Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Arguments Against Overly Pessimistic Valuations

BofA's analysis suggests that current high stock market valuations aren't necessarily a cause for immediate alarm. Their perspective is built upon a multi-faceted assessment of the current economic landscape, considering factors often overlooked by those solely focusing on valuation multiples.

The Role of Low Interest Rates

Historically low interest rates significantly influence stock valuations. Low interest rates reduce the discount rate used in present value calculations. This means future earnings are discounted less heavily, resulting in higher present values and, consequently, higher valuations. BofA's research emphasizes that the current low-rate environment supports higher price-to-earnings (P/E) ratios than might have been considered reasonable in periods of higher interest rates.

- Lower discount rates: A lower discount rate increases the present value of future cash flows, justifying higher valuations.

- Impact on valuation models: Traditional valuation models, heavily reliant on discount rates, yield higher valuations in a low-interest-rate environment.

- BofA's data: (Note: Insert specific data points and examples from BofA's research here. This section requires accessing and referencing specific BofA reports and publications). For example, you might cite a specific report showing the correlation between interest rates and P/E ratios. Keywords: low interest rates, discount rates, present value, valuation models.

Strong Corporate Earnings and Profitability

BofA's analysis highlights robust corporate earnings and profitability as a key factor supporting current valuations. Many sectors are demonstrating exceptional performance, suggesting that the market isn't entirely overvalued relative to underlying fundamentals.

- Key sectors: (Note: Insert specific sectors highlighted by BofA's research exhibiting strong earnings growth. Examples could include technology, healthcare, or consumer staples).

- Earnings growth: Many companies are experiencing sustained earnings growth, which helps justify higher valuations.

- Profitability metrics: BofA likely considers metrics like return on equity (ROE) and return on assets (ROA) to gauge the profitability of companies and assess the justification for current stock prices. Keywords: corporate earnings, profitability, sector performance, earnings growth.

Long-Term Growth Potential

BofA's positive outlook on long-term economic growth is another pillar of their argument. They likely identify several factors driving this growth, including technological advancements and evolving economic trends. This positive future outlook, in their view, supports higher valuations today.

- Technological advancements: (Note: Insert examples of specific technological advancements cited by BofA that are expected to drive long-term economic growth, such as AI, renewable energy, or biotechnology).

- Economic trends: (Note: Insert examples of economic trends cited by BofA, such as globalization or demographic shifts).

- Future outlook: BofA's long-term economic projections likely play a crucial role in their assessment of current valuations, implying that higher current valuations reflect expectations of future earnings growth. Keywords: long-term growth, economic growth, technological advancements, future outlook.

Addressing Common Investor Concerns

While acknowledging the inherent risks in the market, BofA addresses common investor anxieties surrounding high stock market valuations.

The Risk of a Market Correction

BofA acknowledges the possibility of a market correction. However, their perspective doesn't advocate for a panicked sell-off. They likely propose strategies for managing risk during periods of potential volatility.

- Likelihood and severity: (Note: Insert BofA's assessment on the likelihood and potential severity of a market correction. This should be sourced from their reports).

- Risk management strategies: (Note: Include specific risk management strategies suggested by BofA, such as diversification, hedging, or dollar-cost averaging).

- Strategic approach: BofA's advice will likely focus on maintaining a long-term perspective and adjusting investment strategies based on informed analysis rather than knee-jerk reactions. Keywords: market correction, market volatility, risk management, investment strategies.

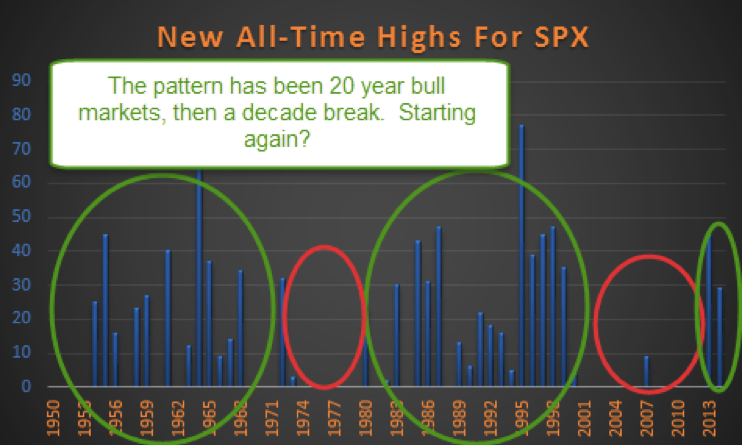

Comparison to Historical Valuations

Comparing current valuations to historical averages requires careful consideration. BofA likely emphasizes that direct comparisons may be misleading due to differences in economic conditions and interest rate environments across different periods.

- Contextual analysis: BofA’s approach probably focuses on a contextual analysis of valuations within the current economic environment rather than relying solely on historical comparisons.

- Market cycles: The analysis likely accounts for the cyclical nature of the stock market and the influence of macroeconomic factors on valuation levels.

- Economic conditions: BofA’s assessment recognizes the significant differences between current economic conditions and those prevailing during periods with similar valuations in the past. Keywords: historical valuations, market cycles, economic conditions.

Don't Let High Stock Market Valuations Deter You – BofA's Perspective

In summary, BofA's perspective suggests that while high stock market valuations warrant attention, they don't necessarily signal an impending crash. Their analysis emphasizes the impact of low interest rates, strong corporate earnings, and promising long-term growth potential. While acknowledging the risk of a market correction, BofA advocates for a balanced, informed investment strategy that accounts for both potential risks and opportunities. Remember to consider long-term growth potential and the influence of low interest rates when forming your investment decisions.

To make informed decisions, we encourage you to explore BofA's investment strategies and research on high stock market valuations further. Learn more about their insights and resources available to help you navigate the complexities of the current market. Keywords: investment strategy, high stock valuations, informed decisions, BofA research, long-term investing.

Featured Posts

-

Fox News Faces Defamation Suit From Ray Epps Over Jan 6th Reporting

Apr 22, 2025

Fox News Faces Defamation Suit From Ray Epps Over Jan 6th Reporting

Apr 22, 2025 -

Hegseths Military Plans Revealed In Signal Chat With Family

Apr 22, 2025

Hegseths Military Plans Revealed In Signal Chat With Family

Apr 22, 2025 -

Pope Francis 1936 2024 A Papal Legacy Of Service And Compassion

Apr 22, 2025

Pope Francis 1936 2024 A Papal Legacy Of Service And Compassion

Apr 22, 2025 -

The Trump Administrations Trade Agenda And Its Consequences For Us Finance

Apr 22, 2025

The Trump Administrations Trade Agenda And Its Consequences For Us Finance

Apr 22, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 22, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 22, 2025