Why The Indian Stock Market Is Rising: Sensex 1400, Nifty 23800+ Analysis

Table of Contents

Strong Economic Fundamentals Fueling Growth

The robust performance of the Indian economy is a primary driver of the stock market's ascent. Several key indicators point towards a healthy and growing economy, bolstering investor confidence and fueling further investment in the Indian stock market.

-

Robust GDP Growth: India's GDP growth consistently exceeds projections, demonstrating the resilience and strength of the Indian economy. This sustained growth creates a positive feedback loop, attracting further investment and driving market expansion. Recent quarters have shown impressive growth figures, outperforming many other major economies globally.

-

Increased Foreign Direct Investment (FDI) and Foreign Institutional Investor (FII) Inflows: The Indian market is attracting significant FDI and FII inflows. These investments demonstrate global confidence in the Indian economy's long-term potential. Factors such as government reforms and a growing consumer base are key attractions for international investors.

-

Positive Government Policies and Reforms Boosting Investor Confidence: Government initiatives aimed at improving the business environment, reducing bureaucratic hurdles, and promoting ease of doing business have significantly boosted investor confidence. Policies like "Make in India" and the emphasis on infrastructure development are creating a more favorable investment climate.

-

Controlled Inflation Rates Creating a Stable Economic Environment: While inflation remains a concern globally, India has managed to keep inflation relatively controlled, creating a more stable economic environment. This stability reduces uncertainty and encourages both domestic and foreign investment.

-

Government Initiatives like "Make in India" Attracting Manufacturing Investment: The "Make in India" initiative is successfully attracting significant manufacturing investments, leading to job creation and economic growth, further contributing to the positive sentiment surrounding the Indian stock market. This initiative is not only boosting domestic manufacturing but also attracting global players.

Positive Corporate Earnings and Sectoral Performance

Strong corporate earnings across various sectors are another significant contributor to the Indian stock market's rise. Profitability is high, driving investor enthusiasm and pushing stock prices higher.

-

Strong Corporate Earnings Reported Across Various Sectors: Many Indian companies are reporting exceptionally strong earnings, demonstrating robust financial health and resilience. This positive performance underscores the overall health of the Indian corporate sector.

-

High Profitability Driving Investor Enthusiasm: The high profitability of Indian companies is a major draw for investors, leading to increased demand for their shares and driving up stock prices. This translates to higher returns for investors and further fuels the market's upward trajectory.

-

Exceptional Performance of Specific Sectors like IT, Pharmaceuticals, and Banking: Certain sectors, such as IT, pharmaceuticals, and banking, are showing particularly strong performance. These sectors are benefiting from both domestic and global growth opportunities. The IT sector, in particular, is experiencing a boom driven by increased global demand for technology services.

-

Growth in Domestic Consumption Contributing to Strong Corporate Performance: Rising domestic consumption is a crucial factor driving strong corporate earnings. As the Indian middle class expands, so does consumer spending, creating significant demand for goods and services.

-

Positive Outlook for Future Earnings Projected by Analysts: Analysts are largely projecting positive earnings growth for Indian companies in the coming years, reinforcing the positive outlook for the Indian stock market. This positive sentiment further encourages investment and contributes to the market's rise.

Global Factors Contributing to the Indian Stock Market's Rise

Global factors also play a significant role in the Indian stock market's upward trajectory. Favorable global economic conditions and shifts in investment flows are contributing to the growth.

-

Favorable Global Economic Conditions Supporting Emerging Markets: Generally favorable global economic conditions are creating a supportive environment for emerging markets, including India. This positive global environment attracts foreign investment and boosts investor confidence.

-

Shift in Global Investment Flows Towards India: There's a discernible shift in global investment flows towards India, driven by its strong economic fundamentals and growth potential. India is increasingly viewed as an attractive investment destination compared to other emerging markets.

-

Increased Demand for Indian Goods and Services in International Markets: The demand for Indian goods and services in global markets is increasing, further boosting the economy and positively impacting the stock market. This reflects India's growing prominence in the global economy.

-

Stable Geopolitical Environment Boosting Investor Confidence: A relatively stable geopolitical environment compared to some other regions enhances investor confidence in the Indian market. This stability reduces uncertainty and encourages investment.

-

Comparison of Indian Market Performance with Other Global Indices: Compared to other major global indices, the Indian market has shown comparatively strong performance, attracting investors seeking better returns. This relative outperformance makes the Indian market an attractive investment proposition.

Potential Risks and Challenges Ahead

While the outlook for the Indian stock market is currently positive, it's crucial to acknowledge potential risks and challenges that could impact its performance.

-

Potential for Increased Market Volatility: The market is subject to inherent volatility and unforeseen events could lead to price fluctuations. Investors should be prepared for potential market corrections.

-

Risks Associated with Inflation and Interest Rate Hikes: Inflation and interest rate hikes pose potential risks. Rising interest rates can impact borrowing costs for companies and potentially cool down economic growth.

-

Geopolitical Uncertainties and Their Potential Impact: Geopolitical events could significantly impact the Indian stock market, as they do with global markets generally. Investors need to remain aware of global developments.

-

Regulatory Changes That Could Affect Market Performance: Changes in regulations could influence market performance. Investors need to stay informed about any potential regulatory changes that could affect their investments.

-

Need for Careful Risk Management by Investors: Given the potential risks, careful risk management is crucial for investors. Diversification and a well-defined investment strategy are essential.

Conclusion

The Indian stock market's remarkable rise, with the Sensex and Nifty reaching record highs, is a result of several converging factors: strong domestic economic fundamentals, robust corporate earnings, and a favorable global environment. While potential risks exist, the overall outlook remains positive, driven by India's continued economic growth and its increasing global prominence.

Understanding the factors driving the rise of the Indian stock market is vital for making informed investment decisions. Stay updated on the latest market trends and analysis to make sound investment choices in this dynamic market. Learn more about investing in the Indian stock market and capitalize on its growth potential. Continue your research on Sensex and Nifty trends for insightful market analysis. Careful monitoring of economic indicators, corporate performance, and global events will be key to navigating this exciting yet volatile market.

Featured Posts

-

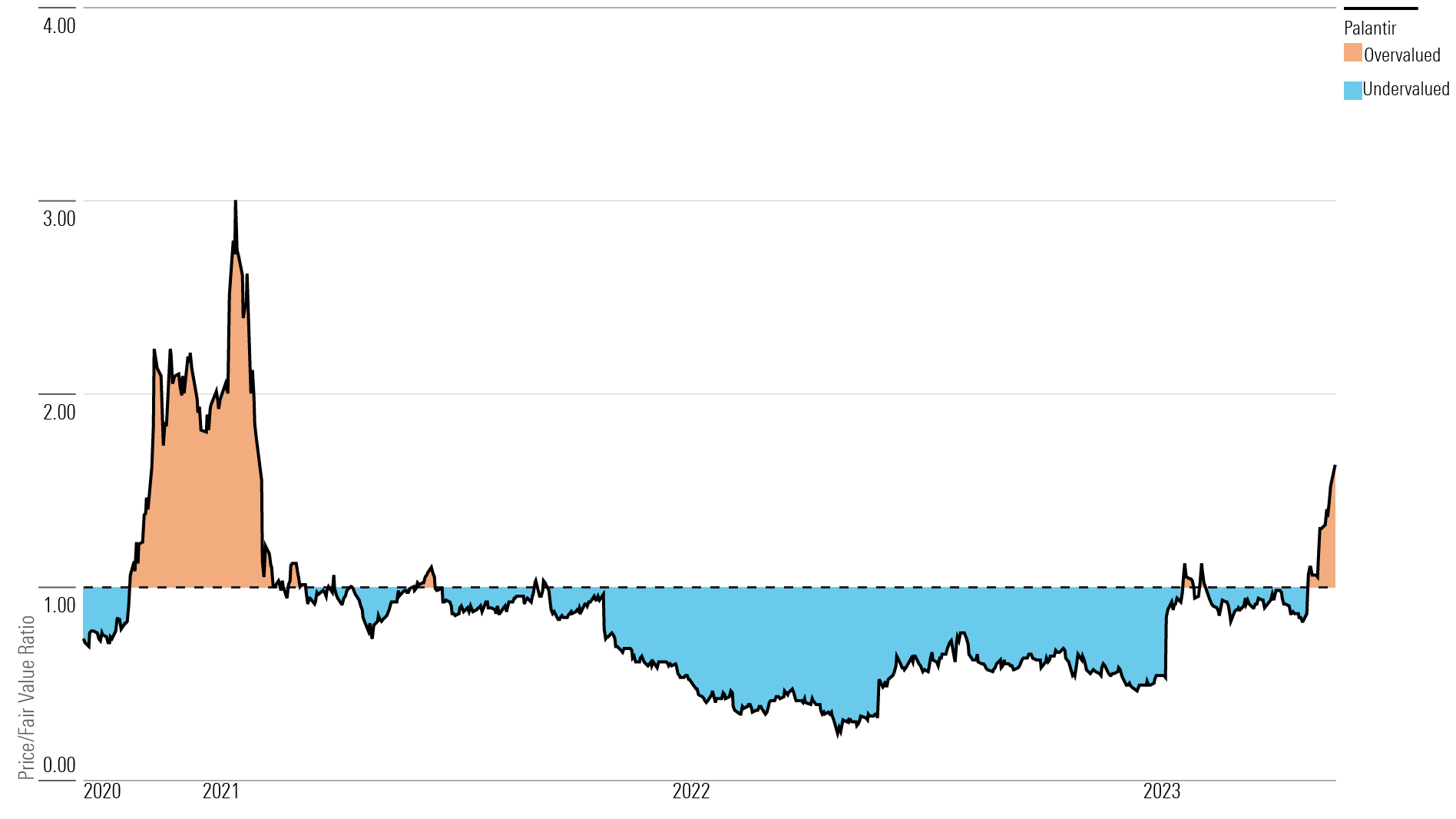

Should You Buy Palantir Stock A Pre May 5th Earnings Review

May 10, 2025

Should You Buy Palantir Stock A Pre May 5th Earnings Review

May 10, 2025 -

The Scars Of Racism A Familys Pain After A Brutal Unprovoked Killing

May 10, 2025

The Scars Of Racism A Familys Pain After A Brutal Unprovoked Killing

May 10, 2025 -

El Salvador Prison Transfers Jeanine Pirros Stance On Due Process Under Fire

May 10, 2025

El Salvador Prison Transfers Jeanine Pirros Stance On Due Process Under Fire

May 10, 2025 -

Investing In Palantir Before May 5th A Comprehensive Guide

May 10, 2025

Investing In Palantir Before May 5th A Comprehensive Guide

May 10, 2025 -

International Transgender Day Of Visibility 3 Ways To Be A Better Ally

May 10, 2025

International Transgender Day Of Visibility 3 Ways To Be A Better Ally

May 10, 2025