Why Did D-Wave Quantum (QBTS) Stock Crash On Monday?

Table of Contents

Market-Wide Factors Contributing to the QBTS Stock Decline

Several market-wide factors likely contributed to the decline in QBTS stock price on Monday. Understanding these broader trends is crucial for placing the D-Wave situation within its proper context.

Broader Tech Stock Sell-off

Monday's market witnessed a general sell-off in the technology sector. This negative sentiment wasn't isolated to quantum computing stocks; it reflected a broader bearish trend affecting many tech companies. Several factors likely fueled this downturn.

-

Interest Rate Hikes: Ongoing interest rate hikes by central banks to combat inflation created a risk-averse environment, pushing investors away from growth stocks, which are generally more sensitive to interest rate changes. The higher cost of borrowing makes future profits less valuable, impacting valuations.

-

Inflation Concerns: Persistent inflation concerns also contributed to the negative sentiment. High inflation erodes purchasing power and can lead to uncertainty in the market, impacting investor confidence and driving them towards safer assets.

-

Correlation between QBTS and the NASDAQ Composite: QBTS, like many tech companies, is closely correlated with the NASDAQ Composite. A significant drop in the NASDAQ naturally pulls down the prices of its constituent stocks, including QBTS.

-

Impact of general risk aversion on growth stocks: Growth stocks, particularly those in the nascent stages like quantum computing companies, are often the first to be affected by increased risk aversion. Investors tend to move towards more established, less volatile sectors during periods of uncertainty.

Increased Volatility in the Quantum Computing Sector

The decline in QBTS wasn't solely a reflection of broader market trends. The quantum computing sector itself experienced increased volatility on Monday.

- Comparison of QBTS performance to other quantum computing companies: It's important to determine whether other publicly traded quantum computing companies experienced similar drops. If so, it suggests sector-specific concerns rather than solely D-Wave-related issues.

- Analysis of investor sentiment toward the broader quantum computing market: Investor sentiment toward the quantum computing sector as a whole plays a significant role. Negative news or lack of significant breakthroughs in the field can lead to a general sell-off. Any announcements from competitors affecting the industry's overall perception would have influenced QBTS.

D-Wave Quantum (QBTS)-Specific Factors

Beyond the broader market forces, certain D-Wave-specific factors might have contributed to the stock crash.

Absence of Recent Positive News or Announcements

A lack of positive news or recent updates from D-Wave could have disappointed investors and triggered selling pressure. Growth stocks like QBTS thrive on positive news and forward momentum.

- Review of recent D-Wave press releases and financial reports: Examining recent communications from D-Wave is crucial. The absence of positive announcements regarding partnerships, technological breakthroughs, or financial performance could have contributed to the decline.

- Analysis of any analyst reports or ratings changes: Any downgrades or negative analyst reports preceding the crash would also have a significant impact on investor sentiment and trading activity. Analyst expectations play a vital role in influencing stock prices.

Financial Performance and Expectations

D-Wave's recent financial performance (if publicly available) is a critical factor. Did the company meet or exceed investor expectations? Any shortfall could have led to investor concern.

- Review of D-Wave's revenue, profits, and cash flow: Analyzing D-Wave's financial statements, including revenue, profits, and cash flow, helps assess the company's financial health. Any significant deviation from expectations could trigger selling.

- Comparison of D-Wave's performance to industry benchmarks: Comparing D-Wave's financial performance to its competitors provides a benchmark to evaluate its relative success and potential for future growth.

Analyzing the Impact and Investor Sentiment

Understanding the impact of the QBTS stock crash and the subsequent investor sentiment is critical for assessing the future.

Short-Term vs. Long-Term Implications

Is the stock drop a temporary correction or a reflection of deeper concerns about D-Wave's long-term prospects?

- Consideration of technical analysis indicators: Technical analysis, which examines price trends and patterns, can offer insights into the short-term outlook. However, it doesn't predict long-term value.

- Assessment of future growth potential for D-Wave's technology: The fundamental value of D-Wave, independent of short-term market fluctuations, rests on the long-term potential of its quantum computing technology. Assessing this potential is crucial for long-term investors.

Investor Reaction and Trading Activity

Analyzing investor behavior on Monday provides further insights into the intensity and causes of the sell-off.

- Analysis of trading volume and price fluctuations: A high trading volume during the decline indicates a strong sell-off driven by numerous investors. Analyzing the price fluctuations helps gauge the severity and speed of the drop.

- Examination of investor comments and opinions on social media platforms: Monitoring social media sentiment towards QBTS provides a real-time gauge of investor confidence and concerns.

Conclusion

The D-Wave Quantum (QBTS) stock crash on Monday resulted from a confluence of factors, including a broader tech sell-off fueled by interest rate hikes and inflation concerns, sector-specific volatility within the quantum computing industry, and potentially D-Wave-specific issues related to recent news and financial performance. While the short-term implications are uncertain, a thorough analysis of D-Wave's fundamentals and long-term potential is crucial for investors.

Key Takeaways: The QBTS stock decline highlights the risks associated with investing in growth stocks, particularly in a volatile market. Understanding the broader market context and company-specific news is crucial for informed decision-making.

Call to Action: Before making any investment decisions related to D-Wave Quantum (QBTS) or other quantum technology companies, conduct thorough due diligence. Stay informed about D-Wave Quantum (QBTS) news, financial reports, and industry trends to make informed investment choices. Carefully analyze the risks involved in investing in D-Wave Quantum (QBTS) and similar quantum computing stocks.

Featured Posts

-

Saskatchewans Political Landscape Analyzing The Impact Of The Federal Election

May 21, 2025

Saskatchewans Political Landscape Analyzing The Impact Of The Federal Election

May 21, 2025 -

Market Reaction To Moody S Dow Futures Dollar And Economic Outlook

May 21, 2025

Market Reaction To Moody S Dow Futures Dollar And Economic Outlook

May 21, 2025 -

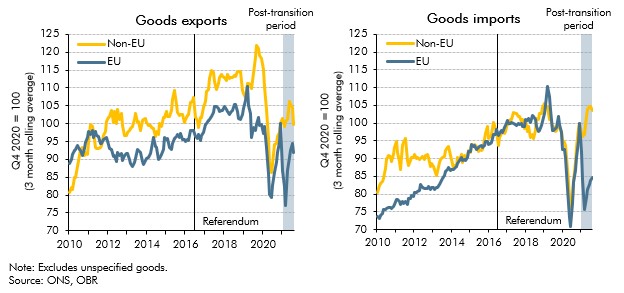

The Brexit Effect A Uk Luxury Industry Export Analysis

May 21, 2025

The Brexit Effect A Uk Luxury Industry Export Analysis

May 21, 2025 -

10 Minute Unpiloted Lufthansa Flight Investigation Into Co Pilot Medical Emergency

May 21, 2025

10 Minute Unpiloted Lufthansa Flight Investigation Into Co Pilot Medical Emergency

May 21, 2025 -

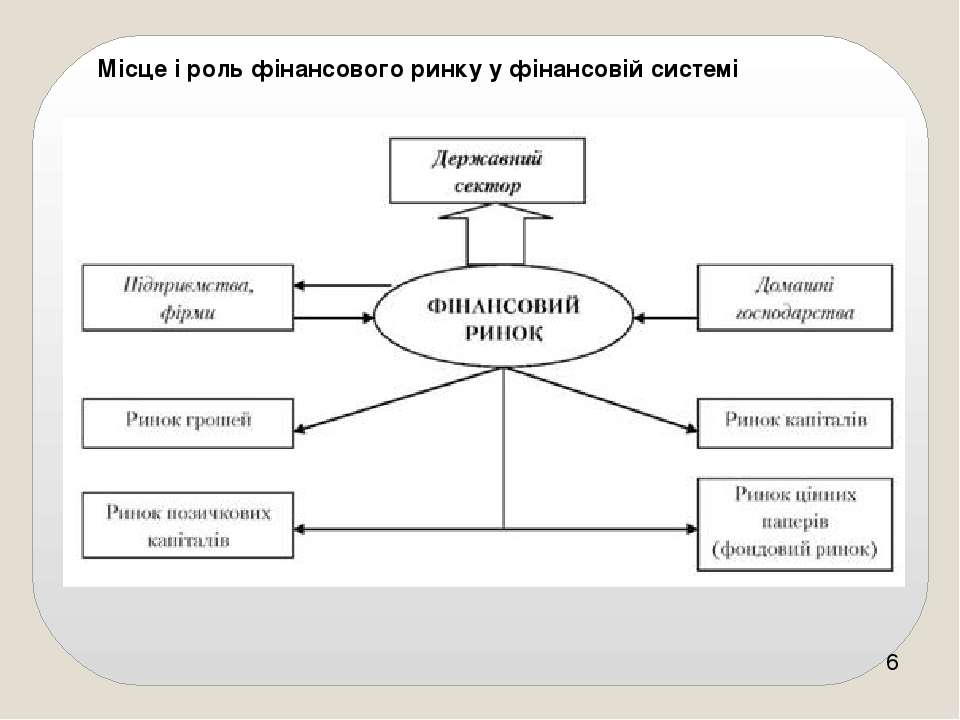

Oglyad Lideriv Finansovogo Rinku Ukrayini Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 21, 2025

Oglyad Lideriv Finansovogo Rinku Ukrayini Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 21, 2025