Wildfire Speculation: The Growing Market In Disaster Betting

Table of Contents

The Mechanics of Wildfire Speculation

Wildfire speculation involves attempting to profit from the occurrence and impact of wildfires. This can take several forms:

- Insurance Payouts: Investors might bet on the magnitude of insurance payouts related to wildfire damage. This could involve investing in insurance companies heavily exposed to wildfire risk or even utilizing derivative instruments to predict and profit from claims.

- Post-Wildfire Recovery: Companies involved in wildfire recovery – construction firms, timber companies, and disaster relief organizations – see a surge in business after a major wildfire. Investing in these companies constitutes a form of wildfire speculation, though less direct than betting on insurance claims.

- Commodity Trading: The prices of certain commodities, like lumber and water, are directly affected by wildfires. Speculators can trade these commodities, attempting to profit from price fluctuations driven by wildfire events.

- Derivative Markets: Sophisticated investors might utilize derivative markets to predict and profit from changes in wildfire severity indices or insurance claim volumes. These complex financial instruments allow for highly leveraged bets on future wildfire activity.

Data and predictive modeling play a crucial role in wildfire speculation. Sophisticated algorithms analyze historical wildfire data, weather patterns, fuel loads, and other factors to forecast wildfire risk. However, the inherent unpredictability of weather and the complex interplay of human factors (e.g., arson, negligence) limit the accuracy of these predictions, introducing considerable risk to speculative ventures.

The Ethical Concerns Surrounding Wildfire Betting

The ethical implications of wildfire betting are profound. Profiting from the devastation caused by wildfires raises serious moral questions.

- Irresponsible Behavior: The potential exists for irresponsible behavior driven by the pursuit of profit. For example, the withholding of critical information about potential wildfire risks could be tempting for those seeking to manipulate markets.

- Moral Hazard: Does the existence of a market for wildfire speculation incentivize negligence in wildfire prevention and mitigation efforts? Could the potential for profit outweigh the incentive to invest in preventative measures?

- Impact on Insurance Markets: Increased speculation could destabilize insurance markets, potentially leading to higher premiums for everyone, including those who are not involved in speculation.

The Financial Landscape of Wildfire Speculation

Wildfire speculation presents both substantial opportunities for profit and significant risks of loss. The market is inherently volatile, subject to the unpredictable nature of wildfires themselves and external factors influencing the economy.

- Insurance Company Exposure: Insurance companies bear the brunt of wildfire damage costs, making them key players in this market. Their financial stability is directly affected by the frequency and intensity of wildfires.

- Regulatory Frameworks: Currently, regulatory frameworks governing wildfire speculation are limited. However, given the potential for market manipulation and ethical concerns, tighter regulation might emerge in the future.

- Climate Change Impact: Climate change is exacerbating wildfire risks, potentially making wildfire speculation both more lucrative and more dangerous. The increasing frequency and severity of wildfires amplify the volatility of this market.

The Future of Wildfire Speculation

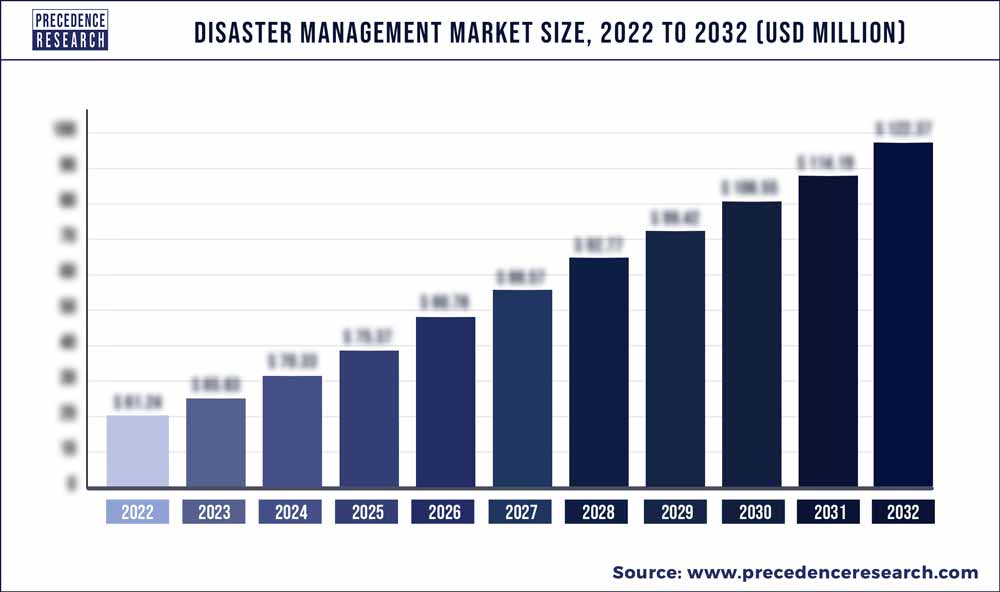

The future of wildfire speculation is likely to be shaped by several factors. The increasing frequency and severity of wildfires globally point to substantial growth in this market.

- Technological Advancements: Improvements in predictive modeling, remote sensing technology, and data analytics will likely enhance the accuracy of wildfire risk assessments, potentially attracting more investors.

- Government Policy and Regulation: Government policies regarding wildfire prevention, mitigation, and insurance regulation will significantly influence the development of this market.

- Responsible Investment: The potential exists for responsible investment strategies that focus not only on profit but also on supporting wildfire recovery efforts and community resilience. Such strategies could balance financial gain with ethical considerations.

Conclusion

Wildfire speculation represents a burgeoning but ethically complex market. We've explored its mechanics, the significant ethical concerns involved, and the volatile financial landscape it inhabits. The increasing frequency and intensity of wildfires, fueled by climate change, only serve to magnify its potential impact. Understanding the intricacies of wildfire speculation is crucial for navigating the evolving landscape of disaster risk and responsible investment. It's essential to critically assess the ethical implications of such speculation and explore ways to promote responsible investment strategies that contribute to community resilience and disaster recovery while mitigating the risks inherent in this volatile market.

Featured Posts

-

Dijon Emplois Disponibles Dans Les Restaurants Et Au Rooftop Dauphine

May 10, 2025

Dijon Emplois Disponibles Dans Les Restaurants Et Au Rooftop Dauphine

May 10, 2025 -

A Familys Plea For Justice Following A Racist Hate Crime

May 10, 2025

A Familys Plea For Justice Following A Racist Hate Crime

May 10, 2025 -

Sensex And Nifty Live Market Soars All Sectors In Green

May 10, 2025

Sensex And Nifty Live Market Soars All Sectors In Green

May 10, 2025 -

The China Factor How It Affects Luxury Car Brands Like Bmw And Porsche

May 10, 2025

The China Factor How It Affects Luxury Car Brands Like Bmw And Porsche

May 10, 2025 -

Stock Market Reaction Analyzing Trumps Tariff Plan And Uk Trade Agreement

May 10, 2025

Stock Market Reaction Analyzing Trumps Tariff Plan And Uk Trade Agreement

May 10, 2025