XRP Price Below $3: Should You Invest In Ripple Right Now?

Table of Contents

H2: Understanding the Current XRP Price Dip

The current XRP price dip is a complex issue stemming from a confluence of factors impacting the broader cryptocurrency market and Ripple specifically.

H3: Market Sentiment and Crypto Winter

The cryptocurrency market is notoriously volatile. We're currently experiencing a period some analysts refer to as a "crypto winter," characterized by decreased investor confidence and lower overall prices across the board.

- Bitcoin's Influence: Bitcoin's price movements heavily influence the entire crypto market, including altcoins like XRP. A decline in Bitcoin's price often triggers a sell-off in other cryptocurrencies.

- Recent News Impact: Negative news headlines regarding regulatory uncertainty or large-scale hacks can further exacerbate market sentiment, pushing XRP's price down. For example, recent regulatory crackdowns in certain countries have created a ripple effect across the crypto space, impacting investor confidence in XRP and other digital assets.

H3: The Ripple Lawsuit and Its Ongoing Impact

The SEC lawsuit against Ripple Labs, alleging the sale of unregistered securities, continues to cast a long shadow over XRP's price. The outcome of this legal battle will significantly impact XRP's future.

- Legal Arguments and Potential Outcomes: The case hinges on whether XRP is considered a security or a currency. A ruling in favor of the SEC could severely impact XRP's price, potentially leading to delisting from major exchanges. Conversely, a victory for Ripple could boost XRP's price significantly.

- News Impact on XRP Price: Positive news regarding the lawsuit, such as favorable court rulings or settlements, can cause short-term price spikes. Conversely, negative developments tend to trigger immediate sell-offs. Monitoring legal developments closely is crucial for XRP investors.

H3: Technical Analysis of XRP Price Charts

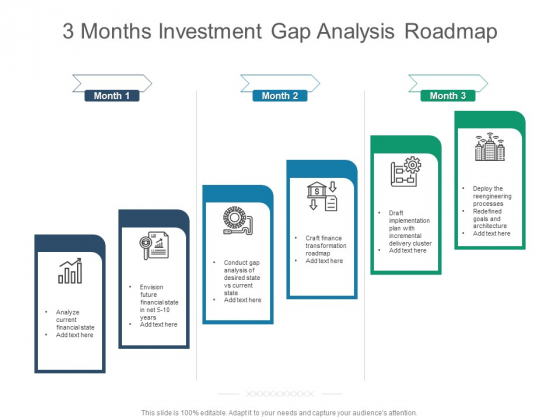

Analyzing XRP price charts using technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can offer insights into potential support and resistance levels.

- Technical Indicator Suggestions: Currently, the RSI may indicate whether XRP is oversold (suggesting a potential rebound) or overbought (suggesting a potential correction). The MACD can help identify potential trend reversals. (Note: Charts would be included here in a published article)

- Short-Term and Long-Term Trajectory: Based on technical analysis, the short-term price prediction for XRP might suggest either a period of consolidation or a further decline, while long-term predictions are highly dependent on the outcome of the lawsuit and broader market conditions.

H2: Potential Benefits of Investing in Ripple at this Price Point

Despite the current challenges, investing in Ripple at a lower price point could offer potential benefits for long-term investors.

H3: Long-Term Growth Potential

Ripple's technology has the potential to revolutionize the global payments industry. Its focus on fast, low-cost cross-border transactions could lead to widespread adoption in the future.

- Partnerships and Collaborations: Ripple boasts partnerships with numerous financial institutions worldwide, enhancing its credibility and potential for future growth. These collaborations signal a growing acceptance of Ripple's technology within the traditional financial sector.

- XRP Adoption as a Payment Solution: The potential for XRP to become a widely used cross-border payment solution is a major driver of its long-term value proposition. Increased adoption would inevitably increase demand and drive up the price.

H3: Risk vs. Reward Analysis

Investing in XRP, like any cryptocurrency, carries significant risk.

- Potential Losses: If the price of XRP continues to decline, particularly in light of a negative outcome in the lawsuit, investors could experience substantial losses.

- Potential Gains: Conversely, a positive resolution to the lawsuit or broader market recovery could lead to significant price appreciation, potentially surpassing previous highs.

H3: Diversification Strategies with XRP

XRP should be part of a well-diversified cryptocurrency portfolio, not the entirety of it.

- Risk Management: Diversification is key to mitigating risk in the volatile cryptocurrency market. Don't invest more than you can afford to lose.

- Portfolio Allocation: A typical recommendation for a diversified portfolio might allocate a small percentage (e.g., 5-10%) to high-risk assets like XRP.

H2: Factors to Consider Before Investing in Ripple

Before investing in XRP, carefully weigh several crucial factors.

H3: Regulatory Landscape and Future Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain. Future regulations could significantly impact XRP's price and trading accessibility.

H3: Market Volatility and Risk Tolerance

The cryptocurrency market is highly volatile; prices can fluctuate dramatically in short periods. Assess your personal risk tolerance before investing.

H3: Alternative Investment Options

Explore alternative investment options, such as established stocks or bonds, to balance your portfolio and manage risk.

3. Conclusion:

Investing in XRP at a price below $3 presents both substantial opportunities and considerable risks. The outcome of the Ripple lawsuit, the overall cryptocurrency market sentiment, and future regulations all play crucial roles in determining XRP's future price. Thoroughly research the market, understand the inherent risks involved, and assess your own risk tolerance before making any investment decisions. Remember to diversify your portfolio to mitigate potential losses. This analysis should not be considered financial advice. Conduct your own due diligence before deciding whether to invest in XRP or any other cryptocurrency. Only invest what you can afford to lose.

Featured Posts

-

Thaco Cup 2025 Cap Nhat Lich Thi Dau Vong Chung Ket Chi Tiet

May 01, 2025

Thaco Cup 2025 Cap Nhat Lich Thi Dau Vong Chung Ket Chi Tiet

May 01, 2025 -

Edward Leads Minnesota To Victory Against Brooklyn

May 01, 2025

Edward Leads Minnesota To Victory Against Brooklyn

May 01, 2025 -

Xrp Up 400 In Three Months Investment Analysis And Risks

May 01, 2025

Xrp Up 400 In Three Months Investment Analysis And Risks

May 01, 2025 -

Social Media Frenzy Kashmir Cat Owners React To Viral Videos

May 01, 2025

Social Media Frenzy Kashmir Cat Owners React To Viral Videos

May 01, 2025 -

Boxeo En Saltillo Impulso Al Desarrollo Social A Traves Del Deporte

May 01, 2025

Boxeo En Saltillo Impulso Al Desarrollo Social A Traves Del Deporte

May 01, 2025