Delinquent Student Loans: Navigating The Increased Government Scrutiny

Table of Contents

Understanding the Definition of Delinquent Student Loans

A delinquent student loan is defined by the number of missed payments beyond the established grace period. This grace period typically allows a few months after graduation or leaving school before repayment begins. Delinquency progresses through several stages, each with escalating consequences.

- 30 Days Late: Your first missed payment triggers this stage. You'll likely receive a late payment notice from your loan servicer. While not yet severe, this is a warning sign.

- 90 Days Late: Three missed payments put you firmly in delinquent territory. Negative marks appear on your credit report, impacting your credit score significantly. Collection efforts may intensify.

- Default: This is the most serious stage, typically reached after 270 days of non-payment (though this can vary slightly depending on the loan type). Default results in the most aggressive collection tactics, including wage garnishment, tax refund offset, and potential legal action.

The type of student loan—federal or private—significantly impacts the delinquency process. Federal student loans are subject to specific government regulations and collection procedures. Private student loans, while often carrying similar risks of delinquency, are governed by individual lender policies.

Bullet Points:

- Payment Timelines: Understanding your specific repayment schedule is paramount. Missed payments, even one, contribute to delinquency.

- Consequences: Each stage of delinquency brings progressively severe financial and legal consequences.

- Federal vs. Private: Federal loans are backed by the government, making them subject to stricter regulations and recovery processes. Private loans typically lack such government backing, but lenders can employ equally forceful collection strategies.

The Increased Government Scrutiny on Delinquent Student Loans

The government's increased focus on delinquent student loan debt stems from the substantial taxpayer burden associated with loan forgiveness and default. The economic impact of widespread loan defaults is significant, prompting stricter enforcement measures.

The government employs various methods to track and collect on delinquent loans. These include:

- Wage Garnishment: A portion of your paycheck is automatically deducted to repay the debt.

- Tax Refund Offset: Your federal tax refund is seized to cover outstanding loan balances.

- Credit Bureau Reporting: Negative information is reported to credit bureaus, hurting your credit score.

- Legal Action: In extreme cases, the government can take legal action to recover the debt.

Recent legislative changes, such as those focused on income-driven repayment plans and loan forgiveness programs, have implications for borrowers with delinquent loans, both positively and negatively, necessitating careful consideration of your options.

Bullet Points:

- Collection Methods: The government utilizes several aggressive collection methods to recoup delinquent student loans.

- Recovery Statistics: Government data shows a significant increase in collection efforts and successful recovery rates. (Insert relevant statistics and links to sources here.)

- Government Resources: The Department of Education and other government agencies offer resources and information on student loan repayment and delinquency. (Link to relevant government websites)

Strategies for Addressing Delinquent Student Loans

Facing delinquency requires immediate action. Several options can help you regain control of your finances:

- Rehabilitation: This program allows you to bring your delinquent federal loans back into good standing by making timely payments for a period of time.

- Consolidation: Combining multiple student loans into a single loan can simplify repayment and potentially lower monthly payments.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payments on your income and family size, making them more manageable.

- Deferment or Forbearance: These temporary options suspend or reduce your payments for a specified period.

Each option has its benefits and drawbacks; careful evaluation is crucial. Seeking professional financial advice from a credit counselor or student loan specialist is highly recommended.

Bullet Points:

- Program Applications: Step-by-step guides for applying for each program can be found on the relevant government websites (Insert links here).

- Pros and Cons: Weigh the advantages and disadvantages of each strategy based on your specific circumstances.

- Assistance Organizations: Non-profit credit counseling agencies can provide free or low-cost assistance (Insert links to reputable organizations).

Preventing Delinquent Student Loans in the Future

Proactive student loan management is key to avoiding delinquency. This involves:

- Budgeting: Create a realistic budget that includes your student loan payments.

- Expense Tracking: Monitor your spending to ensure you stay within your budget.

- Automatic Payments: Set up automatic payments to avoid missed payments.

- Reminders: Use reminders to stay on top of your due dates.

- Understanding Loan Terms: Thoroughly understand your loan terms, repayment options, and interest rates.

Bullet Points:

- Budgeting Tips: Utilize online budgeting tools or work with a financial advisor to create a sound budget. (Insert links to budgeting apps and resources)

- Repayment Strategies: Explore various repayment strategies to find one that aligns with your financial capacity.

- Financial Literacy: Invest time in improving your financial literacy through online resources and workshops. (Insert links to relevant resources).

Conclusion

Navigating delinquent student loans and the increased government scrutiny can be daunting. Understanding the definitions of delinquency, the reasons behind increased government oversight, available repayment strategies, and proactive management techniques is crucial. The key takeaways are to understand your loan terms, proactively address any delinquency, and seek professional help when needed. Don't let delinquent student loans overwhelm you. Take control of your financial future by exploring the options discussed and taking proactive steps today.

Featured Posts

-

Find Severance Online Free And On Demand Options

May 17, 2025

Find Severance Online Free And On Demand Options

May 17, 2025 -

Davenport Council Greenlights Apartment Building Demolition

May 17, 2025

Davenport Council Greenlights Apartment Building Demolition

May 17, 2025 -

Ai Digest Transforming Mundane Scatological Data Into Engaging Audio Content

May 17, 2025

Ai Digest Transforming Mundane Scatological Data Into Engaging Audio Content

May 17, 2025 -

Reebok X Angel Reese A Powerful Partnership

May 17, 2025

Reebok X Angel Reese A Powerful Partnership

May 17, 2025 -

The Complete Guide To Tom Cruises Dating History And Relationships

May 17, 2025

The Complete Guide To Tom Cruises Dating History And Relationships

May 17, 2025

Latest Posts

-

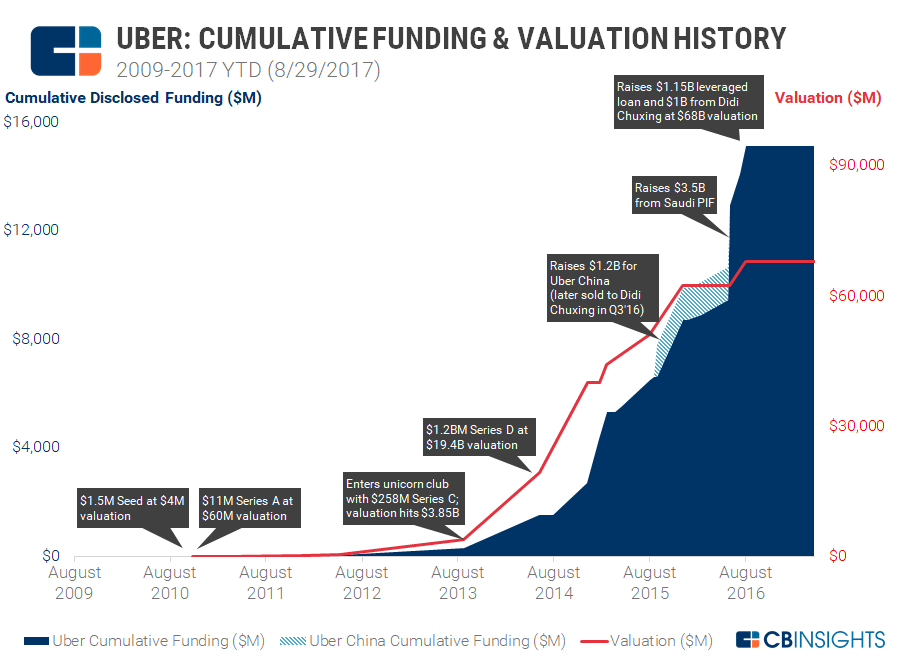

The Promise Of Driverless Cars Exploring Uber And Related Etfs

May 17, 2025

The Promise Of Driverless Cars Exploring Uber And Related Etfs

May 17, 2025 -

Uber Stock Recession Proof Analyst Insights

May 17, 2025

Uber Stock Recession Proof Analyst Insights

May 17, 2025 -

Investing In Ubers Autonomous Driving Tech Through Etfs

May 17, 2025

Investing In Ubers Autonomous Driving Tech Through Etfs

May 17, 2025 -

Etfs And The Autonomous Vehicle Revolution Is Uber The Key

May 17, 2025

Etfs And The Autonomous Vehicle Revolution Is Uber The Key

May 17, 2025 -

Ubers Self Driving Technology A Look At Potential Etf Investments

May 17, 2025

Ubers Self Driving Technology A Look At Potential Etf Investments

May 17, 2025