XRP On The Brink: Analyzing ETF Potential, SEC Actions, And Ripple's Impact

Table of Contents

The Allure of an XRP ETF

The potential approval of an XRP ETF (Exchange-Traded Fund) holds significant implications for the cryptocurrency's future. Such an event could dramatically alter XRP's market dynamics and accessibility.

Increased Liquidity and Accessibility

An XRP ETF would revolutionize access to the cryptocurrency for a broader range of investors.

- Reduced barriers to entry for retail investors: Currently, purchasing XRP often involves navigating complex cryptocurrency exchanges. An ETF would simplify this process, making it accessible through traditional brokerage accounts.

- Increased trading volume through regulated exchanges: Listing on major exchanges would dramatically increase trading volume, boosting liquidity and potentially reducing price volatility.

- Potential for significant price appreciation driven by institutional investment: Institutional investors, often hesitant to directly invest in cryptocurrencies due to regulatory uncertainty, would likely find ETFs a more palatable entry point, driving substantial demand.

Regulatory Uncertainty and Approval Challenges

Despite the potential benefits, significant regulatory hurdles stand in the way of XRP ETF approval.

- The SEC's classification of XRP as a security is a major obstacle: The SEC's ongoing lawsuit against Ripple hinges on this classification. A decision against Ripple could severely hinder ETF approval.

- The outcome of the Ripple lawsuit will heavily influence any ETF application: A favorable ruling for Ripple would significantly increase the likelihood of ETF approval, while an unfavorable outcome could effectively kill it.

- Other crypto ETFs face similar regulatory challenges: The regulatory landscape for cryptocurrencies remains volatile and uncertain, making ETF approval for any digital asset a complex process.

The Ripple-SEC Lawsuit: A Defining Moment for XRP

The lawsuit between Ripple Labs and the SEC is arguably the most crucial factor influencing XRP's trajectory.

The Core Arguments and Potential Outcomes

The lawsuit centers on the SEC's claim that XRP is an unregistered security.

- Analysis of the arguments presented by both sides: Ripple argues that XRP is a decentralized digital asset, not a security. The SEC maintains that XRP sales constituted an unregistered securities offering.

- Potential implications of a summary judgment or trial verdict: A victory for Ripple would likely boost investor confidence and pave the way for ETF approval. A loss could severely damage XRP's price and future prospects.

- Impact on investor sentiment and market confidence: The outcome will significantly influence investor sentiment, potentially causing substantial price fluctuations.

Ripple's Defense and Future Strategies

Ripple's response to the SEC lawsuit and its long-term strategies are vital to XRP's success.

- Ripple's legal strategy and counter-arguments: Ripple is actively defending its position, arguing that XRP is a decentralized digital asset with its own independent ecosystem.

- Ripple's partnerships and collaborations within the crypto space: Building a strong network of partnerships and collaborations can help enhance XRP's utility and adoption.

- Ripple's efforts to educate investors and address regulatory concerns: Clear communication and proactive engagement with regulators are crucial for navigating the complex regulatory environment.

Ripple's Impact Beyond the Lawsuit

Ripple's ongoing technological advancements and community engagement also play significant roles in XRP's future.

Technological Advancements and Adoption

Ripple's technology, primarily RippleNet, continues to evolve, expanding its utility and potential.

- RippleNet's expansion and adoption by financial institutions: The broader adoption of RippleNet by banks and other financial institutions demonstrates the growing utility of XRP in cross-border payments.

- Developments in XRP's technology and scalability: Improvements in XRP's technology and scalability could increase its efficiency and appeal to users and investors.

- The potential for increased utility beyond payments: XRP’s potential applications extend beyond just payments, potentially finding use cases in other financial and technological sectors.

Community Engagement and Market Sentiment

The XRP community's influence on market sentiment is undeniable.

- Community support and advocacy: A strong and active community can help support XRP's price and adoption, even amid regulatory uncertainty.

- The influence of social media and online forums: Online platforms are vital for community building and shaping public perception of XRP.

- The impact of price volatility on community sentiment: Price fluctuations can significantly impact community morale and participation.

Conclusion

XRP's future hinges on the outcome of the Ripple-SEC lawsuit and the potential approval of XRP ETFs. While significant regulatory hurdles exist, the underlying technology and strong community support offer reasons for optimism. The legal battle will be a defining moment, shaping XRP's trajectory for years to come. Stay informed about developments in the Ripple-SEC lawsuit and the ever-evolving regulatory landscape to make informed decisions about investing in XRP. Understanding the interplay between ETF potential, SEC actions, and Ripple's impact is crucial for navigating the complexities of the XRP market. Continue to research XRP, its technological advancements, and its potential for future growth.

Featured Posts

-

Disney Cruise Line Expands Alaska Offerings For Summer 2026

May 01, 2025

Disney Cruise Line Expands Alaska Offerings For Summer 2026

May 01, 2025 -

Recept Kycklingnuggets Majsflingor And Asiatisk Kalsallad

May 01, 2025

Recept Kycklingnuggets Majsflingor And Asiatisk Kalsallad

May 01, 2025 -

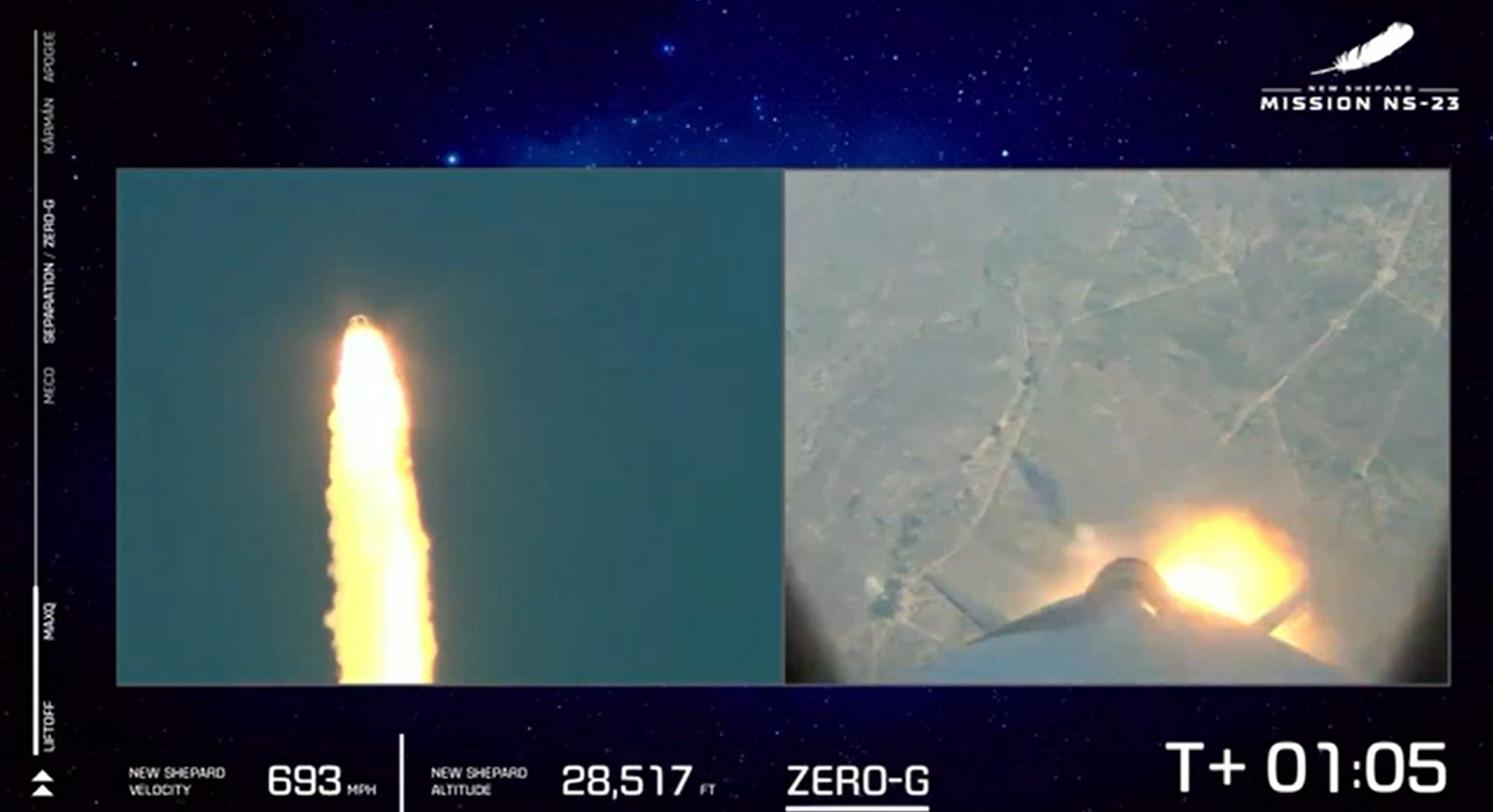

Technical Glitch Forces Blue Origin To Abort Rocket Launch

May 01, 2025

Technical Glitch Forces Blue Origin To Abort Rocket Launch

May 01, 2025 -

March 26th Ace Power Promotions Boxing Seminar

May 01, 2025

March 26th Ace Power Promotions Boxing Seminar

May 01, 2025 -

Is Age Just A Number Redefining Youth And Vitality

May 01, 2025

Is Age Just A Number Redefining Youth And Vitality

May 01, 2025