Village Roadshow's $417.5 Million Alcon Deal Approved: A Stalking Horse Bid Success

Table of Contents

Understanding the Village Roadshow Alcon Deal

This acquisition unites two powerhouses in the entertainment world. Village Roadshow, known for its extensive film distribution network and theme park ventures, gains a significant asset in Alcon Entertainment. Alcon, a renowned independent film studio, brings with it a valuable library of films, established production capabilities, and a strong track record of success. The strategic rationale behind Village Roadshow's acquisition is multifaceted:

- Synergistic Partnership: The Village Roadshow Alcon deal creates a synergy between a strong distribution network and a reputable film production company.

- Expanding Market Reach: This merger broadens Village Roadshow's reach into diverse film genres and target audiences.

- Access to a Robust Film Library: Alcon’s film library provides Village Roadshow with a catalog of proven, successful films for distribution and licensing.

- Enhancing Production Capabilities: Alcon's production expertise strengthens Village Roadshow's overall capabilities.

The key benefits for Village Roadshow are numerous:

- Expanded market reach and diversification into new film genres.

- Access to a valuable and profitable film library for licensing and distribution.

- Strengthened production capabilities, leading to increased output and potential cost savings.

- Potential for significant increases in profitability through cross-promotion and synergistic activities.

The Stalking Horse Bid Strategy and its Success

A "stalking horse bid" is a crucial strategy in mergers and acquisitions, particularly in bankruptcy proceedings or competitive auctions. It involves a preliminary bid that sets a baseline for other potential bidders. In the Village Roadshow Alcon deal, Village Roadshow's offer acted as the stalking horse, establishing a benchmark price and terms. This approach is highly effective because:

- It sets a floor for bidding: Encourages other potential buyers to submit higher bids, potentially driving up the final price.

- It provides a framework for the process: Defines the terms of the acquisition, such as the assets being acquired, deadlines for bidding, and payment conditions.

- It minimizes risks for the seller: Reduces uncertainty by providing a secure initial buyer.

While details of competing offers remain confidential, several factors contributed to Village Roadshow’s success:

- Competitive Pricing: Village Roadshow offered a compelling price that proved attractive to Alcon's stakeholders.

- Strong Financial Backing: Their robust financial position demonstrated their ability to complete the transaction.

- Comprehensive Acquisition Plan: A clear and well-defined plan for integrating Alcon into Village Roadshow's operations provided confidence to all parties.

- Favorable Terms for Creditors: Attractive conditions for creditors likely played a significant role in securing approval.

Implications for the Film Industry - Village Roadshow Alcon Deal Analysis

The Village Roadshow Alcon deal has significant implications for the film industry landscape. The combination of Alcon’s creative expertise with Village Roadshow’s distribution might lead to:

- Increased Competition: The merger might intensify competition among major studios, potentially impacting film production and distribution strategies.

- Shifts in Market Dynamics: The deal could influence the way independent films are produced and distributed, especially for mid-budget productions.

- Innovative Collaborations: We can expect to see new and innovative collaborations emerge, blending Alcon's creative strengths with Village Roadshow's extensive resources.

Potential future projects and collaborations could include:

- Joint production of major motion pictures, utilizing both companies' resources.

- Expansion into new international markets through Village Roadshow's global network.

- Development of new franchises based on Alcon's existing intellectual property.

Financial Aspects of the Village Roadshow Alcon Deal

The $417.5 million deal likely involved a mix of cash and potentially debt financing. The precise financial structure, including details of funding sources and debt arrangements, hasn't been publicly disclosed. However, Village Roadshow's strong financial position suggests a healthy return on investment is anticipated, subject to the successful integration of Alcon and the performance of future projects. The deal's completion required regulatory approvals, which were successfully obtained, paving the way for the integration process.

Conclusion: The Future of Village Roadshow and Alcon After the Successful Acquisition

The successful completion of the Village Roadshow Alcon deal, facilitated by a cleverly executed stalking horse bid, significantly alters the film industry landscape. This strategic acquisition combines a strong production company with a robust distribution network, promising a powerful entity in the years to come. The future holds exciting possibilities for collaborative projects, expanded market reach, and increased profitability. Stay tuned for further updates on the integration of Alcon into Village Roadshow and the exciting projects to come from this successful Village Roadshow Alcon deal.

Featured Posts

-

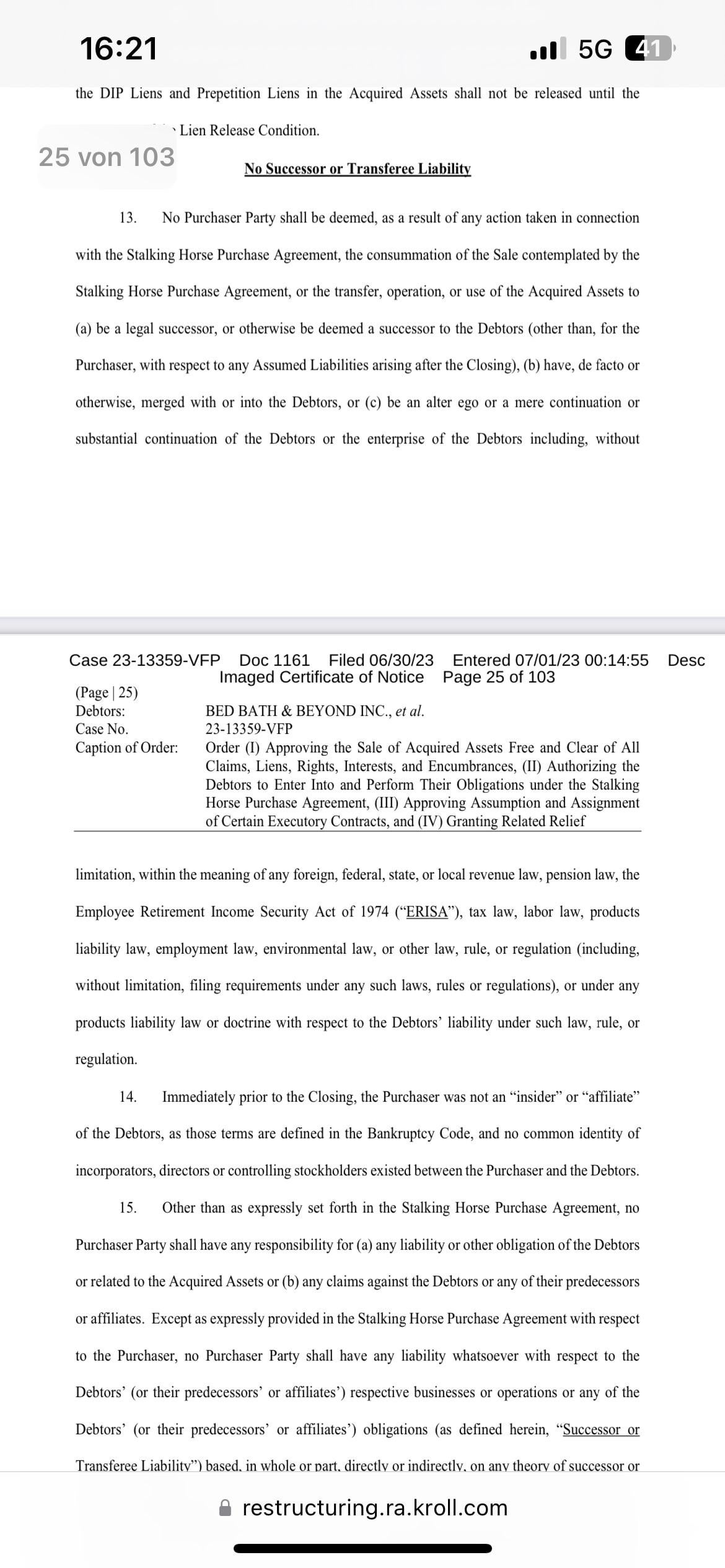

Is Betting On Wildfires Like The La Fires A Sign Of Our Times

Apr 24, 2025

Is Betting On Wildfires Like The La Fires A Sign Of Our Times

Apr 24, 2025 -

Vs

Apr 24, 2025

Vs

Apr 24, 2025 -

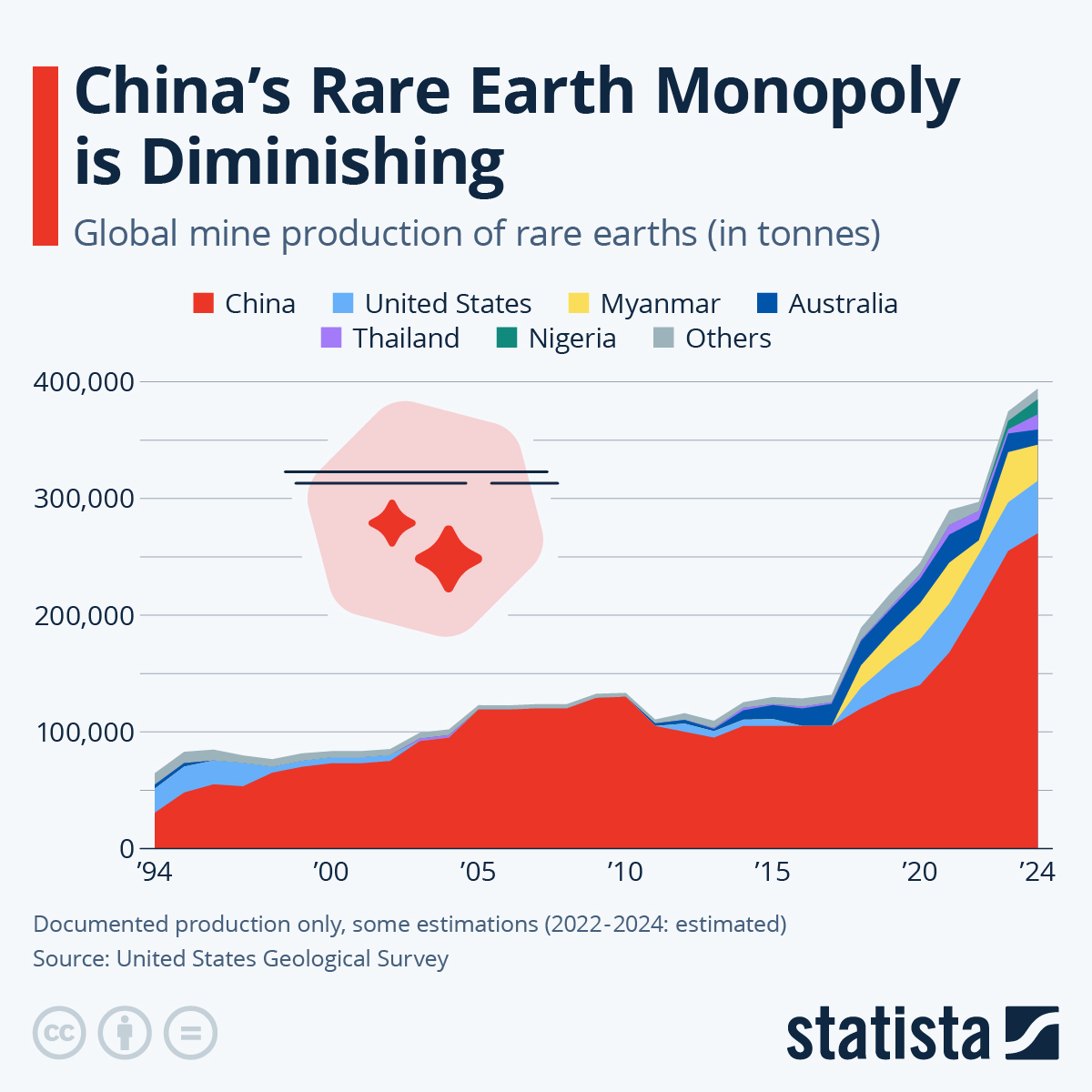

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025 -

India And Saudi Arabia Partner For Two New Oil Refineries

Apr 24, 2025

India And Saudi Arabia Partner For Two New Oil Refineries

Apr 24, 2025 -

The Bold And The Beautiful Thursday April 3 2024 Liams Collapse And Hopes New Home

Apr 24, 2025

The Bold And The Beautiful Thursday April 3 2024 Liams Collapse And Hopes New Home

Apr 24, 2025