XRP (Ripple) Price Prediction And Investment Strategy

Table of Contents

Understanding XRP and its Technology

XRP is a cryptocurrency designed to facilitate fast and cost-effective cross-border payments. Its core functionality is deeply intertwined with RippleNet, a global network connecting banks and financial institutions. Mastering the nuances of XRP's technology is a critical first step in forming a successful XRP investment strategy.

RippleNet and its Role in Cross-Border Payments

RippleNet is a real-time gross settlement system, currency exchange, and remittance network created by Ripple Labs. It streamlines international transactions by significantly reducing processing times and costs. Its impact on the global financial landscape is considerable, with increasing adoption by major banks.

- Faster Transactions: RippleNet allows for near-instantaneous cross-border payments, compared to the days or even weeks often required by traditional methods.

- Reduced Costs: Transaction fees on RippleNet are significantly lower than those charged by traditional payment processors.

- Increased Transparency: The network offers enhanced transparency throughout the payment process.

- Improved Security: RippleNet utilizes robust security protocols to protect against fraud and unauthorized access.

Key partnerships include major banks like Santander, SBI Holdings, and many more, illustrating a growing acceptance of Ripple's technology within the established financial system. This adoption rate is a key factor in XRP price prediction models.

XRP's Role within the Ripple Ecosystem

XRP acts as the bridge currency facilitating transactions within the RippleNet ecosystem. Banks use XRP to exchange different currencies quickly and efficiently. This differs from other cryptocurrencies like Bitcoin, which primarily function as decentralized stores of value.

- Speed: XRP transactions are significantly faster than Bitcoin or Ethereum transactions.

- Scalability: The Ripple network is designed for high transaction volume, making it suitable for large-scale financial operations.

- Low Fees: Transaction fees on the Ripple network are exceptionally low.

- Energy Efficiency: Compared to proof-of-work cryptocurrencies, XRP’s consensus mechanism requires significantly less energy.

These unique features make XRP attractive to financial institutions seeking efficient and cost-effective cross-border payment solutions, a key consideration when forming an XRP investment strategy.

Regulatory Landscape and Legal Challenges

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP price prediction and investment decisions. The SEC alleges that XRP is an unregistered security. The outcome of this legal battle will greatly influence XRP's future.

- SEC Arguments: The SEC contends that Ripple sold XRP as an unregistered security, violating federal securities laws.

- Ripple's Arguments: Ripple maintains that XRP is a currency and not a security, arguing it is used for payments and not investment.

Different legal outcomes could lead to vastly different price trajectories. A favorable ruling could lead to a significant price surge, while an unfavorable outcome might cause a substantial drop. This uncertainty underlines the importance of thorough risk assessment in any XRP investment strategy.

XRP Price Prediction Analysis

Predicting the price of any cryptocurrency is inherently speculative. However, analyzing historical data, technical indicators, and fundamental factors can provide insights into potential price movements. This section aims to give you a comprehensive understanding for a better XRP price prediction.

Historical Price Performance and Trends

XRP's price has experienced significant volatility throughout its history. Analyzing past price movements, identifying key support and resistance levels, and understanding the factors influencing these changes are crucial for making informed investment decisions. For example, positive regulatory news often correlates with price increases, while negative news, like the SEC lawsuit, can cause sharp declines.

- 2017-2018 Bull Run: XRP experienced a dramatic price surge during the broader cryptocurrency bull market.

- 2018-2020 Bear Market: Like other cryptocurrencies, XRP experienced a significant price correction.

- 2021-Present: The price has fluctuated significantly, influenced by the ongoing SEC lawsuit and overall market sentiment.

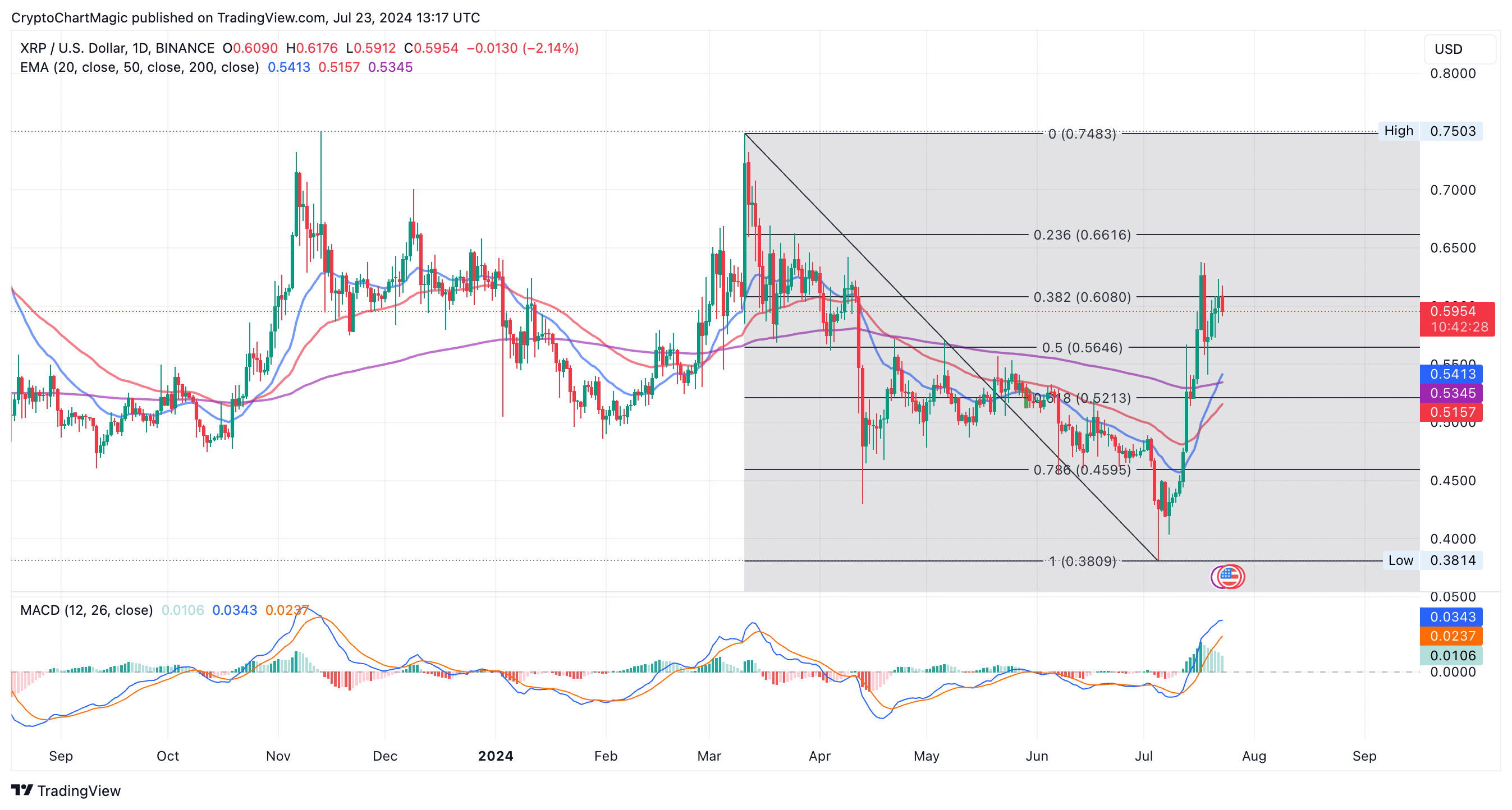

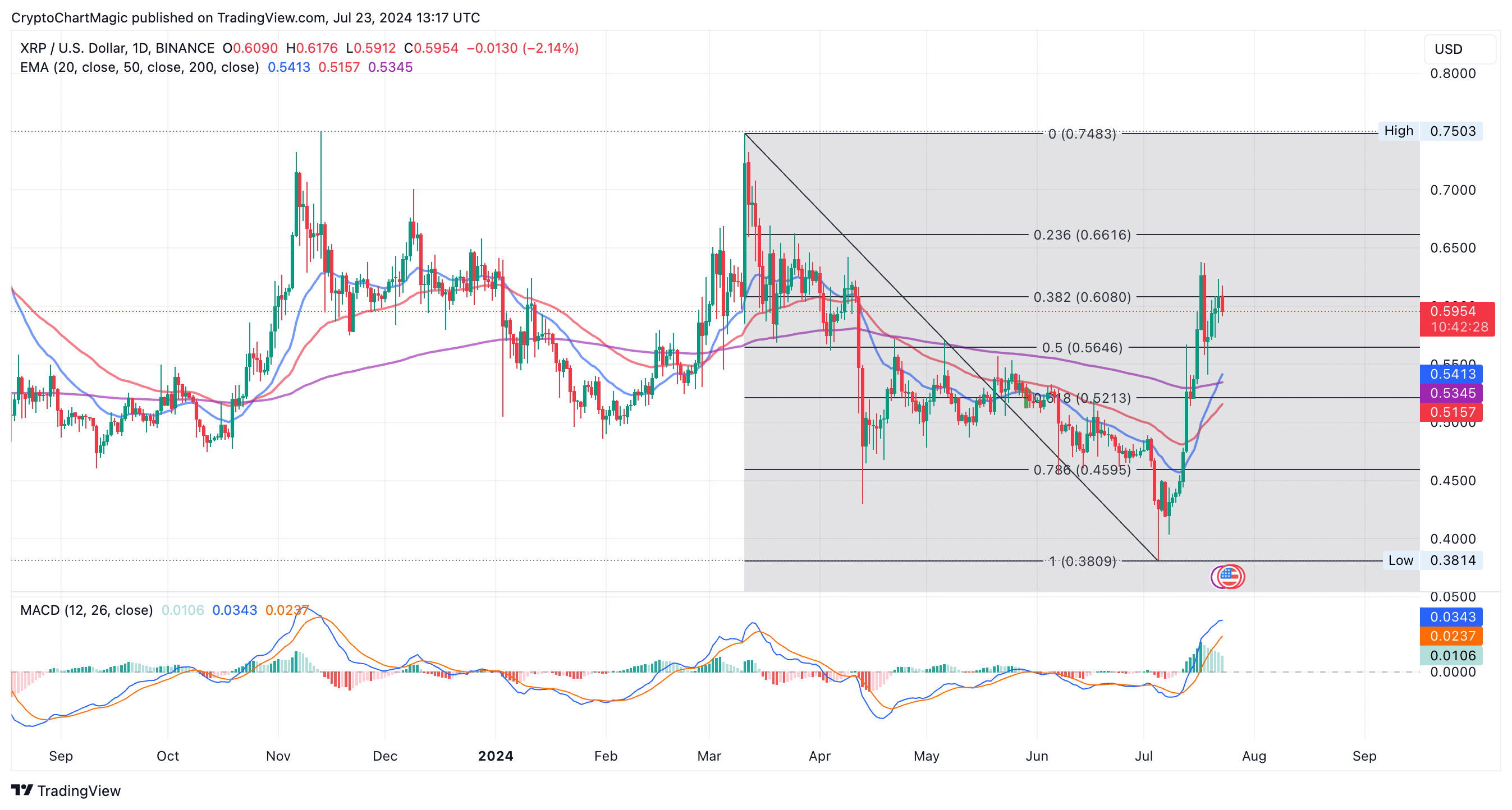

Technical Analysis of XRP

Technical analysis uses charts and indicators to predict future price movements based on past price action. Indicators like moving averages, relative strength index (RSI), and moving average convergence divergence (MACD) can provide valuable insights. However, it's essential to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

- Moving Averages: Identify trends and potential support/resistance levels.

- RSI: Measures the momentum of price changes and helps identify overbought or oversold conditions.

- MACD: Identifies changes in momentum and potential trend reversals.

Fundamental Analysis of XRP

Fundamental analysis assesses the intrinsic value of XRP based on its underlying technology, adoption rate, and market position. Factors like the ongoing adoption by financial institutions and the potential impact of regulatory developments significantly influence its long-term potential.

- Adoption Rate: Growing adoption by banks and payment processors strengthens XRP's value proposition.

- Technology: The efficiency and scalability of RippleNet are key to its long-term viability.

- Market Position: XRP's position within the broader cryptocurrency market and its competitive advantages are crucial.

Different Price Predictions from Experts

Various analysts and platforms offer XRP price predictions, ranging from optimistic to pessimistic. It's crucial to remember that these are just predictions, and the actual price may differ significantly. Always conduct thorough independent research and consider these predictions as just one piece of the puzzle.

- Disclaimer: Cryptocurrency price predictions are inherently speculative and should not be considered financial advice.

Developing an XRP Investment Strategy

Developing a robust investment strategy is paramount to mitigating risks and maximizing potential returns when investing in XRP. This involves understanding your risk tolerance, setting realistic goals, and securing your assets.

Risk Assessment and Diversification

Investing in cryptocurrencies like XRP carries significant risk. Price volatility, regulatory uncertainty, and security risks are all factors to consider. Diversification is crucial to mitigating risk. Don't put all your eggs in one basket.

- Diversify your portfolio: Spread your investment across different asset classes, including other cryptocurrencies, stocks, bonds, and real estate.

- Dollar-cost averaging: Invest smaller amounts regularly, rather than investing a lump sum at once.

Investment Timeline and Goals

Setting clear investment goals and a realistic timeline is vital. Are you a short-term trader aiming for quick gains, or a long-term investor focused on accumulating wealth over time? Your strategy should align with your goals.

- Short-term goals (e.g., less than 1 year): Higher risk tolerance, potentially involving active trading.

- Mid-term goals (e.g., 1-5 years): Moderate risk tolerance, a balanced approach combining trading and holding.

- Long-term goals (e.g., 5+ years): Lower risk tolerance, primarily focusing on holding XRP.

Buying and Storing XRP Securely

Choose reputable cryptocurrency exchanges to buy XRP, and prioritize secure storage using hardware wallets to protect your assets from hacking or theft.

- Reputable Exchanges: Coinbase, Binance, Kraken (Always research and choose exchanges with a strong security track record).

- Secure Wallets: Ledger, Trezor (Hardware wallets provide the highest level of security).

Conclusion: Your Guide to XRP (Ripple) Price Prediction and Investment Strategy

This comprehensive guide has explored XRP price prediction and provided a framework for developing a robust investment strategy. Remember that predicting XRP's price with certainty is impossible. However, by understanding its technology, analyzing its historical performance, and assessing the risks involved, you can make more informed decisions.

Armed with this guide on XRP (Ripple) price prediction and investment strategy, you can now make informed decisions about incorporating XRP into your investment portfolio. Remember to always conduct your own thorough research and adjust your strategy based on market conditions and ongoing developments. Stay updated on XRP’s price fluctuations and news surrounding the SEC lawsuit for optimal investment management.

Featured Posts

-

Chicago Bulls Vs Cleveland Cavaliers Cavaliers Secure 22 Point Win

May 07, 2025

Chicago Bulls Vs Cleveland Cavaliers Cavaliers Secure 22 Point Win

May 07, 2025 -

Federal Oversight Of Columbia University Exclusive Look At Trump Administrations Proposal

May 07, 2025

Federal Oversight Of Columbia University Exclusive Look At Trump Administrations Proposal

May 07, 2025 -

Unraveling The Cobra Kai Karate Kid Continuity Easter Eggs And References

May 07, 2025

Unraveling The Cobra Kai Karate Kid Continuity Easter Eggs And References

May 07, 2025 -

Warriors Vs Trail Blazers April 11th Game Time Tv Channel And Live Stream Guide

May 07, 2025

Warriors Vs Trail Blazers April 11th Game Time Tv Channel And Live Stream Guide

May 07, 2025 -

Xrp Price Surge Grayscale Etf Filing Fuels Record High Hopes

May 07, 2025

Xrp Price Surge Grayscale Etf Filing Fuels Record High Hopes

May 07, 2025