Will A Minority Government Weaken The Canadian Dollar? Expert Analysis

Table of Contents

The Impact of Political Instability on the Canadian Dollar

The inherent instability of a minority government can significantly influence the Canadian dollar's performance. This influence primarily stems from two key areas: reduced policy predictability and increased risk perception.

Reduced Policy Predictability

Minority governments often face difficulties in passing legislation efficiently, leading to unpredictable policy shifts. This uncertainty is a major deterrent for foreign investment, impacting investor confidence and potentially weakening the CAD. The inability to swiftly implement necessary economic reforms adds to the volatility.

- Increased volatility in the stock market: Uncertainty about future policy creates a volatile investment climate, potentially leading to capital flight.

- Difficulty implementing long-term economic plans: The constant need for negotiation and compromise can hinder the development and execution of strategic economic plans.

- Potential delays in crucial economic reforms: Essential reforms, such as tax changes or infrastructure projects, might face significant delays, impacting economic growth and investor sentiment.

Increased Risk Perception

The inherent instability of a minority government increases the perceived risk for investors. This heightened risk aversion can trigger capital flight, reducing demand for the Canadian dollar and consequently lowering its value.

- Lower credit ratings: A perceived increase in political risk can lead to credit rating agencies downgrading Canada's sovereign debt, increasing borrowing costs.

- Reduced foreign direct investment (FDI): Companies may hesitate to invest in Canada due to the uncertain political landscape, impacting economic growth and the CAD.

- Higher borrowing costs for the government: The increased risk associated with lending to a minority government can lead to higher interest rates, impacting government spending and the overall economy.

Economic Factors Beyond Political Stability

While political stability is a significant factor, it's crucial to remember that the Canadian dollar's value isn't solely determined by domestic politics. Global economic conditions and domestic economic performance also play critical roles.

Global Economic Conditions

The Canadian dollar's value is strongly influenced by global economic factors such as commodity prices (particularly oil) and international trade. A minority government's impact might be overshadowed by these larger forces.

- Fluctuations in oil prices: As a major commodity exporter, Canada's economy is heavily reliant on oil prices. Fluctuations in global oil markets directly impact the CAD.

- Changes in global demand for Canadian exports: International demand for Canadian goods and services influences the CAD's value. A decline in global demand can weaken the currency.

- Strength of the US dollar: The US dollar is a major global currency, and its strength relative to the CAD significantly influences the exchange rate.

Domestic Economic Performance

Strong domestic economic growth and low inflation can mitigate the negative effects of political instability. A minority government's ability to effectively manage the economy is, therefore, crucial.

- Job creation: A thriving job market indicates economic strength, which supports a stronger currency.

- Consumer confidence: High consumer confidence indicates a healthy economy and boosts demand, supporting the CAD.

- Inflation rates: High inflation erodes purchasing power and weakens a currency. Low and stable inflation is beneficial for the CAD.

- GDP growth: Sustained GDP growth is a key indicator of a healthy economy and a strong currency.

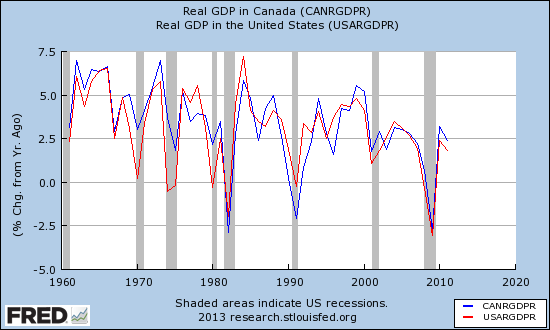

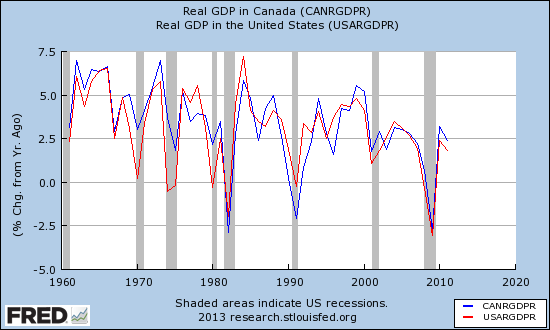

Historical Analysis of Minority Governments and the Canadian Dollar

Analyzing past instances of minority governments in Canada and their subsequent effects on the CAD reveals a complex picture. While some periods showed decreased investor confidence and currency volatility, others demonstrated resilience and minimal impact on the CAD's value. A thorough review of historical data, including expert opinions from those periods, is essential for a comprehensive understanding. Such analysis helps identify common trends and patterns, enabling better prediction of future scenarios.

- Case studies of specific minority governments and their impact: Examining past experiences provides valuable insights into how different minority governments managed the economy and the resulting effect on the CAD.

- Analysis of CAD performance during those periods: Comparing the CAD's performance during minority governments with periods of majority government allows for a more nuanced understanding of the relationship.

- Comparison with periods of majority government: This comparative analysis allows for a better understanding of the specific impact of minority governments on the Canadian dollar, isolating it from other confounding factors.

Conclusion

While a minority government can introduce uncertainty and potentially impact investor confidence, its effect on the Canadian dollar is multifaceted. Global economic conditions and the government's adeptness at economic management play equally significant roles. The CAD's value is a complex interplay of several factors. Therefore, predicting the precise impact of a minority government on the Canadian dollar requires a holistic view encompassing both political and economic landscapes.

Call to Action: Understanding the potential impact of a minority government on the Canadian dollar is vital for investors and businesses. Stay informed about Canadian economic and political developments to make well-informed decisions regarding your investments and financial planning. Continue to monitor the Canadian dollar and its response to both political and economic factors to effectively manage your financial future. Stay updated on the Canadian dollar exchange rate and its relationship with the Canadian political climate.

Featured Posts

-

Pasifika Sipoti April 4th At A Glance

May 01, 2025

Pasifika Sipoti April 4th At A Glance

May 01, 2025 -

Gillian Anderson And David Duchovny Share A Stage At Sag Awards Ceremony

May 01, 2025

Gillian Anderson And David Duchovny Share A Stage At Sag Awards Ceremony

May 01, 2025 -

From Leading Party To Supporting Role The Spds Transformation In German Politics

May 01, 2025

From Leading Party To Supporting Role The Spds Transformation In German Politics

May 01, 2025 -

Nrc Suspends Warri Itakpe Rail Operations Due To Engine Failure

May 01, 2025

Nrc Suspends Warri Itakpe Rail Operations Due To Engine Failure

May 01, 2025 -

M And A Opportunities For Recordati Amidst Italian Tariff Instability

May 01, 2025

M And A Opportunities For Recordati Amidst Italian Tariff Instability

May 01, 2025