Why Did Uber Stock Jump Over 10% In April?

Table of Contents

Strong First-Quarter Earnings Report

Uber's impressive April stock performance was largely fueled by a surprisingly strong first-quarter earnings report. The company significantly exceeded analyst expectations across several key metrics, sending a powerful signal to the market.

Exceeding Analyst Expectations

Uber's Q1 2024 results showcased robust growth across its core businesses. Key metrics surpassed predictions, indicating a healthy recovery and promising future trajectory.

- Revenue Growth: Uber reported a year-over-year revenue increase of X%, significantly exceeding the projected Y%.

- Adjusted EBITDA: The company's adjusted earnings before interest, taxes, depreciation, and amortization reached Z dollars, a substantial increase of W% compared to the same period last year.

- Gross Bookings: Total gross bookings increased by V%, showcasing strong demand across Uber's services.

Compared to the previous quarter (Q4 2023), Uber also demonstrated significant improvement in several key areas, suggesting a positive trend.

Improved Profitability

Uber's improved profitability was a key driver of the stock surge. The company implemented various cost-cutting measures and efficiency improvements, leading to stronger margins.

- Operational Efficiency: Streamlined operations and technological advancements contributed to reduced operational costs.

- Pricing Strategies: Strategic adjustments to pricing models optimized revenue generation while maintaining competitiveness.

- Reduced Marketing Expenses: Targeted marketing campaigns yielded better ROI, reducing overall marketing spend.

These improvements showcase Uber's commitment to sustainable growth and profitability.

Positive Outlook

Uber's management provided positive guidance for the coming quarters, further bolstering investor confidence. This optimistic outlook solidified the positive market sentiment.

- Revenue Projections: The company projected a continued strong revenue growth of X% for the next quarter.

- Profitability Targets: Uber aims to maintain or improve its profitability margins in the subsequent quarters.

- Industry Trends: The positive outlook was supported by growing industry trends, such as increasing urban mobility needs and the sustained popularity of food delivery services.

Increased Demand and Ridership

The surge in Uber's stock price was also directly linked to a noticeable increase in demand and ridership. This demonstrates the company's successful recovery from the pandemic and its ability to capture growing market share.

Post-Pandemic Recovery

The post-pandemic recovery significantly impacted Uber's performance. Ridership numbers demonstrated a strong rebound, exceeding pre-pandemic levels in several key markets.

- Ridership Increase: Uber reported a Y% increase in overall ridership compared to the same period last year.

- Geographic Growth: Strongest growth was observed in [mention specific regions, e.g., major metropolitan areas in North America and Europe].

- Return to Commuting: The return of commuters to offices and workplaces boosted daily rides and overall demand.

Growing Adoption of Uber Eats

Uber Eats, the company's food delivery service, played a crucial role in the overall growth. Its continued expansion and increased popularity contributed significantly to the positive financial results.

- Uber Eats Growth: Uber Eats experienced a Z% increase in order volume year-over-year.

- Strategic Initiatives: New partnerships with restaurants and promotional campaigns boosted food delivery volume and user engagement.

- Market Penetration: Uber Eats continues to expand its reach into new markets and demographics.

Expansion into New Markets and Services

Uber's strategic expansion into new markets and the introduction of new services further strengthened its position and fueled investor confidence.

- New Market Entry: Uber expanded its services into [mention specific regions or countries].

- New Service Launches: The introduction of new features and services, like [mention examples, e.g., enhanced ride-sharing options, new delivery categories] attracted new users and increased engagement.

- Strategic Acquisitions: Any strategic acquisitions made during this period also contributed to overall growth.

Positive Investor Sentiment and Market Conditions

The positive market sentiment surrounding Uber was another crucial element contributing to the stock price jump. Several factors played a role in this favorable investor outlook.

Overall Market Trends

The general state of the stock market in April was relatively positive, creating a favorable environment for growth stocks like Uber.

- Economic Indicators: Positive economic indicators, such as [mention specific indicators, e.g., lower inflation rates, strong employment numbers], contributed to overall market optimism.

- Market Volatility: A period of reduced market volatility also helped boost investor confidence.

- Sector Performance: Positive performance within the technology and transportation sectors also supported Uber's stock price increase.

Analyst Upgrades and Price Target Increases

Several financial analysts upgraded their ratings for Uber's stock, citing strong performance and positive future outlook. Increased price targets further fueled the positive sentiment.

- Analyst Upgrades: [Mention specific examples of analyst upgrades and their rationales].

- Price Target Increases: Increased price targets by leading investment banks reflected increased confidence in Uber's growth potential.

- Positive Media Coverage: Positive news coverage also contributed to improved investor sentiment.

Strategic Partnerships and Investments

Strategic partnerships and investments further bolstered investor confidence in Uber's future.

- Strategic Partnerships: New partnerships with [mention examples of partners and the benefits of these partnerships].

- Investments: Strategic investments in [mention areas of investment, e.g., autonomous driving technology] indicated a commitment to long-term innovation.

- Technological Advancements: Any significant technological advancements announced during the period also contributed to positive sentiment.

Understanding the Uber Stock Surge – A Recap and Call to Action

The April surge in Uber stock was driven by a combination of strong Q1 earnings, increased ridership, positive investor sentiment, and favorable market conditions. Understanding these interconnected factors is vital for investors seeking to navigate the complexities of the ride-sharing market. The strong Q1 results, post-pandemic recovery, expanding market share, and a generally positive market environment all contributed to this significant price increase.

To stay updated on future Uber stock movements and gain insights into the dynamic ride-sharing industry, continue following our financial news and analysis. Understanding the factors that influence Uber stock is crucial for making informed investment decisions.

Featured Posts

-

Exploring The Reebok X Angel Reese Sneaker Line

May 17, 2025

Exploring The Reebok X Angel Reese Sneaker Line

May 17, 2025 -

Best Bitcoin Casinos For 2025 Secure Fast Withdrawals And Exclusive Bonuses Revealed

May 17, 2025

Best Bitcoin Casinos For 2025 Secure Fast Withdrawals And Exclusive Bonuses Revealed

May 17, 2025 -

New York Daily News Archives May 2025 Edition

May 17, 2025

New York Daily News Archives May 2025 Edition

May 17, 2025 -

Josh Hart Injury Report Playing Status For Knicks Vs Celtics February 23rd

May 17, 2025

Josh Hart Injury Report Playing Status For Knicks Vs Celtics February 23rd

May 17, 2025 -

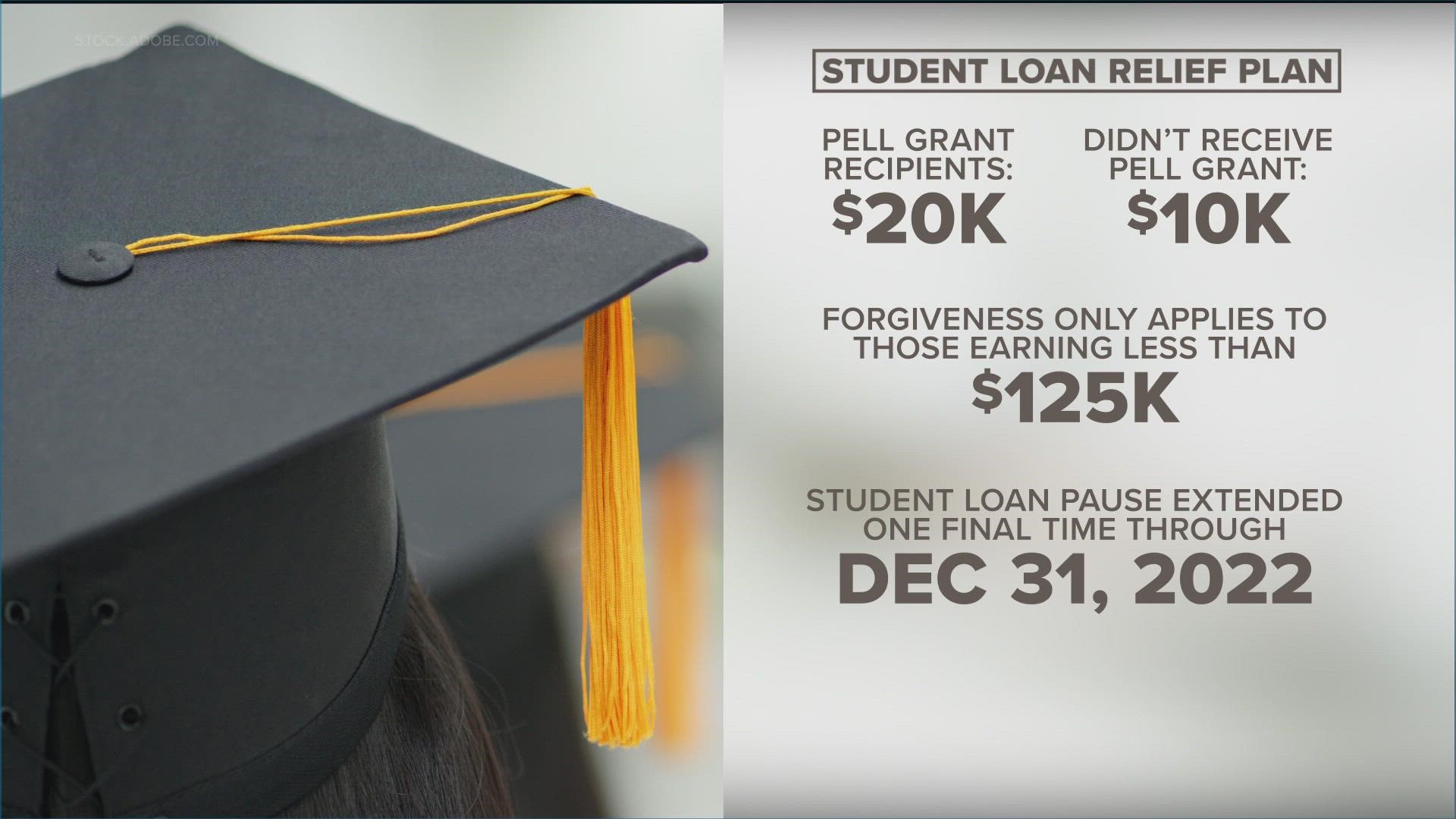

Student Loans Gops Proposed Changes To Pell Grants Repayment And More

May 17, 2025

Student Loans Gops Proposed Changes To Pell Grants Repayment And More

May 17, 2025

Latest Posts

-

Did Donald And Melania Trump Separate A Look At Their Marriage

May 17, 2025

Did Donald And Melania Trump Separate A Look At Their Marriage

May 17, 2025 -

Iga Svjontek I Njena Pobeda Vesti I Reakcije Nakon Meca

May 17, 2025

Iga Svjontek I Njena Pobeda Vesti I Reakcije Nakon Meca

May 17, 2025 -

Lawrence O Donnell Show The Night Trump Was Humbled

May 17, 2025

Lawrence O Donnell Show The Night Trump Was Humbled

May 17, 2025 -

Dominacija Ige Svjontek Detaljan Pregled Meca Protiv Ukrajinke

May 17, 2025

Dominacija Ige Svjontek Detaljan Pregled Meca Protiv Ukrajinke

May 17, 2025 -

Lawrence O Donnell Trumps Humiliating Live Tv Moment

May 17, 2025

Lawrence O Donnell Trumps Humiliating Live Tv Moment

May 17, 2025