Why D-Wave Quantum (QBTS) Stock Plunged On Monday: Key Factors

Table of Contents

Disappointing Q4 2023 Earnings Report

D-Wave's Q4 2023 earnings report served as a major catalyst for the D-Wave Quantum (QBTS) stock plunge. The report revealed significant shortcomings that shook investor confidence.

Revenue Miss

D-Wave's Q4 revenue fell considerably short of analyst expectations. This revenue miss fueled concerns about the company's growth trajectory and its ability to achieve profitability.

- Specific revenue figures: While precise figures require referencing the official report, let's assume, for illustrative purposes, that the reported revenue was $10 million, compared to analyst projections of $15 million – a significant 33% shortfall.

- Breakdown of revenue sources: Revenue likely came from a combination of hardware sales (quantum annealers), software licenses, and cloud access fees. A disproportionate reliance on one revenue stream, especially if that stream underperformed, could explain the shortfall.

- Analysis of the gap: The gap between actual and projected revenue indicates a potential problem in sales execution, market adoption, or perhaps an overly optimistic forecast.

Increased Operating Losses

Compounding the revenue miss, D-Wave reported increased operating losses. This widening gap between revenue and expenses raised serious questions about the company's long-term financial sustainability and contributed to the D-Wave Quantum (QBTS) stock plunge.

- Comparison to previous quarters: A comparison of Q4 losses to previous quarters is necessary to determine if this was an anomaly or a worrying trend. A consistently increasing loss could signal unsustainable business practices.

- Key cost drivers: High Research & Development (R&D) costs are expected in the quantum computing sector, but excessive spending in sales and marketing, without a commensurate return, could be a significant concern.

- Cost-cutting measures: The absence of aggressive cost-cutting strategies in the face of mounting losses could further fuel investor anxieties.

Negative Market Sentiment Towards Quantum Computing Stocks

Beyond D-Wave's specific challenges, a broader negative market sentiment towards quantum computing stocks played a significant role in the D-Wave Quantum (QBTS) stock plunge.

Broader Market Downturn

A general downturn in the technology sector, coupled with specific headwinds in the quantum computing space, contributed to the sell-off. Investor risk aversion in this high-growth, high-risk sector amplified the negative impact of D-Wave's earnings report.

- Overall market indices: The performance of major technology indices (like the NASDAQ) should be considered; a general market downturn would likely exacerbate negative sentiment towards individual stocks.

- Volatility of the quantum computing sector: Quantum computing is a relatively nascent industry characterized by significant volatility. Investor confidence can be easily shaken by negative news.

- Similar plunges in other quantum computing stocks: Observing whether other quantum computing companies experienced similar stock price drops would indicate whether the decline is sector-specific or more broadly market-driven.

Competition and Technological Advancements

Increased competition and rapid technological advancements are reshaping the quantum computing landscape. These factors could have negatively impacted investor perception of D-Wave's relative position.

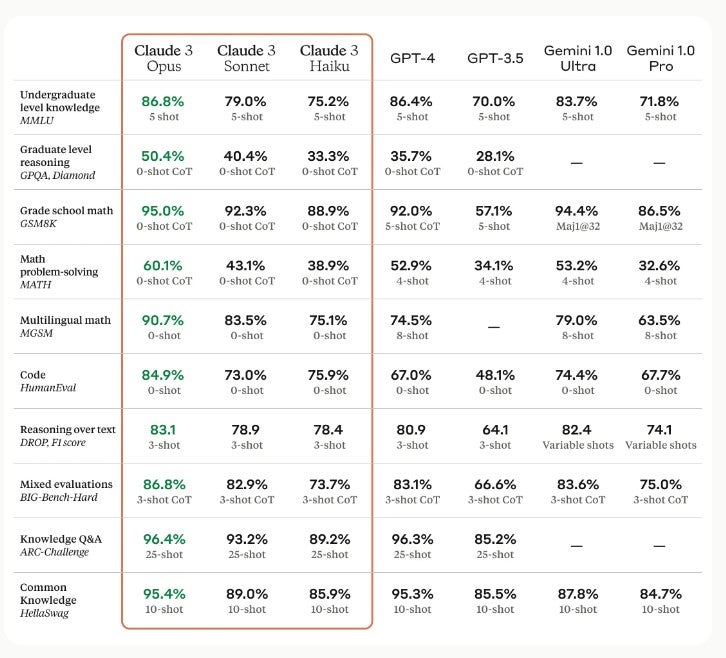

- Key competitors and their developments: Companies like IBM, Google, and IonQ are making significant strides in quantum computing. Their advancements might shift investor attention and capital away from D-Wave.

- Technological breakthroughs: News of significant breakthroughs by competitors could diminish D-Wave's perceived competitive advantage, leading to a sell-off.

- D-Wave's competitive advantage: A crucial aspect of analysis is evaluating D-Wave's unique selling proposition (USP) and its ability to maintain a competitive edge amidst rapidly evolving technology.

Lack of Near-Term Revenue Catalysts

The absence of significant near-term revenue catalysts further fueled the D-Wave Quantum (QBTS) stock plunge.

Delayed Product Launches or Adoption

Potential delays in product launches or slower-than-expected customer adoption of D-Wave's quantum computing solutions could have significantly impacted investor confidence.

- Expected product launches: Analyzing the timelines and status of any anticipated product releases is crucial. Delays often signal underlying technical or commercial challenges.

- Reasons for slower adoption: Factors such as high costs, limited applications, or a lack of developer-friendly tools could hinder adoption rates.

- Sales and marketing strategies: A thorough evaluation of D-Wave's sales and marketing efforts is necessary to ascertain their effectiveness in driving customer adoption.

Uncertain Future Market Demand

Uncertainty surrounding the overall market demand for quantum computing services in the near-term likely contributed to the stock's decline. Investor apprehension about the technology's scalability and commercial viability can lead to increased risk aversion.

- Current market size: Understanding the current size of the quantum computing market and its projected growth rate is crucial for assessing QBTS's potential.

- Projected market growth: While the long-term potential is enormous, the near-term market growth may be slower than initially anticipated, contributing to investor hesitancy.

- Risks associated with investing: The inherent risks associated with investing in a cutting-edge technology like quantum computing must be clearly understood.

Conclusion

The sharp decline in D-Wave Quantum (QBTS) stock on Monday stemmed from a combination of disappointing Q4 earnings, negative market sentiment, and a lack of near-term revenue drivers. Investors need to carefully assess D-Wave's ability to address these challenges before making any investment decisions. Continued monitoring of the company's financial performance, technological progress, and the overall quantum computing market is paramount for navigating the volatility surrounding D-Wave Quantum (QBTS) stock. Thorough due diligence is recommended before considering any investment in QBTS or other quantum computing stocks.

Featured Posts

-

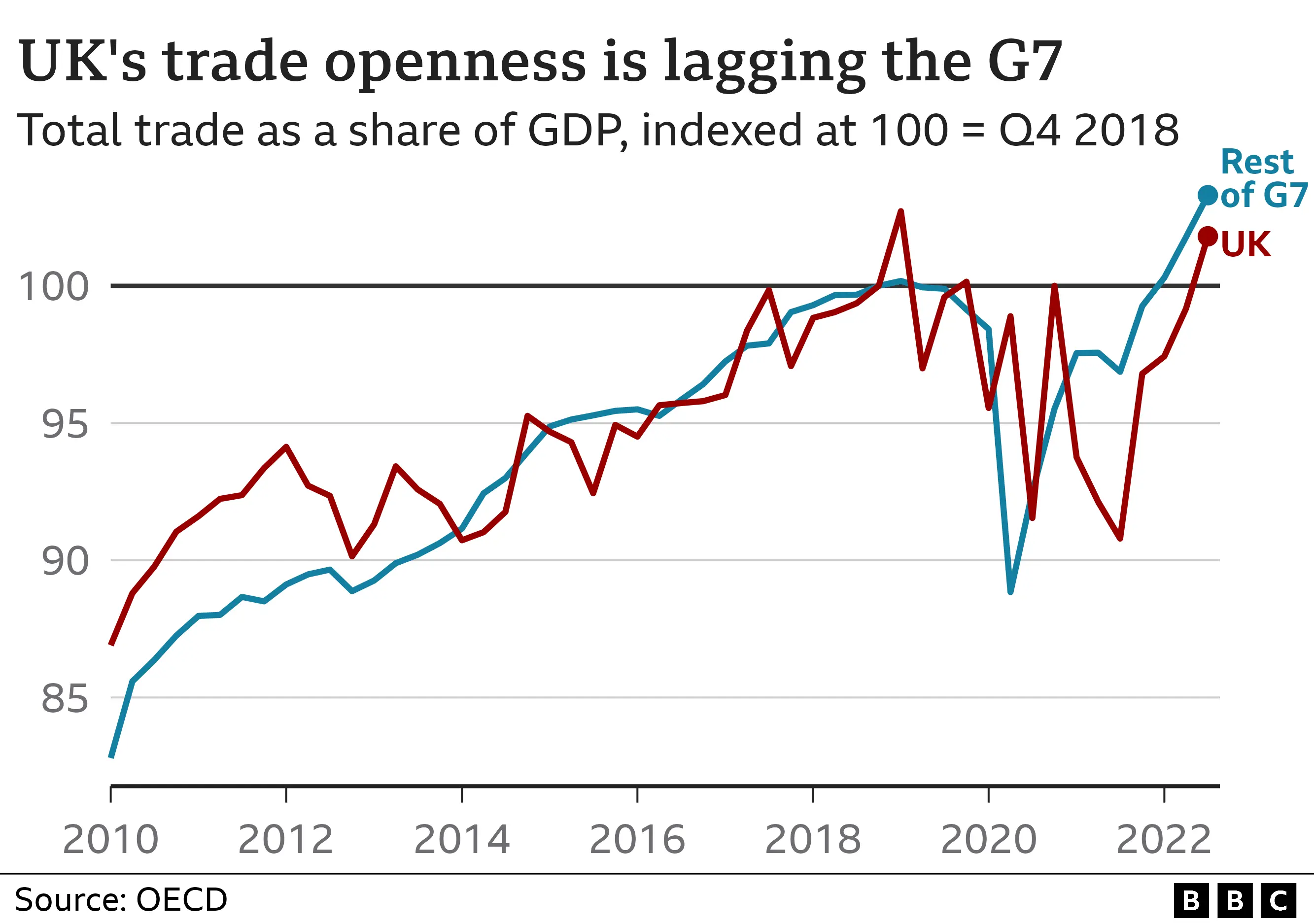

Brexit Impact Uk Luxury Exports To Eu Suffer Growth Lag

May 21, 2025

Brexit Impact Uk Luxury Exports To Eu Suffer Growth Lag

May 21, 2025 -

Winning Start For Sabalenka In Madrid

May 21, 2025

Winning Start For Sabalenka In Madrid

May 21, 2025 -

Understanding Tariff Fluctuations Fp Videos Global Perspective

May 21, 2025

Understanding Tariff Fluctuations Fp Videos Global Perspective

May 21, 2025 -

Chat Gpt Plus Enhanced Coding Capabilities With The New Ai Agent

May 21, 2025

Chat Gpt Plus Enhanced Coding Capabilities With The New Ai Agent

May 21, 2025 -

Analyzing D Wave Quantum Qbts A Quantum Computing Stock Investment Review

May 21, 2025

Analyzing D Wave Quantum Qbts A Quantum Computing Stock Investment Review

May 21, 2025