XRP Price Rally: Outperforming Bitcoin Post-SEC Grayscale ETF News

Table of Contents

XRP's Decoupling from Bitcoin's Price Action

Historically, a strong correlation has existed between Bitcoin's price and that of altcoins like XRP. However, the current XRP price rally demonstrates a weakening of this traditional correlation.

Reduced Correlation:

- Positive Ripple News: Positive developments surrounding Ripple Labs, such as favorable court rulings or strategic partnerships, can independently drive XRP's price upwards, decoupling it from Bitcoin's performance. The ongoing legal battle's positive trajectory significantly influences market sentiment.

- Independent Market Sentiment: XRP's price is increasingly influenced by factors specific to its own ecosystem, such as increasing adoption by financial institutions for cross-border payments. This independent market sentiment contributes to the XRP price rally.

- Growing Institutional Interest: Institutional investors are increasingly allocating funds to XRP, recognizing its unique utility in the payment space. This growing institutional interest is a key driver of the current XRP price rally and its decoupling from Bitcoin. Increased trading volume and market capitalization data further reinforce this claim. Comparing XRP price charts against Bitcoin's clearly illustrates this divergence.

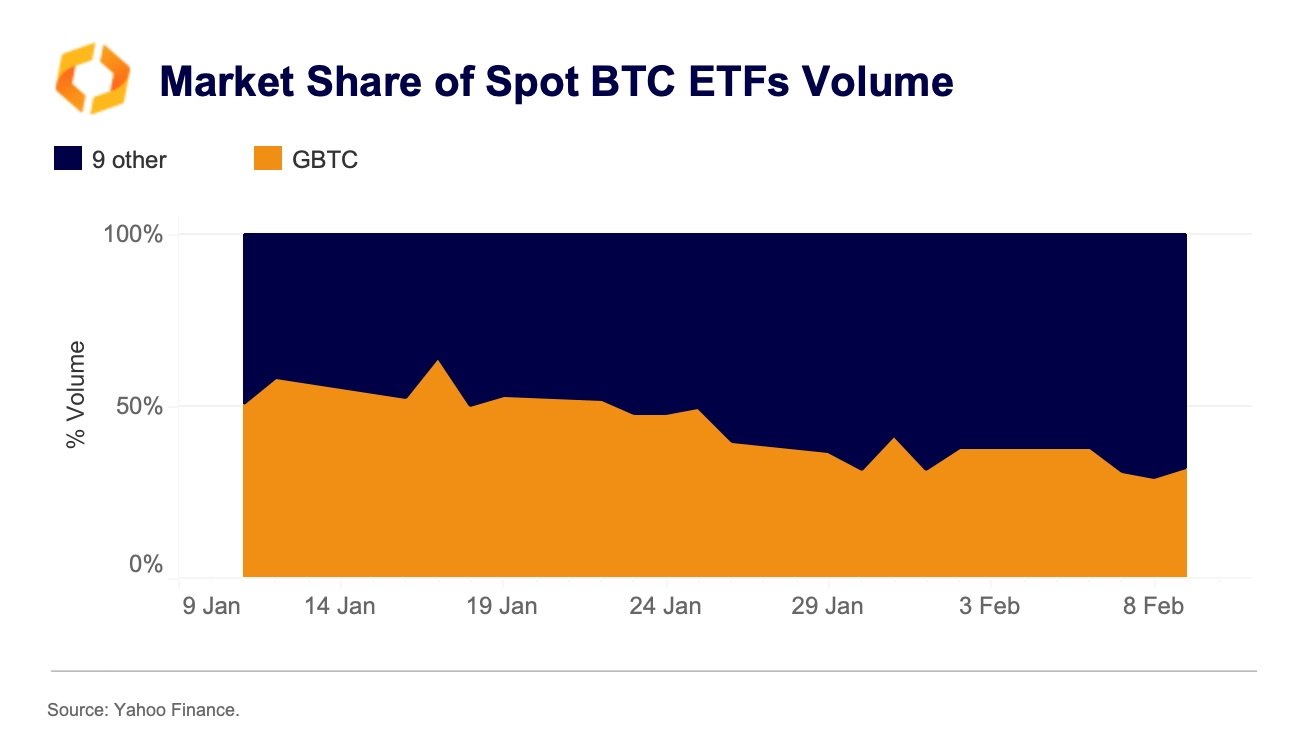

Impact of the Grayscale Ruling on XRP Sentiment:

The Grayscale victory injected significant confidence into the broader crypto market. This positive sentiment spilled over to altcoins, including XRP, leading to increased investment.

- Increased Investor Confidence: The successful ETF application signifies a step towards greater regulatory clarity and acceptance of cryptocurrencies, bolstering investor confidence and fueling the XRP price rally.

- Potential for Further Positive Regulatory Developments: The Grayscale win sets a positive precedent, potentially leading to more favorable regulatory outcomes for other cryptocurrencies, including XRP, further driving price increases.

- Positive Media Coverage: Extensive positive media coverage surrounding the Grayscale decision and its impact on XRP amplified investor enthusiasm and contributed to the price increase.

Fundamental Factors Driving the XRP Price Rally

Beyond market sentiment, fundamental factors significantly contribute to the XRP price rally.

Ripple's Ongoing Legal Battle and its Resolution Prospects:

The ongoing Ripple vs. SEC lawsuit casts a long shadow over XRP's price. However, recent developments suggest a potential for a favorable outcome.

- Expert Opinions: Many legal experts believe Ripple has a strong chance of winning the case, which would significantly improve XRP's regulatory outlook and boost its price.

- Positive Resolution Implications: A positive resolution would likely lead to a substantial surge in XRP's price, as the uncertainty surrounding its regulatory status would be removed.

- Global Regulatory Status: A favorable ruling in the US could significantly impact XRP's regulatory status globally, opening up new markets and driving further price appreciation.

Growing Institutional Adoption and Use Cases for XRP:

XRP's utility in cross-border payments is attracting increasing attention from financial institutions.

- Real-World Examples: Several financial institutions are already leveraging XRP's speed and low transaction costs for international money transfers, showcasing its real-world applications.

- Speed and Low Costs: XRP's efficiency in facilitating fast and low-cost transactions makes it a compelling alternative to traditional payment systems.

- Further Institutional Adoption Potential: As more institutions explore and adopt XRP, demand is likely to increase, further driving up its price.

Technical Analysis of the XRP Price Rally

Technical analysis provides further insight into the sustainability of the XRP price rally.

Chart Patterns and Indicators:

Analyzing XRP's price charts using indicators like RSI, MACD, and moving averages reveals potential support and resistance levels.

- Chart Interpretation: Technical indicators suggest potential upward price momentum, hinting at continued growth in the XRP price.

- Future Price Targets: Based on these indicators, several analysts have projected potential price targets for XRP.

- Risk Assessment: It's crucial to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

Volume and Volatility:

Analyzing trading volume and volatility helps assess the strength and sustainability of the rally.

- Volume and Volatility Data: High trading volume accompanied by controlled volatility suggests a robust and sustainable XRP price rally.

- Implications of Volume and Volatility: Low volume or extreme volatility could indicate a potential correction or short-term price fluctuation.

- Short-Term and Long-Term Predictions: By combining volume and volatility data with technical indicators, more informed short-term and long-term price predictions can be made.

Conclusion:

The current XRP price rally, outperforming Bitcoin after the Grayscale ETF news, is multifaceted. While the Grayscale ruling improved overall market sentiment, XRP's decoupling showcases its increasing independence and potential. The Ripple lawsuit's trajectory, growing institutional adoption, and positive technical indicators all paint a promising picture. However, thorough research and risk assessment are essential before investment. Stay informed on further developments in the XRP market to capitalize on this potential. Continue monitoring the XRP price rally for further opportunities.

Featured Posts

-

Nintendo Direct March 2025 Predicted Ps 5 And Ps 4 Game Reveals

May 08, 2025

Nintendo Direct March 2025 Predicted Ps 5 And Ps 4 Game Reveals

May 08, 2025 -

New Trailer For Stephen Kings The Long Walk Adaptation

May 08, 2025

New Trailer For Stephen Kings The Long Walk Adaptation

May 08, 2025 -

Is Bitcoins Rebound Just The Beginning A Deep Dive Into The Market

May 08, 2025

Is Bitcoins Rebound Just The Beginning A Deep Dive Into The Market

May 08, 2025 -

Dojs Google Antitrust Action Impact On User Trust And Search Results

May 08, 2025

Dojs Google Antitrust Action Impact On User Trust And Search Results

May 08, 2025 -

Lidl Faces Lawsuit From Consumer Group Regarding Its Plus App

May 08, 2025

Lidl Faces Lawsuit From Consumer Group Regarding Its Plus App

May 08, 2025

Latest Posts

-

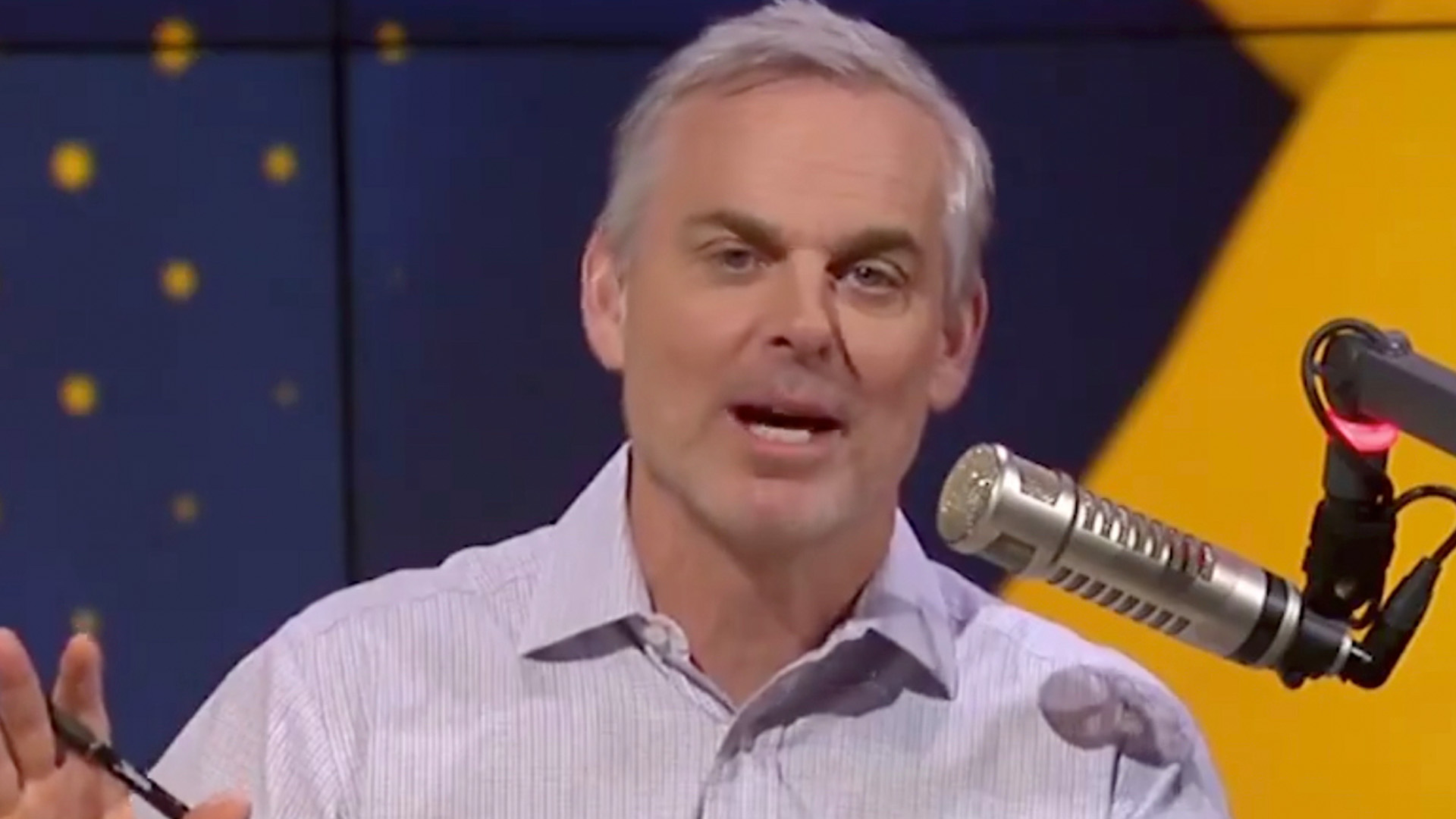

Jayson Tatum Faces Renewed Criticism From Colin Cowherd

May 08, 2025

Jayson Tatum Faces Renewed Criticism From Colin Cowherd

May 08, 2025 -

Cowherds Persistent Attacks On Jayson Tatum An Analysis

May 08, 2025

Cowherds Persistent Attacks On Jayson Tatum An Analysis

May 08, 2025 -

Colin Cowherd Remains Critical Of Jayson Tatums Performance

May 08, 2025

Colin Cowherd Remains Critical Of Jayson Tatums Performance

May 08, 2025 -

Colin Cowherds Continued Criticism Of Jayson Tatum

May 08, 2025

Colin Cowherds Continued Criticism Of Jayson Tatum

May 08, 2025 -

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025