XRP ETFs: A $800 Million First Week? Examining The Market Potential

Table of Contents

The Allure of XRP ETFs: Why Investors are Excited

The potential success of XRP ETFs hinges on several key factors that are attracting significant investor interest.

Regulatory Clarity and SEC Approval

The most significant factor influencing XRP ETF adoption is the potential for SEC (Securities and Exchange Commission) approval. SEC approval would dramatically alter the landscape. Approval signifies regulatory legitimacy, boosting investor confidence and attracting institutional capital. Conversely, rejection would likely dampen enthusiasm and significantly limit the ETF's success. This decision would also have ripple effects, influencing the SEC's stance on other cryptocurrency ETFs.

- Increased institutional investment: Approval opens the door for large institutional investors, traditionally hesitant due to regulatory uncertainty.

- Reduced regulatory uncertainty: SEC approval provides clarity, reducing the risk associated with investing in crypto assets.

- Improved liquidity: A regulated ETF enhances liquidity, making it easier for investors to buy and sell XRP.

XRP's Unique Position in the Crypto Market

XRP's functionality extends beyond simple speculation. It serves as a crucial component of Ripple's payment system, facilitating fast and low-cost cross-border transactions. This inherent utility differentiates it from many other cryptocurrencies, offering a compelling investment proposition.

- Faster transaction speeds: XRP transactions are significantly faster than many other cryptocurrencies.

- Lower fees: XRP boasts considerably lower transaction fees, making it attractive for businesses.

- Global reach: Ripple's network spans numerous countries, supporting international payments.

- Established partnerships: Ripple has established partnerships with numerous financial institutions globally.

The Potential for High Trading Volume

Several factors point towards high trading volume for XRP ETFs. The ease of access for both retail and institutional investors, coupled with media attention, could generate significant demand.

- High demand: Anticipation of SEC approval and XRP's utility are fueling substantial demand.

- Increased liquidity: An ETF structure inherently improves liquidity compared to directly trading XRP.

- Ease of access for investors: ETFs provide a simpler and more accessible way to invest in XRP.

- Media attention: The considerable media coverage surrounding XRP ETFs further amplifies investor interest.

Challenges and Risks Associated with XRP ETFs

While the potential rewards are substantial, investing in XRP ETFs also presents significant challenges and risks.

Ongoing Legal Battles and Regulatory Uncertainty

The ongoing legal battle between Ripple and the SEC casts a shadow over XRP's future and, consequently, its ETFs. The outcome of this case remains uncertain and could significantly impact investor confidence. Further regulatory changes or unexpected legal challenges could disrupt the market.

- Legal uncertainty: The Ripple/SEC lawsuit creates significant uncertainty regarding XRP's regulatory status.

- Potential for regulatory setbacks: Future regulatory actions could negatively impact XRP's value and ETF performance.

- Impact on investor confidence: Negative news or legal setbacks could erode investor confidence and lead to price drops.

Market Volatility and Price Fluctuations

The cryptocurrency market is inherently volatile, and XRP is no exception. Investors should brace themselves for significant price swings and the potential for substantial losses.

- Market volatility: The cryptocurrency market is known for its unpredictable price movements.

- Price fluctuations: XRP's price can experience sharp increases and decreases in short periods.

- Potential for significant losses: Investing in XRP ETFs carries a considerable risk of losing capital.

Competition from Other Crypto ETFs

The cryptocurrency ETF market is becoming increasingly crowded. Competition from other crypto ETFs could fragment the market share, potentially impacting the performance of XRP ETFs.

- Competition from other cryptocurrencies: Other cryptocurrencies also seek ETF listings, creating competition.

- Market share competition: XRP ETFs will face competition for investor capital from other crypto ETFs.

- Potential for lower returns: Increased competition could lead to lower returns for XRP ETFs.

Forecasting the Future: XRP ETF Market Projections

Predicting the future of XRP ETFs requires considering multiple scenarios based on regulatory outcomes and market sentiment.

Realistic Growth Scenarios

While a $800 million first week is ambitious, significant growth is plausible. A conservative estimate might see substantial trading volume within the first year, while an optimistic outlook could project even higher figures, depending on SEC approval and broader market adoption.

- Conservative estimates: Moderate growth based on gradual institutional adoption and positive regulatory developments.

- Optimistic projections: Significant growth driven by widespread retail and institutional interest and positive regulatory outcomes.

- Potential market size: The ultimate size of the XRP ETF market depends on many factors, including regulatory clarity and market sentiment.

Long-Term Investment Potential

The long-term potential of XRP and its associated ETFs depends on several factors. Continued technological advancements, increased adoption by financial institutions, and a clear regulatory framework are essential for sustained growth.

- Long-term growth potential: XRP's utility and potential for widespread adoption suggest substantial long-term growth.

- Technological advancements: Further developments in blockchain technology could enhance XRP's capabilities and appeal.

- Regulatory changes: A clear and supportive regulatory environment is crucial for the long-term success of XRP ETFs.

Conclusion: The Future of XRP ETFs – A Promising Investment?

XRP ETFs present a potentially lucrative investment opportunity, but considerable risks remain. The ongoing legal battles, market volatility, and competitive landscape demand careful consideration. While the speculated $800 million first-week trading volume may be optimistic, significant growth is certainly possible with positive regulatory developments and continued adoption. Before investing in XRP ETFs, thorough research is essential. Stay informed about regulatory developments and market trends to make informed decisions. Invest wisely in XRP ETFs, but only after careful consideration of your risk tolerance and financial goals. Learn more about the XRP ETF market and explore the potential of XRP ETFs today.

Featured Posts

-

Cantina Canalla Malaga El Restaurante Mexicano De Moda

May 08, 2025

Cantina Canalla Malaga El Restaurante Mexicano De Moda

May 08, 2025 -

5880 Potential Is This Altcoin The Next Xrp Analysis And Prediction

May 08, 2025

5880 Potential Is This Altcoin The Next Xrp Analysis And Prediction

May 08, 2025 -

Freeway Series Mookie Betts Absence Due To Ongoing Illness

May 08, 2025

Freeway Series Mookie Betts Absence Due To Ongoing Illness

May 08, 2025 -

Lahwr Ky Ahtsab Edaltwn Ka Khatmh Kya Yh Fyslh Drst Tha

May 08, 2025

Lahwr Ky Ahtsab Edaltwn Ka Khatmh Kya Yh Fyslh Drst Tha

May 08, 2025 -

Anchor Brewing Companys Legacy 127 Years And Counting To Closure

May 08, 2025

Anchor Brewing Companys Legacy 127 Years And Counting To Closure

May 08, 2025

Latest Posts

-

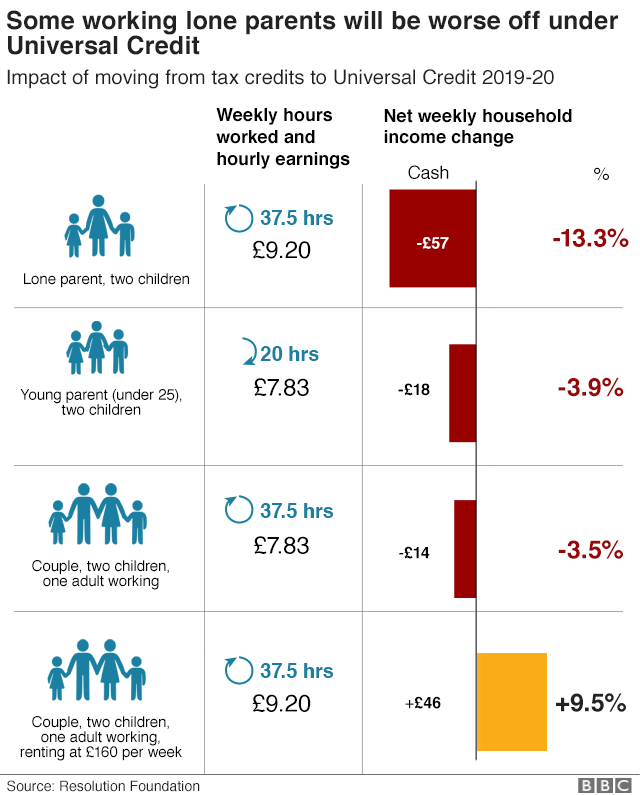

Are You A Universal Credit Recipient Check If You Re Owed Hardship Payment Money

May 08, 2025

Are You A Universal Credit Recipient Check If You Re Owed Hardship Payment Money

May 08, 2025 -

Historical Universal Credit Refunds Find Out If You Re Entitled

May 08, 2025

Historical Universal Credit Refunds Find Out If You Re Entitled

May 08, 2025 -

Celtics Star Jayson Tatum Reflects On Larry Birds Impact

May 08, 2025

Celtics Star Jayson Tatum Reflects On Larry Birds Impact

May 08, 2025 -

Tatum Under Fire Colin Cowherds Post Game 1 Critique

May 08, 2025

Tatum Under Fire Colin Cowherds Post Game 1 Critique

May 08, 2025 -

Dont Lose Your Benefits What To Do If Your Dwp Letter Is Missing

May 08, 2025

Dont Lose Your Benefits What To Do If Your Dwp Letter Is Missing

May 08, 2025