USD Rally: Market Reaction To Trump's Changing Approach To Federal Reserve Policy

Table of Contents

Trump's Shifting Stance on the Federal Reserve

From Criticism to Acceptance

Initially, President Trump's relationship with the Federal Reserve was characterized by significant criticism. He frequently voiced his disapproval of the Fed's interest rate hikes, arguing that they hampered economic growth and hindered his administration's policy goals. This rhetoric often led to uncertainty in the markets and contributed to volatility in the USD.

- June 2018: Trump publicly criticized Fed Chair Jerome Powell, tweeting his dissatisfaction with interest rate increases and their potential negative impact on the economy. This resulted in a temporary weakening of the USD, with the Dollar Index falling by approximately 1.5% in the following week.

- September 2019: Further criticism followed, with Trump again expressing concern over the Fed's monetary policy stance. This renewed pressure further impacted market sentiment, causing some fluctuations in the USD's value.

The Impact of Changing Rhetoric

However, recently, Trump's tone towards the Fed has noticeably shifted. His public pronouncements have become more conciliatory, with less overt criticism of the central bank's actions. This change in rhetoric is being interpreted by markets as a sign of increased stability and predictability in US economic policy.

- Late 2020 - Early 2021: A noticeable decrease in public criticism of the Fed was observed, coinciding with the significant injection of liquidity into the markets in response to the COVID-19 pandemic. This change in approach positively impacted market sentiment, fostering greater confidence in the USD.

- Impact on Investor Confidence: The decreased antagonism towards the Fed translates to reduced uncertainty for investors. This creates a more favorable environment for investments in USD-denominated assets, strengthening the USD's value.

Market Response and USD Strength

Increased Investor Confidence

The shift in Trump's approach has undeniably bolstered investor confidence. This increased confidence translates directly into higher demand for USD-denominated assets, including US Treasury bonds and stocks, driving up the value of the US dollar.

- Increased Capital Inflows: A stronger belief in the stability of US economic policy attracts foreign investment, boosting the demand for USD.

- Safe-Haven Demand: The USD frequently acts as a safe-haven currency during times of global economic uncertainty. A more predictable political environment further enhances this safe-haven appeal.

Implications for Global Markets

A stronger USD has broad implications for the global economy. For example, it makes US exports more expensive and imports cheaper, potentially impacting trade balances for various countries.

- Emerging Markets: Countries with significant USD-denominated debt face increased repayment burdens when the USD strengthens, potentially creating financial strain.

- Currency Pairs: The USD rally has influenced major currency pairs like EUR/USD and USD/JPY, leading to notable fluctuations in their exchange rates. A stronger USD generally translates to a weaker Euro and Yen against the dollar.

Economic Factors Contributing to the USD Rally

Strong US Economic Data

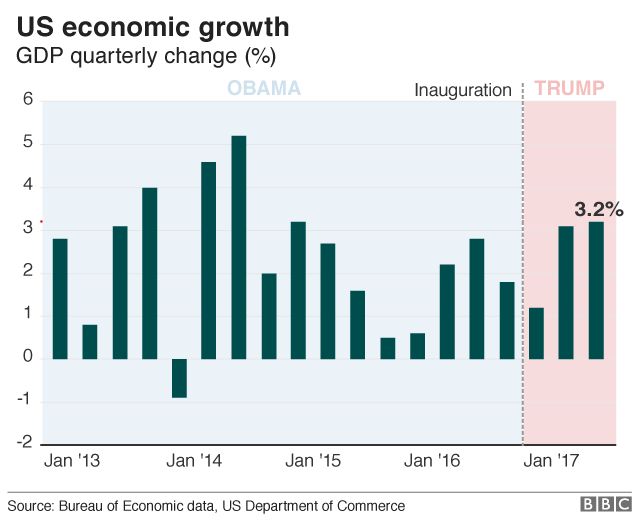

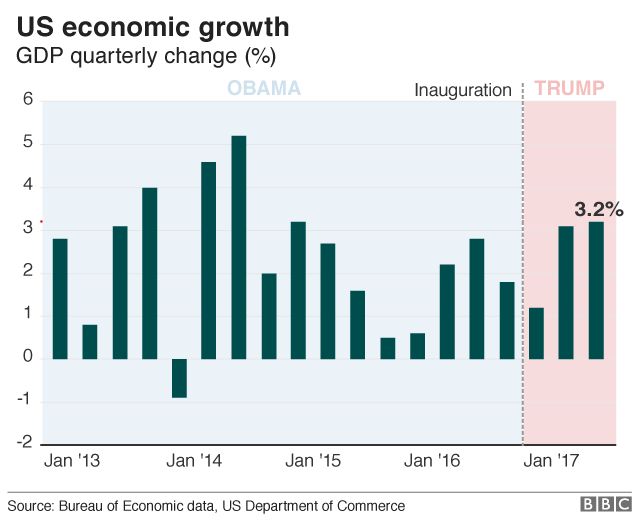

Beyond political factors, robust US economic data also contributes to the USD rally. Positive economic indicators signal a healthy economy, bolstering investor confidence and increasing demand for the USD.

- Employment Figures: Consistently strong job growth figures indicate a healthy labor market, supporting a positive outlook for the US economy.

- GDP Growth: Positive GDP growth further reinforces the narrative of a strong and expanding US economy, contributing to the USD’s strength.

- Inflation Rates: While inflation is a factor, moderate inflation is generally viewed positively, suggesting a healthy economy without overheating.

Safe-Haven Status of the USD

The USD's role as a global safe-haven asset also plays a significant role. During times of uncertainty, investors often flock to the USD, considering it a less risky investment compared to other currencies.

- Geopolitical Uncertainty: Global political instability and uncertainty often lead to a flight to safety, boosting demand for the USD.

- Economic Slowdowns: Concerns about economic slowdowns in other regions of the world also drive investors towards the relative safety of the USD.

Conclusion

The recent USD rally is a complex phenomenon driven by a confluence of factors. President Trump's evolving relationship with the Federal Reserve, marked by a shift from criticism to a more conciliatory stance, has significantly impacted market sentiment and investor confidence. Simultaneously, strong US economic fundamentals and the USD's enduring safe-haven appeal contribute to its robust performance. Understanding the interplay between these political and economic factors is crucial for navigating the global financial landscape. Stay tuned for further updates on this dynamic situation and its continued impact on the USD rally. Understanding these shifts is crucial for navigating the complex landscape of global finance.

Featured Posts

-

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 24, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 24, 2025 -

Full List Famous Faces Affected By The Palisades Fires

Apr 24, 2025

Full List Famous Faces Affected By The Palisades Fires

Apr 24, 2025 -

Liberal Fiscal Irresponsibility A Threat To Canadas Economic Vision

Apr 24, 2025

Liberal Fiscal Irresponsibility A Threat To Canadas Economic Vision

Apr 24, 2025 -

Activision Blizzard Acquisition Ftcs Appeal And Future Uncertainties

Apr 24, 2025

Activision Blizzard Acquisition Ftcs Appeal And Future Uncertainties

Apr 24, 2025 -

Recent Gains In Indias Nifty Market Trends And Future Outlook

Apr 24, 2025

Recent Gains In Indias Nifty Market Trends And Future Outlook

Apr 24, 2025