XRP Investment Surge: Trump's Influence And Institutional Adoption

Table of Contents

Donald Trump's Unexpected Influence on XRP Price

Trump's Pro-Crypto Stance:

Donald Trump's past pronouncements on cryptocurrencies, while sometimes seemingly contradictory, have nonetheless sparked considerable interest within the crypto community. His generally positive attitude towards innovation and disruption, coupled with his occasional mentions of Bitcoin and the potential of blockchain technology, have contributed to a positive investor sentiment, which could indirectly benefit XRP. For example, his statements about the potential of blockchain technology to revolutionize financial systems could resonate positively with investors already interested in XRP's use cases in cross-border payments. Specific examples, such as tweets or interviews expressing this sentiment, should be referenced here with links to reputable news sources for verification. [Insert links to credible news sources here].

The Ripple Effect of Political Uncertainty:

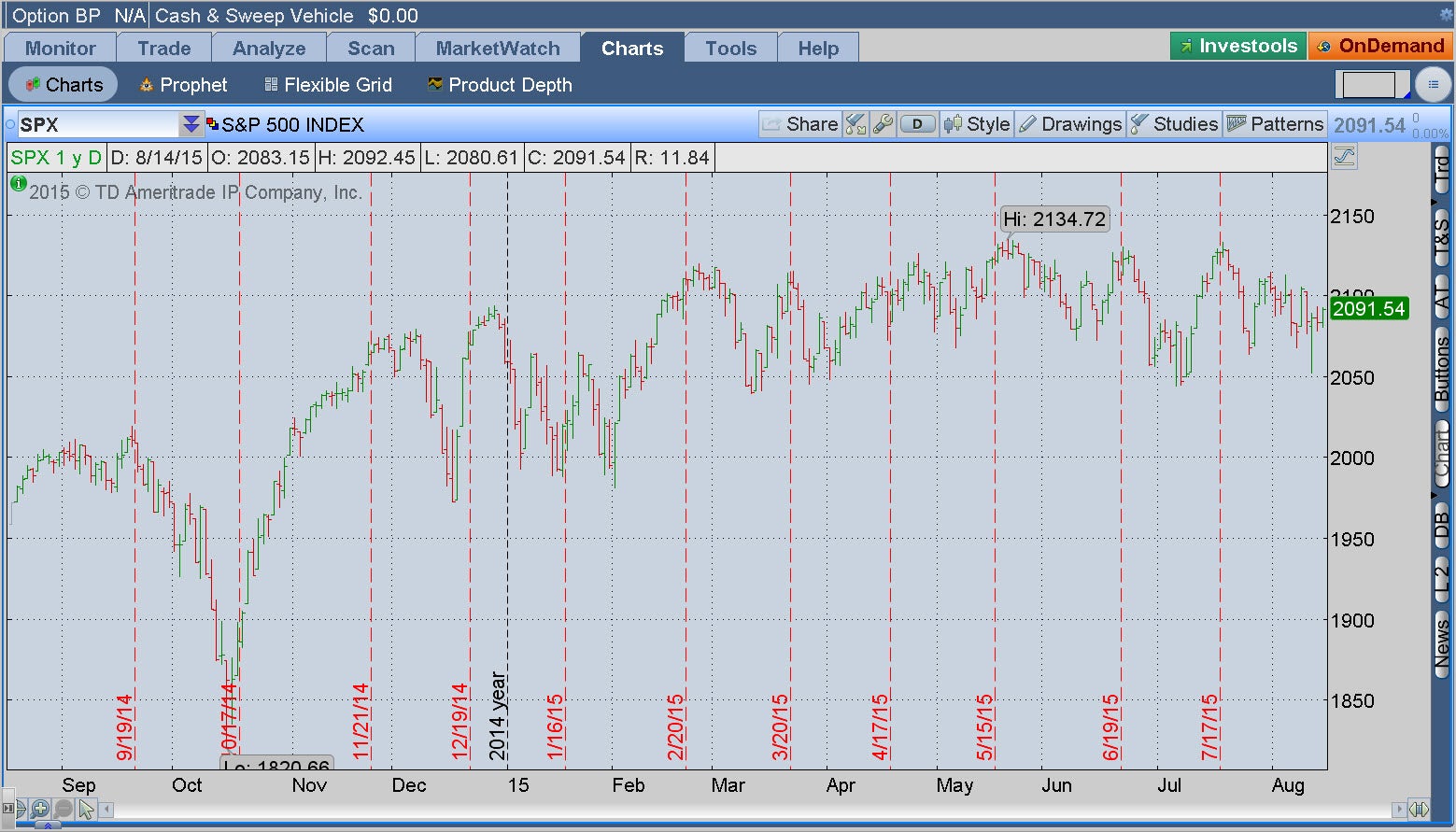

Political uncertainty, particularly in the US, can often lead investors to seek refuge in alternative assets perceived as less vulnerable to political turmoil. This is where XRP, with its relatively decentralized nature and global reach, could benefit. The concept of "safe haven" assets is often associated with gold or stablecoins, but during periods of heightened political instability, investors might diversify into assets perceived as less correlated with traditional markets. However, it's crucial to acknowledge that XRP, like all cryptocurrencies, remains volatile. Charts demonstrating XRP price fluctuations correlated with significant political events would provide valuable visual evidence supporting this analysis. [Insert chart showing XRP price correlation with major political events here].

Institutional Adoption: A Cornerstone of XRP's Growth

Growing Interest from Institutional Investors:

The increasing interest from institutional investors is a significant catalyst for XRP's growth. Several financial institutions are exploring the use of XRP and Ripple's technology for cross-border payments, recognizing its potential advantages in speed, cost-effectiveness, and efficiency. Quantifying this growth with statistics on institutional XRP holdings, if available from reliable sources, would strengthen this argument. The ability of XRP to facilitate swift and low-cost transactions makes it an attractive option for institutions handling large-scale international payments.

Ripple's Strategic Partnerships and Their Impact:

Ripple's strategic partnerships with financial institutions worldwide are fundamental to XRP's wider adoption. These collaborations provide legitimacy and demonstrate the practical applications of XRP in the real world. Detailing key partnerships, outlining how they contribute to XRP's use cases, and analyzing the long-term implications of these alliances on XRP's price and market capitalization will paint a comprehensive picture of Ripple's influence on XRP’s trajectory. For example, partnerships with major banks significantly increase the credibility and adoption potential of XRP, which in turn can lead to price appreciation.

Analyzing the Risks: Potential Challenges for XRP Investment

Regulatory Uncertainty:

The regulatory landscape surrounding XRP and Ripple is a significant factor to consider. The ongoing legal battles faced by Ripple, and their potential outcomes, could significantly impact XRP's price. Understanding potential future regulatory hurdles and their implications is crucial for any potential investor. A clear and balanced assessment of the regulatory risks associated with XRP is crucial for informed investment decisions.

Market Volatility and Competition:

Investing in cryptocurrencies inherently involves a high degree of risk due to market volatility. The cryptocurrency market is susceptible to rapid price swings, influenced by various factors including news events, regulatory changes, and overall market sentiment. Moreover, XRP faces competition from other cryptocurrencies vying for market share in the cross-border payment space. Analyzing XRP's competitive position and its unique selling propositions against its rivals provides a complete perspective on the inherent risks associated with XRP investments.

Conclusion: XRP Investment Outlook: Navigating the Future

The surge in XRP investments is driven by a combination of factors: the potential positive influence of Donald Trump’s pro-crypto stance and the increasing adoption of XRP by institutional investors. While the former offers a less predictable element of potential influence, the latter represents a more tangible factor driving growth. However, potential investors must carefully weigh the significant risks, including regulatory uncertainty and inherent market volatility. A balanced approach is necessary, acknowledging both the potential benefits and inherent challenges. To make informed decisions about XRP investment, it’s essential to conduct thorough research and stay updated on the latest developments in the regulatory landscape and market trends. Learn more about the potential of XRP investment and stay updated on the latest developments to craft a sound XRP investment strategy and assess XRP price prediction possibilities.

Featured Posts

-

Navigating The Crypto News Landscape Prioritizing Reliability And Trust

May 08, 2025

Navigating The Crypto News Landscape Prioritizing Reliability And Trust

May 08, 2025 -

Dyshime Te Medha Rrethojne Arsenalin Pas Ndeshjes Me Psg Akuza Per Shkelje Te Rregullave Te Uefa S

May 08, 2025

Dyshime Te Medha Rrethojne Arsenalin Pas Ndeshjes Me Psg Akuza Per Shkelje Te Rregullave Te Uefa S

May 08, 2025 -

Kripto Para Piyasasinda Kripto Lider In Yuekselisi

May 08, 2025

Kripto Para Piyasasinda Kripto Lider In Yuekselisi

May 08, 2025 -

Cantina Canalla Malaga Menu Reservas Y Opiniones

May 08, 2025

Cantina Canalla Malaga Menu Reservas Y Opiniones

May 08, 2025 -

Understanding The Recent Decline In Scholar Rock Stock Price

May 08, 2025

Understanding The Recent Decline In Scholar Rock Stock Price

May 08, 2025

Latest Posts

-

The Colin Cowherd Jayson Tatum Debate A Comprehensive Analysis

May 08, 2025

The Colin Cowherd Jayson Tatum Debate A Comprehensive Analysis

May 08, 2025 -

Update On Jayson Tatums Wrist Boston Celtics Head Coach Weighs In

May 08, 2025

Update On Jayson Tatums Wrist Boston Celtics Head Coach Weighs In

May 08, 2025 -

Jayson Tatums Place In The Nba Analyzing Colin Cowherds Perspective

May 08, 2025

Jayson Tatums Place In The Nba Analyzing Colin Cowherds Perspective

May 08, 2025 -

Jayson Tatums Wrist Injury Boston Celtics Head Coach Gives Update

May 08, 2025

Jayson Tatums Wrist Injury Boston Celtics Head Coach Gives Update

May 08, 2025 -

Is Jayson Tatum Overlooked Colin Cowherds Take And The Ongoing Debate

May 08, 2025

Is Jayson Tatum Overlooked Colin Cowherds Take And The Ongoing Debate

May 08, 2025