Where To Invest: Mapping The Country's Top Business Hotspots

Table of Contents

Tech Hubs: Silicon Valleys of Tomorrow

The technology sector is a significant driver of economic growth, and investing in tech hubs can yield substantial returns. These “Silicon Valleys of tomorrow” are characterized by a thriving startup ecosystem, ample venture capital funding, and a readily available pool of tech talent. When considering where to invest in technology, focus on these key aspects:

Keywords: Tech investment, startup ecosystem, venture capital, innovation hubs, technology sector, digital economy, coding bootcamps, tech talent.

-

Key Cities and Regions:

- City A: Known for its strong concentration of fintech companies and a supportive government initiative providing tax breaks for tech startups. Major players include Company X and Company Y. Numerous coding bootcamps provide a steady stream of skilled graduates.

- City B: A burgeoning hub for AI and machine learning, attracting significant venture capital funding. It boasts a thriving network of incubators and accelerators, fostering innovation and entrepreneurship.

- Region C: Home to several large tech corporations and a growing number of smaller, innovative businesses. The region's robust infrastructure and relatively low cost of living make it attractive for both startups and established companies.

-

Government Support: Many cities and regions offer government grants, tax incentives, and other forms of support to attract tech businesses and foster innovation. Researching these incentives is crucial for maximizing your return on investment.

-

Affordable Co-working Spaces: The availability of affordable co-working spaces is a key indicator of a healthy and accessible tech ecosystem. These spaces facilitate collaboration and networking, crucial for startups and entrepreneurs.

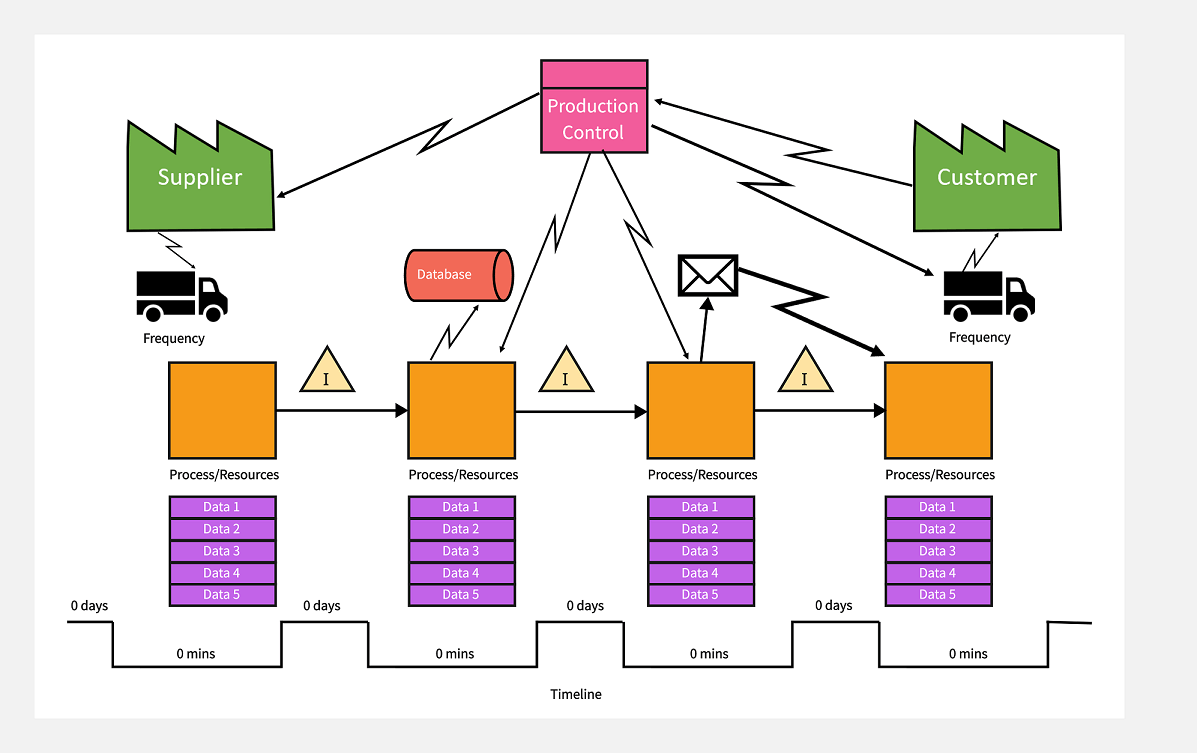

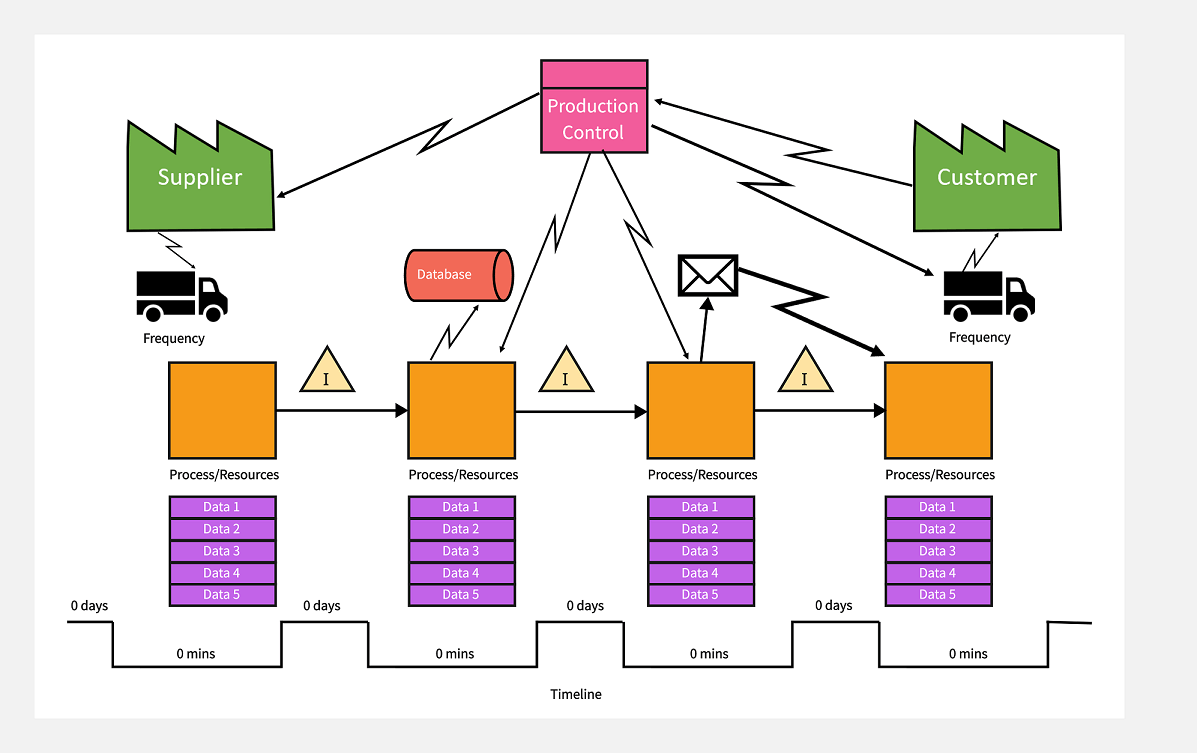

Manufacturing and Industrial Powerhouses

For investors seeking stability and tangible assets, manufacturing and industrial regions offer compelling opportunities. These areas typically benefit from established infrastructure, a skilled workforce, and government incentives geared towards attracting manufacturers.

Keywords: Manufacturing investment, industrial parks, logistics, supply chains, infrastructure development, workforce availability, manufacturing jobs, industrial real estate.

-

Regions Specializing in Specific Sectors:

- Region D: A major center for automotive manufacturing, boasting a well-developed supply chain and a highly skilled workforce. Government incentives include tax breaks and streamlined permitting processes for new factories.

- Region E: Specializes in aerospace manufacturing, attracting significant investment due to its proximity to key research institutions and a strong cluster of related industries.

- Region F: A growing hub for renewable energy manufacturing, benefiting from government initiatives promoting sustainable technologies.

-

Infrastructure and Logistics: Access to major transportation networks—ports, railways, and highways—is crucial for efficient logistics and supply chains. Regions with robust infrastructure are more attractive to manufacturers and investors alike.

-

Government Incentives: Many regions offer tax breaks, subsidies, and other incentives to attract manufacturers, reducing the cost of doing business and boosting profitability.

Emerging Markets with High Growth Potential

Emerging markets present opportunities for high returns but also come with higher risks. These regions are experiencing rapid economic growth, often driven by sectors such as renewable energy, tourism, and agriculture.

Keywords: Emerging markets, high-growth sectors, real estate development, infrastructure projects, foreign direct investment, economic diversification, untapped potential, investment opportunities.

- Specific Emerging Markets:

- Region G: Experiencing rapid growth in its tourism sector, driven by investment in infrastructure and promotion of its natural beauty. Real estate investment presents significant opportunities but requires careful due diligence.

- Region H: Focusing on renewable energy, attracting significant foreign direct investment in solar and wind power projects. The government's commitment to sustainable development makes this a promising but potentially volatile sector.

- Region I: A rapidly developing agricultural region, with opportunities in food processing and export. Investment in irrigation and improved farming techniques offers high potential.

Factors to Consider Before Investing

Before committing capital to any region, thorough due diligence is essential. This includes a detailed market analysis, risk assessment, legal review, and financial planning.

Keywords: Due diligence, market research, risk assessment, investment analysis, financial planning, legal considerations, regulatory compliance, tax implications.

- Conduct Thorough Market Research: Understand the local market, competitive landscape, and demand for your product or service.

- Assess Political and Economic Stability: Evaluate the region’s political climate, economic outlook, and potential risks.

- Analyze the Competitive Landscape: Identify your competitors and develop a strategy to differentiate your business.

- Understand Tax Implications: Be aware of the tax regulations and implications of your investment.

- Secure Necessary Legal and Regulatory Approvals: Ensure you comply with all local laws and regulations.

Conclusion

This article has explored several key locations across the country that represent prime opportunities for investment. From established tech hubs to emerging markets brimming with potential, careful consideration of various factors—including infrastructure, workforce, and regulatory environment—is crucial for successful investment.

Ready to discover more about the best places to invest your money and achieve your financial goals? Start your research today by focusing on the key business hotspots highlighted in this article. Understanding where to invest is the first step towards building a prosperous future. Remember to conduct thorough due diligence before making any investment decisions, ensuring you choose wisely among the many compelling options.

Featured Posts

-

Double Trouble In Hollywood Writers And Actors Strike Brings Production To Halt

May 17, 2025

Double Trouble In Hollywood Writers And Actors Strike Brings Production To Halt

May 17, 2025 -

Update On Valerio Therapeutics S A S 2024 Financial Report Publication

May 17, 2025

Update On Valerio Therapeutics S A S 2024 Financial Report Publication

May 17, 2025 -

Finding Serenity In The City Soundproof Apartments In Tokyo

May 17, 2025

Finding Serenity In The City Soundproof Apartments In Tokyo

May 17, 2025 -

Delinquent Student Loans Navigating The Increased Government Scrutiny

May 17, 2025

Delinquent Student Loans Navigating The Increased Government Scrutiny

May 17, 2025 -

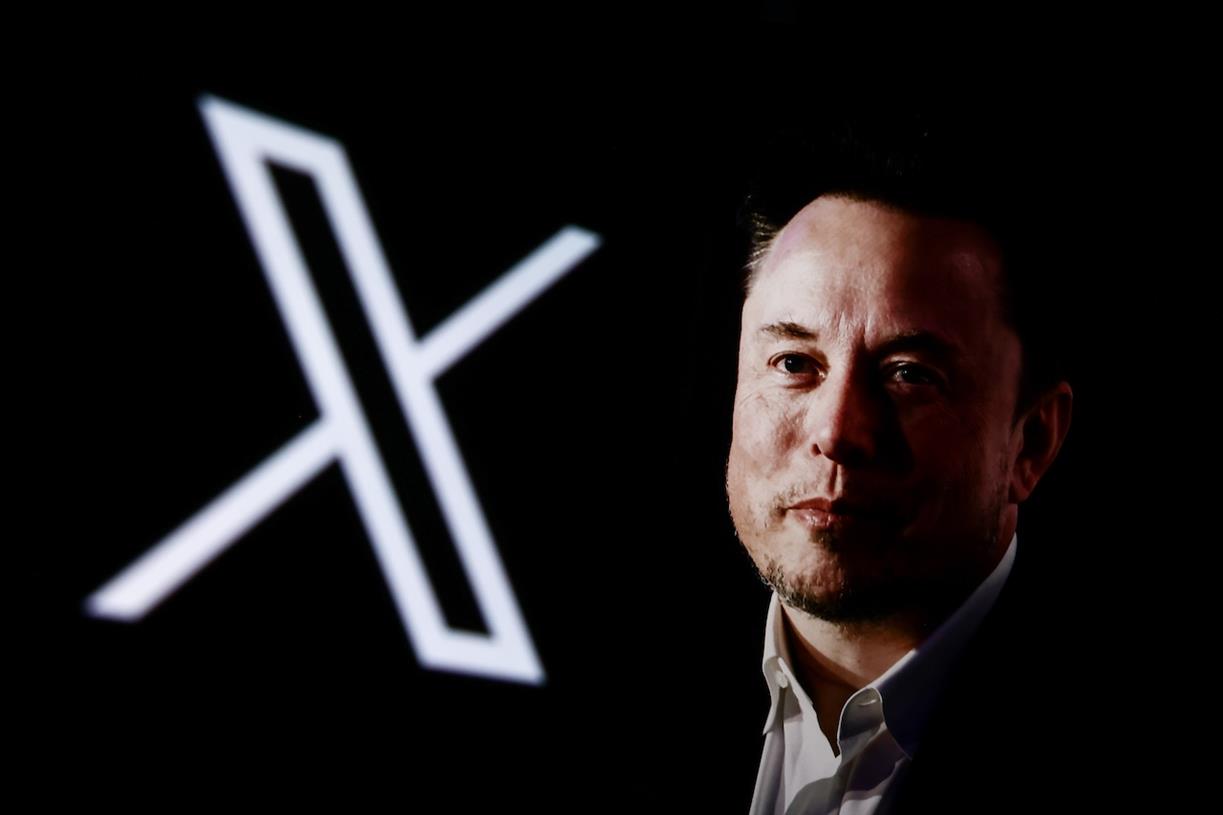

Nestle And Shell Rebuff Musks Boycott Claims Advertisers Respond

May 17, 2025

Nestle And Shell Rebuff Musks Boycott Claims Advertisers Respond

May 17, 2025

Latest Posts

-

7 Bit Casino Top Choice For Real Money Online Casino Players

May 17, 2025

7 Bit Casino Top Choice For Real Money Online Casino Players

May 17, 2025 -

7 Bit Casino A Leading Online Casino In Canada

May 17, 2025

7 Bit Casino A Leading Online Casino In Canada

May 17, 2025 -

Top Rated Online Casino Canada 7 Bit Casino Player Experience

May 17, 2025

Top Rated Online Casino Canada 7 Bit Casino Player Experience

May 17, 2025 -

7 Bit Casino Best Online Casino Canada For Canadian Players

May 17, 2025

7 Bit Casino Best Online Casino Canada For Canadian Players

May 17, 2025 -

Exploring The Best Crypto Casinos Of 2025 Jackbits Bitcoin Offering

May 17, 2025

Exploring The Best Crypto Casinos Of 2025 Jackbits Bitcoin Offering

May 17, 2025