XRP ETF Risks: The Impact Of High Supply And Limited Institutional Adoption

Table of Contents

The Impact of XRP's High Circulating Supply

XRP's large circulating supply presents significant challenges for potential XRP ETF investors. This high supply directly impacts price stability and market saturation, creating a riskier investment environment than some other cryptocurrencies.

Dilution Concerns

A large circulating supply can lead to price dilution, making it harder for the price to appreciate significantly.

- Increased supply can outpace demand, putting downward pressure on the XRP price. This is a fundamental economic principle; increased availability without corresponding increased demand generally leads to lower prices.

- This risk is amplified during periods of low trading volume. When trading is slow, even small increases in supply can have a disproportionately large impact on price.

- Comparing XRP's supply to Bitcoin or Ethereum highlights the potential for greater price volatility. Bitcoin and Ethereum have significantly lower circulating supplies, making them potentially less susceptible to price dilution from new coin releases. Analyzing these differences is essential for understanding the unique risks of an XRP ETF.

Market Saturation

The high supply of XRP increases the potential for market saturation, making it more challenging for an XRP ETF to attract substantial investment.

- Existing XRP holders may be less inclined to sell if they anticipate future price appreciation. This reduced selling pressure can limit the available supply for an ETF, affecting liquidity.

- This could limit the liquidity of an XRP ETF. Low liquidity means it might be difficult to buy or sell shares of the ETF quickly without significantly impacting the price.

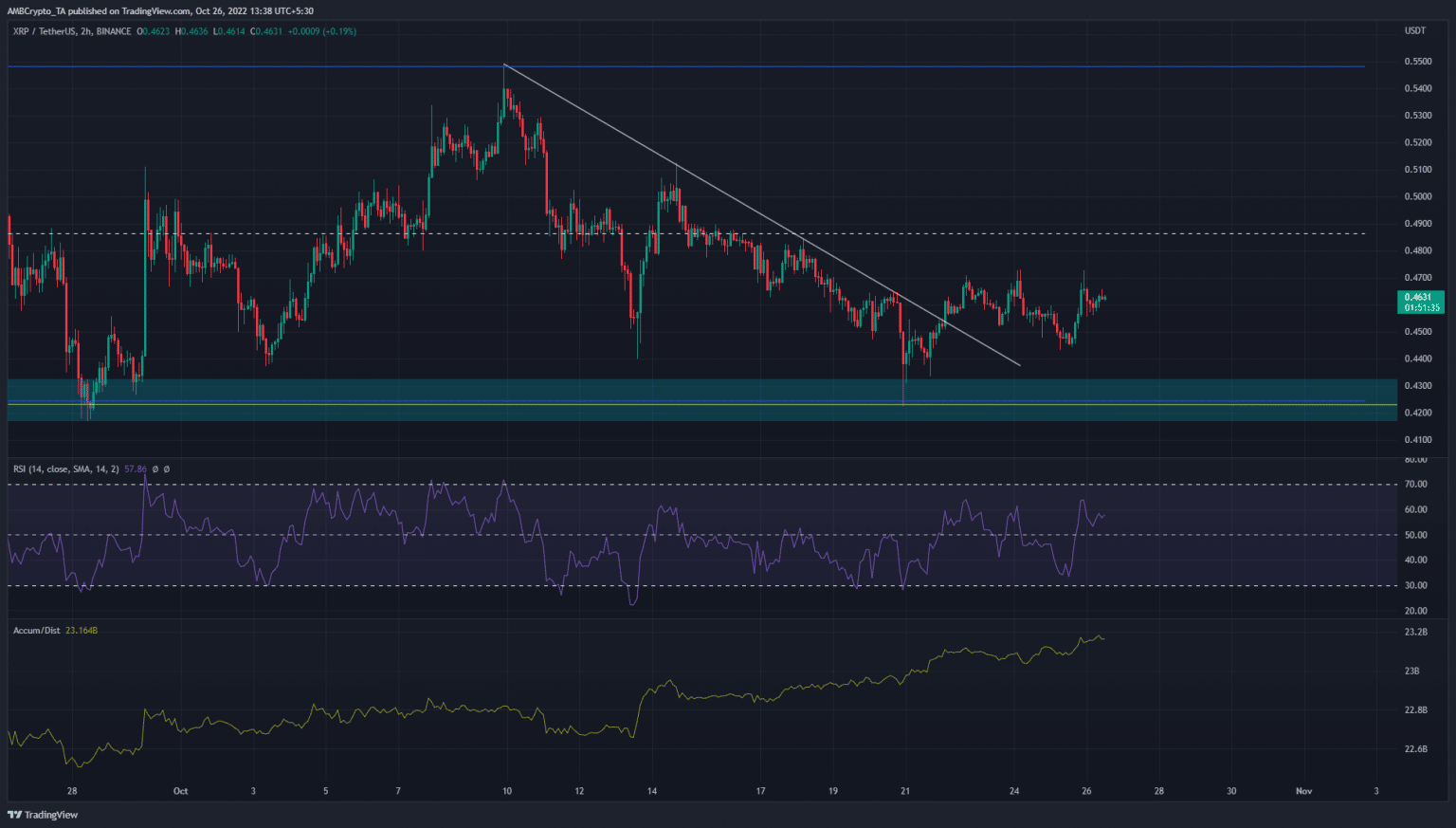

- Analyzing historical XRP price charts helps illustrate the effects of supply on price. Examining past price movements in relation to supply increases can provide valuable insights into potential future price behavior.

Limited Institutional Adoption and Regulatory Uncertainty

Beyond supply concerns, the relatively limited institutional adoption of XRP and lingering regulatory uncertainty significantly impact the viability and attractiveness of an XRP ETF.

Regulatory Scrutiny

XRP faces ongoing regulatory uncertainty, particularly concerning its classification as a security. This uncertainty creates substantial risk for investors.

- A negative regulatory ruling could significantly impact the price of XRP and the viability of an XRP ETF. A legal determination that XRP is a security could severely restrict its trading and dramatically reduce its value.

- The SEC's stance on XRP remains a key factor influencing institutional investment. Large institutional investors are often hesitant to invest in assets facing regulatory ambiguity.

- Comparing XRP's regulatory landscape to other cryptocurrencies with clearer regulatory pathways is crucial. Bitcoin and Ethereum, while not entirely without regulatory challenges, have seen greater regulatory clarity in some jurisdictions, making them more appealing to institutional investors.

Lack of Institutional Backing

Compared to Bitcoin and Ethereum, XRP has seen comparatively less institutional adoption. This lack of institutional interest translates to a higher risk profile for an XRP ETF.

- This limited institutional interest could hinder the demand for an XRP ETF. Without strong institutional backing, the ETF may struggle to attract significant investment.

- Examining the investment strategies of major institutional players reveals their preference for other crypto assets. Analyzing the investment portfolios of large financial institutions highlights the relative lack of allocation towards XRP compared to its competitors.

- This lack of institutional confidence contributes to higher risk for XRP ETF investors. Institutional investors often conduct extensive due diligence, and their hesitancy towards XRP suggests potential underlying concerns.

Assessing Overall Risk and Potential Rewards

While an XRP ETF may offer the potential for high returns, the risks associated with high supply and regulatory uncertainty are substantial and need careful consideration.

Risk vs. Reward Analysis

Investing in an XRP ETF requires a thorough risk assessment, weighing the potential rewards against the significant inherent risks.

- A comprehensive risk assessment should be conducted before investing. This assessment should consider all factors discussed above, including supply, regulation, and market demand.

- Diversification within a broader investment portfolio is recommended to mitigate risk. Don't put all your eggs in one basket; spreading investments across various asset classes can help reduce overall portfolio volatility.

- Understanding your personal risk tolerance is essential when considering XRP ETF investments. Only invest an amount you're comfortable potentially losing.

Conclusion

Investing in an XRP ETF presents both opportunities and significant challenges. The high circulating supply of XRP and the relatively limited institutional adoption, coupled with regulatory uncertainties, contribute to a higher risk profile compared to other cryptocurrencies. Before investing in any XRP ETF, thoroughly research the market, understand the risks associated with high supply and regulatory scrutiny, and carefully evaluate your own risk tolerance. Don't rush into XRP ETF investments without a comprehensive understanding of the potential pitfalls. Conduct thorough due diligence and consider consulting a financial advisor before making any decisions regarding XRP ETF investments.

Featured Posts

-

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Son Gelismeler Ve Analiz

May 08, 2025

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Son Gelismeler Ve Analiz

May 08, 2025 -

Should You Buy Xrp After Its 400 Increase A Comprehensive Guide

May 08, 2025

Should You Buy Xrp After Its 400 Increase A Comprehensive Guide

May 08, 2025 -

Micro Strategy Vs Bitcoin Which To Invest In For Long Term Growth In 2025

May 08, 2025

Micro Strategy Vs Bitcoin Which To Invest In For Long Term Growth In 2025

May 08, 2025 -

Andors Showrunner Hints At Rogue Ones Recut Version

May 08, 2025

Andors Showrunner Hints At Rogue Ones Recut Version

May 08, 2025 -

Ultimate Nba Playoffs Triple Doubles Quiz Can You Ace It

May 08, 2025

Ultimate Nba Playoffs Triple Doubles Quiz Can You Ace It

May 08, 2025

Latest Posts

-

Andor Season 2 Release Date Trailer And Plot Speculation

May 08, 2025

Andor Season 2 Release Date Trailer And Plot Speculation

May 08, 2025 -

Star Wars Andor Creator Calls It His Most Important Work

May 08, 2025

Star Wars Andor Creator Calls It His Most Important Work

May 08, 2025 -

Data Transfer Solutions Choosing The Right Method

May 08, 2025

Data Transfer Solutions Choosing The Right Method

May 08, 2025 -

Andor Season 2 Trailer Release Date News And Updates

May 08, 2025

Andor Season 2 Trailer Release Date News And Updates

May 08, 2025 -

Andor Showrunner On Star Wars Most Important Thing I Ll Ever Do

May 08, 2025

Andor Showrunner On Star Wars Most Important Thing I Ll Ever Do

May 08, 2025