XRP Price Prediction: Dubai License, Resistance Break, And The Path To $10

Table of Contents

The Ripple Effect of the Dubai License

The recent granting of a virtual asset license to Ripple in Dubai is a game-changer for XRP. This signifies a significant step towards greater regulatory clarity and wider adoption, potentially impacting the XRP price prediction positively.

Increased Adoption and Regulatory Clarity

The Dubai license enhances XRP's legitimacy and opens doors for wider adoption within a regulated market. This has several crucial implications:

- Enhanced Institutional Investor Confidence: The regulatory approval instills confidence in institutional investors who are often hesitant to invest in cryptocurrencies without clear regulatory frameworks. This influx of institutional money could significantly drive up demand.

- Strategic Market Expansion: Dubai's strategic location as a global financial hub facilitates expansion into the Middle Eastern and Asian markets, regions with considerable growth potential for crypto adoption. This increased market reach directly contributes to higher XRP demand.

- Reduced Uncertainty for Potential Investors: Regulatory clarity reduces the uncertainty surrounding XRP's legal status, encouraging more retail investors to participate in the market, further fueling demand.

Implications for XRP Price

Increased adoption directly correlates with increased demand, potentially driving up the XRP price. Analyzing historical price movements following similar regulatory approvals in other jurisdictions provides valuable insights.

- Previous Regulatory Approvals: We can examine how other cryptocurrencies reacted to similar regulatory green lights. Such historical data can provide a framework for projecting potential price movements for XRP.

- Potential Price Targets: Based on historical data and current market analysis, we can cautiously project potential price targets following increased adoption driven by the Dubai license. However, remember that these are just estimates.

- Price Correlation with Positive News: Charts and graphs illustrating the correlation between positive regulatory news and price increases in other cryptocurrencies can be used to support potential price predictions for XRP.

Breaking Resistance Levels: Technical Analysis

Technical analysis is crucial for predicting XRP's future price movement. Identifying and analyzing key resistance levels is paramount to understanding the potential for a sustained upward trend.

Identifying Key Resistance Points

Resistance levels represent price points where selling pressure overwhelms buying pressure, hindering further price increases. Identifying these levels helps us anticipate potential price corrections or breakouts.

- Understanding Resistance Levels: Resistance levels are typically identified on price charts by observing previous price highs where the price failed to break through.

- Key Resistance Levels on the XRP Chart: Using charting tools and analyzing historical price data, we can pinpoint key resistance levels on the XRP chart. These levels often act as significant barriers to further price appreciation.

- Volume and Price Action: The volume and price action around these resistance levels provide additional clues about the strength of the resistance and the potential for a breakout.

Indicators Suggesting a Breakout

Technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages offer valuable insights into the potential for an imminent price breakout.

- Indicator Relevance: Each indicator provides unique information about price momentum, trend strength, and potential reversals. Analyzing these indicators in conjunction provides a more comprehensive view.

- Indicator Readings and Implications: The current readings of these indicators on XRP's chart can help determine the likelihood of a breakout. Bullish signals from multiple indicators strengthen the probability of a price increase.

- Potential Price Targets Post-Breakout: Once key resistance levels are broken, these indicators can be used to project potential price targets based on the strength and momentum of the breakout.

The Path to $10: Factors Contributing to Long-Term Growth

Reaching a $10 price target for XRP requires a confluence of factors and sustained positive momentum. However, several elements contribute to the long-term growth potential of XRP.

Continued Technological Advancements

Ripple's continuous development of its technology and its expansion into new use cases are key to XRP's long-term viability.

- Ripple's Technological Innovations: Ongoing developments in Ripple's technology, such as improvements to its payment infrastructure and expansion into new markets, contribute to XRP's utility and adoption.

- Impact on Adoption and Utility: These advancements can lead to increased adoption by financial institutions and businesses, leading to higher demand for XRP.

- Partnerships and Collaborations: Strategic partnerships and collaborations with financial institutions and businesses worldwide will enhance XRP's utility and drive its adoption.

Market Sentiment and Investor Confidence

Positive market sentiment and growing investor confidence are crucial for XRP to reach the $10 mark.

- Current Market Sentiment: The overall sentiment towards XRP and the broader cryptocurrency market plays a significant role in its price.

- Influencing Factors: Factors such as regulatory developments, technological advancements, and adoption rates influence investor confidence and market sentiment.

- Role of Social Media and News Coverage: Social media and mainstream news coverage significantly impact market sentiment and investor perception, affecting XRP's price.

Conclusion

The Dubai license, coupled with a potential break of key resistance levels and continued technological advancements, paints a promising picture for XRP's future price. While reaching $10 requires a confluence of favorable factors and overcoming market volatility, the current trajectory suggests a substantial price appreciation is possible. However, remember that this is an XRP price prediction and not financial advice. Conduct your own thorough research before investing. Stay informed about the latest developments concerning the XRP price prediction and continue monitoring its performance in the market. Understanding the nuances of this XRP price prediction can help you make more informed investment decisions.

Featured Posts

-

Ripple Secures Dubai License Impact On Xrp Price And 10 Target

May 02, 2025

Ripple Secures Dubai License Impact On Xrp Price And 10 Target

May 02, 2025 -

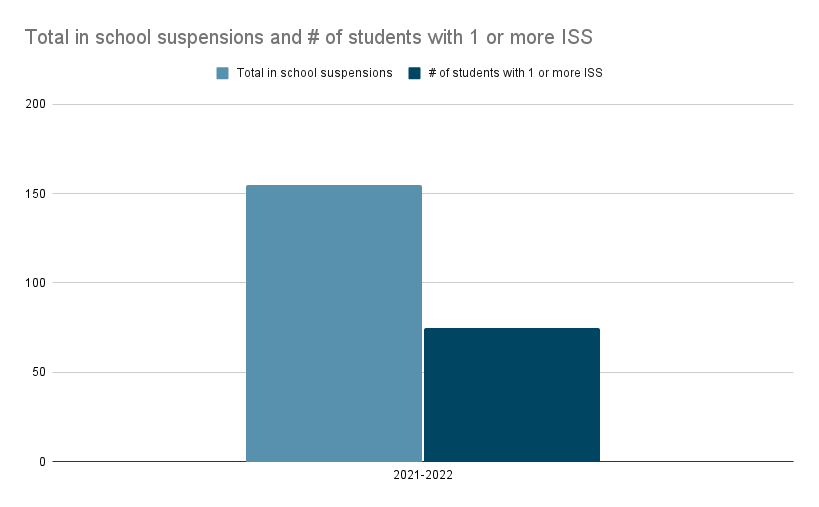

School Suspensions Harmful Effects And Effective Discipline Strategies

May 02, 2025

School Suspensions Harmful Effects And Effective Discipline Strategies

May 02, 2025 -

High Court Ruling Techiman South Parliamentary Seat Petition Rejected

May 02, 2025

High Court Ruling Techiman South Parliamentary Seat Petition Rejected

May 02, 2025 -

Blay Styshn 6 Twqeat Wmwasfat Aljyl Aljdyd

May 02, 2025

Blay Styshn 6 Twqeat Wmwasfat Aljyl Aljdyd

May 02, 2025 -

Elektrisch Rijden In Noord Nederland Bespaar Met Enexis Slimme Laadtarieven

May 02, 2025

Elektrisch Rijden In Noord Nederland Bespaar Met Enexis Slimme Laadtarieven

May 02, 2025