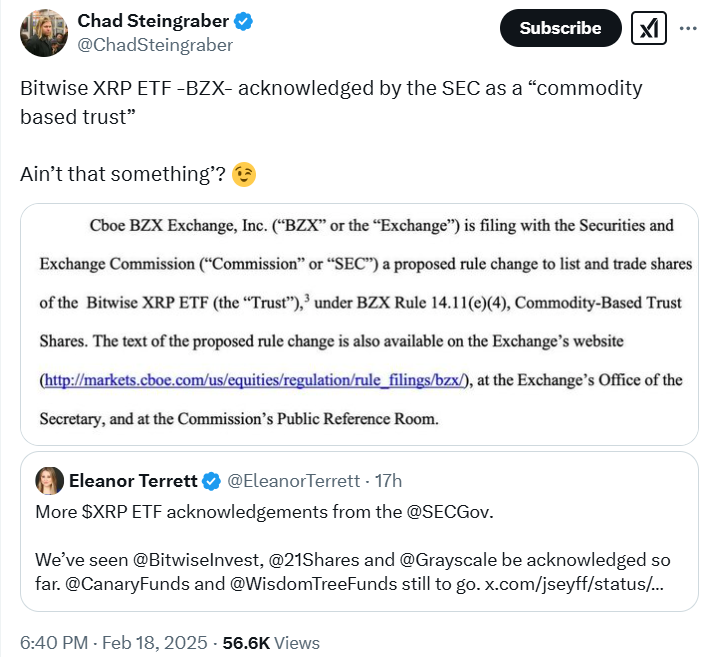

XRP News: SEC Classification - Commodity Or Security?

Table of Contents

The SEC's Case Against Ripple: The "Howey Test" and its Application to XRP

The SEC's case against Ripple hinges on the "Howey Test," a legal framework used to determine whether an investment contract qualifies as a security. The Howey Test comprises four elements:

- Investment of money: Did investors contribute capital?

- In a common enterprise: Is there a shared investment scheme?

- With an expectation of profits: Did investors anticipate profits primarily from the efforts of others?

- Derived solely from the efforts of others: Were profits generated predominantly through the efforts of a third party, rather than the investor's own efforts?

The SEC argues that XRP sales meet all four criteria. They claim that:

- Ripple raised capital by selling XRP.

- Investors expected profits based on Ripple's development and marketing efforts.

- XRP holders participated in a common enterprise through their shared investment in XRP and reliance on Ripple's success.

The SEC's filings [insert link to relevant SEC filing] detail their arguments, emphasizing the programmatic sales of XRP and Ripple's active involvement in promoting its value. Understanding these arguments is crucial for grasping the core of the legal dispute.

Ripple's Defense: Arguments for XRP as a Commodity or Decentralized Currency

Ripple vehemently contests the SEC's claims, arguing that XRP functions as a decentralized digital asset, similar to other cryptocurrencies, and thus shouldn't be classified as a security. Their defense rests on several pillars:

- Decentralization: Ripple highlights XRP's independent operation outside of its direct control. They argue that its functionality as a payment tool within a decentralized ecosystem differentiates it from a centrally managed investment scheme.

- Utility as a Payment Tool: Ripple emphasizes XRP's use in facilitating cross-border payments, showcasing its practical application beyond speculative investment. They argue that its primary function is as a currency, not a security.

- Early XRP Sales: Ripple contests the SEC's characterization of early XRP sales as investment contracts, arguing that these were primarily designed to foster network growth and adoption, not to raise capital in the traditional sense.

Expert legal analysis [insert link to relevant legal analysis] supports Ripple's position, pointing to the increasing decentralization of the XRP ecosystem and the inherent differences between XRP and other assets deemed securities by the SEC.

The Impact of the SEC's Decision on XRP's Price and Market Adoption

The SEC's ruling will profoundly impact XRP's price and market adoption. Several scenarios are possible:

- Security Classification: If deemed a security, XRP could face delisting from major exchanges, leading to significant price volatility and reduced liquidity. This would severely limit its accessibility to investors.

- Commodity Classification: A commodity classification would provide regulatory clarity, potentially boosting investor confidence and market adoption. This could lead to increased trading volume and a more stable price.

The ruling's impact extends beyond XRP, influencing the regulatory landscape for other cryptocurrencies and shaping future innovation within the industry. The broader implications for decentralized finance (DeFi) and the future of blockchain technology are substantial.

Expert Opinions and Future Predictions for XRP

Prominent figures in the crypto industry and legal experts offer diverse perspectives on the case's outcome and XRP's future. [Insert quotes from experts and links to their analysis]. While some remain cautiously optimistic, others highlight the potential risks associated with a security classification. The ongoing legal proceedings and any potential appeals will significantly influence the timeline and final outcome. Further developments in the case and potential settlement negotiations will shape the future trajectory of XRP.

Conclusion: Navigating the Uncertain Future of XRP

The SEC's classification of XRP as a security or a commodity remains a pivotal moment for the cryptocurrency market. This article has explored the key arguments presented by both the SEC and Ripple, analyzing the potential consequences of each outcome. The decision will have far-reaching implications for XRP's price, market adoption, and the broader regulatory environment. For investors, navigating this uncertainty requires a cautious approach. Thorough research, diversification, and responsible investment practices are crucial. Follow the latest XRP news and stay informed about the SEC's classification of XRP to make informed investment decisions. Learn more about the XRP legal battle and its potential impact on your portfolio.

Featured Posts

-

Xrp Price Surge Ripple Sec Case Update And Potential Us Etf Approval

May 02, 2025

Xrp Price Surge Ripple Sec Case Update And Potential Us Etf Approval

May 02, 2025 -

Why Middle Managers Are Essential For Company Success And Employee Growth

May 02, 2025

Why Middle Managers Are Essential For Company Success And Employee Growth

May 02, 2025 -

Bbc Funding Crisis 1bn Loss Sparks Concerns Over Future Programming

May 02, 2025

Bbc Funding Crisis 1bn Loss Sparks Concerns Over Future Programming

May 02, 2025 -

Investing In Ripple Xrp In 2024 A Realistic Path To Wealth

May 02, 2025

Investing In Ripple Xrp In 2024 A Realistic Path To Wealth

May 02, 2025 -

Kate And Lila Moss Matching Lbds At London Fashion Week

May 02, 2025

Kate And Lila Moss Matching Lbds At London Fashion Week

May 02, 2025