Why Did CoreWeave (CRWV) Stock Fall On Tuesday?

Table of Contents

Impact of Recent News and Announcements

The absence of positive catalysts and the presence of even subtle negative news can significantly influence investor sentiment and trigger stock price fluctuations. Let's analyze potential contributing factors related to recent news and announcements surrounding CoreWeave.

Lack of Positive Catalysts

A lack of positive news can deflate investor optimism, leading to selling pressure. For CRWV, several factors could have contributed to this:

- Missed Earnings Expectations: Did CoreWeave miss its projected earnings for the quarter? Disappointing financial results often lead to immediate stock price corrections.

- Project Delays: Any delays in significant project launches or deployments could signal operational challenges and dampen investor confidence. The cloud computing market is highly competitive, and delays can be costly.

- Absence of Major Partnerships: The lack of announcements regarding new strategic partnerships or large contracts could indicate a slowdown in growth, affecting investor perception of CRWV's future prospects.

Negative News or Press

Negative news, even if seemingly minor, can trigger a sell-off. Potential negative factors include:

- Negative Analyst Reports: Downgrades from influential analysts can significantly impact investor confidence and lead to a drop in share price.

- Increased Competition: Growing competition within the cloud computing and AI sectors might have raised concerns about CoreWeave's market share and profitability.

- Regulatory Hurdles: Unexpected regulatory challenges or changes in the industry landscape could create uncertainty and negatively impact the stock.

- Negative Media Coverage: Unfavorable media attention, even if not directly related to CoreWeave's performance, can contribute to a negative market perception.

Broad Market Trends and Sector-Specific Factors

Macroeconomic factors and industry-wide trends significantly influence individual stock performance. Let's examine the broader market context of CRWV's Tuesday decline.

Overall Market Sentiment

The overall market performance on Tuesday is crucial. A broad market sell-off can drag down even well-performing stocks.

- Economic News: Significant economic news releases, such as inflation data or interest rate announcements, can influence overall market sentiment and lead to widespread selling.

- Tech Sector Downturn: A broader downturn in the technology sector, particularly in cloud computing or AI, could negatively impact CoreWeave's stock price regardless of its specific performance.

Cloud Computing Sector Performance

Comparing CRWV's performance to its competitors within the cloud computing sector provides valuable insights.

- Competitor Performance: Did other major players in the cloud computing market also experience declines on Tuesday? A sector-wide downturn suggests broader industry headwinds.

- Similar Issues: Were similar challenges affecting other companies in the sector? This could point to industry-specific concerns impacting CRWV.

Investor Sentiment and Trading Activity

Understanding investor behavior is crucial in analyzing stock price fluctuations. Let's explore the dynamics of investor sentiment and trading activity on Tuesday.

Increased Selling Pressure

Several factors can contribute to increased selling pressure on a stock:

- Insider Selling: Significant insider selling can signal a lack of confidence in the company's future prospects and trigger a sell-off.

- High Volume of Sell Orders: An unusually high volume of sell orders suggests a significant number of investors are simultaneously offloading their shares.

- Institutional Investor Activity: Large institutional investors offloading their holdings can significantly impact a stock's price.

Profit-Taking

Profit-taking after a period of substantial gains is a common market phenomenon.

- Prior Price Increases: Did CRWV's stock price experience a significant run-up prior to Tuesday's decline? This might suggest investors were taking profits after a period of strong performance.

Conclusion

CoreWeave (CRWV)'s stock price decline on Tuesday likely resulted from a confluence of factors. These include a potential lack of positive news, the influence of broader market trends impacting the cloud computing and AI sectors, and potentially increased selling pressure among investors. Understanding these contributing factors, from missed earnings expectations to overall market sentiment, is key to interpreting the CRWV stock price movement.

Call to Action: Understanding the factors that influenced CoreWeave (CRWV)'s stock fall on Tuesday is crucial for investors. Stay informed about CRWV stock price fluctuations and market news affecting the cloud computing and AI sectors by regularly reviewing financial news and conducting thorough due diligence before making any investment decisions regarding CoreWeave (CRWV) stock. Continue to monitor the CRWV share price and related news for a clearer understanding of future performance.

Featured Posts

-

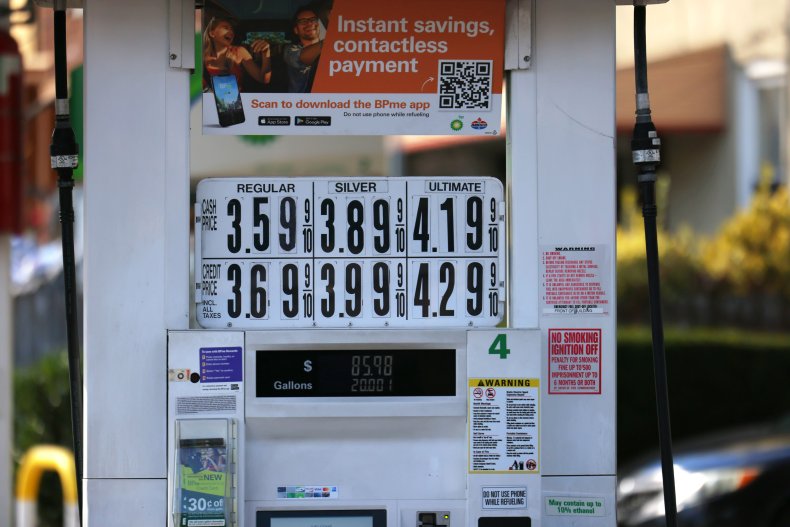

National Average Gas Price Drops Below 3 Amid Economic Uncertainty

May 22, 2025

National Average Gas Price Drops Below 3 Amid Economic Uncertainty

May 22, 2025 -

Vanja Mijatovic Razvod I Borba Protiv Traceva

May 22, 2025

Vanja Mijatovic Razvod I Borba Protiv Traceva

May 22, 2025 -

Trans Australia Run On The Verge Of A Record Breaking Attempt

May 22, 2025

Trans Australia Run On The Verge Of A Record Breaking Attempt

May 22, 2025 -

Low Rock Legends Vapors Of Morphine Live In Northcote

May 22, 2025

Low Rock Legends Vapors Of Morphine Live In Northcote

May 22, 2025 -

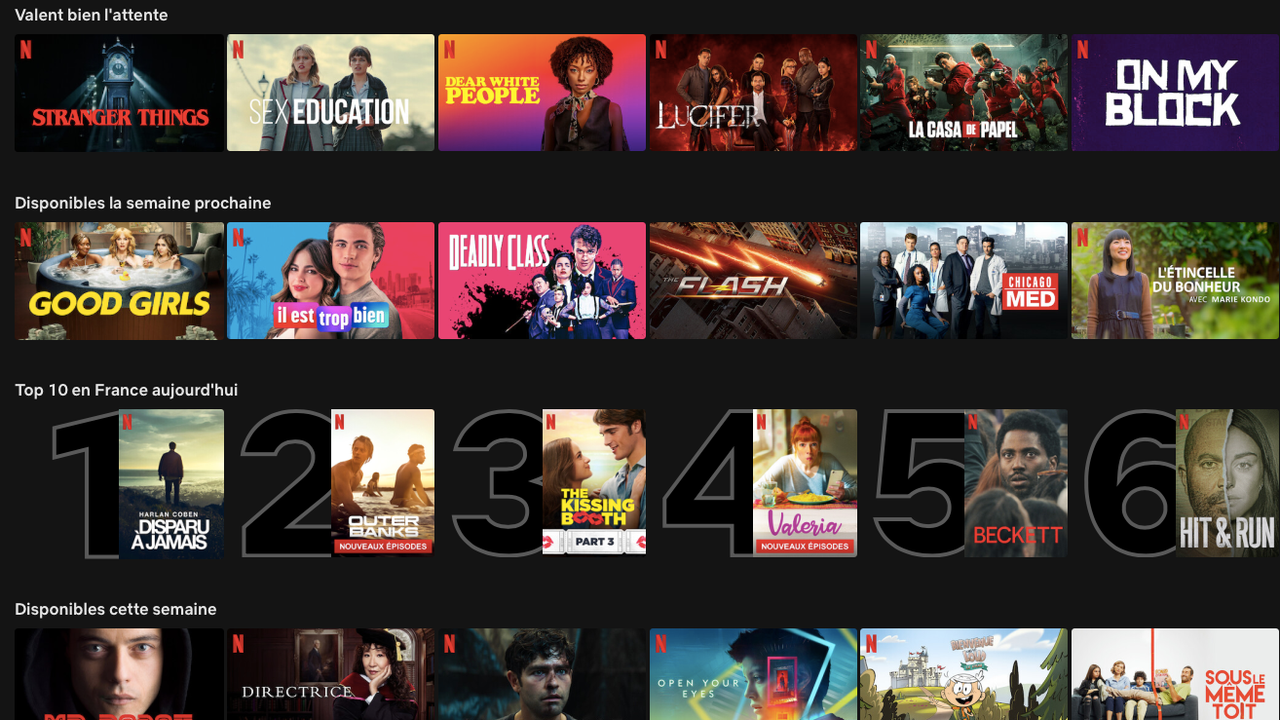

Complete Guide Netflix Releases May 2025

May 22, 2025

Complete Guide Netflix Releases May 2025

May 22, 2025