Weihong Liu And His Acquisition Of 28 Hudson's Bay Leases

Table of Contents

The Scale and Scope of the Acquisition

Weihong Liu's acquisition of 28 Hudson's Bay leases is a considerable undertaking, impacting numerous locations across Canada. While precise details of all locations and square footage may not be publicly available due to confidentiality agreements, the sheer number of leases indicates a substantial investment. This portfolio likely includes a mix of flagship stores and smaller outlets, encompassing a significant amount of prime retail space in key Canadian cities. The financial details surrounding the purchase price remain undisclosed, adding to the intrigue surrounding this deal. It is likely the acquisition was financed through a combination of private equity, debt financing, and perhaps partnerships, reflecting a sophisticated investment strategy. The geographic distribution is likely strategically chosen, targeting high-traffic areas and potentially underserved markets.

- Specific examples of acquired properties: While specific locations aren't publicly known, we can assume major city centers across Canada were targeted for their high-value potential.

- Unique features: The acquired properties may include historically significant buildings or locations offering unique redevelopment opportunities.

- Total retail space: The total square footage acquired likely represents a considerable chunk of prime retail space in Canada.

Weihong Liu's Investment Strategy and Objectives

Weihong Liu’s history demonstrates a clear focus on strategic acquisitions and shrewd investments in the real estate sector. His background and previous successes suggest a keen eye for properties with strong redevelopment potential or substantial long-term appreciation. The acquisition of the Hudson's Bay leases likely aligns with his overall investment strategy. Several objectives could be driving this investment:

- Redevelopment Potential: Many Hudson's Bay locations are situated in prime urban areas, presenting significant opportunities for mixed-use developments, integrating residential, commercial, and retail spaces.

- Rental Income: In the short term, generating rental income from the existing tenants would be a key objective.

- Long-Term Appreciation: Prime real estate in major Canadian cities tends to appreciate significantly over time, ensuring a healthy return on investment.

The rationale behind this significant investment likely stems from Liu's assessment of favorable market conditions, low interest rates (at the time of the acquisition), and a belief in the resilience of the Canadian real estate market.

- Synergies: This acquisition likely creates synergies with Liu’s existing portfolio, providing economies of scale in management and development.

- Future Plans: Converting the properties into mixed-use developments incorporating residential units seems highly probable, given current urban development trends.

- Risks and Opportunities: Potential risks include economic downturns and changing retail landscapes; however, the opportunities offered by prime locations outweigh these risks.

Implications for Hudson's Bay Company and the Canadian Retail Sector

The impact of this acquisition on Hudson's Bay Company is significant. The sale of these leases likely frees up capital for the company to focus on its core business and potentially streamline its operations. For Hudson's Bay, the deal represents a restructuring move rather than a sign of weakness.

The Canadian retail landscape is also expected to see shifts as a result of this acquisition. The new ownership could:

- Increase Competition: Changes in tenancy and redevelopment might intensify competition amongst retailers in specific markets.

- Impact Employment: Redevelopment projects could lead to job creation in construction and related fields, while potential tenant changes might impact existing retail employees.

- Long-Term Urban Impact: The revitalization of these properties will undoubtedly impact the urban landscape and the development of Canadian cities.

The Future of Weihong Liu's Hudson's Bay Portfolio - A Lasting Impact?

Weihong Liu's acquisition of 28 Hudson's Bay leases represents a substantial investment with far-reaching consequences for the Canadian retail and real estate sectors. The scale of the acquisition highlights Liu’s ambition and his confidence in the long-term growth of the Canadian market. The future of these properties will depend on Liu's execution of his redevelopment plans and the prevailing economic climate. However, given Liu's track record and the prime location of the properties, the potential for significant urban revitalization and long-term appreciation is substantial. The changes brought about by this deal will undoubtedly shape the future of Canadian real estate for years to come. Stay informed about developments related to Weihong Liu’s real estate ventures, Hudson's Bay property developments, and other significant Canadian real estate acquisitions to understand the evolving dynamics of this sector.

Featured Posts

-

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025 -

Glastonbury Festival Resale Chaos Fans Frustrated By Ticket Scalping

May 30, 2025

Glastonbury Festival Resale Chaos Fans Frustrated By Ticket Scalping

May 30, 2025 -

Was Geschah Am 10 April Wichtige Ereignisse Des Tages

May 30, 2025

Was Geschah Am 10 April Wichtige Ereignisse Des Tages

May 30, 2025 -

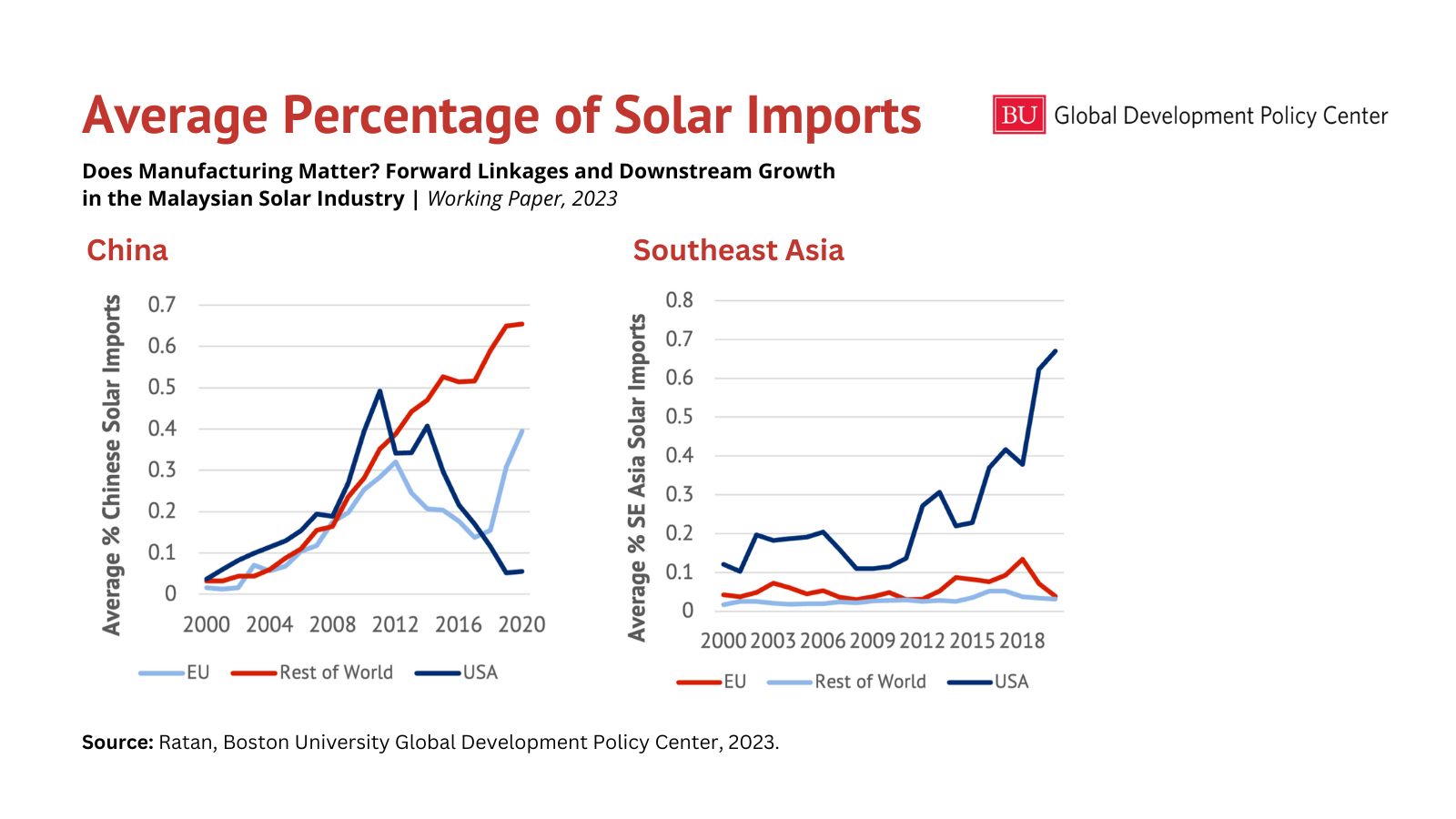

Southeast Asian Solar Imports Face Steep Us Tariffs A 3 521 Duty

May 30, 2025

Southeast Asian Solar Imports Face Steep Us Tariffs A 3 521 Duty

May 30, 2025 -

Problemas Ticketmaster 8 De Abril Informacion Y Actualizaciones Grupo Milenio

May 30, 2025

Problemas Ticketmaster 8 De Abril Informacion Y Actualizaciones Grupo Milenio

May 30, 2025