Your Path To A Private Credit Job: 5 Critical Steps

Table of Contents

Build a Strong Foundation: Essential Education and Skills

A strong educational foundation is crucial for a successful private credit career. The complexities of credit analysis, financial modeling, and portfolio management demand a solid understanding of finance and related disciplines.

Academic Background:

A relevant academic background significantly enhances your chances of securing a private credit job. While not always mandatory, a strong educational foundation provides the necessary theoretical knowledge and analytical skills.

- Relevant Degrees: An MBA, a Bachelor's degree in Finance, Accounting, Economics, or a related field are highly valuable. A Master's degree in Financial Engineering or a similar specialized program can provide a competitive edge.

- Beneficial Coursework: Focus on courses in corporate finance, financial modeling, credit analysis, valuation, and risk management. Strong quantitative skills are essential.

- Relevant Certifications: Obtaining certifications like the Chartered Financial Analyst (CFA), Chartered Alternative Investment Analyst (CAIA), Financial Risk Manager (FRM), or Certified Public Accountant (CPA) can significantly boost your credentials and demonstrate your commitment to the field.

Develop Crucial Skills:

Beyond academics, specific skill sets are paramount for private credit roles. These skills are highly sought after by employers and will set you apart from other candidates.

- Software Proficiency: Mastery of Microsoft Excel, Bloomberg Terminal, and Argus is essential for financial modeling, data analysis, and portfolio management. Familiarity with other relevant software packages is also beneficial.

- Analytical & Problem-Solving Skills: Private credit involves analyzing complex financial data, identifying risks, and making informed investment decisions. Strong analytical and problem-solving skills are crucial.

- Communication & Networking Skills: Effectively communicating your findings and building strong professional relationships are key to success in this collaborative environment.

Gain Relevant Experience: Internships and Entry-Level Roles

Practical experience is invaluable when aiming for a private credit job. Internships and entry-level roles provide the opportunity to develop crucial skills and build your professional network.

Securing Internships:

Internships in investment banking, commercial banking, accounting, or directly within private credit firms offer invaluable hands-on experience.

- Networking: Leverage your network to explore internship opportunities. Attend industry events, connect with alumni, and reach out to professionals on LinkedIn.

- Targeted Applications: Carefully research firms and tailor your application materials to highlight your relevant skills and experience. Demonstrate your understanding of the private credit industry.

- Online Platforms: Utilize platforms like LinkedIn, company websites, and specialized job boards to find and apply for internships.

Targeting Entry-Level Positions:

Entry-level positions can serve as a stepping stone to a private credit career. These roles often provide exposure to various aspects of the industry and allow you to build your skillset.

- Relevant Titles: Look for roles such as Financial Analyst, Credit Analyst, Associate, or similar titles within private credit firms, investment banks, or asset management companies.

- Transferable Skills: Highlight transferable skills from previous roles, such as financial modeling, data analysis, or client communication.

- Job Boards: Explore job boards like Indeed, SimplyHired, and LinkedIn for relevant entry-level openings. Don't overlook company websites directly.

Master the Art of Networking: Building Connections in Private Credit

Networking is essential for success in the private credit industry. Building relationships with professionals can lead to valuable insights, mentorship, and job opportunities.

Industry Events and Conferences:

Attending industry events and conferences provides opportunities to meet professionals, learn about current trends, and build your network.

- Targeted Events: Research and attend conferences and events specifically focused on private credit, alternative investments, or related fields.

- Informational Interviews: Request informational interviews with professionals to learn about their career paths and gain insights into the industry.

- Professional Organizations: Join relevant professional organizations like the Association for Corporate Growth (ACG) or the American Investment Council (AIC) to connect with industry peers.

Leveraging LinkedIn:

LinkedIn is a powerful tool for networking in the private credit industry. Use it effectively to connect with professionals and showcase your expertise.

- Optimize Your Profile: Create a compelling LinkedIn profile that highlights your skills, experience, and interests relevant to private credit.

- Targeted Outreach: Connect with professionals in private credit and reach out for informational interviews. Personalize your connection requests.

- Relevant Groups: Join relevant LinkedIn groups focused on private credit, finance, or alternative investments to participate in discussions and expand your network.

Showcase Your Expertise: Crafting a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression on potential employers. They must effectively communicate your skills and experience and highlight your suitability for a private credit role.

Tailoring Your Resume:

Tailor your resume to each specific job application, emphasizing the skills and experience most relevant to the position.

- Keywords: Incorporate relevant keywords from the job description to improve your resume's visibility in applicant tracking systems (ATS).

- Quantifiable Achievements: Quantify your achievements whenever possible to demonstrate your impact in previous roles (e.g., "Increased efficiency by 15%").

- Clear & Concise Format: Use a clear and concise format, avoiding jargon and focusing on your most relevant accomplishments.

Writing a Persuasive Cover Letter:

Your cover letter should demonstrate your understanding of the private credit industry and express your enthusiasm for the specific role.

- Address Job Requirements: Specifically address the requirements and responsibilities outlined in the job description.

- Industry Knowledge: Demonstrate your understanding of the private credit market, its challenges, and its opportunities.

- Enthusiasm & Passion: Convey your genuine interest in the role and your passion for the private credit industry.

Ace the Interview: Preparing for Success in Private Credit Interviews

Private credit interviews often involve technical questions assessing your financial acumen and behavioral questions assessing your personality and work style. Thorough preparation is key.

Technical Preparation:

Technical questions will test your understanding of finance, accounting, and credit analysis. Be prepared to answer questions related to financial statements, valuation methodologies, and credit risk assessment.

- Case Studies: Practice case studies related to financial modeling, credit analysis, and investment decisions.

- Financial Statement Analysis: Demonstrate a strong understanding of financial statements (balance sheet, income statement, cash flow statement).

- Technical Skills: Be ready to discuss your proficiency in financial modeling software and your analytical abilities.

Behavioral Questions:

Behavioral questions assess your soft skills and how you've handled situations in the past. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- STAR Method: Practice using the STAR method to answer behavioral questions, providing specific examples from your past experiences.

- Teamwork & Problem-Solving: Showcase your ability to work effectively in teams and solve complex problems.

- Passion & Enthusiasm: Reinforce your passion for the private credit industry and your eagerness to contribute to the firm's success.

Conclusion:

Securing a private credit job requires dedication, strategic planning, and a focused approach. By following these five critical steps—building a strong foundation, gaining relevant experience, mastering the art of networking, showcasing your expertise, and acing the interview—you can significantly increase your chances of landing your dream private credit job. Remember, consistent effort and a proactive approach are crucial in this competitive field. Start building your path to a rewarding private credit career today!

Featured Posts

-

Preparing Your Pitch For Dragons Den A Comprehensive Checklist

May 02, 2025

Preparing Your Pitch For Dragons Den A Comprehensive Checklist

May 02, 2025 -

Daisy May Cooper Opens Up About Weight Loss And Cosmetic Procedures

May 02, 2025

Daisy May Cooper Opens Up About Weight Loss And Cosmetic Procedures

May 02, 2025 -

Project Muse Fostering Community Through Shared Access To Research

May 02, 2025

Project Muse Fostering Community Through Shared Access To Research

May 02, 2025 -

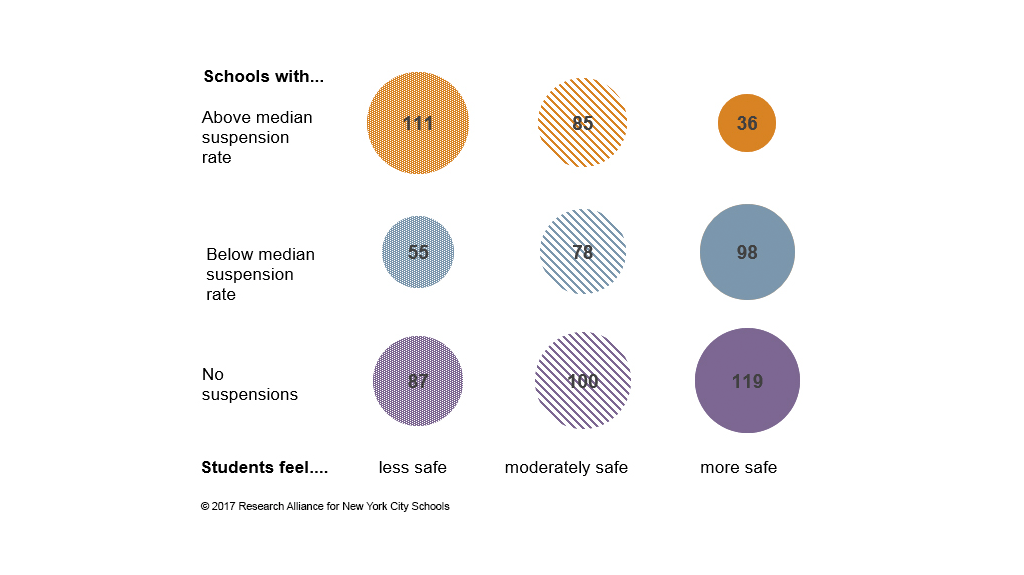

Are School Suspensions Doing More Harm Than Good A Comprehensive Analysis

May 02, 2025

Are School Suspensions Doing More Harm Than Good A Comprehensive Analysis

May 02, 2025 -

This Country A Detailed Look At Its Regions And Cities

May 02, 2025

This Country A Detailed Look At Its Regions And Cities

May 02, 2025