What Is XRP And How Does It Work?

Table of Contents

The cryptocurrency market is booming, with new digital assets emerging constantly. Amidst this excitement, XRP stands out as a prominent player, often generating significant interest and discussion. But what exactly is XRP, and how does it work? This beginner's guide will delve into the fundamentals of XRP, exploring its technology, use cases, and potential, providing a clear understanding of this intriguing digital asset.

Understanding XRP: More Than Just a Cryptocurrency

XRP is not your typical cryptocurrency like Bitcoin. Unlike Bitcoin which relies on a Proof-of-Work consensus mechanism and is mined, XRP's creation and distribution are different. It exists within the Ripple ecosystem, functioning as a bridge currency facilitating fast and efficient transactions across various payment networks. This sets it apart from other cryptocurrencies focusing primarily on decentralized peer-to-peer transactions.

- XRP's creation and total supply: A total of 100 billion XRP were created at its inception, with a significant portion held in escrow by Ripple Labs to ensure a controlled release into the market over time.

- Its decentralized nature and its differences from Bitcoin and other cryptocurrencies: While XRP operates on a decentralized ledger, the XRP Ledger (XRPL), the degree of decentralization differs from cryptocurrencies like Bitcoin and Ethereum. Ripple Labs plays a significant role in the XRP ecosystem, a factor differentiating it from purely community-driven projects.

- The role of Ripple Labs in the XRP ecosystem: Ripple Labs developed the XRP Ledger and actively promotes the adoption of XRP and its associated technologies. This close relationship is a key characteristic of XRP.

- Explain the concept of "bridging" currencies: XRP acts as a bridge between different currencies, enabling faster and cheaper conversions compared to traditional banking systems. This bridging functionality is crucial for its use in international transactions.

How XRP Transactions Work: Speed and Efficiency

XRP transactions occur on the XRP Ledger (XRPL), a distributed ledger technology (DLT) that uses a unique consensus mechanism called the Ripple Protocol Consensus Algorithm (RPCA). This algorithm enables incredibly fast transaction processing with significantly lower fees compared to other blockchain networks like Bitcoin and Ethereum.

- Step-by-step explanation of an XRP transaction: A user initiates a transaction by sending XRP from one wallet to another. The transaction is broadcast to the XRPL network, verified by RPCA, and added to the ledger, typically within a few seconds.

- Detailed explanation of the Ripple Protocol Consensus Algorithm (RPCA): RPCA is a faster and more energy-efficient consensus mechanism than Proof-of-Work or even Proof-of-Stake. It utilizes a unique process involving trusted validators to reach consensus on the validity of transactions.

- Comparison of transaction fees and speeds with Bitcoin and Ethereum: XRP transactions are significantly faster and cheaper, making it attractive for high-volume transactions. Bitcoin and Ethereum transactions, while secure, often involve longer processing times and higher fees.

- Discussion of scalability and its impact on transaction processing: The XRPL is designed for scalability, handling a large number of transactions per second, a critical factor for its use in global payment systems.

Use Cases for XRP: Beyond Payments

While often associated with peer-to-peer payments, XRP's applications extend far beyond basic transfers. Its speed, efficiency, and low cost make it suitable for various use cases.

- Cross-border payments and remittances: XRP excels at facilitating swift and cost-effective cross-border transactions, reducing the time and expense associated with traditional international money transfers.

- Institutional adoption and its benefits: Many financial institutions are exploring XRP for streamlining their payment operations, leveraging its speed and efficiency to improve their services.

- Potential use cases in supply chain management and other industries: XRP's potential extends to tracking assets, verifying authenticity, and optimizing processes within supply chains and other industries.

- Discussion of the RippleNet network and its use of XRP: RippleNet is a global network of financial institutions using Ripple's technology, and many utilize XRP for facilitating faster and more affordable cross-border payments.

The Ripple Factor: Understanding the Relationship

It's crucial to understand the distinction between Ripple Labs and XRP. While Ripple Labs developed the XRP Ledger and actively promotes XRP, they are not the same entity. XRP is a decentralized cryptocurrency operating independently of Ripple Labs.

- Ripple Labs' role in developing and promoting XRP: Ripple Labs played a key role in creating and developing the XRP Ledger and continues to support its growth and adoption.

- The distinction between RippleNet and XRP: RippleNet is a network of financial institutions using Ripple's technology, but its functionality is separate from the XRP cryptocurrency itself. While many use XRP within RippleNet, they are not intrinsically linked.

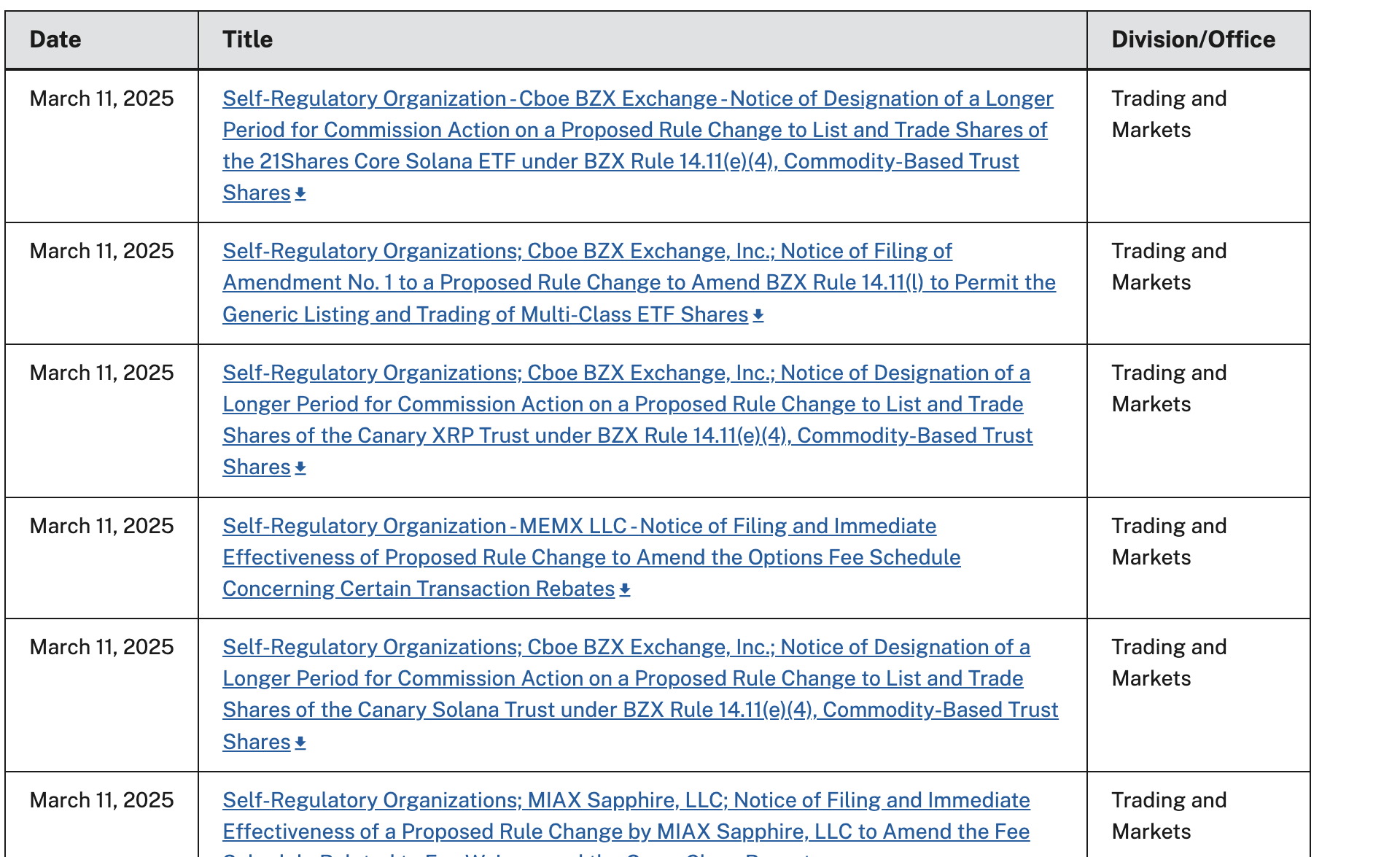

- Current regulatory issues and legal battles facing Ripple: Ripple Labs has faced regulatory scrutiny, particularly in the US, impacting the price and perception of XRP. It's important to stay updated on these legal developments.

- The impact of legal proceedings on XRP's price and adoption: Ongoing legal issues can create volatility in XRP's price and affect its adoption rate among financial institutions.

Investing in XRP: Risks and Considerations

Investing in XRP, like any cryptocurrency, involves significant risk. The market is highly volatile, and XRP's price can fluctuate dramatically.

- Market volatility and price fluctuations: XRP's price is subject to market forces and news events, including regulatory changes and technological advancements.

- Risk assessment and due diligence: Before investing in XRP, conduct thorough research, understanding the potential risks and rewards.

- Diversification strategies for cryptocurrency portfolios: Diversify your investment portfolio, avoiding over-reliance on any single cryptocurrency.

- Where to buy and store XRP safely: Use reputable cryptocurrency exchanges and secure wallets to manage your XRP holdings.

Conclusion

XRP offers a unique proposition in the cryptocurrency space. Its speed, low transaction fees, and potential applications beyond simple payments make it an intriguing asset. However, understanding its relationship with Ripple Labs and the inherent risks associated with cryptocurrency investment is crucial. Remember to conduct your own research before making any investment decisions. Learn more about XRP, explore the world of XRP, and understand the potential of XRP—but always prioritize responsible investment strategies. Further exploration into the XRP Ledger and RippleNet will provide a more comprehensive understanding of XRP's place in the global financial landscape.

Featured Posts

-

Analyzing The Impact Of The Target Dei Controversy On Brand Loyalty And Sales

May 01, 2025

Analyzing The Impact Of The Target Dei Controversy On Brand Loyalty And Sales

May 01, 2025 -

Xrp Etf Approvals Sec Developments And Ripples Future

May 01, 2025

Xrp Etf Approvals Sec Developments And Ripples Future

May 01, 2025 -

Nba Playoffs Game 2 Cavaliers Vs Heat Live Stream Tv Channel And Game Time

May 01, 2025

Nba Playoffs Game 2 Cavaliers Vs Heat Live Stream Tv Channel And Game Time

May 01, 2025 -

Opening Day Disappointment Angels Fall Victim To Walks And Injuries

May 01, 2025

Opening Day Disappointment Angels Fall Victim To Walks And Injuries

May 01, 2025 -

Phipps Aussie Rugbys Dominance Questioned

May 01, 2025

Phipps Aussie Rugbys Dominance Questioned

May 01, 2025