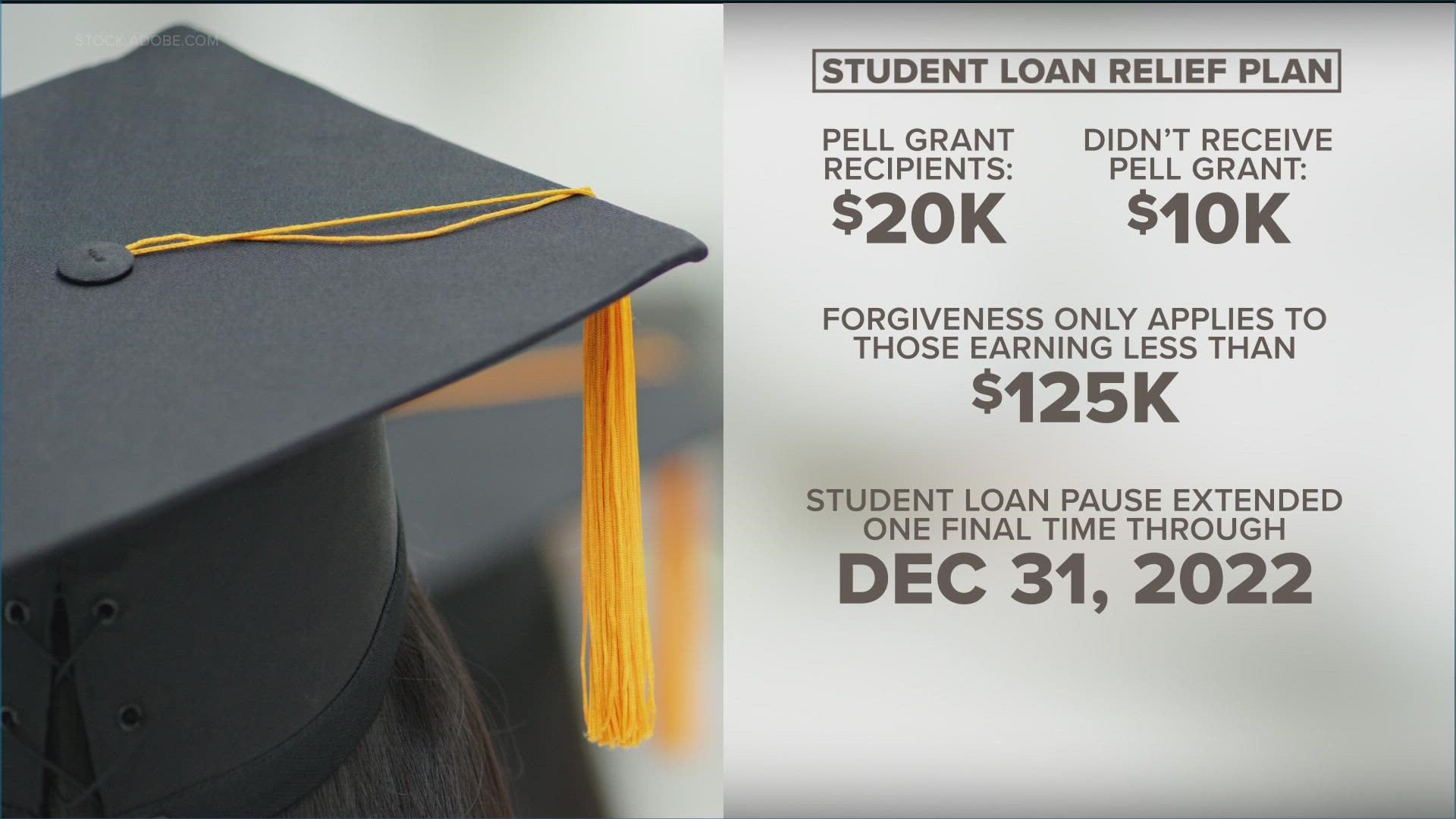

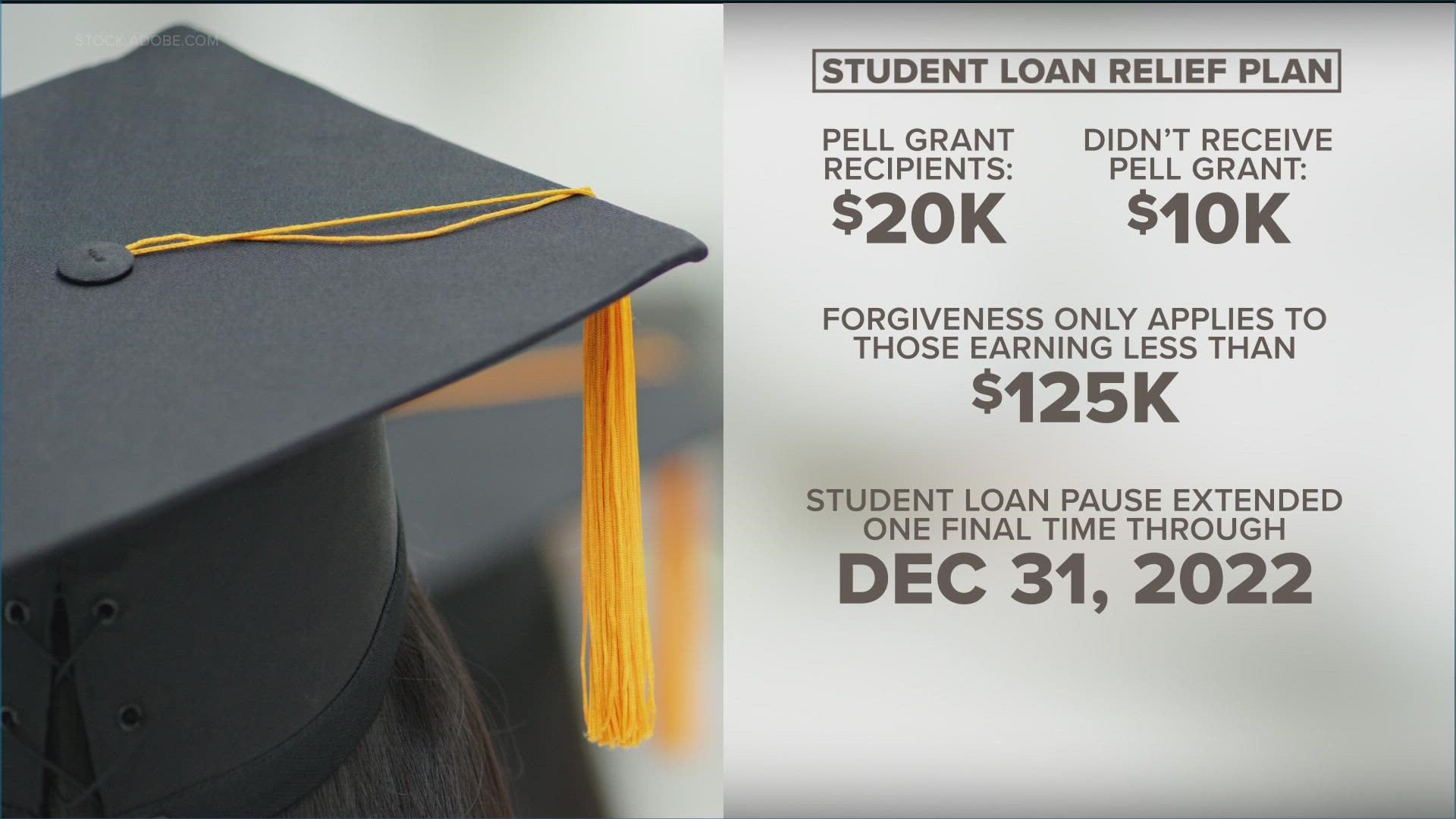

Student Loans: GOP's Proposed Changes To Pell Grants, Repayment, And More

Table of Contents

Proposed Changes to Pell Grants

The GOP's proposed changes to Pell Grants represent a potential blow to students relying on this crucial financial aid. These changes could significantly reduce accessibility and affordability of higher education for many.

Reduced Funding and Eligibility

The proposed plan may involve a substantial decrease in funding allocated to Pell Grants. This could lead to several negative consequences:

- Decreased maximum grant award: The maximum amount awarded per student could be significantly lowered, forcing students to cover a larger portion of their tuition and fees.

- Stricter eligibility requirements based on family income: The income thresholds for Pell Grant eligibility might be lowered, excluding more students from receiving aid, disproportionately impacting low-income families.

- Potential elimination of grants for students attending non-accredited programs: This could further limit options for students seeking affordable education outside of traditional four-year colleges and universities.

The impact of reduced Pell Grant funding is far-reaching. Currently, millions of students rely on Pell Grants to cover their college expenses. A reduction in funding could dramatically decrease college access for low-income students, perpetuating existing inequalities in higher education. For example, according to the National Center for Education Statistics, in 2020-2021, over 6 million students received Pell Grants, with the average award being approximately $4,000. Reducing this amount or restricting eligibility could have devastating consequences for these students’ ability to pursue higher education.

Increased Emphasis on Merit-Based Awards

The GOP's plan may also shift the Pell Grant system towards a merit-based model. This approach could prioritize academic performance and specific career paths:

- Implementation of GPA requirements: Students might need to maintain a certain GPA to qualify for a Pell Grant, potentially excluding students who face academic challenges or those from disadvantaged backgrounds with fewer academic resources.

- Preference given to STEM majors: The proposal might favor students pursuing careers in science, technology, engineering, and mathematics (STEM), potentially neglecting the needs of students in humanities and other fields.

- Potential restrictions based on field of study: Certain fields of study might be excluded from receiving Pell Grant funding, limiting students’ educational choices.

A merit-based Pell Grant system carries the risk of exacerbating existing inequalities in higher education. Students from privileged backgrounds often have better access to resources that boost academic performance, placing them at an advantage in a merit-based system. This could further marginalize students from low-income families and under-resourced communities, limiting their opportunities for upward mobility through higher education.

Repayment Plan Reforms

The proposed changes to student loan repayment plans could significantly alter the financial burden on borrowers.

Income-Driven Repayment (IDR) Changes

The GOP may propose significant alterations to existing Income-Driven Repayment (IDR) plans, potentially making repayment more challenging:

- Higher minimum monthly payments: Borrowers could face substantially higher monthly payments, straining their budgets and impacting their financial stability.

- Shorter repayment periods: Reduced repayment periods could lead to even higher monthly payments and faster accumulation of interest, increasing the total cost of the loan.

- Stricter income verification processes: More rigorous verification could make it more difficult for borrowers to qualify for IDR plans, potentially forcing them into higher-payment standard repayment plans.

- Reduced loan forgiveness eligibility: The proposed changes might drastically reduce or eliminate loan forgiveness under IDR plans, leaving borrowers with significant debt even after decades of repayment.

These changes could disproportionately impact low-income borrowers, who already struggle to manage their student loan debt. Higher minimum payments could push borrowers into financial hardship, potentially leading to increased default rates.

Increased Emphasis on Direct Repayment

The GOP's plan might encourage a shift towards standard repayment plans, potentially overlooking the financial realities faced by many borrowers:

- Promoting faster repayment: A focus on faster repayment could result in significantly higher monthly payments, making it difficult for borrowers to manage their finances.

- Potential incentives for selecting standard repayment: Incentivizing standard repayment over IDR plans could disadvantage borrowers who truly need income-based repayment options.

- Reduced emphasis on income-based repayment options: A diminished focus on income-based repayment options could leave many borrowers struggling to repay their loans, potentially leading to default and damaging their credit scores.

The shift away from IDR plans could create significant financial hardship for borrowers, potentially leading to higher default rates and limiting access to higher education for low-income individuals.

Elimination or Reduction of Loan Forgiveness Programs

The GOP's proposals may target existing student loan forgiveness programs, potentially leaving many borrowers with substantial debt:

Targeting Existing Programs

The proposed changes could severely curtail or eliminate crucial loan forgiveness programs:

- Reduction in the Public Service Loan Forgiveness (PSLF) program: The PSLF program, designed to forgive loans for public service workers after 10 years of payments, could be significantly restricted or eliminated, impacting those working in vital public service roles.

- Elimination of income-driven repayment forgiveness: The elimination of forgiveness at the end of IDR plans could leave millions of borrowers with substantial debt, regardless of their income or repayment efforts.

- Stricter eligibility criteria for existing forgiveness programs: Tighter eligibility criteria would make it harder for borrowers to qualify for existing forgiveness programs, leaving them with a larger debt burden.

These changes could have a devastating impact on borrowers who have relied on loan forgiveness programs to manage their debt. The elimination or reduction of these programs would significantly increase overall student debt levels and discourage individuals from pursuing careers in public service.

Conclusion

The GOP's proposed changes to the student loan system represent a significant shift in higher education financing. The potential alterations to Pell Grants, repayment plans, and loan forgiveness programs could drastically impact students' access to college and their ability to manage student loan debt. Reduced funding for Pell Grants could disproportionately affect low-income students, while changes to repayment plans could increase the burden on borrowers. The potential elimination or reduction of loan forgiveness programs could leave many students with insurmountable debt. Understanding these proposed changes is crucial for advocating for policies that promote access to affordable higher education. Stay informed about the latest developments concerning student loans, student loan debt, and student loan forgiveness, and engage in the discussion to ensure a fair and equitable system for all.

Featured Posts

-

Top Rated Online Casino Canada 7 Bit Casino Player Experience

May 17, 2025

Top Rated Online Casino Canada 7 Bit Casino Player Experience

May 17, 2025 -

Top Bitcoin Casino Jackbits Fast Payouts And Crypto Games

May 17, 2025

Top Bitcoin Casino Jackbits Fast Payouts And Crypto Games

May 17, 2025 -

Play At Mirax Casino Your Top Choice For Online Gambling In Ontario 2025

May 17, 2025

Play At Mirax Casino Your Top Choice For Online Gambling In Ontario 2025

May 17, 2025 -

Forced Grins Hide Tensions Van Lith Reese Matchup In Chicago

May 17, 2025

Forced Grins Hide Tensions Van Lith Reese Matchup In Chicago

May 17, 2025 -

Angel Reeses Fiery Rebuttal To Chrisean Rock Interview Criticism

May 17, 2025

Angel Reeses Fiery Rebuttal To Chrisean Rock Interview Criticism

May 17, 2025

Latest Posts

-

Fortnite Item Shop 1000 Day Old Skins Return

May 17, 2025

Fortnite Item Shop 1000 Day Old Skins Return

May 17, 2025 -

Uber Stocks Recessionary Performance A Deep Dive

May 17, 2025

Uber Stocks Recessionary Performance A Deep Dive

May 17, 2025 -

Analyzing Ubers Stock Recession Resistance And Future Growth

May 17, 2025

Analyzing Ubers Stock Recession Resistance And Future Growth

May 17, 2025 -

Is Uber Stock Recession Resistant Analyzing The Market

May 17, 2025

Is Uber Stock Recession Resistant Analyzing The Market

May 17, 2025 -

Autonomous Vehicles And Etfs Is Uber A Smart Investment

May 17, 2025

Autonomous Vehicles And Etfs Is Uber A Smart Investment

May 17, 2025