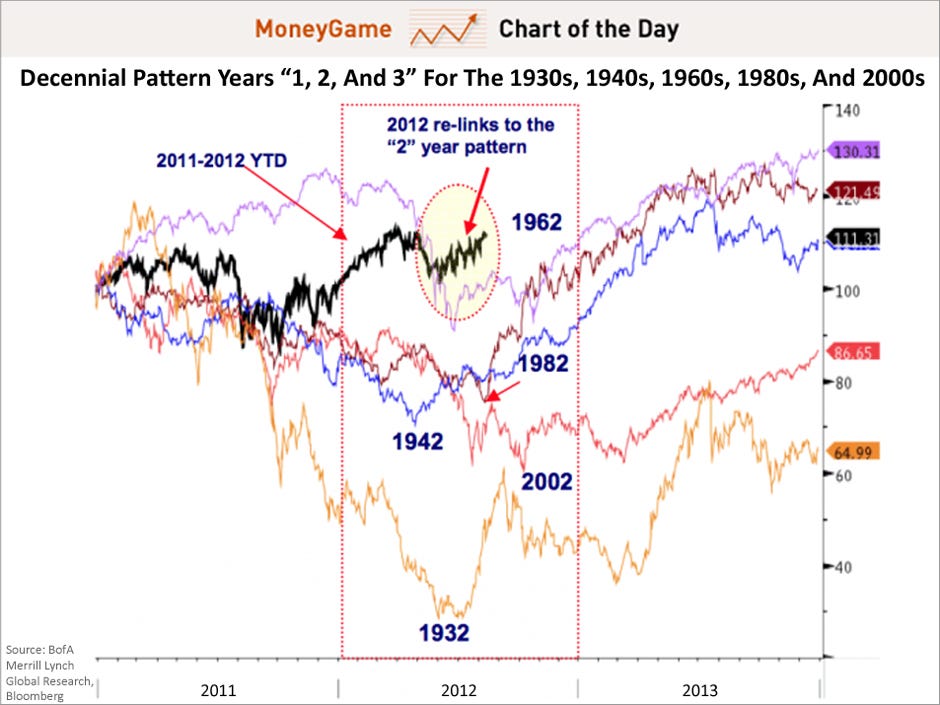

Historical Context and Comparison

While unprecedented in its specifics, Trump's statement and its impact on US stock futures echo historical instances where political statements significantly influenced market sentiment.

- Historical Examples: [Cite specific historical examples where presidential statements or actions had a noticeable impact on the stock market. This could include comments on trade policy, economic forecasts, or regulatory changes].

- Similarities and Differences: [Compare and contrast the current situation with previous instances, highlighting similarities and differences in the market's response and the underlying economic conditions].

- Importance of Historical Context: Understanding historical market trends and the influence of political factors provides essential context for interpreting current market behavior and predicting future movements.

Conclusion

The sharp rise in US stock futures following Trump's statement on Jerome Powell highlights the significant influence of political factors on market sentiment. Analysis of the market's reaction underscores the interplay between investor expectations, the Federal Reserve's monetary policy, and the potential for unforeseen shifts in economic policy. While the short-term impact is clearly visible, the long-term consequences remain to be seen. The interplay between Trump's influence, the Fed's response, and subsequent investor behavior will all impact US stock futures significantly. Staying informed about the latest developments is crucial for navigating this dynamic environment. Subscribe to our newsletter or follow us on social media for continuous updates and in-depth analysis of US stock futures and market trends. We also recommend further reading on investing strategies for volatile markets and understanding the role of the Federal Reserve in economic policy.

Featured Posts

-

World Economic Forum New Probe Into Klaus Schwabs Leadership

Apr 24, 2025

World Economic Forum New Probe Into Klaus Schwabs Leadership

Apr 24, 2025 -

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 24, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 24, 2025 -

60 Minutes Executive Producer Resigns Loss Of Independence Cited After Trump Lawsuit

Apr 24, 2025

60 Minutes Executive Producer Resigns Loss Of Independence Cited After Trump Lawsuit

Apr 24, 2025 -

Dollar Rises Trumps Softened Tone On Fed Chairman Powell Boosts Usd

Apr 24, 2025

Dollar Rises Trumps Softened Tone On Fed Chairman Powell Boosts Usd

Apr 24, 2025 -

Bof A On Stock Market Valuations A Case For Calm

Apr 24, 2025

Bof A On Stock Market Valuations A Case For Calm

Apr 24, 2025