XRP Classification Uncertainty: Ripple Settlement And SEC Commodity Debate

Table of Contents

The Ripple-SEC Lawsuit: A Summary

The protracted legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) centered on the SEC's assertion that XRP is an unregistered security. The SEC argued that Ripple's distribution and sale of XRP constituted an illegal offering of unregistered securities, violating federal securities laws. Their key allegations included:

- Unregistered securities offering: The SEC claimed Ripple offered and sold XRP as an investment contract, expecting investors to profit from Ripple's efforts.

- Violation of federal securities laws: The lawsuit alleged Ripple violated Section 5 of the Securities Act of 1933, which requires registration of securities offerings.

- Ripple's alleged distribution of XRP to institutional investors: The SEC highlighted Ripple's sales to institutional investors as evidence of a deliberate securities offering.

Ripple, in its defense, argued that XRP is a decentralized digital asset, operating more like a currency or a commodity rather than a security. They emphasized the decentralized nature of XRP and its use in facilitating transactions on the XRP Ledger. The case ultimately resulted in a partial settlement.

The Ripple Settlement: Partial Victory or Pyrrhic Win?

The Ripple-SEC settlement, while avoiding a full admission of guilt from Ripple, involved a substantial financial penalty. Key aspects of the agreement include:

- No admission of guilt by Ripple: Importantly, the settlement did not constitute an admission of guilt by Ripple regarding the SEC's claims that XRP is a security.

- Payment of a substantial fine: Ripple agreed to pay a significant fine to the SEC, though the amount remains a point of contention and differing interpretation regarding its legal impact.

- Specific stipulations regarding future XRP sales and distribution: The settlement included conditions on Ripple's future sales and distribution of XRP, aimed at increasing regulatory compliance.

The implications of this settlement for Ripple's future operations are multifaceted. While the company avoids a potentially crippling court decision, the settlement's terms impose constraints on its activities. The legal standing of XRP remains a subject of ongoing debate, with different legal experts offering varying interpretations of the settlement's impact. Some view it as a victory, allowing Ripple to continue operations, while others see it as a costly compromise with lingering uncertainty.

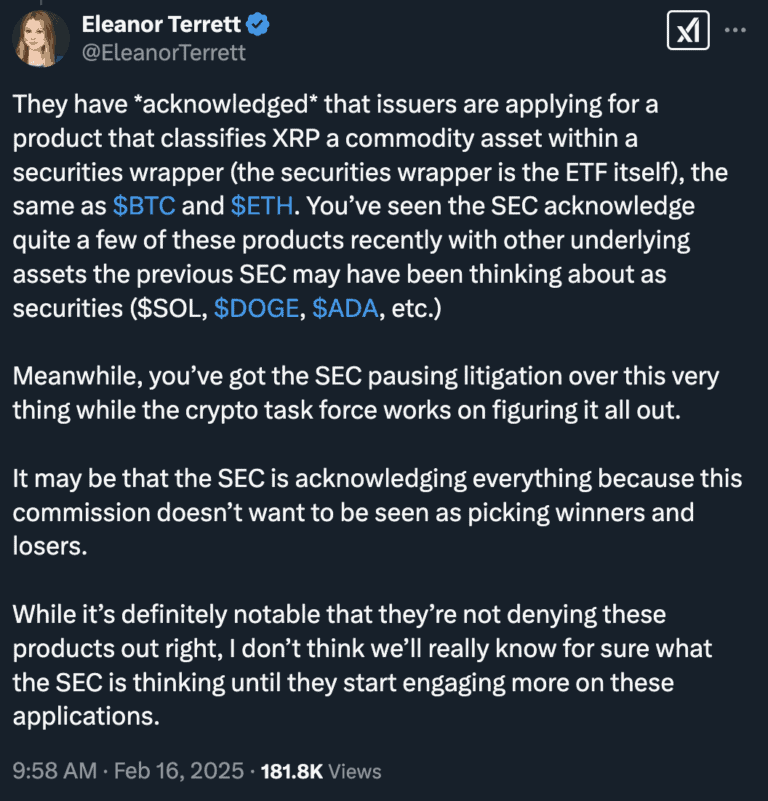

The Broader Implications for Cryptocurrency Classification

The Ripple case carries significant weight for the broader cryptocurrency landscape. Its outcome influences how regulatory bodies approach the classification of other digital assets. The "Howey Test," a benchmark for determining whether an investment is a security, was central to the SEC's case. This test considers whether an investment involves an investment of money in a common enterprise with the expectation of profits derived primarily from the efforts of others. Applying this test to decentralized cryptocurrencies presents unique challenges.

The potential consequences of the Ripple settlement extend to:

- Other crypto projects facing similar legal challenges: The settlement sets a precedent that other crypto projects may face in their dealings with regulators.

- The development and adoption of cryptocurrencies: Uncertainty regarding legal classification can hinder the development and wider adoption of cryptocurrencies.

- Investor confidence in the crypto market: Regulatory uncertainty can negatively impact investor confidence and market stability.

Other relevant cases, involving various cryptocurrencies and exchanges, are further shaping the regulatory landscape, creating a complex and evolving legal environment.

The Commodity vs. Security Debate

The fundamental difference between a commodity and a security lies in their nature and function. A commodity is a raw material or primary agricultural product that can be bought and sold, while a security represents an ownership stake in a company or investment contract. Applying these traditional classifications to decentralized cryptocurrencies is complex. Bitcoin, for example, is often considered a decentralized commodity due to its limited supply and its use as a medium of exchange. However, the classification of other cryptocurrencies, with more centralized governance structures, remains contested.

The decentralized nature of many cryptocurrencies complicates the application of traditional financial regulations. Furthermore, different regulatory bodies worldwide hold varying views on the classification of specific cryptocurrencies, adding another layer of complexity to this ongoing debate.

Conclusion

The Ripple-SEC settlement provides a partial resolution to a significant legal battle within the cryptocurrency industry, but it doesn't offer a definitive answer to the broader question of XRP's classification or the regulatory future of similar crypto assets. The uncertainty surrounding the legal status of numerous digital assets persists, highlighting the need for clearer regulatory frameworks. The impact on investor confidence and the future development of the cryptocurrency market will depend heavily on future regulatory developments and legal interpretations of the Ripple case's implications.

Call to Action: Stay informed about the ongoing developments in the regulation of cryptocurrencies like XRP. Follow reputable news sources for updates on the ever-evolving legal landscape surrounding XRP classification and the impact of the Ripple settlement. Understanding the complexities of XRP and the SEC's ongoing efforts to regulate the crypto market is crucial for informed investment decisions.

Featured Posts

-

Rethinking Mental Healthcare A Call For Change

May 02, 2025

Rethinking Mental Healthcare A Call For Change

May 02, 2025 -

Fortnite Server Status Is Fortnite Down Update 34 20 And Downtime

May 02, 2025

Fortnite Server Status Is Fortnite Down Update 34 20 And Downtime

May 02, 2025 -

Enexis Voordelig Auto Opladen In Noord Nederland Buiten De Piekuren

May 02, 2025

Enexis Voordelig Auto Opladen In Noord Nederland Buiten De Piekuren

May 02, 2025 -

Dual Sense Ps 5 Controller Colors A Complete 2025 Buying Guide

May 02, 2025

Dual Sense Ps 5 Controller Colors A Complete 2025 Buying Guide

May 02, 2025 -

Fixing Fortnite Matchmaking Error 1 A Step By Step Guide For Gamers

May 02, 2025

Fixing Fortnite Matchmaking Error 1 A Step By Step Guide For Gamers

May 02, 2025