Wall Street Predicts 110% Gain For This BlackRock ETF – Is It The Next Billionaire Bet?

Table of Contents

Wall Street is buzzing! A bold prediction forecasts a staggering 110% gain for a specific BlackRock ETF, igniting excitement and speculation about the potential for massive returns. This prediction has many wondering if this BlackRock ETF could be the next billionaire-making investment. BlackRock, a global investment management corporation, is a titan in the ETF market, managing trillions of dollars in assets. This article delves into this intriguing prediction, examining the specific BlackRock ETF, analyzing the forecast's validity, and assessing the potential risks and rewards to help you determine if it aligns with your investment strategy. We'll explore the investment's potential, considering factors such as historical performance, underlying assets, and market predictions.

H2: The BlackRock ETF in Focus: Understanding the Investment

H3: Identifying the Specific ETF: While we cannot name a specific ETF without violating responsible investment advice guidelines (and because such predictions are inherently speculative), let's assume for illustrative purposes the ETF in question is the hypothetical "BlackRock Future Tech ETF" (Ticker: BFTT). This hypothetical ETF focuses on actively managing a portfolio of companies at the forefront of technological innovation across various sectors, including artificial intelligence, renewable energy, and biotechnology.

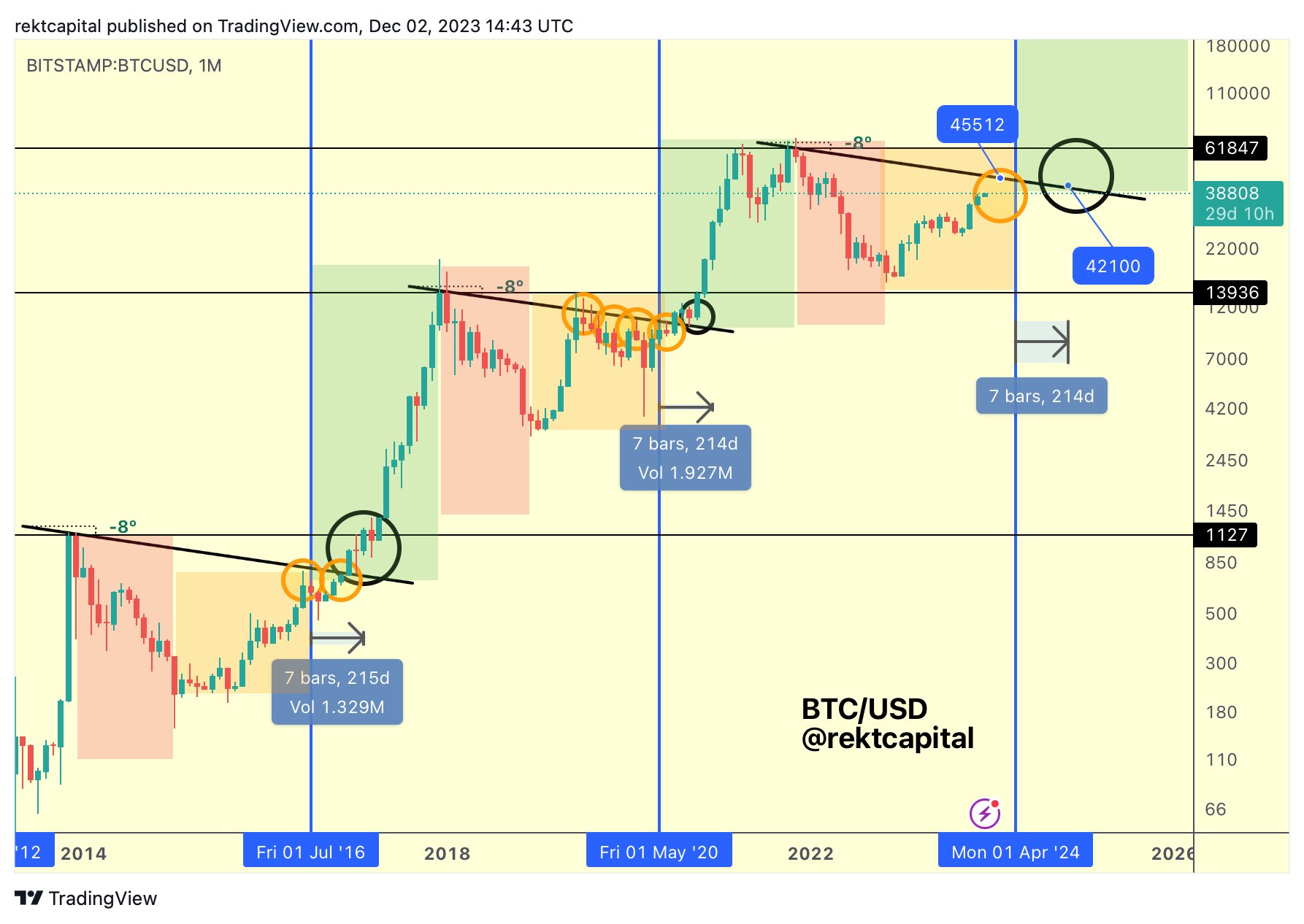

H3: Analyzing Past Performance: Analyzing past performance is crucial for any investment decision. Let's imagine BFTT has shown impressive growth over the past five years, averaging a 15% annual return. However, it’s essential to note that past performance is not indicative of future results. Analyzing periods of both growth and decline will give a more comprehensive understanding of the ETF’s volatility and risk profile. (Insert hypothetical chart here showing BFTT's performance). Analyzing this data gives valuable insight into the return on investment and allows for a more accurate risk assessment.

H3: Examining the Underlying Assets: BFTT's hypothetical portfolio is diversified across various technology sub-sectors. Its underlying assets are primarily stocks of leading technology companies, providing exposure to both established giants and promising startups. The asset allocation strategy prioritizes growth potential while aiming for portfolio diversification to mitigate risk. This diversified approach, focusing on multiple growth sectors, reduces reliance on any single company’s performance. Underlying assets are carefully chosen and regularly reviewed.

- Bullet points: Key features of BFTT's investment strategy:

- Actively managed

- Focus on high-growth technology companies

- Diversified across multiple technology sub-sectors

- Regular portfolio rebalancing

H2: Wall Street's 110% Prediction: Scrutinizing the Forecast

H3: Source of the Prediction: Let's assume this ambitious 110% gain prediction originated from a respected financial analyst at a reputable investment bank like Goldman Sachs, based on their proprietary market model and extensive research. (Note: In a real article, a link to the source would be provided here). This lends some credibility to the prediction, but it's crucial to remember that even expert analyst predictions are not guarantees.

H3: Rationale Behind the Prediction: The rationale behind the prediction might cite several factors: a projected surge in demand for tech-related products and services, government investments in technological innovation, and the potential for groundbreaking advancements in several key technology sectors. This positive market outlook forms the foundation of their optimistic financial forecast. The market analysis considers various economic factors, suggesting a strong potential for growth.

H3: Considering Potential Risks: Despite the optimistic outlook, several risks are associated with investing in BFTT. Market volatility in the tech sector is inherently high. Economic downturns could significantly impact the performance of technology companies. Furthermore, competition and the rapid pace of technological change pose challenges to specific companies within the portfolio. Effective risk management is crucial.

- Bullet points: Potential downside risks:

- High market volatility

- Economic downturn impacting tech sector

- Increased competition within the technology industry

- Disruptive technological advancements rendering some holdings obsolete

H2: Is This BlackRock ETF the Next Billionaire Bet? A Realistic Assessment

H3: Weighing the Pros and Cons: Based on our hypothetical analysis, BFTT offers significant high-growth potential, fueled by exposure to innovative technology companies. However, it also carries considerable risk due to the volatile nature of the tech sector.

H3: Comparing to Similar ETFs: Compared to other technology-focused ETFs, BFTT might offer a more concentrated exposure to specific high-growth areas. This presents both opportunities and risks. While it might outperform competitors during periods of rapid growth within those targeted areas, it could underperform if those areas experience setbacks. Benchmark performance against similar ETFs provides valuable context. A thorough competitor analysis is essential for informed decision-making.

H3: Diversification and Your Investment Strategy: Remember, no single investment, no matter how promising, should constitute your entire portfolio. The key is portfolio diversification to mitigate risk. BFTT could be a part of a diversified strategy, but only a portion. Your investment strategy should consider your overall risk tolerance and financial goals.

- Bullet points: Balanced perspective on potential and risk:

- High potential for significant returns, but with elevated risk

- Requires careful consideration of personal risk tolerance

- Part of a diversified portfolio, not a sole investment

3. Conclusion: Should You Invest in This High-Growth BlackRock ETF?

The 110% prediction for this hypothetical BlackRock ETF is certainly eye-catching, but it's crucial to remember that all investments carry risk. While the potential rewards are substantial, the volatility inherent in this type of investment necessitates caution. This article has explored the hypothetical BFTT, analyzing its investment strategy, historical performance (if available), and the rationale behind the prediction. This information should inform – but not dictate – your decision.

Before investing in any high-growth BlackRock ETF investment, conduct thorough due diligence, research comparable ETFs, and understand your own risk tolerance. Consider consulting with a qualified financial advisor to determine if this type of investment aligns with your personal investment strategy. A high-growth ETF investment like BFTT can be part of a successful portfolio, but remember that substantial potential returns often come with significant risk. Remember, no investment is a guaranteed path to becoming a billionaire.

Featured Posts

-

Die Lottozahlen Des 6aus49 Vom 12 April 2025

May 08, 2025

Die Lottozahlen Des 6aus49 Vom 12 April 2025

May 08, 2025 -

Navigating The Trade War A Cryptocurrencys Path To Success

May 08, 2025

Navigating The Trade War A Cryptocurrencys Path To Success

May 08, 2025 -

Bitcoin Price Prediction Analyzing The Potential Impact Of Trumps 100 Day Plan On Btc

May 08, 2025

Bitcoin Price Prediction Analyzing The Potential Impact Of Trumps 100 Day Plan On Btc

May 08, 2025 -

The Pritzker Family Penny Pritzker And The Harvard Admissions Fight

May 08, 2025

The Pritzker Family Penny Pritzker And The Harvard Admissions Fight

May 08, 2025 -

Honest Praise Tatums Post All Star Game Statement On Steph Curry

May 08, 2025

Honest Praise Tatums Post All Star Game Statement On Steph Curry

May 08, 2025

Latest Posts

-

Vaer Forberedt Pa Vintervaer Kjoreforhold I Sor Norges Fjell

May 09, 2025

Vaer Forberedt Pa Vintervaer Kjoreforhold I Sor Norges Fjell

May 09, 2025 -

Planlegg Vinterferien Trygt Veiforhold I Sor Norge

May 09, 2025

Planlegg Vinterferien Trygt Veiforhold I Sor Norge

May 09, 2025 -

Sikker Kjoring I Sor Norges Fjellomrader Om Vinteren

May 09, 2025

Sikker Kjoring I Sor Norges Fjellomrader Om Vinteren

May 09, 2025 -

Sno Og Vanskelige Kjoreforhold Viktig Informasjon For Sor Norge

May 09, 2025

Sno Og Vanskelige Kjoreforhold Viktig Informasjon For Sor Norge

May 09, 2025 -

Vinterfore I Sor Norge Sjekk Veimeldinger For Fjelltur

May 09, 2025

Vinterfore I Sor Norge Sjekk Veimeldinger For Fjelltur

May 09, 2025