XRP's Commodity Status: Ripple Settlement And SEC Decision

Table of Contents

The SEC's Case Against Ripple

The Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs in December 2020, alleging the sale of XRP constituted unregistered securities offerings, violating federal securities laws.

Allegations of Unregistered Securities Offerings

The SEC's central argument hinged on the Howey Test, a legal framework used to determine whether an investment contract qualifies as a security. The SEC argued that XRP sales met the Howey Test criteria:

- Investment of money: Investors purchased XRP with the expectation of profit.

- Common enterprise: The SEC asserted that XRP's value was tied to Ripple's efforts, creating a common enterprise.

- Expectation of profits: Investors anticipated profits derived from Ripple's efforts, not solely from XRP's use as a currency.

- Efforts of others: Investors relied on Ripple's development and marketing efforts to generate profits.

The SEC focused heavily on Ripple's programmatic sales and sales to institutional investors, claiming these transactions explicitly resembled securities offerings. They emphasized that XRP lacked the decentralized characteristics of a true commodity, pointing to Ripple's significant control over XRP's distribution and development.

Ripple's Defense

Ripple countered the SEC's claims by arguing that XRP functions as a decentralized, functional digital asset, operating as a currency and not a security. Their key arguments included:

- Decentralization: Ripple highlighted XRP's independent existence outside of Ripple's control, emphasizing its use on multiple exchanges and in various decentralized applications.

- Utility: Ripple stressed XRP's utility within its payment network, highlighting its use for fast and efficient cross-border transactions. This utility, they argued, distinguished XRP from an investment contract.

- Howey Test Rebuttal: Ripple challenged the SEC's interpretation of the Howey Test, arguing that the expectation of profit derived primarily from XRP's use and market forces, not Ripple's efforts.

The Ripple Settlement and its Impact on XRP's Commodity Status

The July 2023 settlement between Ripple and the SEC concluded without explicitly defining XRP as either a security or a commodity. This ambiguous outcome leaves much room for interpretation.

Key Terms of the Settlement

The settlement included:

- Financial Penalties: Ripple paid a substantial financial penalty, a key component of the agreement.

- No Explicit Classification: Importantly, the settlement did not explicitly classify XRP as a security or a commodity, leaving this question open for future legal challenges and interpretations.

- Limitations on Future Sales: The settlement may include limitations on Ripple's future sales and distribution of XRP, although the exact details remain subject to interpretation.

Legal Precedents Set by the Settlement

The Ripple settlement sets a significant precedent, but the implications are far from clear:

- Impact on Other Cryptocurrencies: The lack of a definitive classification of XRP adds uncertainty to the regulatory status of other cryptocurrencies.

- Implications for Other Projects: Other crypto projects facing SEC scrutiny now face a more uncertain regulatory future.

- Remaining Uncertainty: The settlement leaves considerable ambiguity about the regulatory landscape and how the Howey Test will be applied in future cases.

Market Reactions and Future Implications for XRP

The Ripple-SEC settlement had a significant impact on XRP's price and market sentiment.

Price Volatility After the Settlement

- Short-Term Fluctuations: The announcement led to considerable short-term price volatility for XRP.

- Long-Term Projections: The long-term outlook for XRP's price remains uncertain and dependent on various market factors and further regulatory developments.

- Investor Sentiment: Investor sentiment concerning XRP showed increased volatility following the settlement.

The Path Forward for XRP Adoption and Regulation

The future of XRP adoption hinges on several factors:

- Regulatory Clarity: Increased regulatory clarity in the crypto space is crucial for widespread adoption.

- Exchange and Processor Adoption: The settlement's impact on XRP's adoption by major exchanges and payment processors remains to be seen.

- Future Legal Challenges: The ambiguity surrounding XRP’s status leaves open the possibility of future legal challenges.

Conclusion

The Ripple-SEC settlement significantly impacts the discussion surrounding XRP's commodity status, providing a partial resolution but leaving significant ambiguity. While the settlement offers a path forward for Ripple, it also highlights the ongoing complexities of regulating cryptocurrencies. Understanding the key aspects of this case and its implications is crucial for navigating the evolving landscape of digital assets. To stay informed about the ongoing developments surrounding the XRP commodity status and other crypto regulations, continue to research and analyze related news and legal interpretations. Keep monitoring the conversation around XRP as a commodity or security to make informed decisions about your investment strategy.

Featured Posts

-

Tribute To Carrie From Daughter Amy Irving Following Death

May 02, 2025

Tribute To Carrie From Daughter Amy Irving Following Death

May 02, 2025 -

Ananya Pandays Happy First Birthday To Her Dog Riot

May 02, 2025

Ananya Pandays Happy First Birthday To Her Dog Riot

May 02, 2025 -

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed As Headliners

May 02, 2025

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed As Headliners

May 02, 2025 -

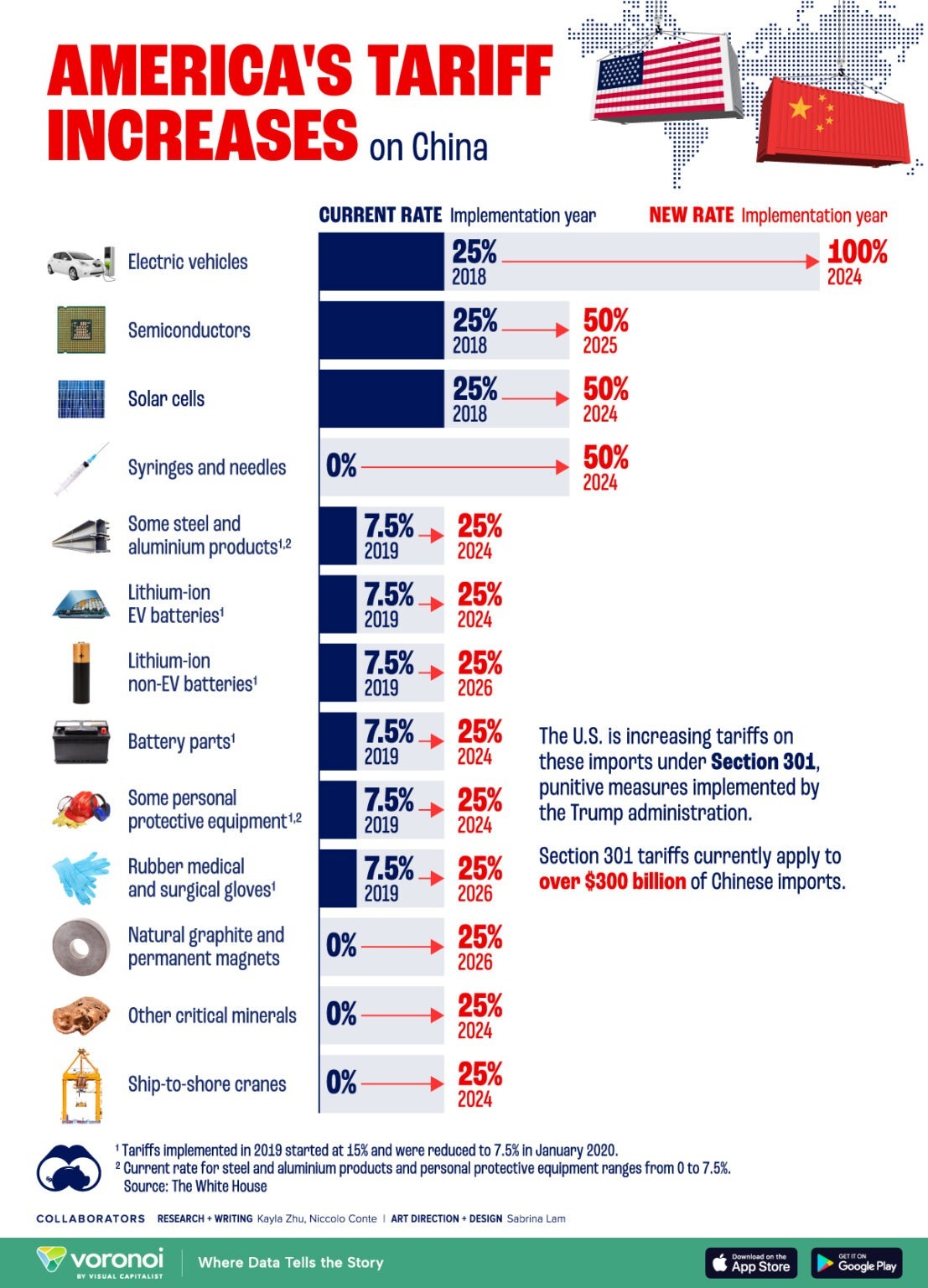

Trumps Tariffs Automakers Struggle With Uncertainty

May 02, 2025

Trumps Tariffs Automakers Struggle With Uncertainty

May 02, 2025 -

Maines Groundbreaking Post Election Audit A Closer Look

May 02, 2025

Maines Groundbreaking Post Election Audit A Closer Look

May 02, 2025